Iowa Personal Guaranty - General

Description

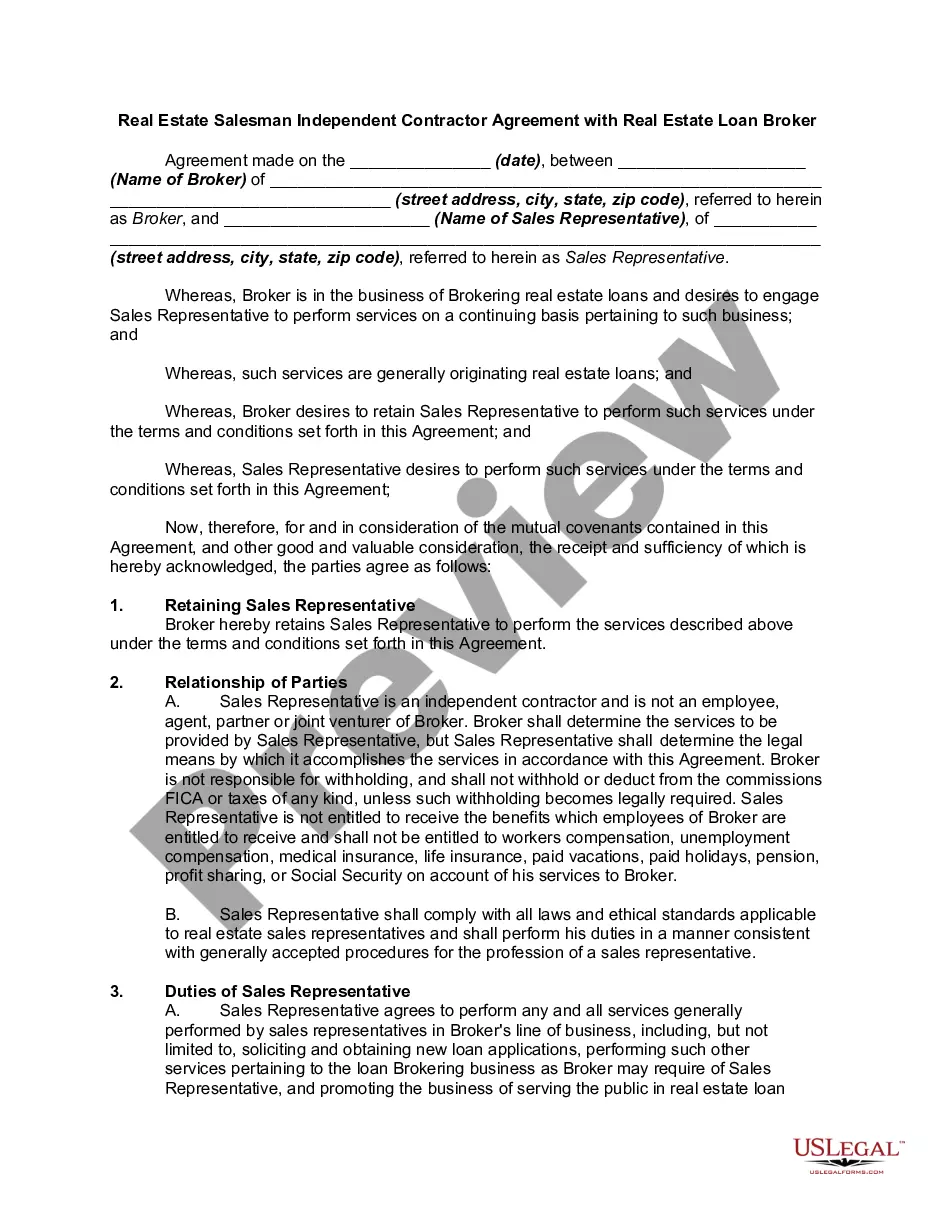

How to fill out Personal Guaranty - General?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a wide selection of legal document templates that you can download or print. Through the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of documents such as the Iowa Personal Guaranty - General in moments. If you already have an account, Log In and download the Iowa Personal Guaranty - General from the US Legal Forms library. The Download button will be available on every form you view.

