This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Iowa Second Amendment of Trust Agreement

Description

How to fill out Second Amendment Of Trust Agreement?

Are you presently in the location where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust is not simple.

US Legal Forms provides an extensive collection of template forms, such as the Iowa Second Amendment of Trust Agreement, which can be tailored to meet state and federal requirements.

Select the pricing plan you desire, enter the necessary information to create your account, and complete the order using your PayPal or Visa or Mastercard.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Iowa Second Amendment of Trust Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

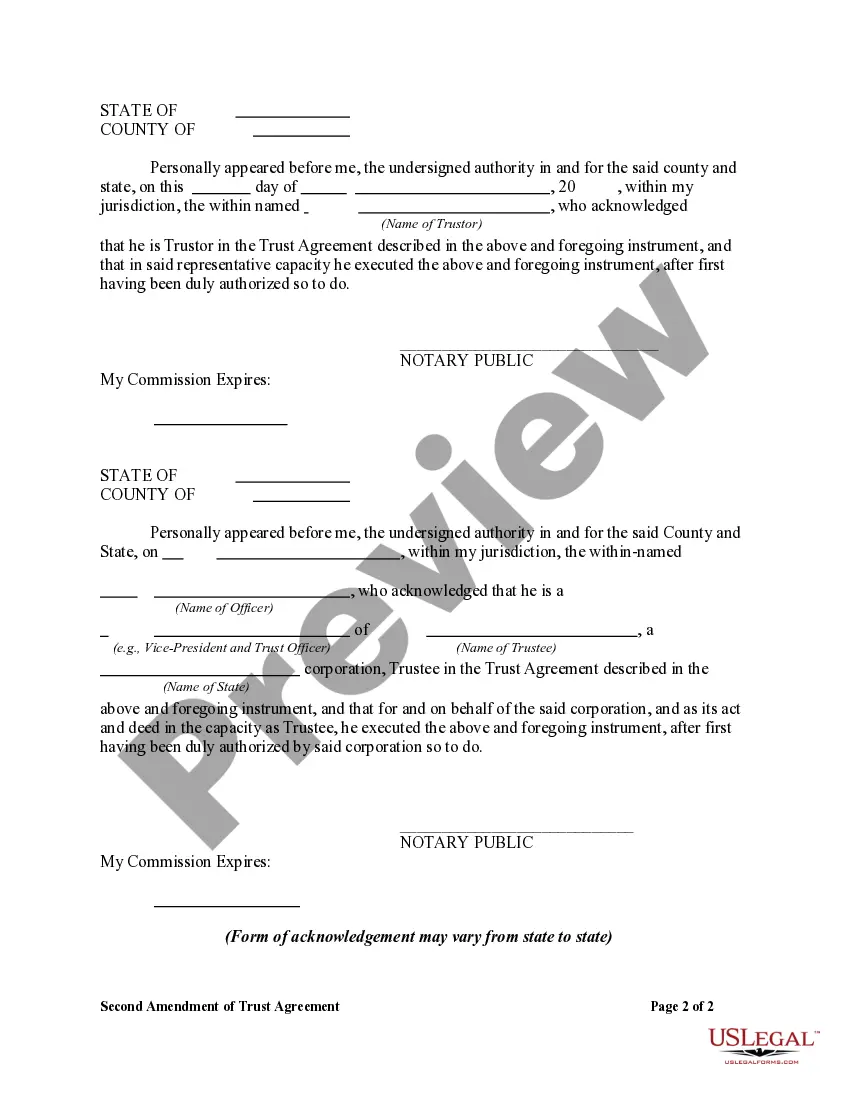

- Use the Review button to examine the form.

- Check the summary to ensure you have selected the correct form.

- If the form does not meet your needs, use the Search area to locate the form that suits you and your requirements.

- Once you have the correct form, click Get now.

Form popularity

FAQ

Yes, establishing a trust can help you avoid probate in Iowa. Since trusts typically bypass the probate process, your assets can be distributed more quickly and privately after your passing. This benefit is a key reason many people opt for the Iowa Second Amendment of Trust Agreement, ensuring a smoother transition for their loved ones.

An amendment to the trust agreement is a formal change to the terms of an existing trust. This can allow for updates based on new circumstances, such as changes in beneficiaries or asset management. Utilizing the Iowa Second Amendment of Trust Agreement enables you to modify your trust while ensuring it remains legally valid and effective.

Iowa's trust laws are designed to protect the interests of both trustees and beneficiaries. The laws stipulate how trusts are created, managed, and dissolved, ensuring clarity and fairness. Understanding these laws, particularly the Iowa Second Amendment of Trust Agreement, will help you set up a trust that aligns with your goals.

In Iowa, a trust is a legal arrangement where one party holds property for the benefit of another. With the Iowa Second Amendment of Trust Agreement, you determine how your assets are managed and distributed. Trusts can be revocable or irrevocable, allowing flexibility in changing your wishes if circumstances arise.

Choosing between a trust and a will in Iowa can significantly impact how you manage your assets. A trust often provides more privacy and can streamline the distribution process. With the Iowa Second Amendment of Trust Agreement, you can ensure your wishes are executed without the lengthy probate court process, which is often required with wills.

Form 1041 is the US fiduciary income tax return that trusts and estates must file to report their income, deductions, and credits. This form is essential for determining tax liabilities and maintaining compliance with IRS regulations. If you have an Iowa Second Amendment of Trust Agreement, knowing how to properly file Form 1041 can help you manage your trust effectively.

Trusts and estates must file an Iowa fiduciary income tax return if they have taxable income that exceeds the set threshold. A fiduciary must handle such responsibilities, ensuring compliance with state tax laws. Understanding these responsibilities is vital for the effective management of the Iowa Second Amendment of Trust Agreement.

In Iowa, having a trust agreement notarized is not a legal requirement, but it is highly recommended. Notarization can help verify the authenticity of the trust agreement and protect against potential disputes. Ensuring your Iowa Second Amendment of Trust Agreement is properly executed can add an extra layer of security to your estate planning.

Iowa does not impose a state estate tax, so there is typically no requirement for an estate tax return. However, it is essential to be aware of federal estate tax rules that may apply. Having an understanding of these regulations can enhance your estate planning, particularly in relation to the Iowa Second Amendment of Trust Agreement.

Generally, anyone who earns income above a certain threshold must file an Iowa income tax return. This includes residents with wages, interest, dividends, and other forms of income. Engaging with a professional familiar with the Iowa Second Amendment of Trust Agreement can provide clarity on tax obligations linked to your trust.