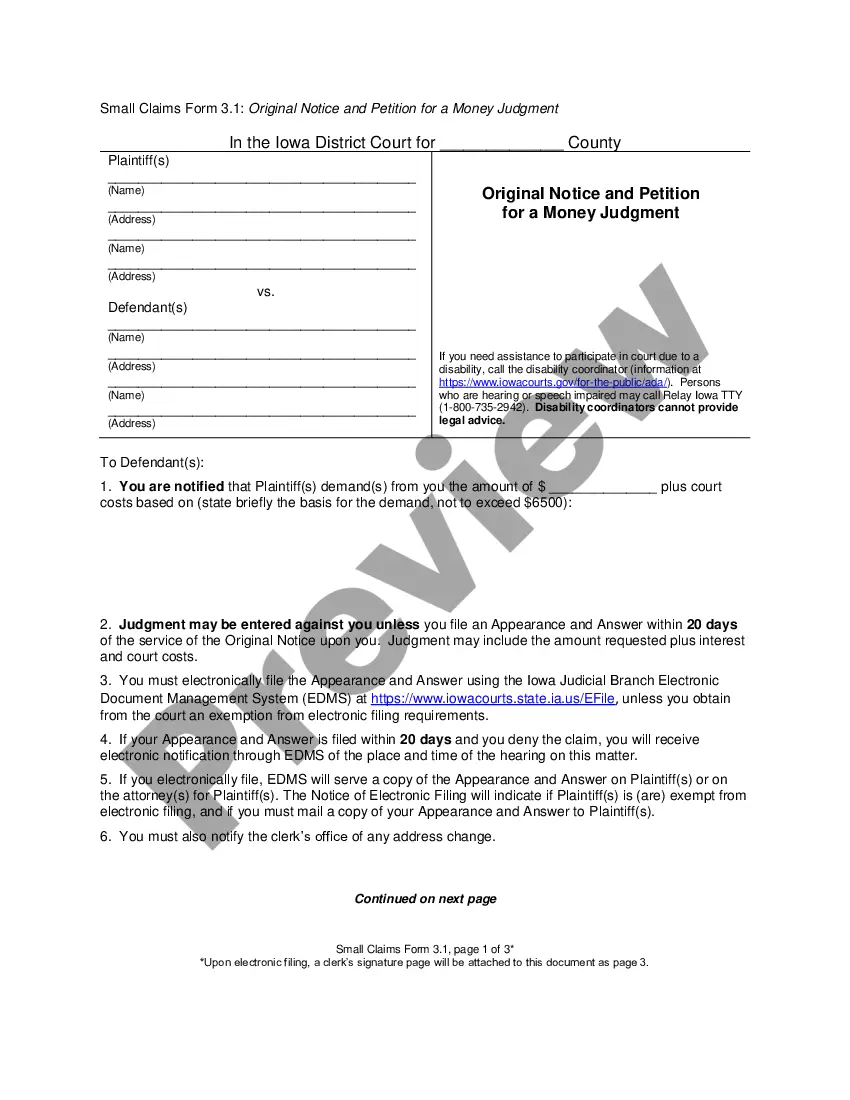

Iowa Original Notice And Petition For A Money Judgment For Taxes Owing is a document filed by the Iowa Department of Revenue against a taxpayer for unpaid taxes. This document initiates a legal action and informs the taxpayer that a money judgment may be obtained in the district court for the unpaid taxes. It gives the taxpayer the opportunity to contest the taxes assessed in court, or to negotiate a payment plan with the Department of Revenue. There are two types of Iowa Original Notice And Petition For A Money Judgment For Taxes Owing: (1) Notice Of Claim and (2) Petition For A Money Judgment. The Notice Of Claim informs the taxpayer of the taxes due, gives the taxpayer the right to appeal the assessed taxes, and provides contact information for the Department of Revenue. The Petition For A Money Judgment is a court document filed after the Notice of Claim has been issued, and requests that the court enter a money judgment against the taxpayer for the unpaid taxes.

Iowa Original Notice And Petition For A Money Judgment For Taxes Owing

Description

How to fill out Iowa Original Notice And Petition For A Money Judgment For Taxes Owing?

If you’re seeking a method to properly finalize the Iowa Original Notice And Petition For A Money Judgment For Taxes Owing without enlisting a legal advisor, then you’ve arrived at the perfect location.

US Legal Forms has established itself as the most comprehensive and esteemed collection of official templates for every individual and business circumstance. Each document you locate in our online service is crafted in compliance with federal and state laws, ensuring that your paperwork is accurate.

Another significant benefit of US Legal Forms is that you can always retrieve any paperwork you have acquired - you can access any of your downloaded templates in the My documents section of your profile whenever you require it.

- Ensure that the document displayed on the page aligns with your legal circumstances and state laws by reviewing its textual description or browsing through the Preview mode.

- Input the form title in the Search tab at the top of the page and select your state from the list to locate an alternative template in case of any discrepancies.

- Perform the content verification again and click Buy now when you are assured of the paperwork's adherence to all requirements.

- Log in to your account and click Download. Register for the service and select a subscription plan if you don’t already have one.

- Utilize your credit card or PayPal option to settle the payment for your US Legal Forms membership. The document will be accessible for download immediately afterward.

- Choose the format you wish to save your Iowa Original Notice And Petition For A Money Judgment For Taxes Owing and download it by clicking the designated button.

- Upload your template to an online editor to fill out and sign it swiftly or print it to prepare your physical copy manually.

Form popularity

FAQ

What kinds of cases are heard in small claims court? A small claims case is a civil action for a money judgment in which the amount of damages is $6,500 or less.

Open account: 5 years from last charge, payment, or admission of debt in writing. Unwritten contracts: 5 years from breach. Written contracts: 10 years from breach.

You must electronically file a request for an order "condemning" the funds held by clerk. The court will then order the clerk to pay you the amounts collected by the sheriff. You must pay the sheriff's fee. The sheriff will continue collection efforts until the judgment is satisfied or for a 120-day period.

The statute of limitations for small claims judgments for execution purposes is twenty years, and liens on those judgments exist for ten years. See Iowa Code sections 614.1(6), 624.23(1), 626.2 and 631.12. However, a judgment can be renewed by filing a new action.

Any judgment is presumed to be paid and discharged ten years after the judgment was rendered, however, a motion to extend judgment will renew the judgment for a period of ten years if sought within ten years from the initial judgment.

You must electronically file this Appearance and Answer using EDMS at unless you obtain from the court an exemption from electronic filing requirements.

Interest Rates on Judgments The interest rate on judgments is 10% unless a different rate was stated in the contract which the judgment was based on, that interest rate can't exceed the max that was permitted at the time.

How long do judgment liens last in Iowa? A judgment lien will remain attached to a debtor's property in Iowa for 10 years. It's worth noting that the lien will remain attached to the property even if the property is transferred or sold.