Iowa Application for Property Tax Exemption for Certain Nonprofit & Charitable Organizations

Description

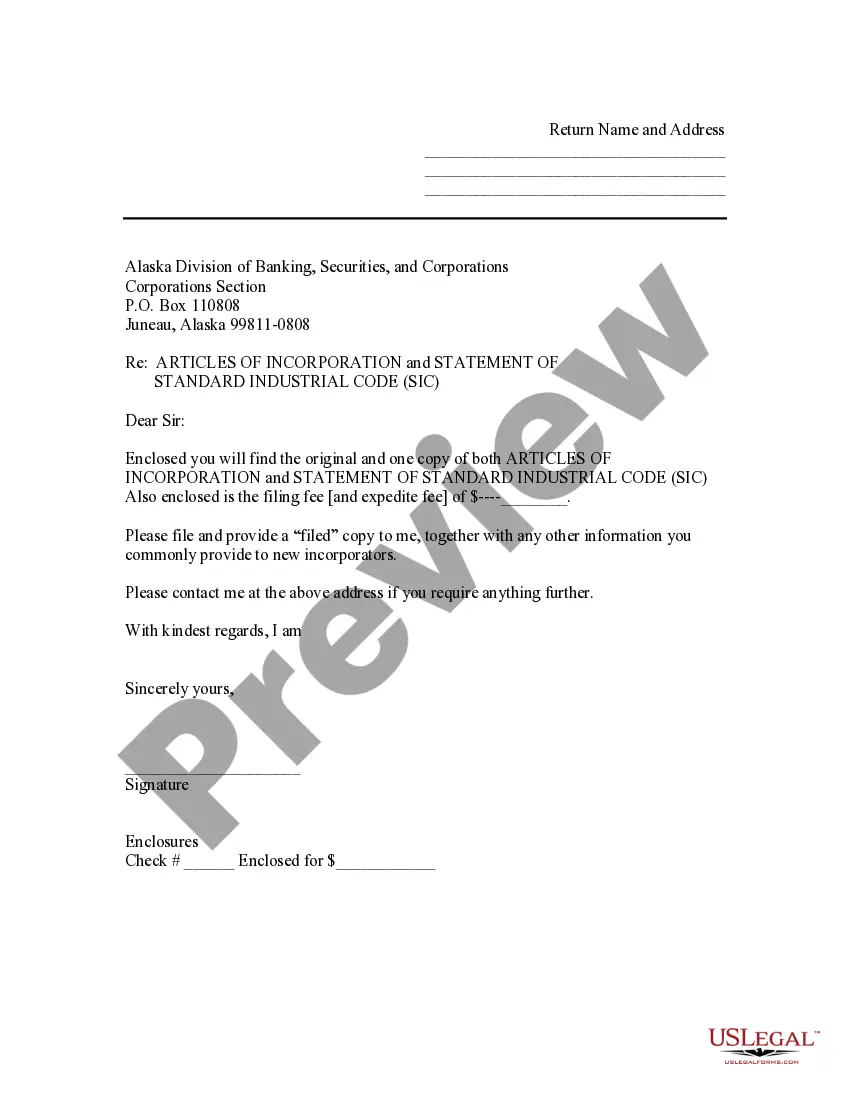

How to fill out Iowa Application For Property Tax Exemption For Certain Nonprofit & Charitable Organizations?

US Legal Forms is the simplest and most cost-effective method to locate suitable legal templates.

It boasts the largest online collection of business and personal legal documents created and confirmed by legal experts.

Here, you can discover printable and fillable templates that adhere to national and local laws - similar to your Iowa Application for Property Tax Exemption for Certain Nonprofit & Charitable Organizations.

Examine the form description or preview the document to ensure you’ve located the one that meets your needs or search for another using the search feature above.

Click Buy now when you’re confident about its alignment with all the specifications, and select the subscription plan that suits you best.

- Acquiring your template involves just a few easy steps.

- Users with an existing account and valid subscription only need to Log In to the site and download the form onto their device.

- Afterwards, they can access it in their profile under the My documents section.

- For first-time users looking for a professionally drafted Iowa Application for Property Tax Exemption for Certain Nonprofit & Charitable Organizations using US Legal Forms, here's what to do.

Form popularity

FAQ

exempt charity refers to an organization recognized by the IRS as eligible to receive taxdeductible contributions because it meets specific criteria under the tax code. These charities can provide essential services, support public benefits, and often enjoy advantages such as exemption from federal income tax. If your organization is considering applying for the Iowa Application for Property Tax Exemption for Certain Nonprofit & Charitable Organizations, understanding this concept is vital.

