The Child Support Guidelines establish the presumptively correct amount of child support due for three children of the marriage. This form is available in both Word and Rich Text formats.

Iowa Child Support Guidelines - Three Children

Description

How to fill out Iowa Child Support Guidelines - Three Children?

Amid numerous complimentary and paid samples available on the internet, you cannot guarantee their trustworthiness.

For instance, who created them or if they possess the necessary skills to address your requirements.

Always remain composed and make use of US Legal Forms! Obtain Iowa Child Support Guidelines - Three Children documents crafted by qualified lawyers and avoid the expensive and lengthy process of searching for an attorney and then compensating them to prepare a document that you can easily do yourself.

Choose a payment plan and register for an account. Process your payment for the subscription using your credit or debit card or Paypal. Download the form in your desired file format. Once you have registered and paid for your subscription, you can utilize your Iowa Child Support Guidelines - Three Children as frequently as you wish or as long as it remains valid in your location. Modify it using your preferred editor, complete it, sign it, and produce a physical copy. Achieve more for less with US Legal Forms!

- If you have a membership, sign in to your account and locate the Download button adjacent to the form you need.

- You will also have access to your previously downloaded samples in the My documents section.

- If this is your first time using our website, follow the steps below to quickly obtain your Iowa Child Support Guidelines - Three Children.

- Ensure that the document you discover is applicable in your state.

- Review the template by examining the details using the Preview feature.

- Press Buy Now to initiate the purchase process or find another template using the Search box located in the header.

Form popularity

FAQ

In Iowa, a child can express their preference regarding visitation at around the age of 12. However, the court considers various factors before making decisions about custody and visitation, including the child's age, maturity, and the specific circumstances of the case. It's important to understand that the Iowa Child Support Guidelines - Three Children do not solely dictate visitation matters, but they play a role in overall child welfare. If you are navigating complex custody issues, US Legal Forms can help you find the necessary legal documents to support your case.

