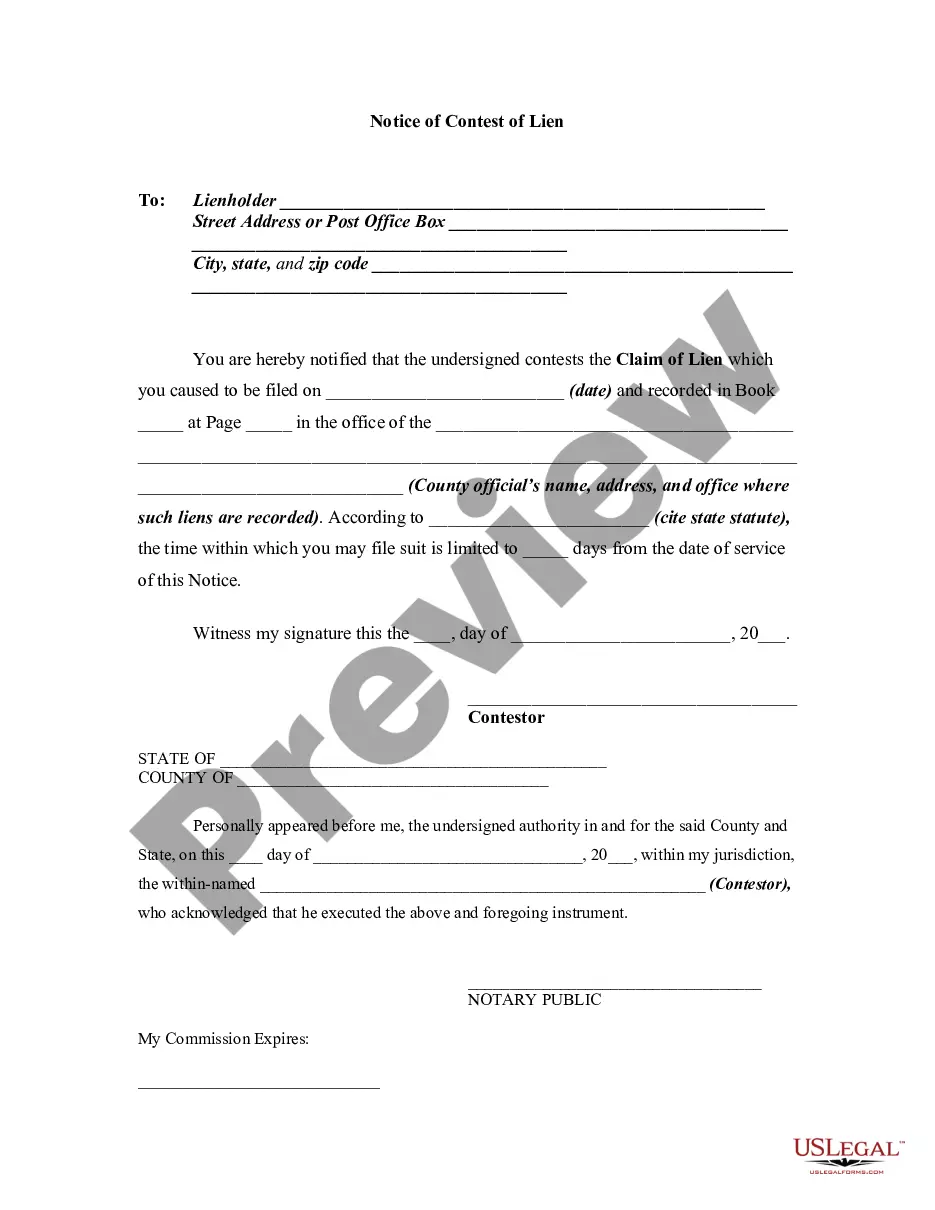

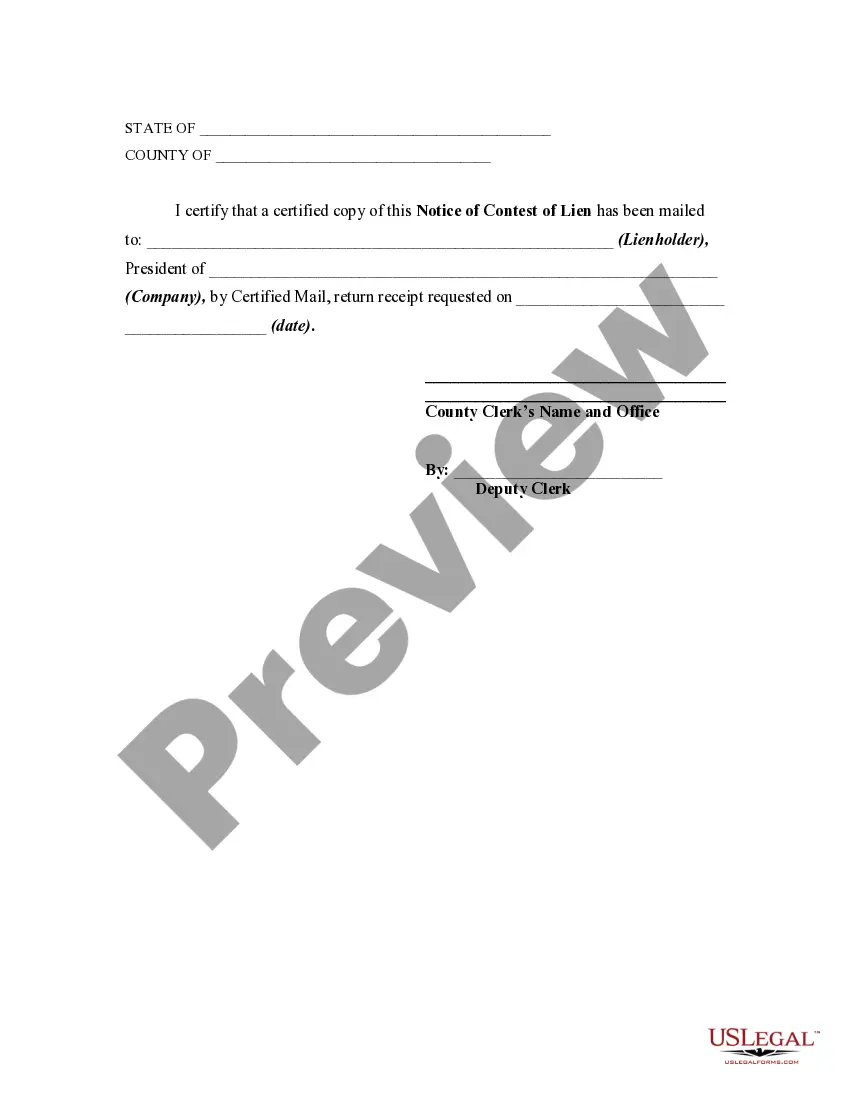

This form is a sample of a notice contesting a lien that has been recorded in the office of the appropriate county official.This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Iowa Notice of Contest of Lien

Description

Form popularity

FAQ

About Iowa Notice of Intent to Lien Form No one wants to be forced to file a mechanics lien, and this document gives all of the parties involved one final chance to take care of the payment issues on a project. This form advises the party that a lien will be filed if payment is not received within 10 days.

The lien lasts for two years and 90 days. Any action to enforce a mechanic's lien shall be brought within two years from the expiration of ninety days after the date on which the last of the material was furnished, or the last of the labor was performed.

