Iowa Promissory Note - Balloon Note

Description

How to fill out Promissory Note - Balloon Note?

Are you in a situation where you require documentation for either business or personal purposes nearly every day? There are many legal document templates available online, but finding ones you can rely on can be challenging.

US Legal Forms offers a vast array of form templates, such as the Iowa Promissory Note - Balloon Note, designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess your account, simply Log In. After that, you can download the Iowa Promissory Note - Balloon Note template.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can retrieve another copy of the Iowa Promissory Note - Balloon Note at any time, if necessary. Simply follow the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. This service provides well-crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you require and ensure it is for your correct area/region.

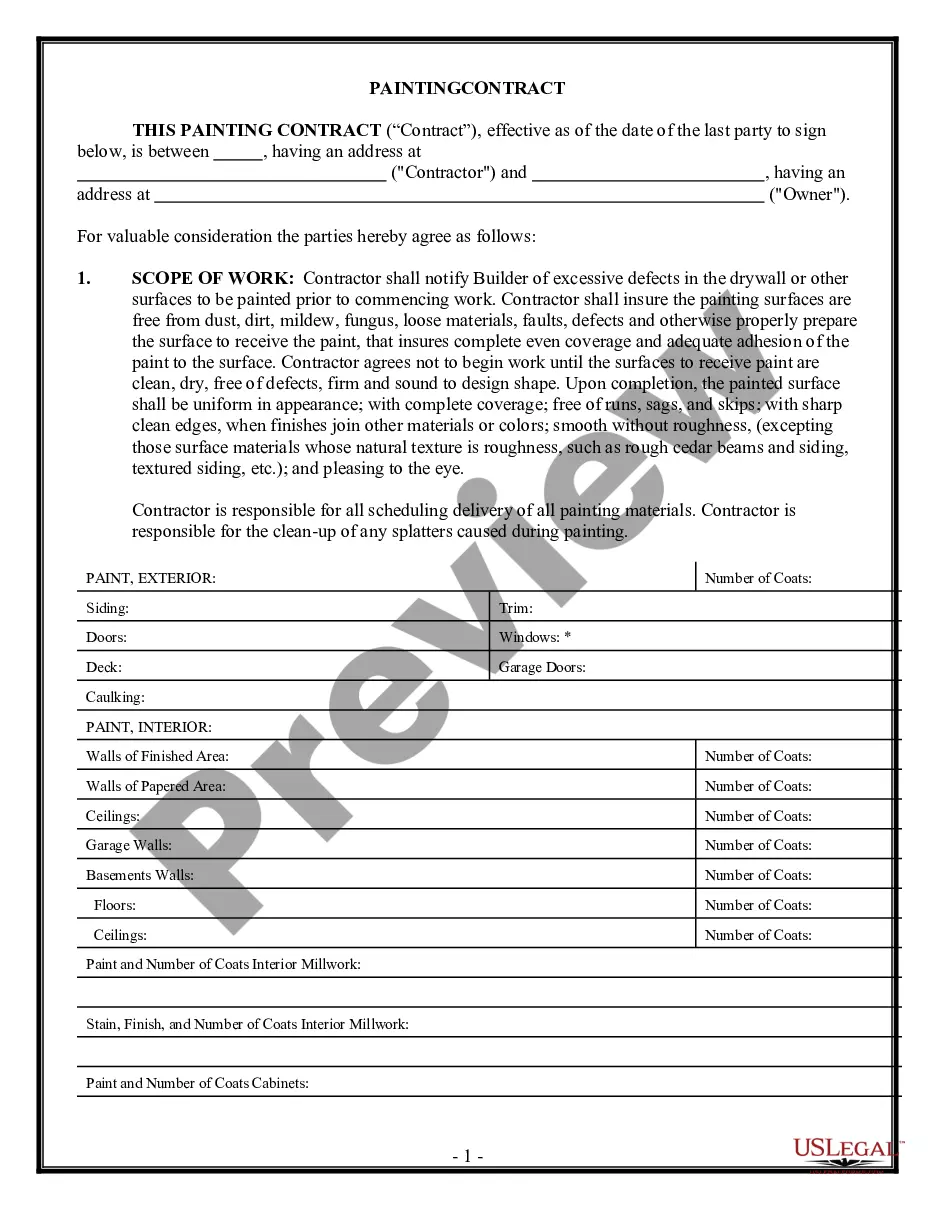

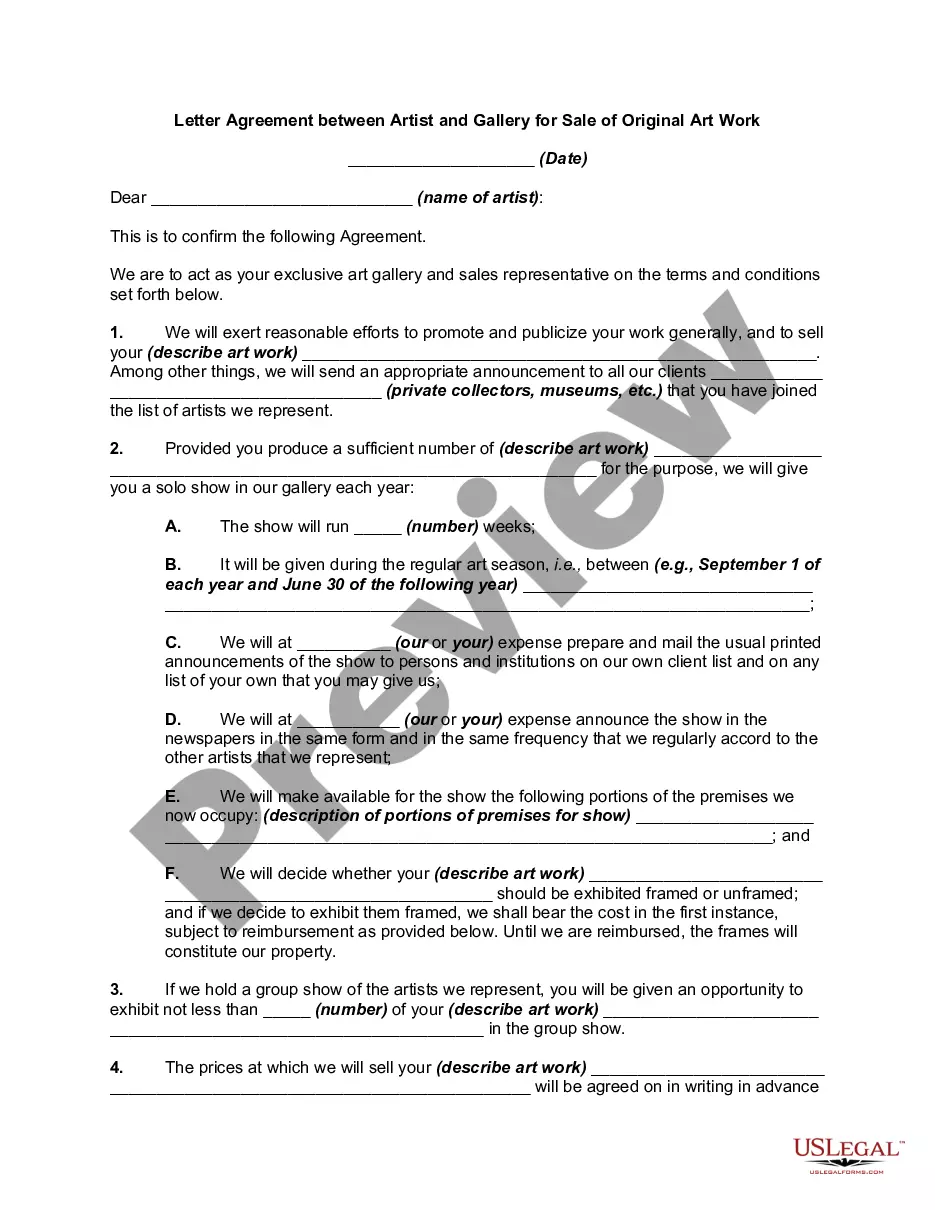

- Utilize the Review button to evaluate the form.

- Check the description to confirm you have selected the suitable form.

- If the form does not fit your needs, use the Search field to find the document that meets your requirements.

- Once you find the appropriate form, click on Acquire now.

- Select the pricing plan you prefer, fill in the needed information to set up your account, and complete the purchase using your PayPal or credit card.

Form popularity

FAQ

Yes, balloon notes are legal in most states, including Iowa. However, they must meet state lending regulations to ensure borrower protection. It's important for borrowers to read the terms carefully and consider seeking legal advice. Utilizing platforms like USLegalForms can provide clarity on the legal aspects of an Iowa Promissory Note - Balloon Note.

