Iowa Mobile Home Park Storm Shelter Property Tax Exemption is a program available to owners of mobile home parks who install storm shelters on their properties. There are two types of Iowa Mobile Home Park Storm Shelter Property Tax Exemption available: a flat-rate tax exemption and a percentage-based tax exemption. The flat-rate tax exemption exempts the owner of a mobile home park from paying all property taxes on the storm shelter, regardless of its value. The percentage-based tax exemption exempts the owner of a mobile home park from paying a certain percentage of the storm shelter’s property taxes, depending on the value of the storm shelter. This program is intended to encourage owners of mobile home parks to install storm shelters for the safety of their residents.

Iowa Mobile Home Park Storm Shelter Property Tax Exemption

Description

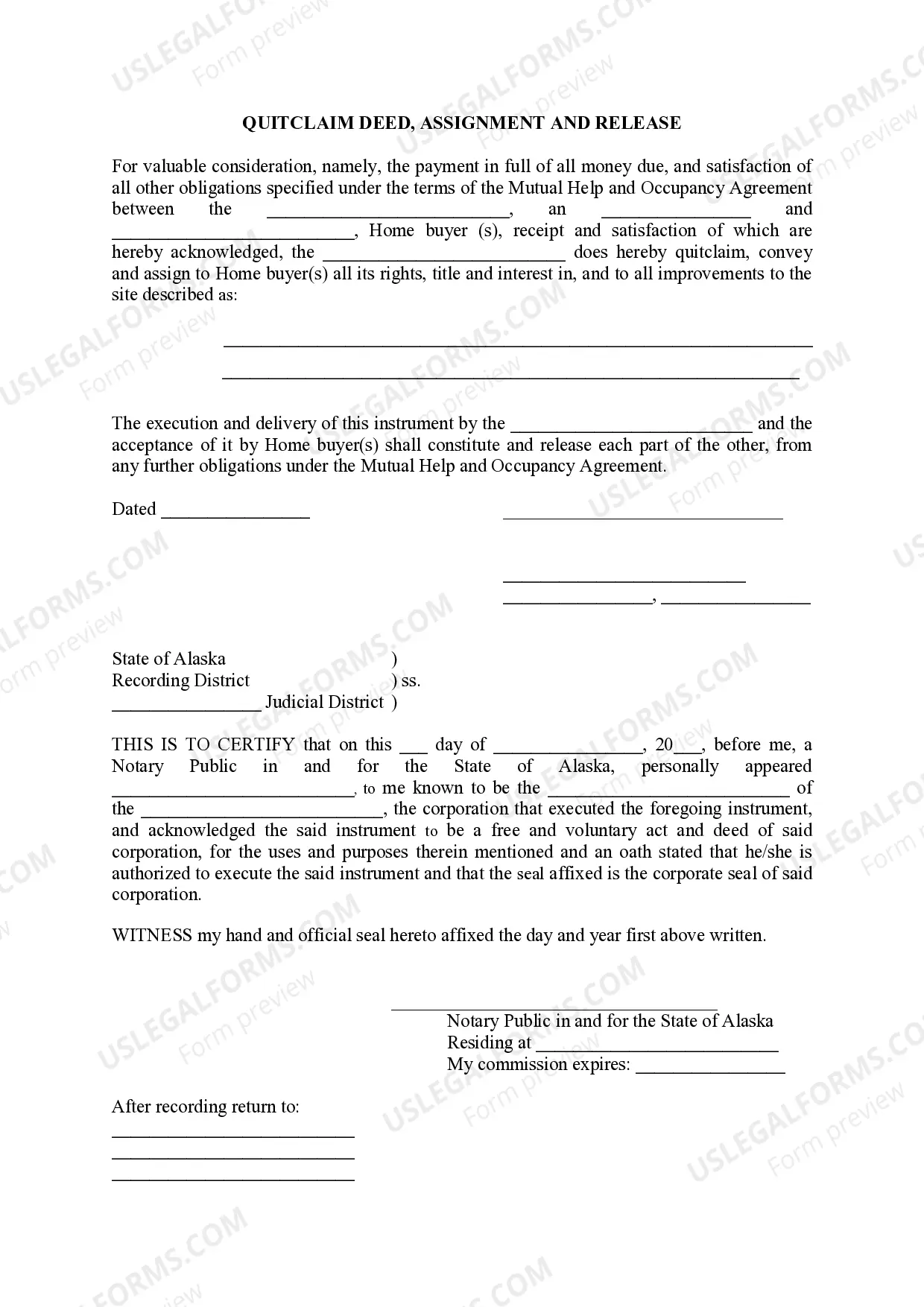

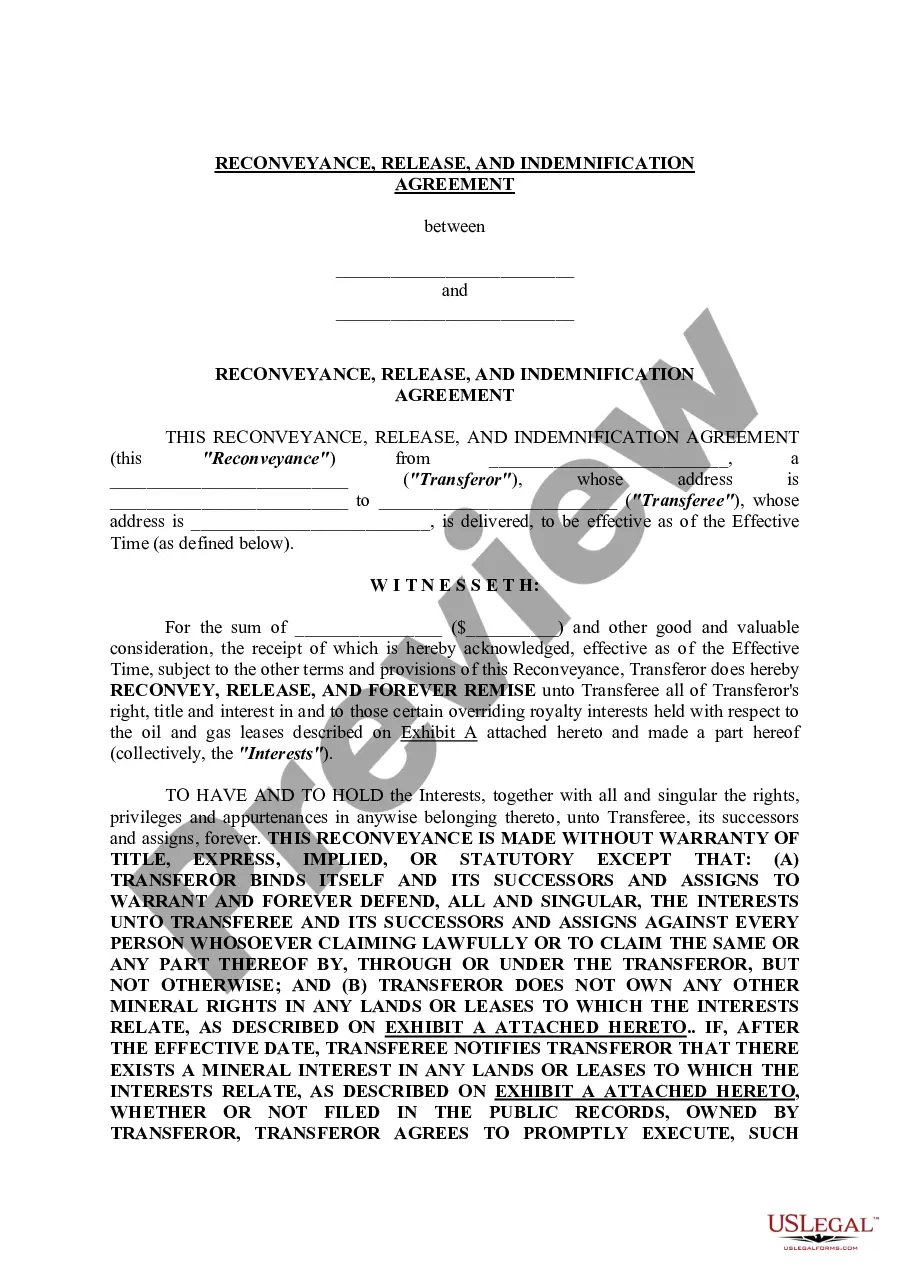

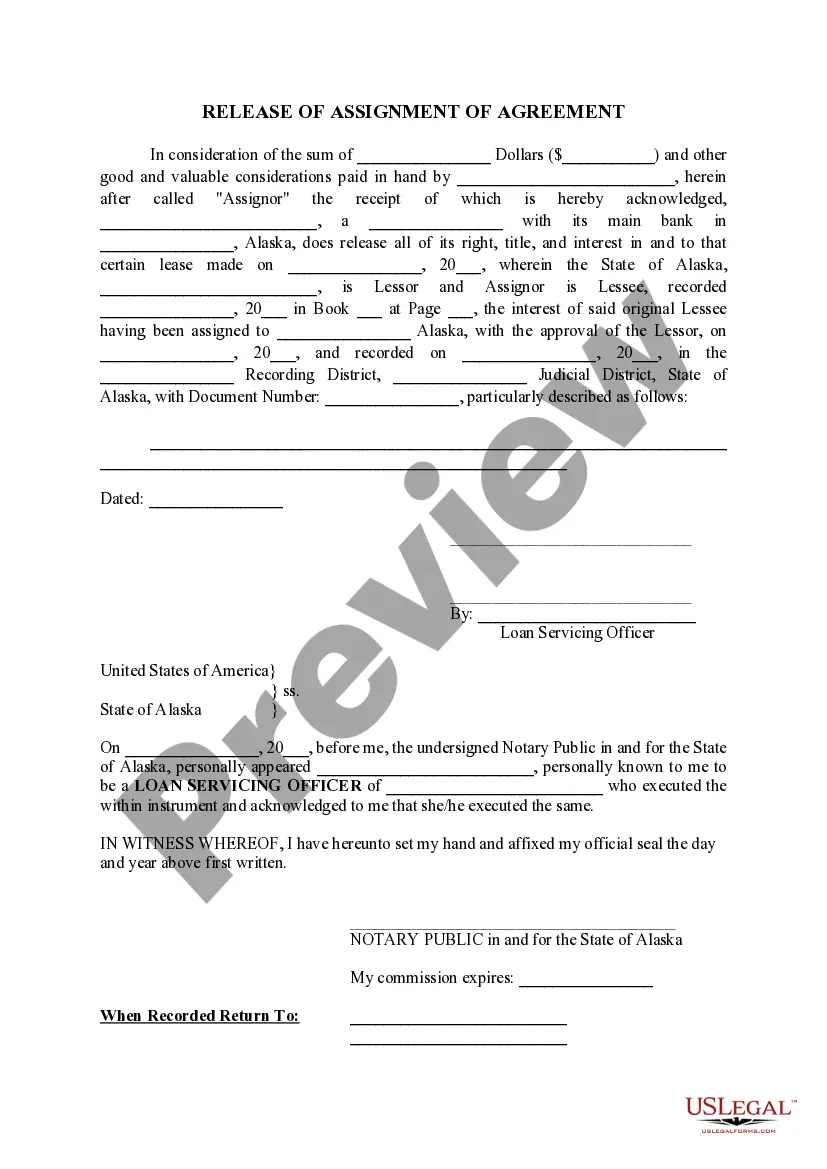

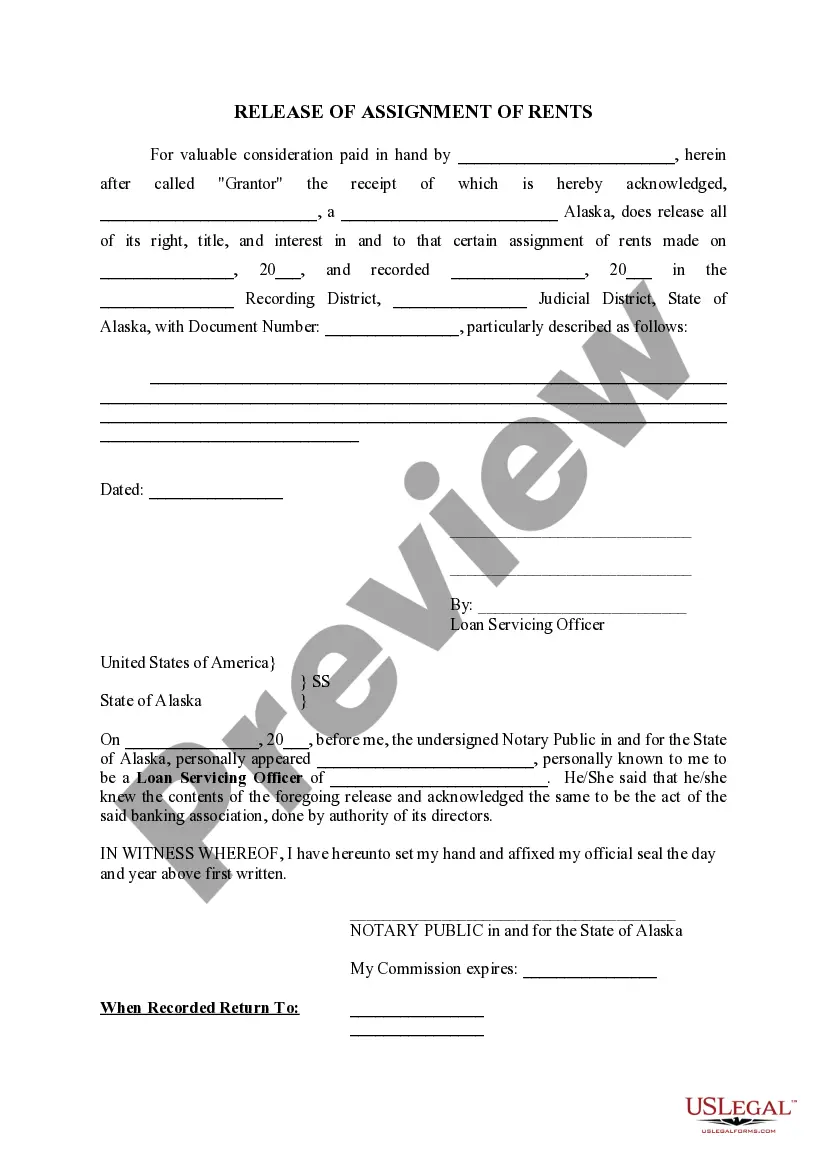

How to fill out Iowa Mobile Home Park Storm Shelter Property Tax Exemption?

Creating official documents can be quite a hassle if you lack accessible fillable templates. With the US Legal Forms online collection of formal papers, you can trust the blanks you receive, as they all align with federal and state regulations and are verified by our professionals.

Obtaining your Iowa Mobile Home Park Storm Shelter Property Tax Exemption from our collection is as simple as 1-2-3. Previously registered users with an active subscription just need to Log In and press the Download button once they locate the correct template. Later, if desired, users can access the same document from the My documents section of their account. However, even if you are not familiar with our service, registering with a valid subscription will only take a few minutes. Here’s a brief guide for you.

Haven’t you utilized US Legal Forms yet? Register for our service today to acquire any formal document swiftly and effortlessly whenever you require it, and maintain your paperwork organized!

