Iowa Agreement for Sale of Business by Sole Proprietorship with Leased Premises

Description

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Leased Premises?

If you require to complete, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's straightforward and efficient search features to locate the documents you need.

Numerous templates for business and personal use are organized by categories and suggestions or keywords.

Step 4. Once you have located the required form, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the Iowa Agreement for Sale of Business by Sole Proprietorship with Leased Premises with just a couple of clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download option to receive the Iowa Agreement for Sale of Business by Sole Proprietorship with Leased Premises.

- You can also access forms you previously obtained from the My documents section of your account.

- If you are new to US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have selected the form for your appropriate area/country.

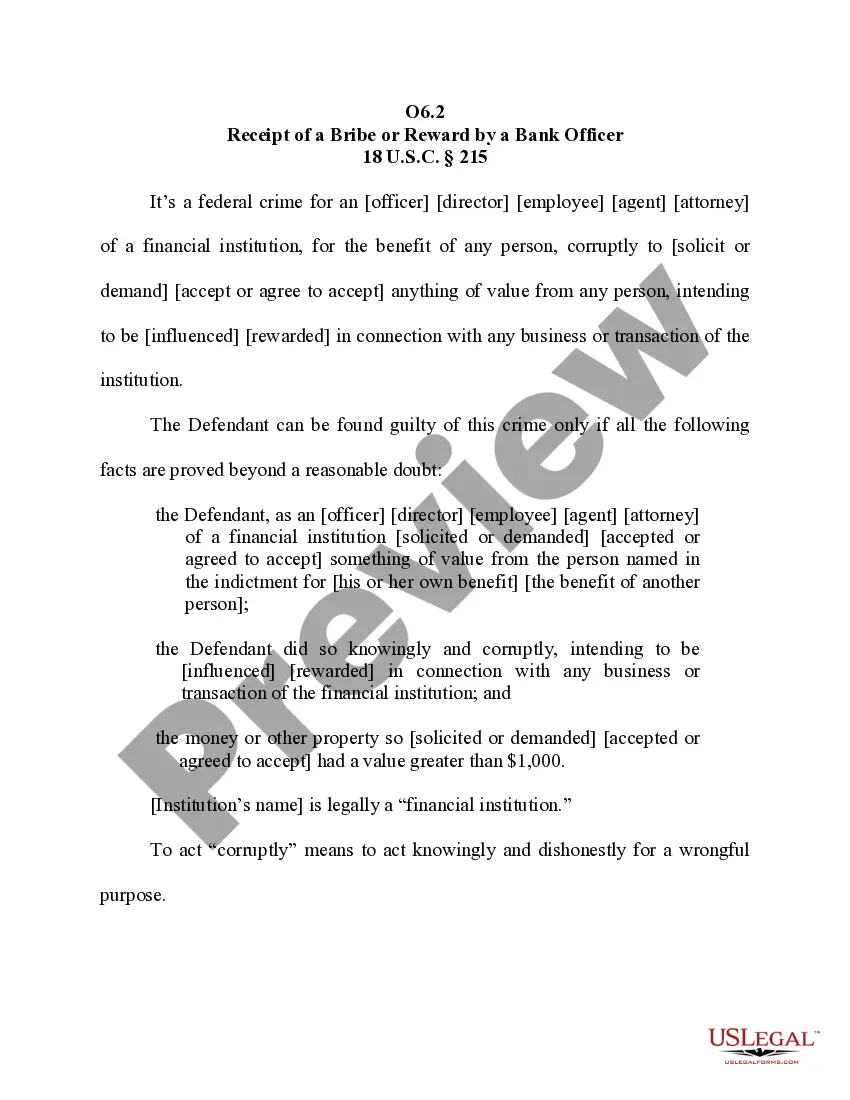

- Step 2. Use the Preview option to review the form's content. Don't forget to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search field near the top of the screen to find other types of the legal form you need.

Form popularity

FAQ

To fill out an Iowa sales tax exemption certificate, you need to provide specific business information along with details about the exempt transaction. The process helps ensure tax compliance for your business dealings. If you are operating under an Iowa Agreement for Sale of Business by Sole Proprietorship with Leased Premises, it’s crucial to complete this form accurately to avoid tax liabilities.

Iowa does not tax certain items such as food, prescription drugs, and certain medical devices. As a business owner, knowing these exemptions can aid in strategic financial planning. When engaging in an Iowa Agreement for Sale of Business by Sole Proprietorship with Leased Premises, be sure to familiarize yourself with all applicable tax exemptions.

Several states do not impose a sales tax on clothing, with notable examples being Delaware and Montana. These states may provide more favorable conditions for businesses focused on apparel. However, if your operations are tied to Iowa, understanding the state’s taxation policies is key within an Iowa Agreement for Sale of Business by Sole Proprietorship with Leased Premises.

Selling clothes in Iowa is generally considered taxable unless the items fall under specific exemptions. Given this, ensure your business structure is compliant with state laws while navigating an Iowa Agreement for Sale of Business by Sole Proprietorship with Leased Premises. Understanding what qualifies for tax exemptions can benefit your bottom line.

In Iowa, there is generally a sales tax applied to clothing purchases. However, certain items may be exempt during designated sales tax holidays. If you are involved in an Iowa Agreement for Sale of Business by Sole Proprietorship with Leased Premises and sell clothing, it's important to understand the tax implications and any exemptions that may apply.

Competition law in Iowa focuses on maintaining fair competition among businesses and preventing monopolistic practices. This law helps protect consumers and ensures a level playing field for all businesses. When structuring an Iowa Agreement for Sale of Business by Sole Proprietorship with Leased Premises, understanding Iowa's competition laws can help you avoid legal pitfalls and operate your business ethically.

Iowa Code 364.2 refers to the city's authority to regulate businesses through licensing and permits. This code helps establish the legal framework for operating a business within the state. If you are planning to enter an Iowa Agreement for Sale of Business by Sole Proprietorship with Leased Premises, familiarity with this code will be essential for compliance with local regulations and ensuring smooth business operations.

The difference lies in the level of control and support provided. A franchise typically involves a well-established brand and ongoing support from the franchisor. In contrast, a business opportunity usually requires less oversight and can often be purchased without the extensive guidelines that come with franchises. When dealing with an Iowa Agreement for Sale of Business by Sole Proprietorship with Leased Premises, understanding these differences will help you choose the right path for your business goals.

Iowa's business opportunity law regulates how business opportunities are sold and marketed, ensuring that buyers receive honest and complete information. This law helps protect consumers from deceptive practices by requiring sellers to provide certain disclosures. If you’re considering an Iowa Agreement for Sale of Business by Sole Proprietorship with Leased Premises, understanding these laws will help you make informed decisions and safeguard your investment.

Iowa does impose a 7% sales tax on most goods and services. This tax is relevant when you are purchasing items or services as part of your business operations. However, certain exemptions may apply, particularly for specific business activities. To navigate these complexities in your business, especially if you are involved in an Iowa Agreement for Sale of Business by Sole Proprietorship with Leased Premises, consult our legal forms for clarity.