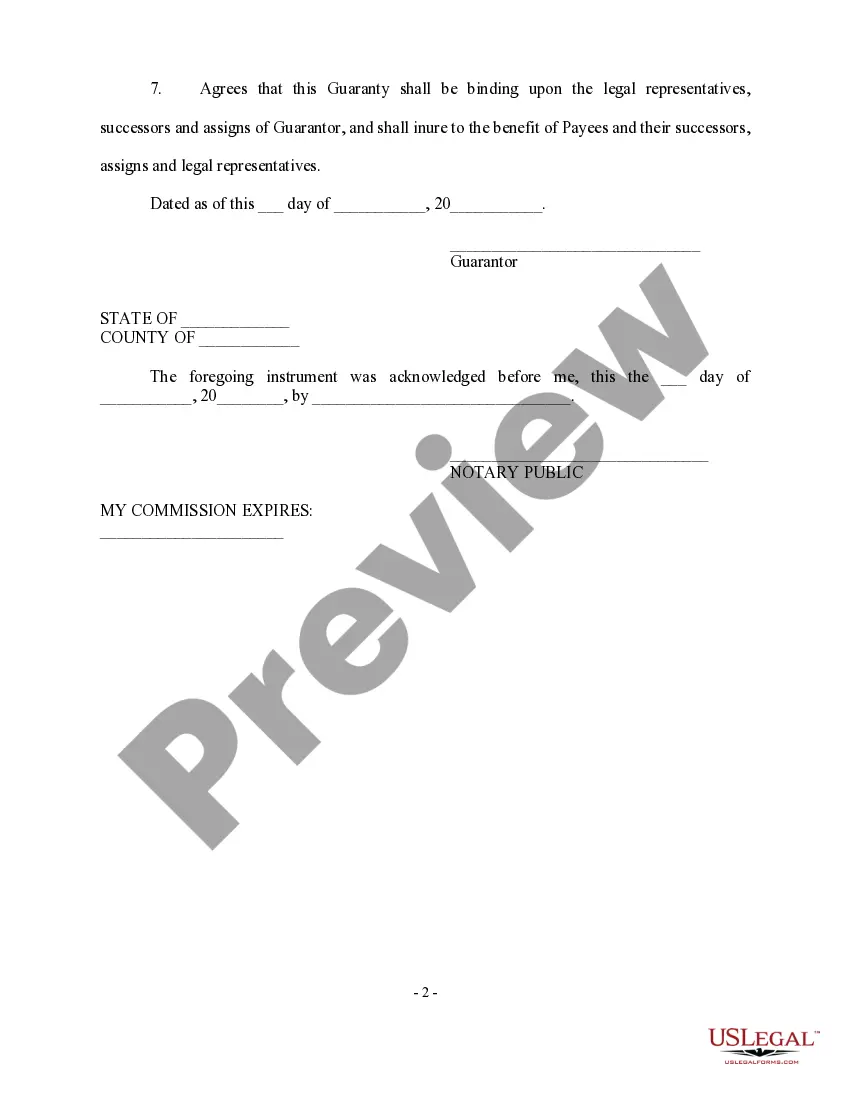

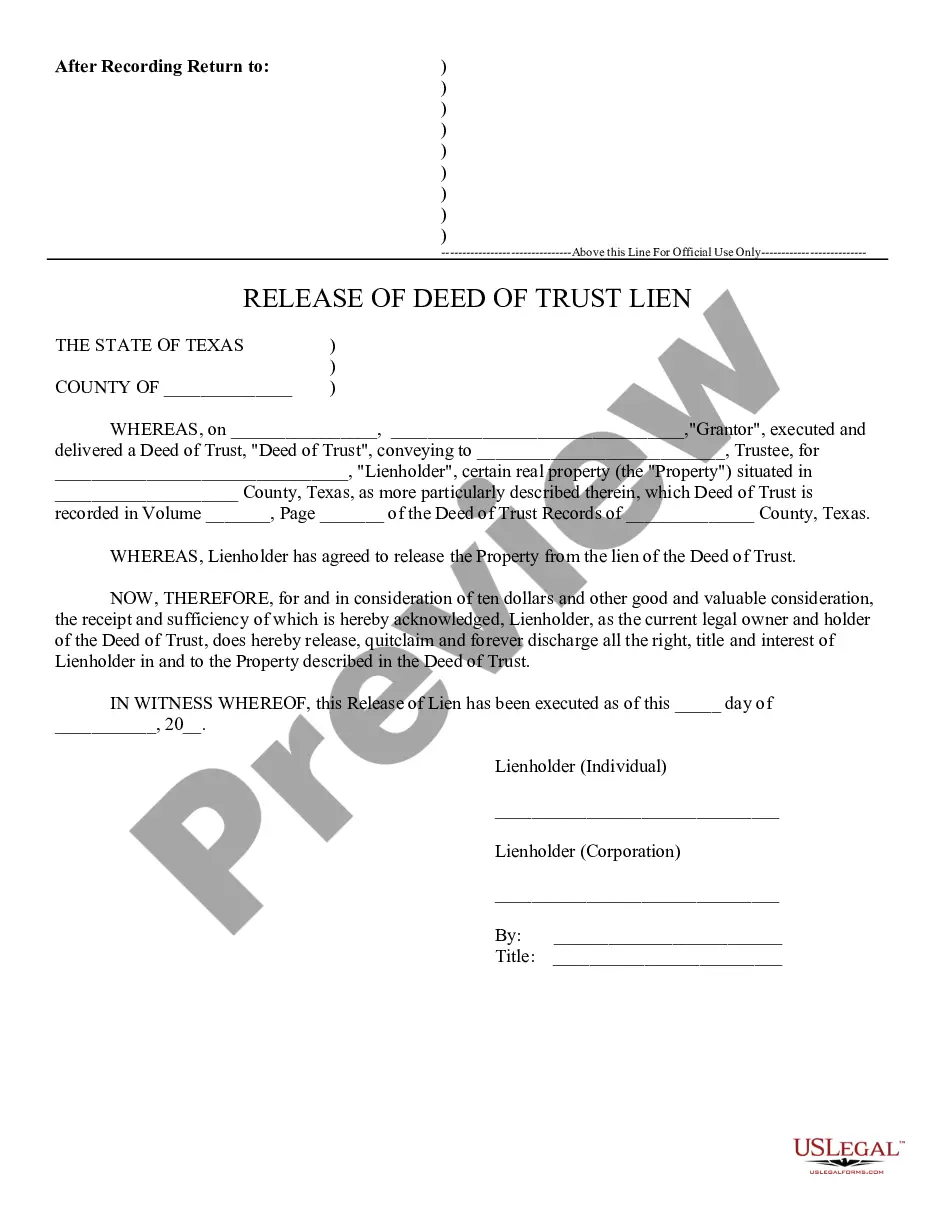

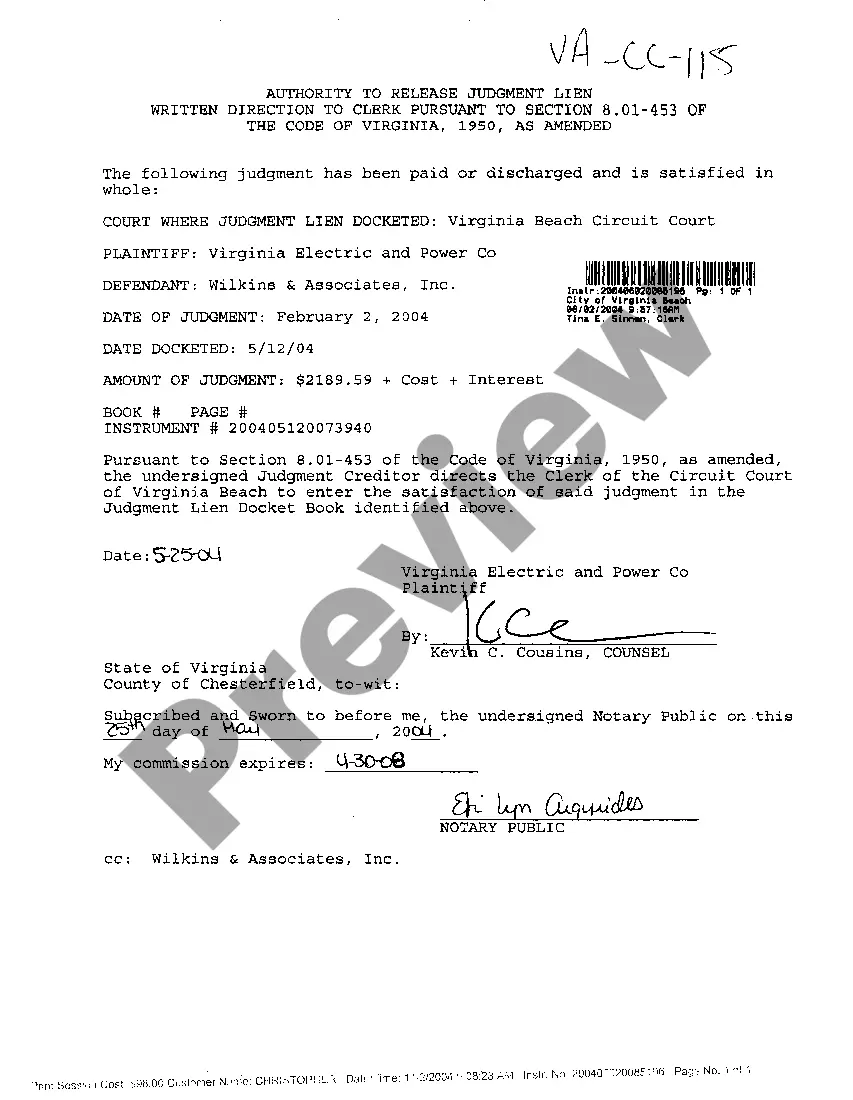

You gain access to all previously acquired forms in the My documents section of your account. To use US Legal Forms for the first time, here are simple steps to help you get started: Ensure you have selected the correct form for your location/state. Click on the Preview button to examine the form’s content. Review the form summary to confirm that you have chosen the correct document.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose the payment plan you prefer and provide your information to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

- Select the format and download the form to your device.

- Make changes. Fill out, modify, and print and sign the downloaded Iowa Personal Guaranty - General.

Form popularity

FAQ

The easiest way to create a power of attorney in Iowa is to use a reliable online legal service where you can find templates and step-by-step guidance. Uslegalforms offers user-friendly resources to help you prepare the document correctly, ensuring it meets all legal requirements. Creating your power of attorney with the help of these services can save time and help you confidently establish your intentions concerning Iowa Personal Guaranty - General.

Generally, you do not need to file power of attorney documents in Iowa, unless they relate to real estate transactions. In that case, filing should occur at the county recorder’s office where the property is located. If you have questions about the proper filing process related to Iowa Personal Guaranty - General, uslegalforms provides comprehensive guidance to simplify your experience.