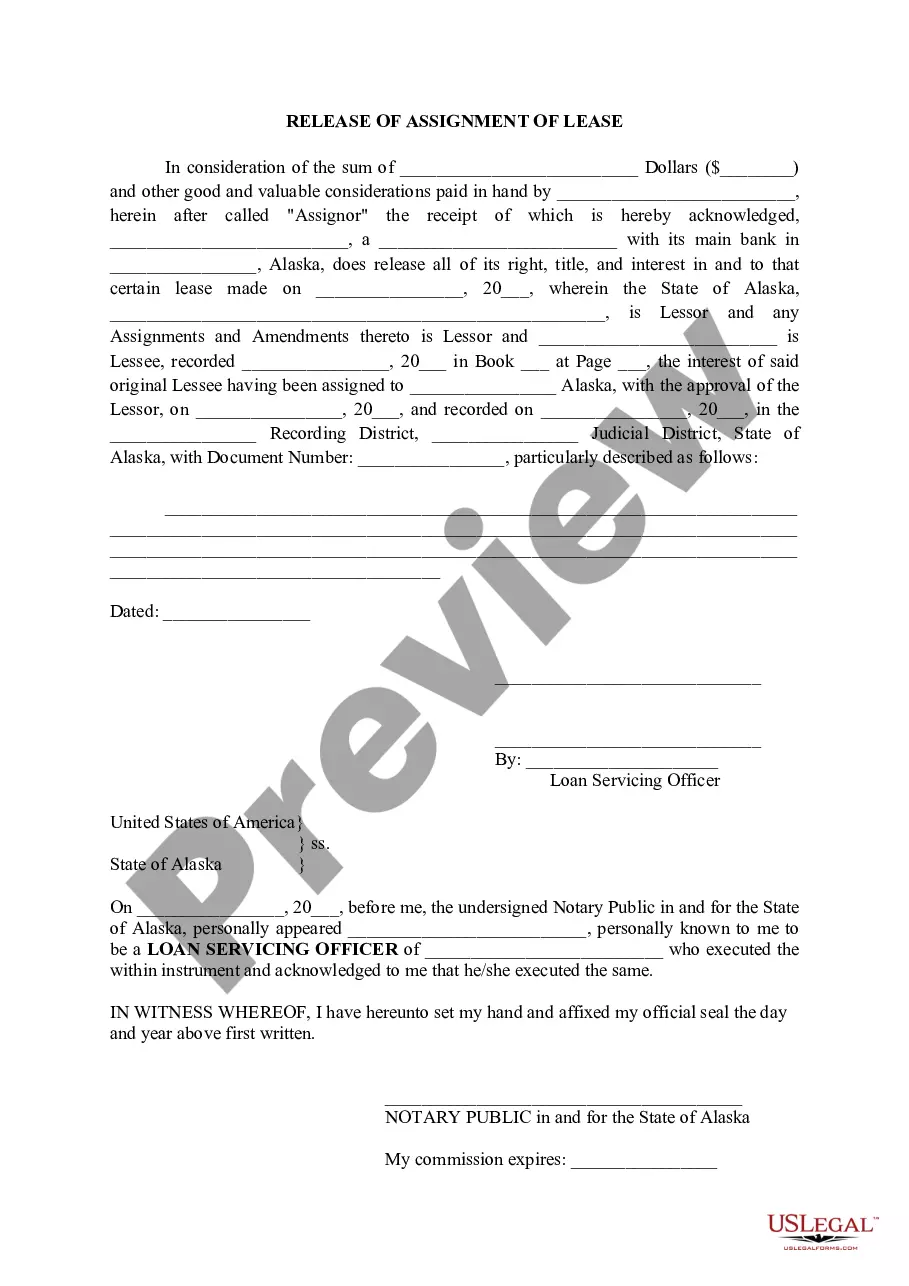

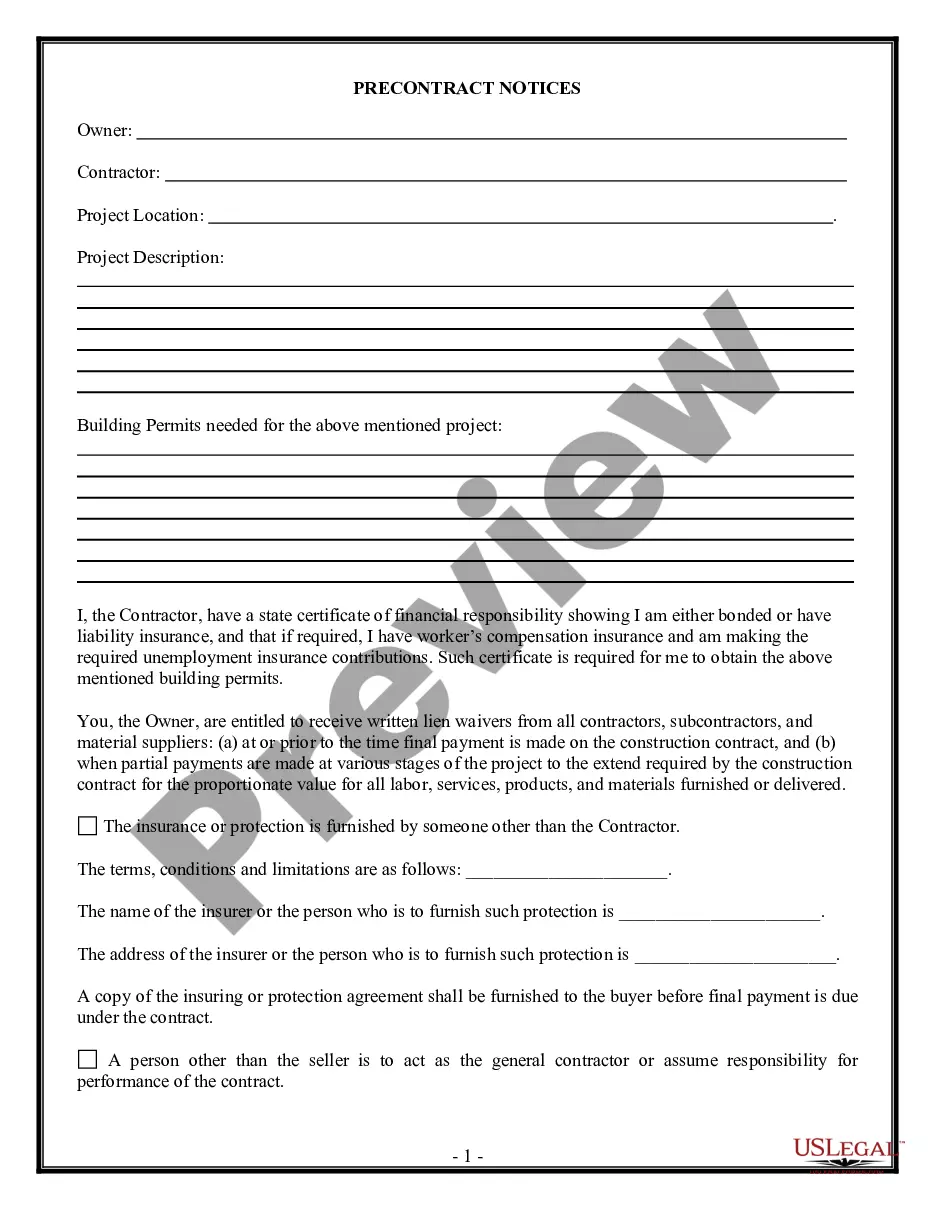

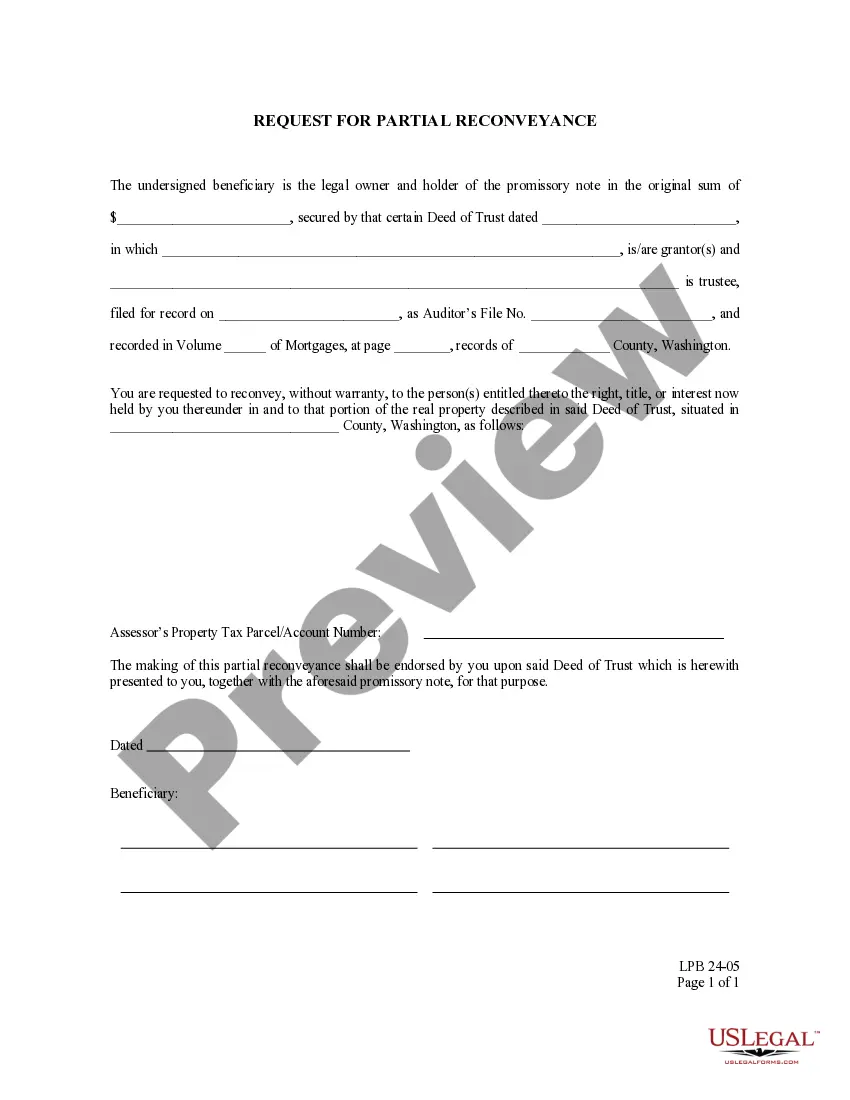

- Document compliance verification. You should thoroughly review the contents of the form you wish to ensure it meets your requirements and adheres to your state law guidelines. Previewing your document and examining its general information will assist you in accomplishing this.

- Alternative search (optional). If you encounter any discrepancies, search the library using the Search tab above until you identify an appropriate blank, and click Buy Now when you find the one you require.

- Account setup and form purchase. Create an account with US Legal Forms. After verifying your account, Log In and select your preferred subscription plan. Proceed with the payment (PayPal and credit card options are available).

- Template download and subsequent use. Choose the file format for your Iowa Mobile Home Park Storm Shelter Property Tax Exemption and click Download to store it on your device. Print it to finish your paperwork by hand, or utilize a feature-rich online editor to prepare an electronic version more swiftly and efficiently.

