Iowa Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor

Description

How to fill out Agreement By Self-Employed Independent Contractor Or Subcontractor Not To Bid Against Painting General Contractor?

Are you in a position where you frequently require documents for various business or personal purposes.

There are numerous legal document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms offers a vast collection of template options, including the Iowa Agreement by Self-Employed Independent Contractor or Subcontractor Not to Compete with Painting General Contractor, designed to satisfy federal and state requirements.

Select a suitable document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can retrieve another copy of the Iowa Agreement by Self-Employed Independent Contractor or Subcontractor Not to Compete with Painting General Contractor at any time, if necessary. Just choose the required template to download or print the document format.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- After that, you can obtain the Iowa Agreement by Self-Employed Independent Contractor or Subcontractor Not to Compete with Painting General Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you require and ensure it is for the correct jurisdiction.

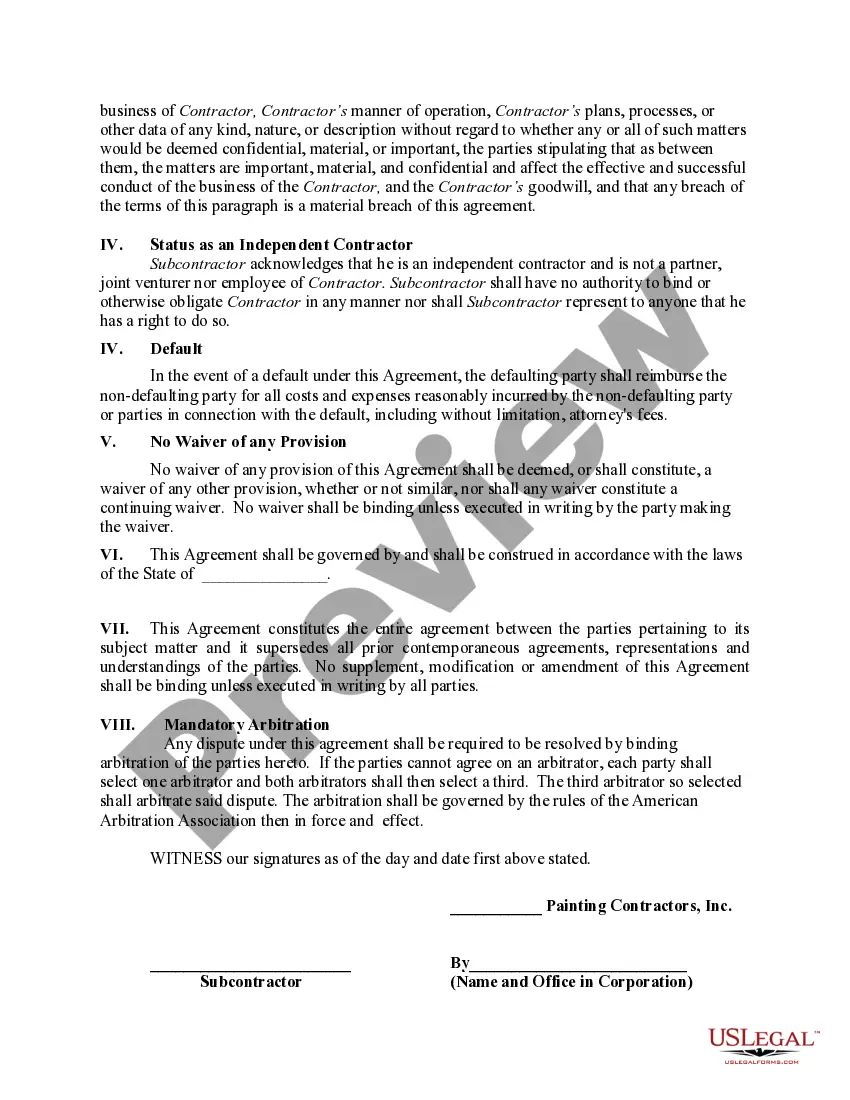

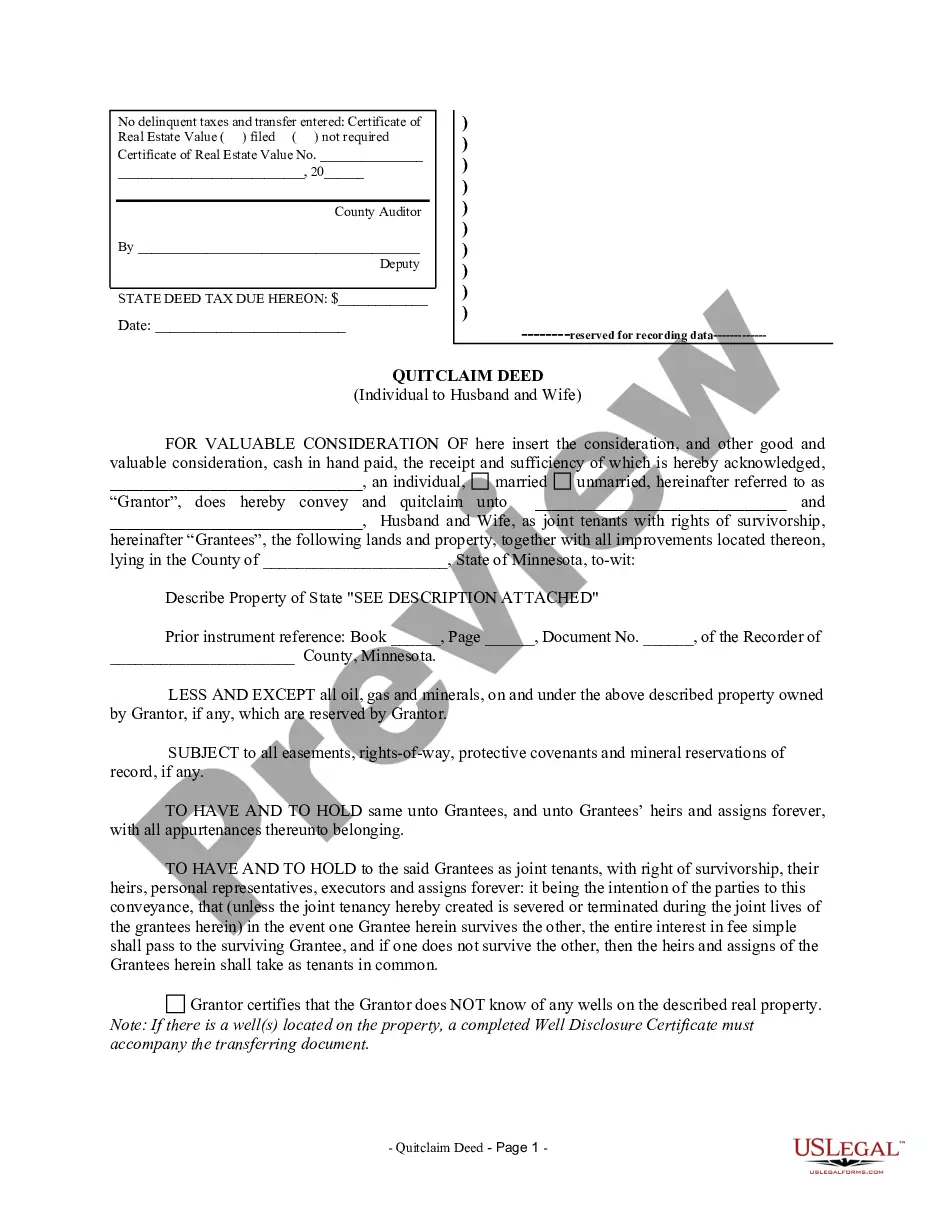

- Use the Preview button to examine the form.

- Check the description to guarantee you have selected the appropriate template.

- If the template is not what you are looking for, utilize the Search box to locate the form that meets your needs.

- When you find the correct template, click Get now.

- Choose the subscription plan you prefer, enter the required details to set up your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

Yes, Iowa requires contractors to be licensed, and this applies to various types of construction work. Licensing standards help maintain quality and safety in the construction industry. To navigate through this process and ensure you are meeting legal requirements, consider using resources such as the Iowa Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor available through platforms like USLegalForms.

Yes, you do need a license to operate as a general contractor in Iowa. Each locality may have different requirements, so it's important to check the specific regulations in your area. Having the proper licensing ensures compliance and allows you to enter into agreements, including the Iowa Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor, which can safeguard your business interests.