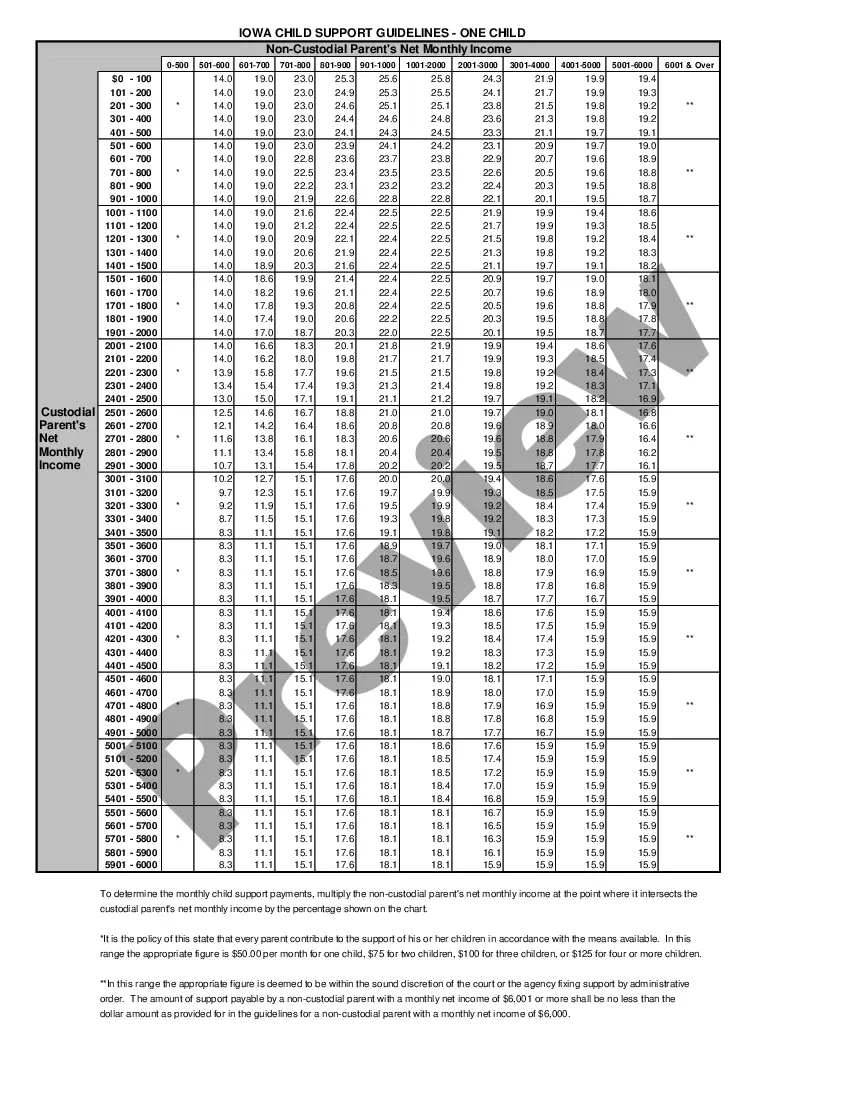

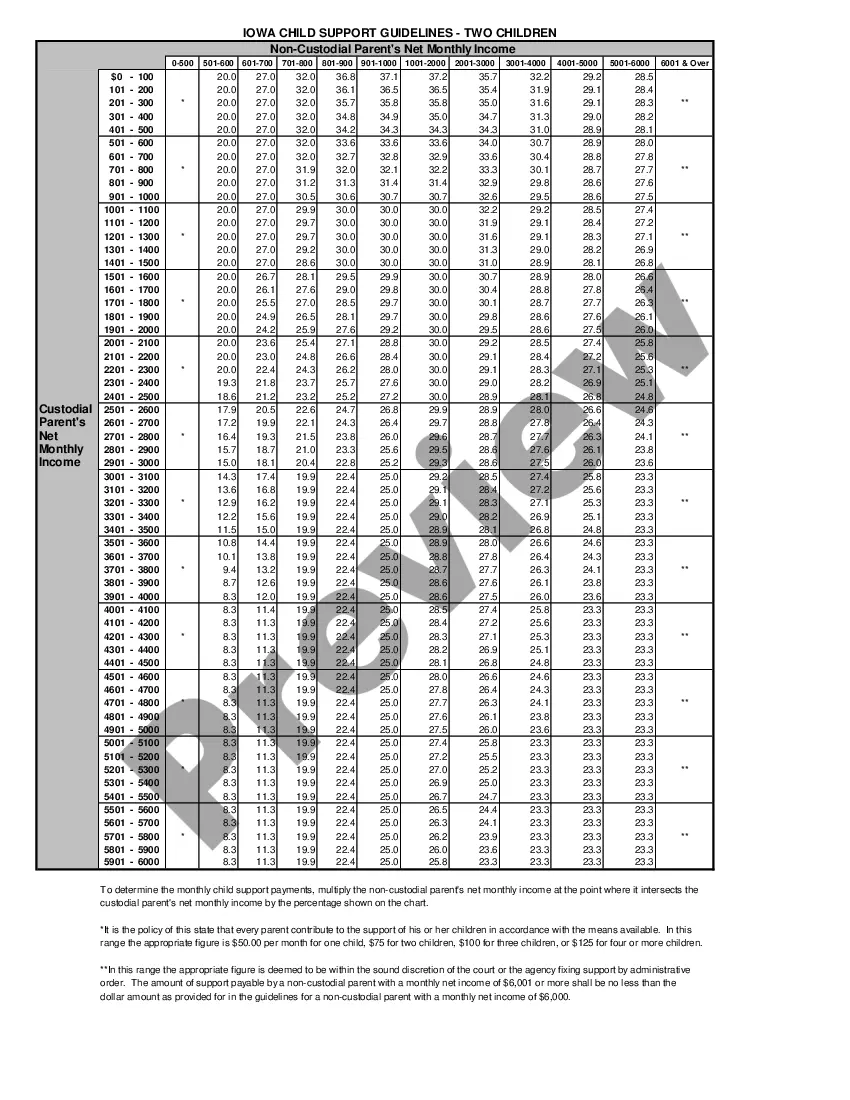

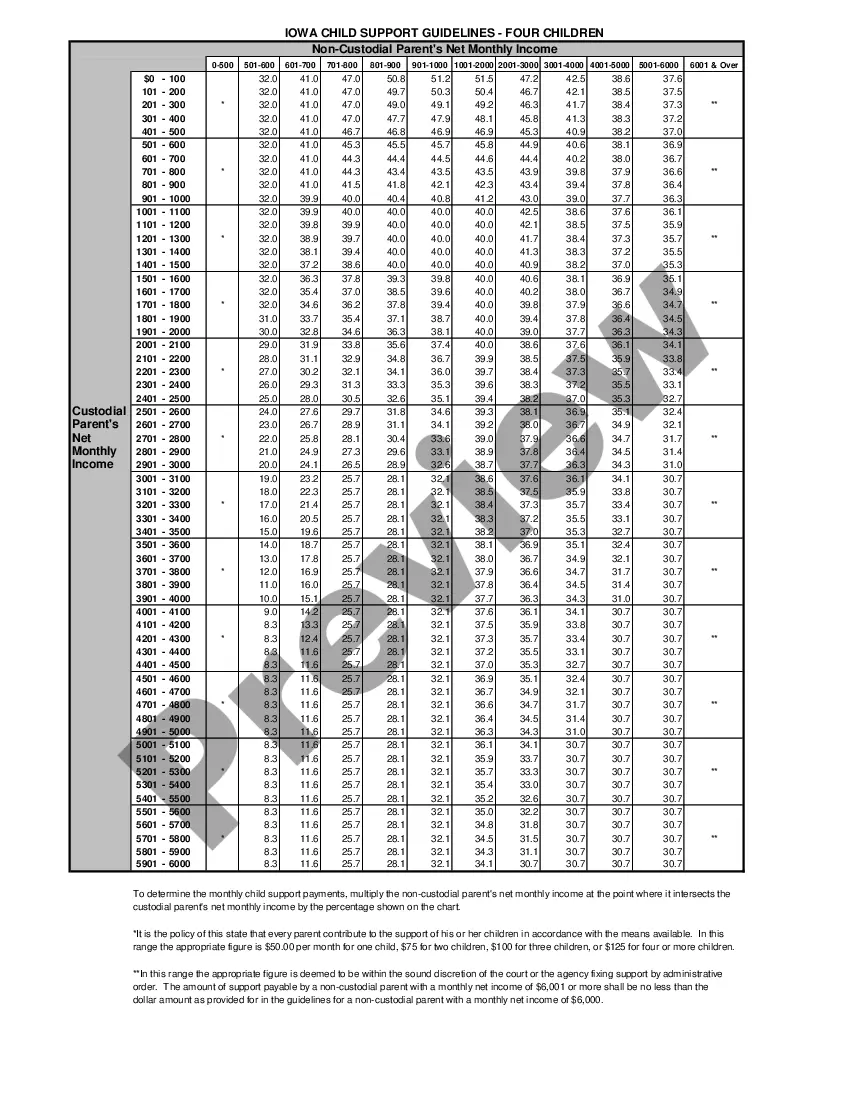

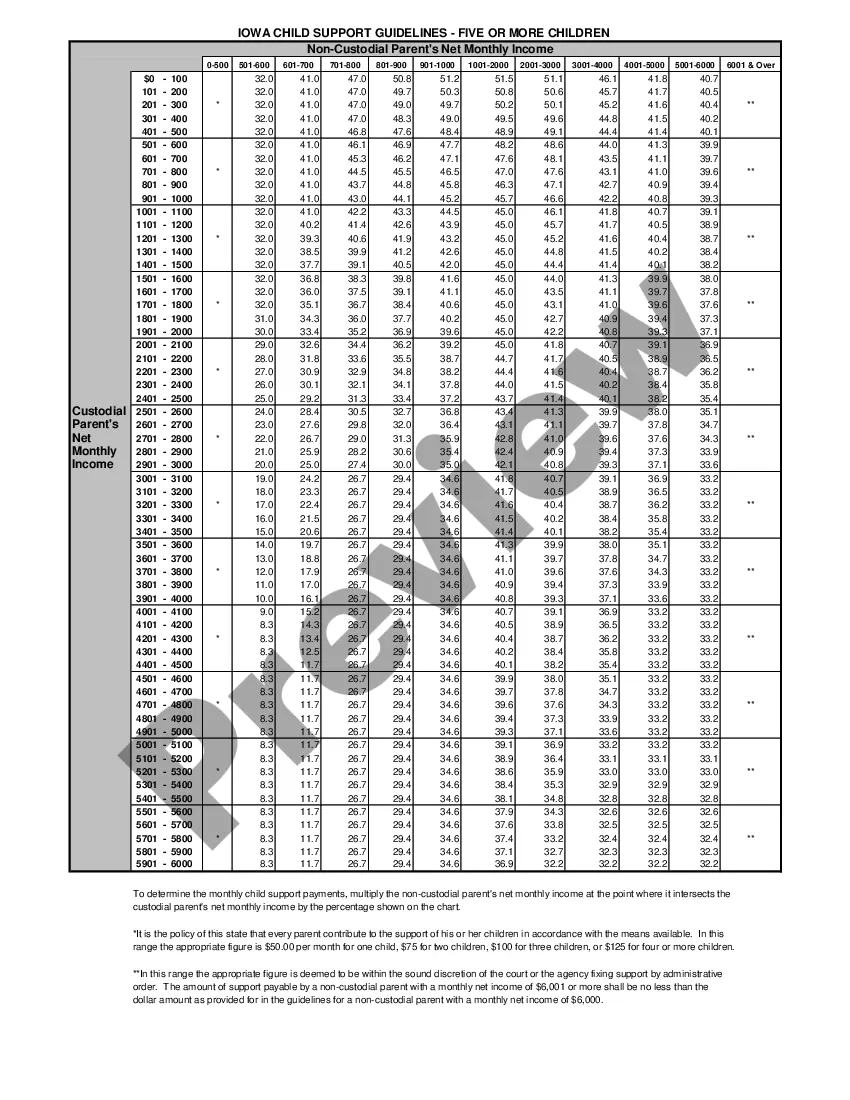

The number of children you have definitely impacts child support amounts in Iowa. The Iowa Child Support Guidelines - Three Children specifically take into account the number of children when calculating support payments. This means that having three children will result in different financial responsibilities compared to having one child. For accurate calculations and a deeper understanding, consider using resources from USLegalForms.

Yes, Iowa does impose a cap on maximum child support amounts as outlined in the Iowa Child Support Guidelines - Three Children. This cap is determined based on the income level of the paying parent and the number of children involved. Understanding these limitations is crucial for both parents to manage expectations regarding support payments. Use tools available at USLegalForms to navigate these guidelines effectively.

In Iowa, child support does not automatically end at 18 years of age. The Iowa Child Support Guidelines - Three Children state that support may continue if the child is still in high school or has special needs. It’s important to keep track of your financial responsibilities to ensure compliance with court orders. Consulting resources such as USLegalForms can provide clarity on these situations.