Iowans age 65 or older are eligible for a property tax exemption worth $3,250 for the assessment year beginning Jan. 1, 2023. In subsequent years, the exemption doubles to $6,500. Exemptions are a reduction in the taxable value of the property, not a direct reduction of how much property taxes a homeowner pays.

12 Iowa Code § 441.39. The statute states that a qualifying organization or society may exempt from property taxation land used by the organization or society solely for its appropriate purposes and not leased or used for pecuniary profit.

In Iowa, nonprofit entities, even if they have qualified for federal tax exempt status, are treated the same as individuals for sales and use tax purposes. However, purchases made for resell are exempt from all sales taxes, even if a nonprofit corporation does not have a sales tax permit.

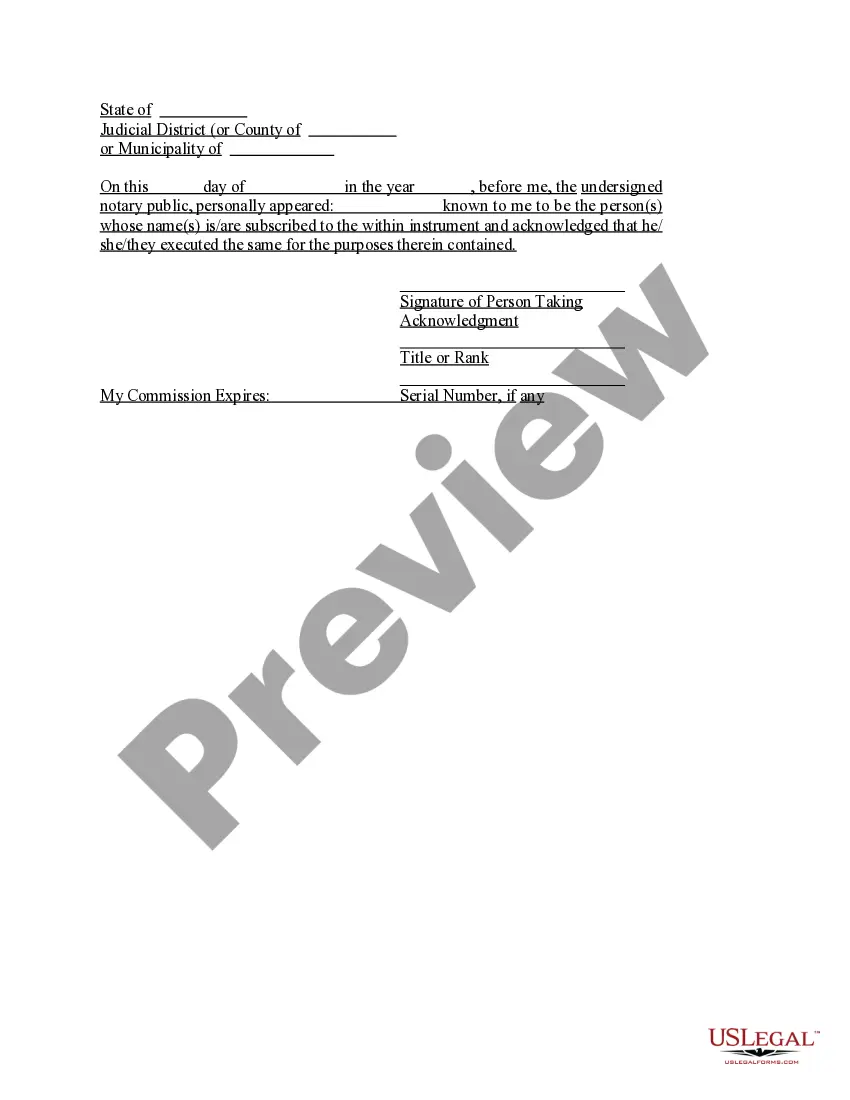

Once the formation documents are correct, requesting tax-exempt status requires the completion of IRS Form 1023, Application for Recognition of Exemption.

19. Pollution control and recycling. Pollution-control or recycling property as defined in this subsection shall be exempt from taxation to the extent provided in this subsection, upon compliance with the provisions of this subsection.

Religious and Charitable Exemption Sign up deadline: February 1. Iowa law allows religious and charitably owned property to be full exempt from taxes. In order for the property to be exempt, it must be solely used for religious or charitable purposes.

The property of any organization composed wholly of veterans of any war, when such property is devoted entirely to its own use and not held for pecuniary profit. 427.1(8) Property of religious, literary, and charitable societies.

All groups wishing to obtain 501(c)(3) exempt status must provide a statement of revenues and expenses and a balance sheet. An organization that has been in existence for five years or more must provide financial data for its most recent five years.

In addition to the homestead tax credit, eligible claimants who own the home they live in and are 65 years of age or older on or before January 1 of the assessment year are now eligible for a homestead tax exemption.