Iowa Leaseback Provision in Sales Agreement

Description

How to fill out Leaseback Provision In Sales Agreement?

You might spend numerous hours online looking for the legal document template that aligns with the federal and state regulations you need.

US Legal Forms offers a wide variety of legal forms that are reviewed by experts.

It is easy to obtain or generate the Iowa Leaseback Provision in Sales Agreement from our services.

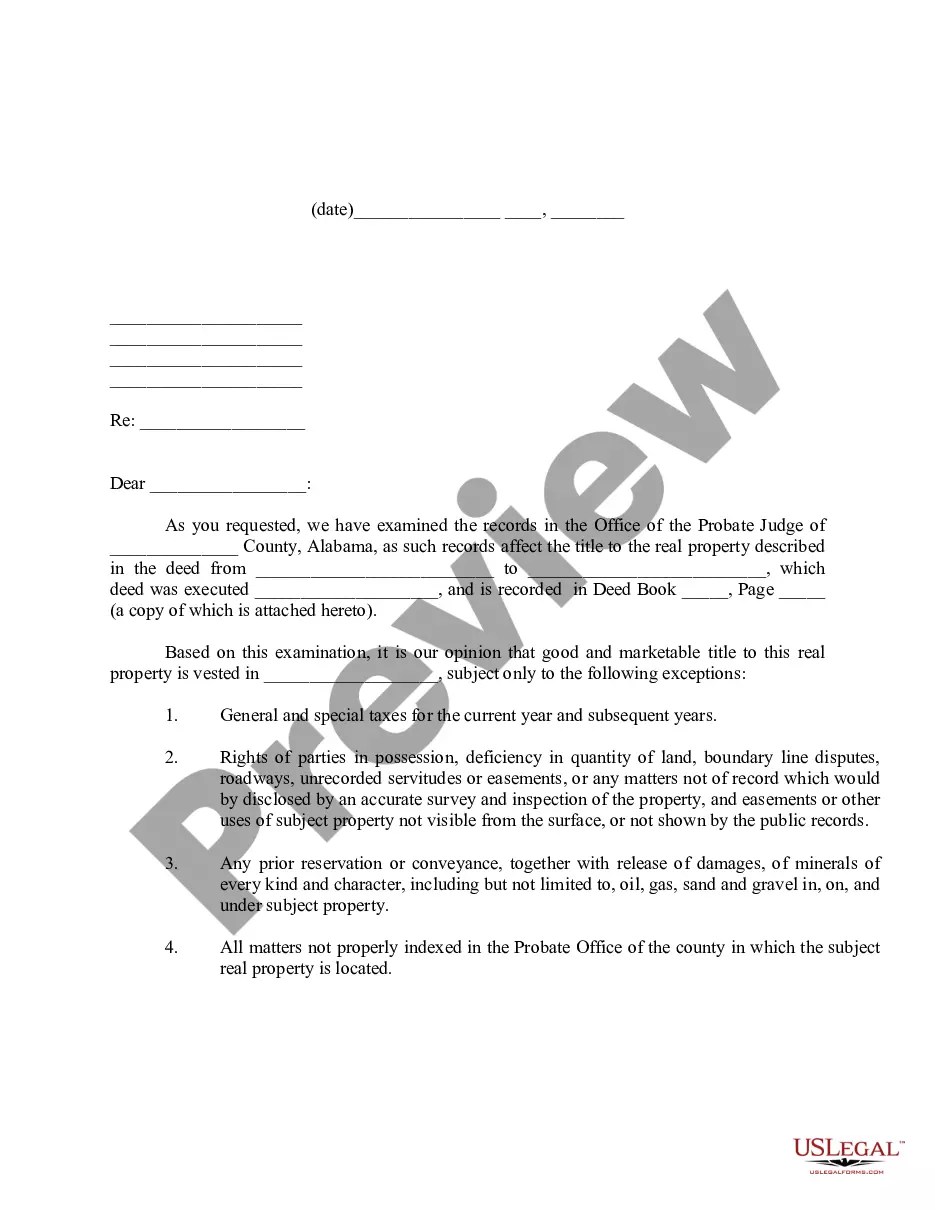

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain button.

- Then, you can complete, modify, generate, or sign the Iowa Leaseback Provision in Sales Agreement.

- Each legal document template you purchase is yours forever.

- To acquire an additional copy of the purchased form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, confirm that you have selected the correct document template for the area/city of your choice.

- Review the form description to ensure you have chosen the right one.

Form popularity

FAQ

Typical sale-leaseback terms include the duration of the lease, rental rates, and responsibilities for property maintenance. Often, the lease duration can range from several months to many years, providing flexibility for the seller. By utilizing the Iowa Leaseback Provision in Sales Agreement, both parties can agree on customized terms that meet their specific needs and ensure mutual satisfaction.

A sale and leaseback transaction allows a business to sell its property while continuing to use it through leasing. This method generates immediate capital for the seller, which can be reinvested into the business without losing access to the property. The Iowa Leaseback Provision in Sales Agreement effectively supports this structure, balancing the financial needs of the seller with the interests of the buyer.

Section 558.44 in Iowa outlines the regulations surrounding leaseback provisions in real estate transactions. It specifies the requirements for disclosures and any legal implications that may arise from such agreements. Understanding this section is crucial when dealing with the Iowa Leaseback Provision in Sales Agreement, ensuring compliance and protection for both the seller and buyer.

A leaseback provision is a clause in a sales agreement that allows the seller to lease the property back from the buyer after the sale. This arrangement lets the seller maintain operational control of the property while receiving immediate capital from the sale. The Iowa Leaseback Provision in Sales Agreement facilitates this, providing clear terms to protect both parties involved.

A key characteristic of a sale and leaseback arrangement is the combination of selling an asset while simultaneously securing the right to use it. This arrangement allows sellers to liquefy assets while continuing operations as usual. The Iowa Leaseback Provision in Sales Agreement ensures that both the buyer and seller understand their rights and responsibilities, thereby creating a beneficial partnership.

At the lease's inception, the sale portion of the sale/leaseback transaction is accounted for by recognizing the proceeds from the sale while ensuring compliance with the Iowa Leaseback Provision in Sales Agreement. Entities should follow applicable accounting standards, recording the asset's transfer and the lease liability. Proper accounting ensures transparent reporting and accurate fiscal insights.

The primary difference between a lease and a sale lies in the ownership of the asset. In a sale, ownership transfers from the seller to the buyer, while in a lease, the lessor retains ownership but grants the lessee the right to use the asset for a period. The Iowa Leaseback Provision in Sales Agreement facilitates this distinction by outlining specific terms regarding asset management and financial responsibilities.

An entity evaluates whether the asset transfer qualifies as a sale by analyzing the terms of the Iowa Leaseback Provision in Sales Agreement. Crucial aspects include whether the risks and rewards of ownership have shifted, as well as if the arrangement meets the accounting standards set forth. Clarity in these terms helps in understanding the implications for financial reporting.

To determine if a sale and leaseback is indeed a sale, you need to assess the ownership transfer of the asset. The Iowa Leaseback Provision in Sales Agreement typically indicates that legal title and the risks of ownership have shifted to the buyer. Look for the terms regarding payment and responsibilities, as these play an essential role in this determination.

Sale and leaseback occurs when an owner sells an asset and immediately leases it back from the buyer. For example, a company might sell its office building to raise funds but then lease it back to maintain operations. Understanding the nuances of the Iowa Leaseback Provision in Sales Agreement can help owners structure this kind of deal to maximize financial flexibility while preserving asset use.