The maximum child support amount in Iowa varies based on the monthly income of the parent responsible for payment. Under the Iowa Child Support Guidelines - Three Children, support calculations take into account the number of children and the payer's financial situation. Understanding these limits can help you better prepare for your financial responsibilities. For personalized calculations, you might want to explore tools available on platforms like USLegalForms.

The new child support laws in Iowa have updated the Iowa Child Support Guidelines - Three Children to reflect changes in financial circumstances and needs. These guidelines detail how support amounts are calculated based on a parent's income and custody arrangements. It is essential to stay informed about these laws, as they can affect your financial obligations. For accurate guidance, consider using resources like USLegalForms, which provide comprehensive information on these updates.

The most that can be taken out of your check for child support is generally a percentage based on your income. In most cases, that amount can vary depending on the number of children and individual cases. The Iowa Child Support Guidelines - Three Children will help you understand these percentages, ensuring that you fulfill your obligations without unknowingly overpaying.

The primary factor in calculating child support is the income of both parents. This includes wages, bonuses, and any additional income sources. The Iowa Child Support Guidelines - Three Children emphasize determining a fair amount that covers children's needs while also considering all parental financial responsibilities.

The amount of child support individuals receive can vary significantly. Factors such as income, the number of children, and expenses play crucial roles in defining payments. Under the Iowa Child Support Guidelines - Three Children, many parents can expect support that reflects their financial situations, ensuring adequate care for their children.

The maximum child support in Texas varies based on the number of children involved. Generally, for three children, the guidelines suggest a maximum percentage of the non-custodial parent's income. When calculating child support according to the Iowa Child Support Guidelines - Three Children, the amount factors in income and other obligations, influencing the final determination.