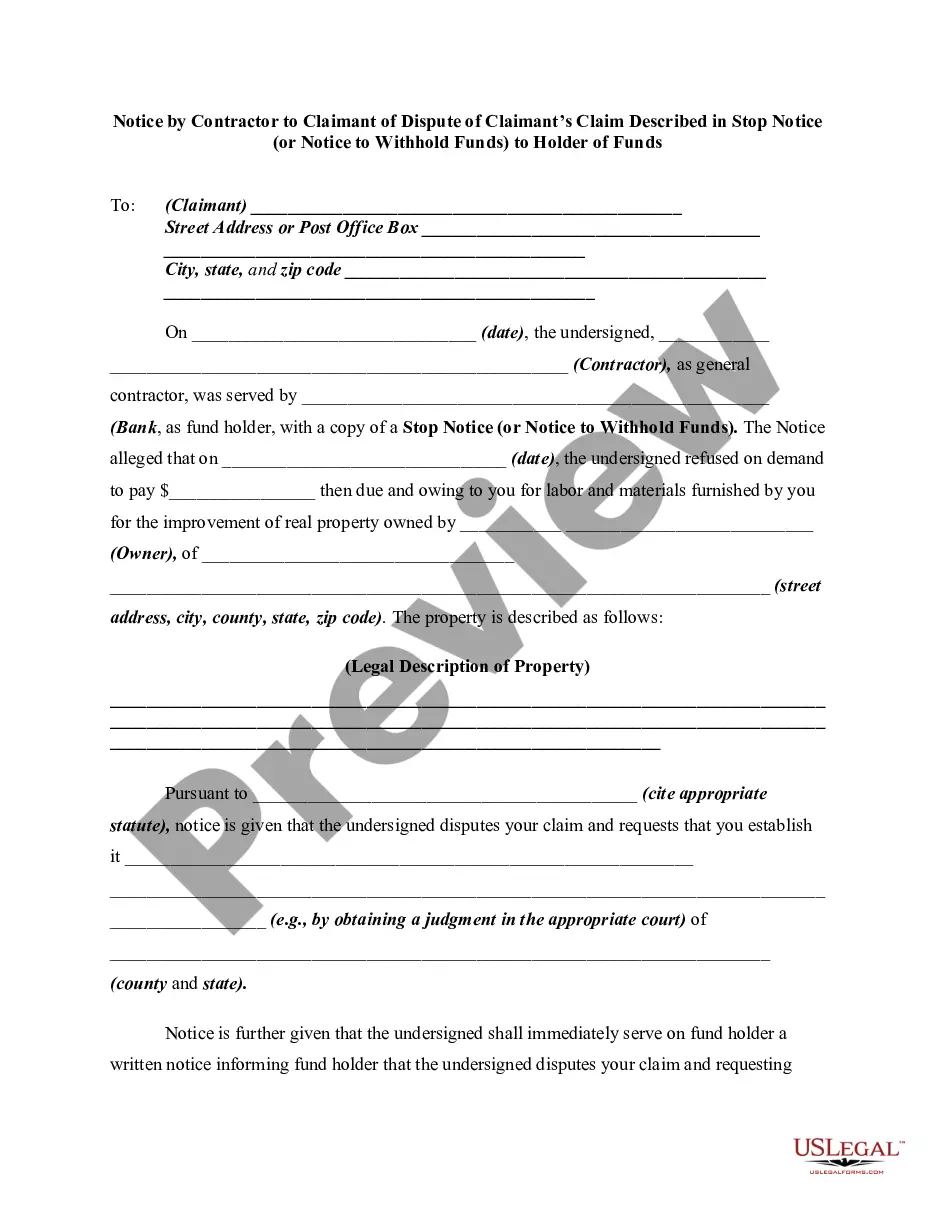

If you challenge the lien, you can also bring a claim for money against the contractor, if you believe the contractor owes you any money damages. Another way to get the lien off of the property is to make a "demand for bringing suit." This is a demand that the contractor enforce the lien.

The property owner will need to have the judgment lien removed so the title can be cleared and the property sold. A knowledgeable California debt settlement attorney can have the lien taken off, possibly without payment to the creditor or debt collector.

To get a lien on property removed, a Release of Lien or a Satisfaction of Judgment must be filed with the Clerk of the District Court in the county where the support order is filed. Contact Iowa Child Support for assistance if part or all of the support is owed to the State of Iowa.

The statute of limitations for small claims judgments for execution purposes is twenty years, and liens on those judgments exist for ten years. See Iowa Code sections 614.1(6), 624.23(1), 626.2 and 631.12.

You should pay your tax debt in full. If a Notice of Tax lien was filed, we release the lien at the county recorder's office approximately 60 days after your tax debt was paid in full. You can pay your tax debt in full at PayDebt.Iowa.gov.

You can search court records on the Iowa Judicial Branch website at: , or you can contact your County Recorder's Office, a title company, or an attorney to search for you.