The best way to set up a power of attorney in Iowa involves understanding your specific needs and selecting a trusted person to act on your behalf. You should also consult an attorney or legal resource, like uslegalforms, to ensure all necessary components are included for the document to be valid. Clear designation of powers and a notarization step will ensure your power of attorney aligns with Iowa Personal Guaranty - General requirements.

In Iowa, you typically do not need to file a power of attorney with a court. However, if it pertains to real estate, it's best to record it with the county recorder where the property is located. For more information on handling paperwork or navigating legal requirements related to Iowa Personal Guaranty - General, uslegalforms offers resources that can guide you through the process effectively.

Yes, in Iowa, a power of attorney generally needs to be notarized to be legally effective. This requirement helps ensure that the document is authentic and the signer's identity is verified. By notarizing your power of attorney, you add an extra layer of security, which is crucial when dealing with matters like Iowa Personal Guaranty - General. It's advisable to consult legal resources or uslegalforms for assistance to ensure compliance.

In Iowa, permissible fees can vary depending on the specific services rendered and the type of transaction. Commonly, fees associated with Iowa Personal Guaranty - General may include closing costs, title search fees, and document preparation charges. It's essential to understand these fees to avoid unexpected costs during property transactions, and platforms like uslegalforms can help provide clear guidance.

The Iowa Life and Health Guaranty Association is supervised by the Iowa Insurance Division. This oversight ensures that the association operates in accordance with state regulations, protecting policyholders in the event of an insurance company insolvency. With this supervision, Iowa Personal Guaranty - General provides an added level of security for consumers, reinforcing trust in the insurance system.

The Iowa Title Guaranty program began in 1985 to enhance the reliability of property transactions in Iowa. This initiative was designed to protect property buyers and mortgagors by providing a form of insurance against title defects. By establishing this program, Iowa aimed to create a secure framework for real estate transactions, making Iowa Personal Guaranty - General a vital aspect of property ownership.

The strength of a personal guarantee largely depends on the asset backing it and the individual’s financial situation. A personal guarantee provides a strong assurance to lenders because it holds the guarantor personally liable. In Iowa, the enforceability of such guarantees is well-established, adding to their strength. Engaging with platforms like uslegalforms can enhance your understanding and aid in drafting a robust Iowa Personal Guaranty - General.

An example of a personal guarantee in Iowa involves a homeowner signing to guarantee a mortgage or home equity line of credit. In this situation, the homeowner is personally responsible for the debt if the primary borrower fails to make payments. This adds a layer of security for lenders, as they may pursue the guarantor's assets in case of default. Understanding such examples clarifies the weight of an Iowa Personal Guaranty - General.