To confirm if a contractor is licensed in Iowa, you can visit the Iowa Department of Public Safety’s website. They provide an online database to check the status of contractor licenses. This verification is essential, especially when considering agreements like the Iowa Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor, ensuring you collaborate with reputable professionals.

Starting a construction company in Iowa requires careful planning and adherence to local regulations. First, you need to develop a detailed business plan outlining your services, target market, and financial projections. Register your business name, obtain necessary licenses, and consider an Iowa Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor to protect your interests in competitive situations.

In Iowa, the taxability of repairs depends on the type of service provided. Generally, repairs to tangible personal property are taxable. Knowing this is important when drafting an Iowa Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor. Consult with a tax professional for specific advice tailored to your situation.

To register as a contractor in Iowa, you may reach the Iowa Division of Labor at 515-242-5871. They can assist you with questions about the registration process and requirements, including the Iowa Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor. Connecting with them ensures you stay informed about necessary regulations.

A contractor is the primary party responsible for completing a project, while a subcontractor is hired by the contractor to perform specific tasks within that project. Understanding this distinction is crucial for setting up an Iowa Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor. Clarity in these roles can lead to smoother project execution and compliance with local regulations.

In Iowa, all income earned is generally subject to taxation, including wages, salaries, and earnings from self-employment. This includes income received from an Iowa Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor. It is essential to keep accurate records of all income, as this will help ensure compliance with state tax laws.

In Iowa, maintenance services can be subject to sales tax. This means that, as a self-employed independent contractor or subcontractor, you should be aware of the tax implications when offering maintenance services. The Iowa Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor can outline your responsibilities and help you navigate taxable services.

Certain individuals and organizations can be exempt from Iowa sales tax, such as non-profit entities and certain government bodies. Additionally, some types of services, depending on their nature, may also fall outside the sales tax requirements. Understanding these exemptions is vital when drafting the Iowa Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor to ensure compliance and avoid unexpected costs.