Form popularity

FAQ

In Iowa, you can obtain a sales tax exemption certificate by filling out the appropriate form available on the Iowa Department of Revenue's website. Following the guidelines correctly ensures you receive a certificate that will help with purchases relating to the Iowa Mobile Home Park Storm Shelter Property Tax Exemption. Consult the resources provided by uslegalforms for a straightforward process and assistance.

What is Tax Abatement? A temporary reduction in property taxes on the portion of assessed value added by new construction or improvements to an existing structure.

News Across the U.S. Access the digital replica of USA TODAY and more than 200 local newspapers with your subscription. Iowans age 65 or older are eligible for a property tax exemption worth $3,250 for the assessment year beginning Jan. 1, 2023. In subsequent years, the exemption doubles to $6,500.

IDR Announces: Homestead Tax Exemption for Claimants 65 Years of Age or Older. Iowa Department Of Revenue.

Iowa Homestead Tax Credit Eligibility: Must own and occupy the property as a homestead on July 1 of each year, declare residency in Iowa for income tax purposes and occupy the property for at least six months each year. Persons in the military or nursing homes who do not occupy the home are also eligible.

Your property tax payment may be paid in one full installment or two half installments. The first half is due on September 1 and becomes delinquent after September 30. The second half is due March 1 and becomes delinquent after March 31.

Eligibility: Must be 65 or older or totally disabled, and meet annual household low income requirements. Filing Requirements: A property owner must file a claim with the county treasurer by June 1 preceding the fiscal year in which the property taxes are due.

State homestead laws do place a limit on the value or acreage of property that can be designated as a homestead. The Hawkeye State allows citizens to set aside 40 acres of rural property or a half-acre of urban property under its homestead protections, and caps the value of protected personal property at $500.

If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. County taxes may still be due. Please contact your local taxing official to claim your homestead exemption.