An Iowa Promissory Note - Balloon Note can be highly enforceable if it meets certain legal requirements. It must include essential details such as the amount, repayment terms, and signatures of both parties. Proper documentation and clear terms help strengthen its enforceability in case of disputes. Using platforms like uslegalforms can assist you in drafting a legally sound promissory note that meets Iowa's specific requirements.

To claim a promissory note, start by reviewing the terms outlined in the Iowa Promissory Note - Balloon Note thoroughly. If payment is overdue, communicate with the borrower to resolve the situation amicably. Should disputes arise, legal action may be necessary, and platforms like USLegalForms can guide you in drafting proper legal documentation for your claim.

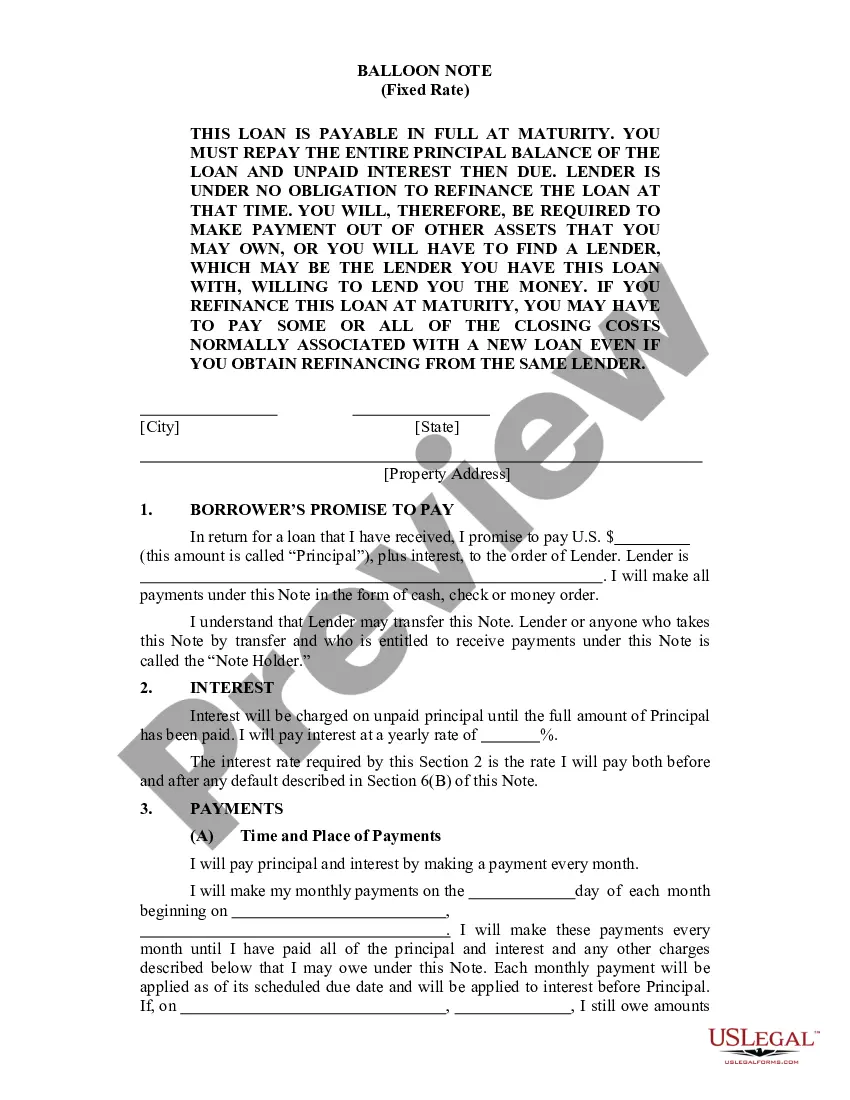

A balloon payment on an Iowa Promissory Note - Balloon Note is a large final payment due after a series of smaller, regular payments. This arrangement can make initial monthly payments lower, but it requires careful planning for the eventual larger amount owed. Understanding this structure is essential for both borrowers and lenders.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

Lender Funding In most cases, this funding happens within 2 to 3 business days after you sign your promissory note. To avoid delays, check your application Status Detail to ensure your bank info is complete.

The lender holds the promissory note while the loan is being repaid. Then the note is marked as paid. It's returned to the borrower when the loan is satisfied.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.