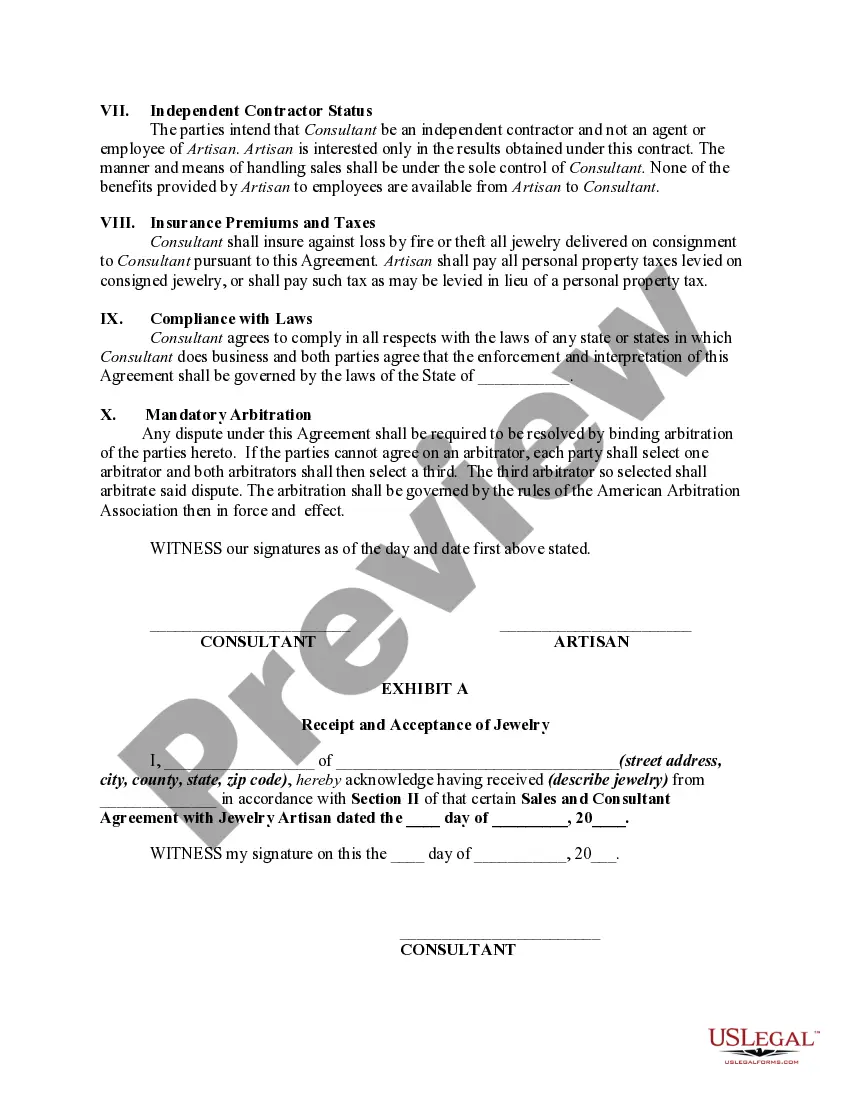

This form is a sample of an agreement to promote and sell jewelry between an artisan, who designs and creates fine jewelry, and an image consultant for various clients who have requested consultant's assessment of their wardrobe with regard to jewelry.

Iowa Sales and Marketing Consultant Agreement with Jewelry Artisan

Description

How to fill out Sales And Marketing Consultant Agreement With Jewelry Artisan?

It is feasible to spend hours online searching for the legal document template that satisfies the federal and state requirements you need.

US Legal Forms offers numerous legal forms that are vetted by experts.

It is easy to obtain or print the Iowa Sales and Marketing Consultant Agreement with Jewelry Artisan from my service.

To obtain another version of the form, use the Search area to find the template that meets your needs and criteria.

- If you already have a US Legal Forms account, you may Log In and click the Obtain button.

- Afterwards, you may fill out, edit, print, or sign the Iowa Sales and Marketing Consultant Agreement with Jewelry Artisan.

- Every legal document template you acquire is yours indefinitely.

- To get an additional copy of any purchased form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document template for your county/city of choice.

- Review the form outline to confirm you have chosen the correct form.

Form popularity

FAQ

In Iowa, a resale certificate remains valid for as long as the purchaser continuously uses it for purchases they are making for resale. However, it's wise to maintain accurate records of your transactions. When working under an Iowa Sales and Marketing Consultant Agreement with Jewelry Artisan, having a current resale certificate can streamline your buying process and keep you compliant.

To obtain a seller's permit in Iowa, you need to complete an application with the Iowa Department of Revenue. This process typically involves providing personal and business information. If you collaborate under an Iowa Sales and Marketing Consultant Agreement with Jewelry Artisan, securing your seller's permit is an essential step to ensure legal compliance in your sales operations.

In Iowa, certain organizations and individuals are exempt from sales tax based on their purpose or function. For instance, non-profit organizations, certain government entities, and some educational institutions may qualify for exemptions. If you are involved in activities covered by an Iowa Sales and Marketing Consultant Agreement with Jewelry Artisan, it's important to confirm your exemption status to ensure compliance.

The Iowa sales tax exemption certificate 31 113a is a specific type of exemption certificate used in Iowa. This certificate is particularly useful for businesses that operate under certain conditions or industries. If you are engaged in agreements such as the Iowa Sales and Marketing Consultant Agreement with Jewelry Artisan, make sure you are familiar with this form and its specific implications for your sales tax obligations. Always stay updated with the latest requirements for your business.

Filling out the Iowa sales tax exemption certificate requires accurate information about your business and the nature of your purchases. Ensure you include your name, address, and the reason for your exemption clearly. When using the Iowa Sales and Marketing Consultant Agreement with Jewelry Artisan, you’ll want to outline your qualification for exemption to avoid unnecessary tax charges. Review the instructions carefully and provide all required details to complete the certificate.

To determine if you are exempt from Iowa income tax, first evaluate your income level and the type of income you earn. Certain individuals, such as those with very low income or specific statuses, may qualify for exemptions. Consulting resources related to the Iowa Sales and Marketing Consultant Agreement with Jewelry Artisan can help you navigate these tax considerations effectively. It's advisable to check directly with a tax professional or the Iowa Department of Revenue.

In Iowa, many professional services, such as consulting and legal services, are generally exempt from sales tax. However, specific services may fall under taxable categories. Understanding the implications of the Iowa Sales and Marketing Consultant Agreement with Jewelry Artisan is crucial for your business strategy, ensuring you remain compliant while enjoying potential tax benefits. Always review the most current tax regulations for your profession.

You can obtain an exemption certificate through the Iowa Department of Revenue's website. This certificate is essential for businesses engaging in sales that qualify for tax exemption. Consider the Iowa Sales and Marketing Consultant Agreement with Jewelry Artisan to ensure you comply with relevant regulations while managing your marketing efforts. Downloading the certificate involves following the instructions provided on their site.