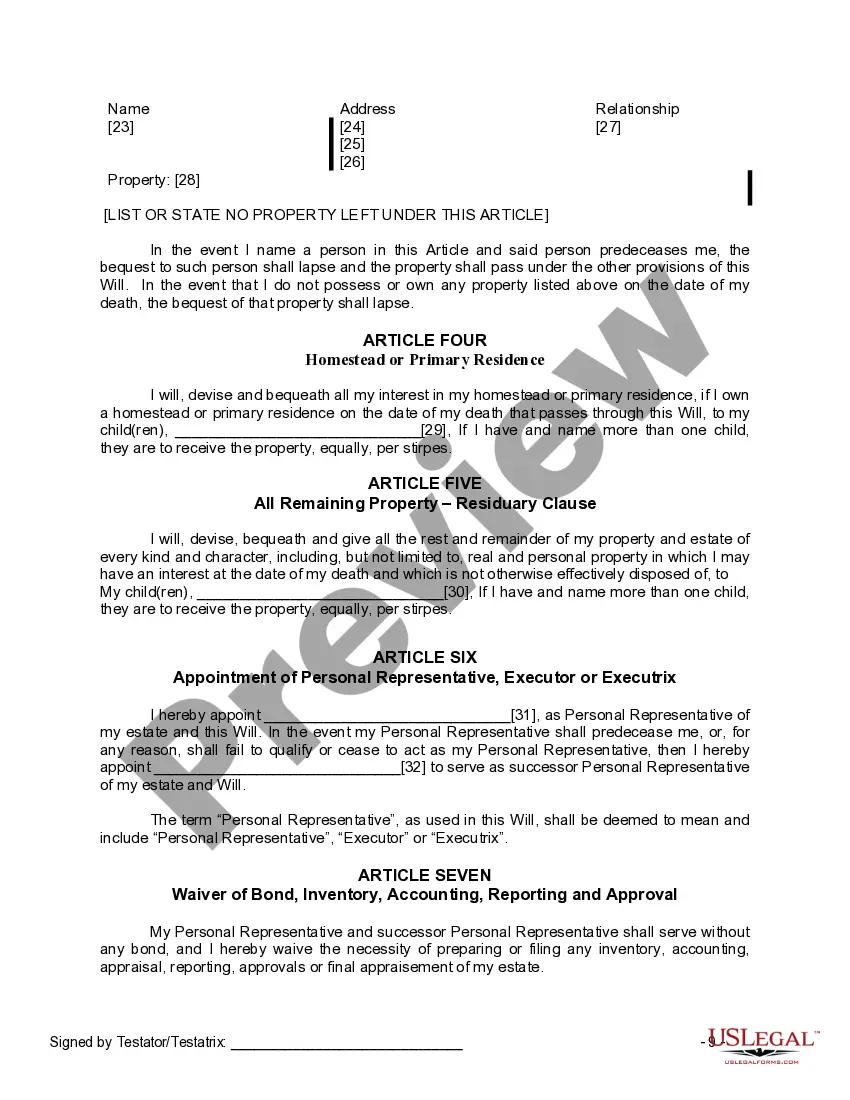

Hawaii Last Will and Testament for a Widow or Widower with Adult Children

Description

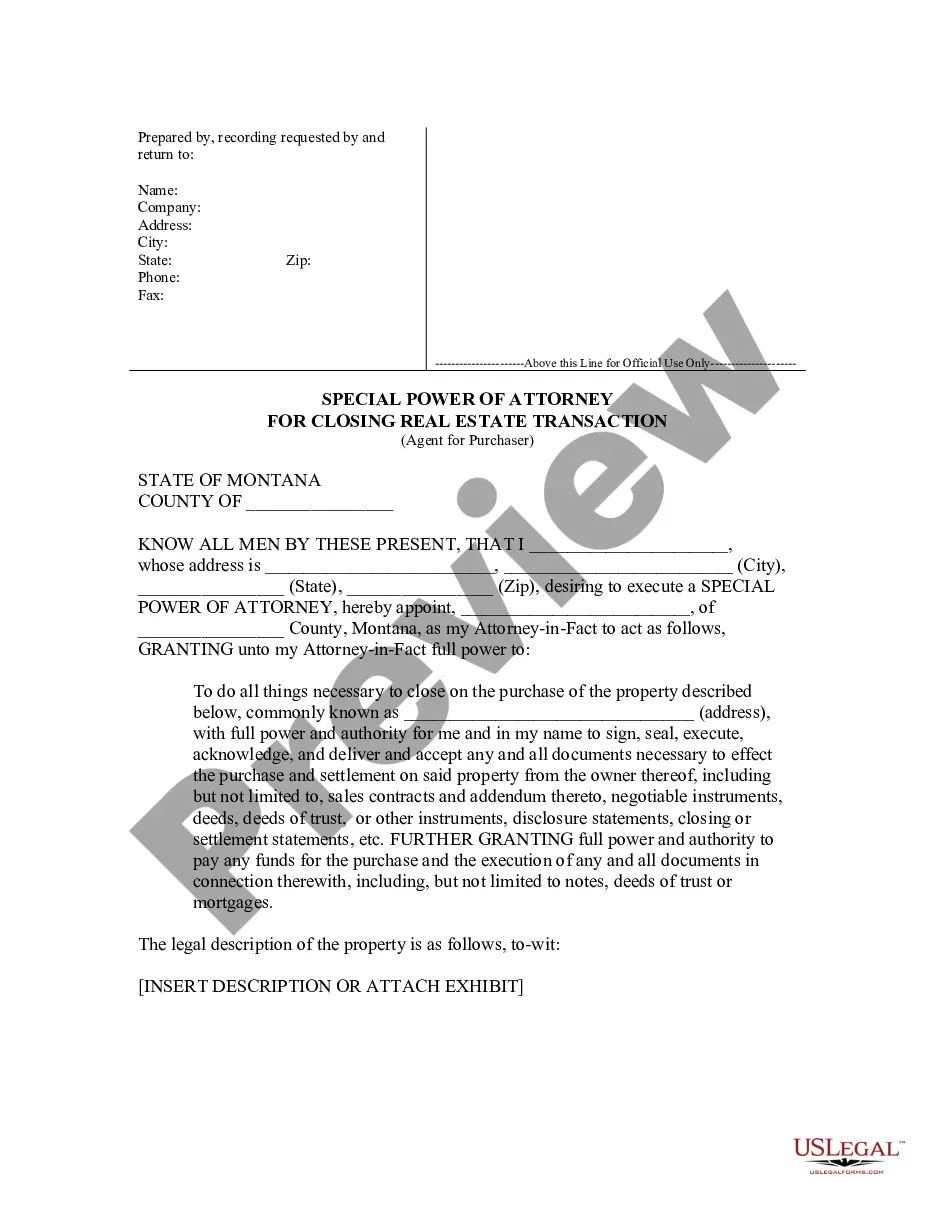

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

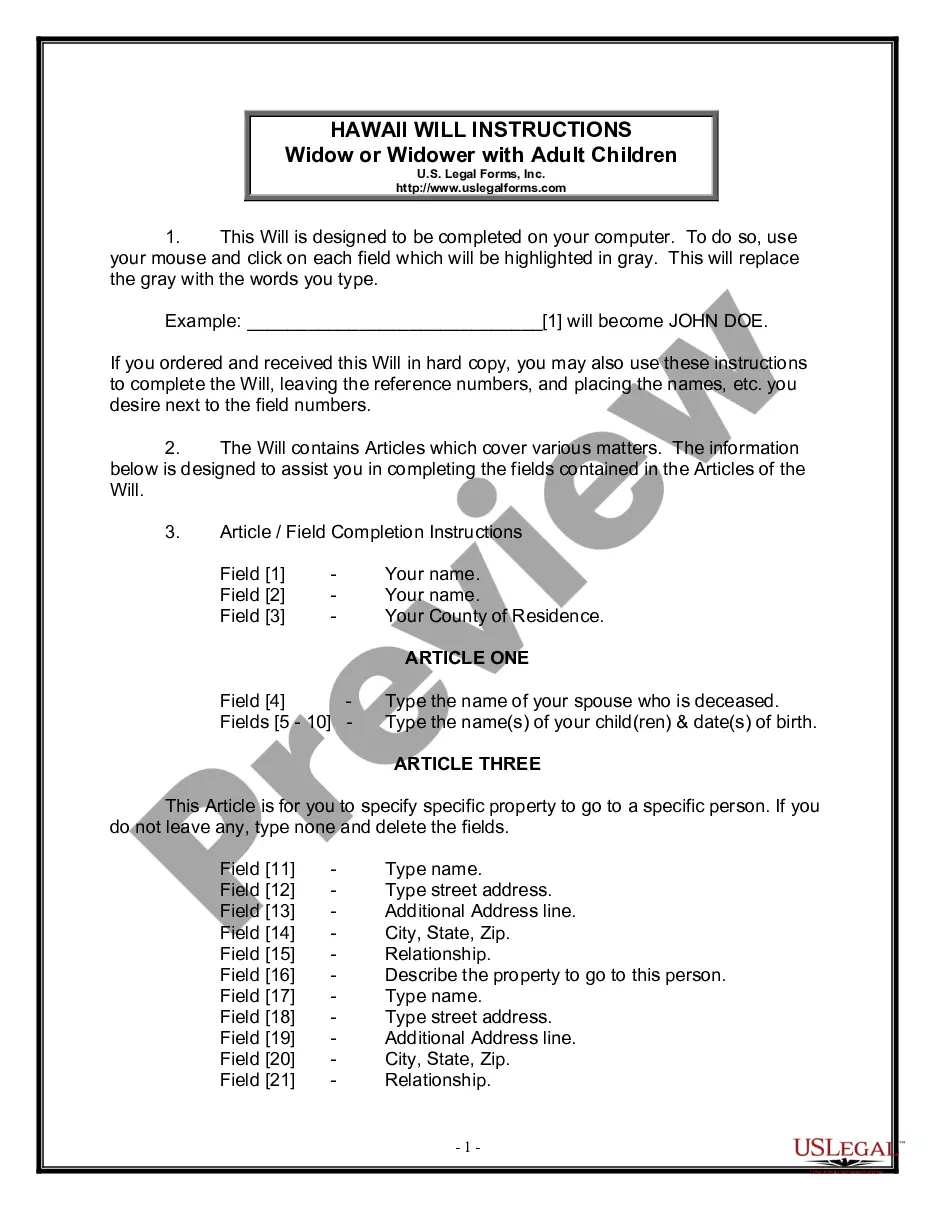

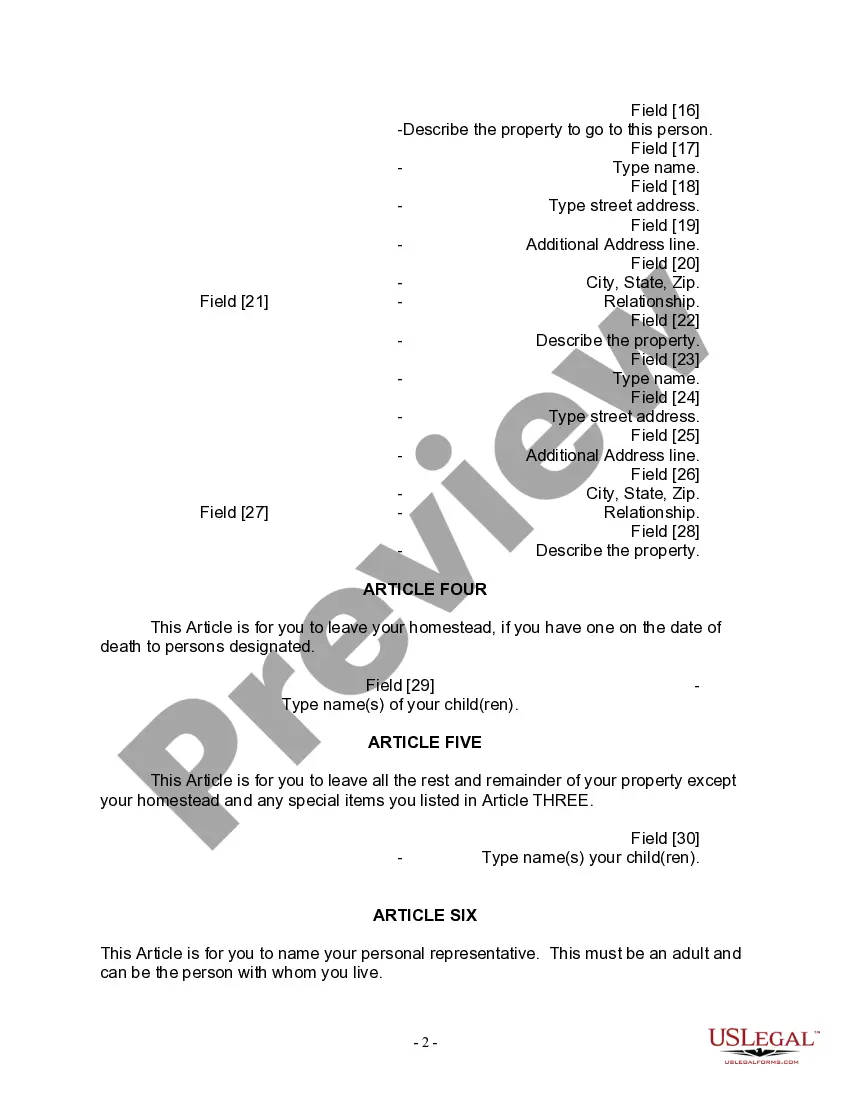

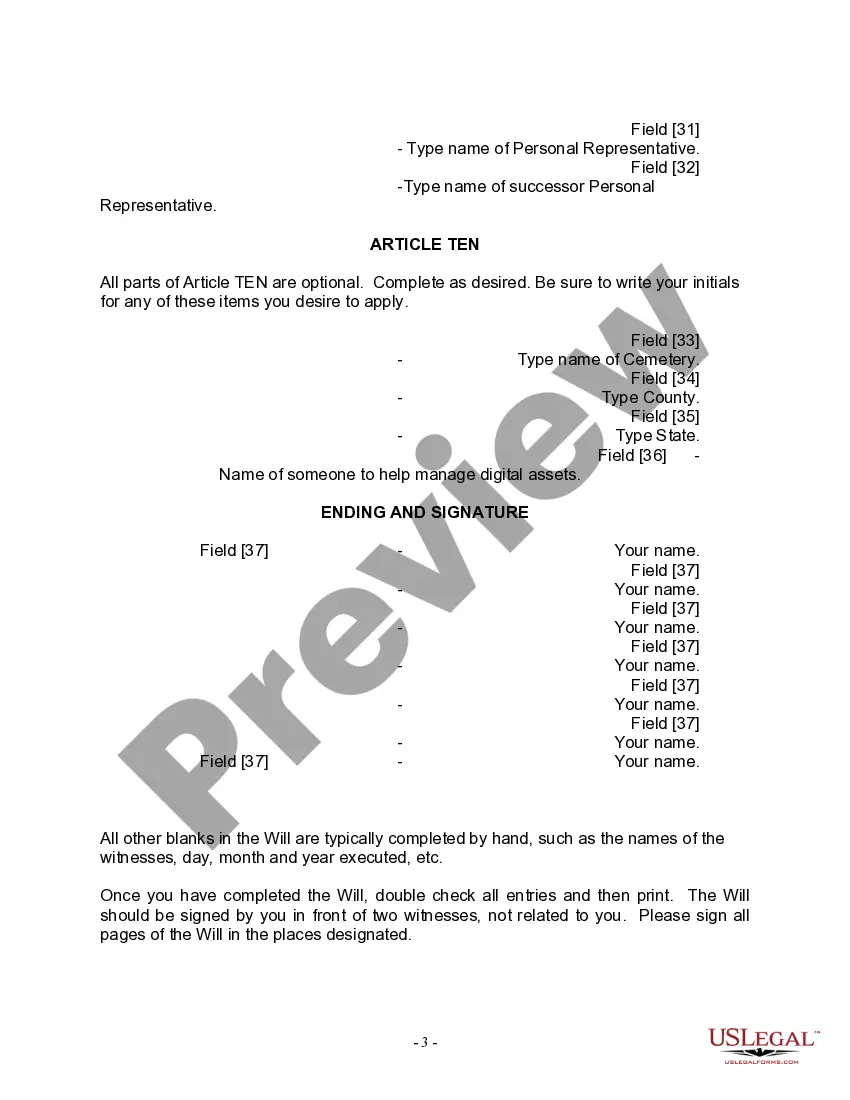

How to fill out Hawaii Last Will And Testament For A Widow Or Widower With Adult Children?

Utilize the most comprehensive collection of legal documents. US Legal Forms serves as a resource to locate any specific form for each state in just a few clicks, including the Hawaii Legal Last Will and Testament Form for a Widow or Widower with Adult Children examples.

There’s no need to squander your time searching for a court-acceptable form. Our certified specialists guarantee that you obtain current templates every time.

To access the document library, choose a subscription and create an account. If you've completed this step, simply Log In and click the Download button. The Hawaii Legal Last Will and Testament Form for a Widow or Widower with Adult Children template will be promptly stored in the My documents section (a section for all templates you save on US Legal Forms).

That's it! You will need to complete the Hawaii Legal Last Will and Testament Form for a Widow or Widower with Adult Children template and verify it. To ensure accuracy, consult your local legal advisor for support. Sign up and effortlessly explore over 85,000 beneficial templates.

- If you are planning to use a state-specific template, ensure that you select the correct state.

- If applicable, read the description to understand all the specifics of the document.

- Utilize the Preview feature if available to review the contents of the document.

- If everything appears accurate, click Buy Now.

- After selecting a pricing plan, create an account.

- Make payment via credit card or PayPal.

- Download the template to your computer by clicking on the Download button.

Form popularity

FAQ

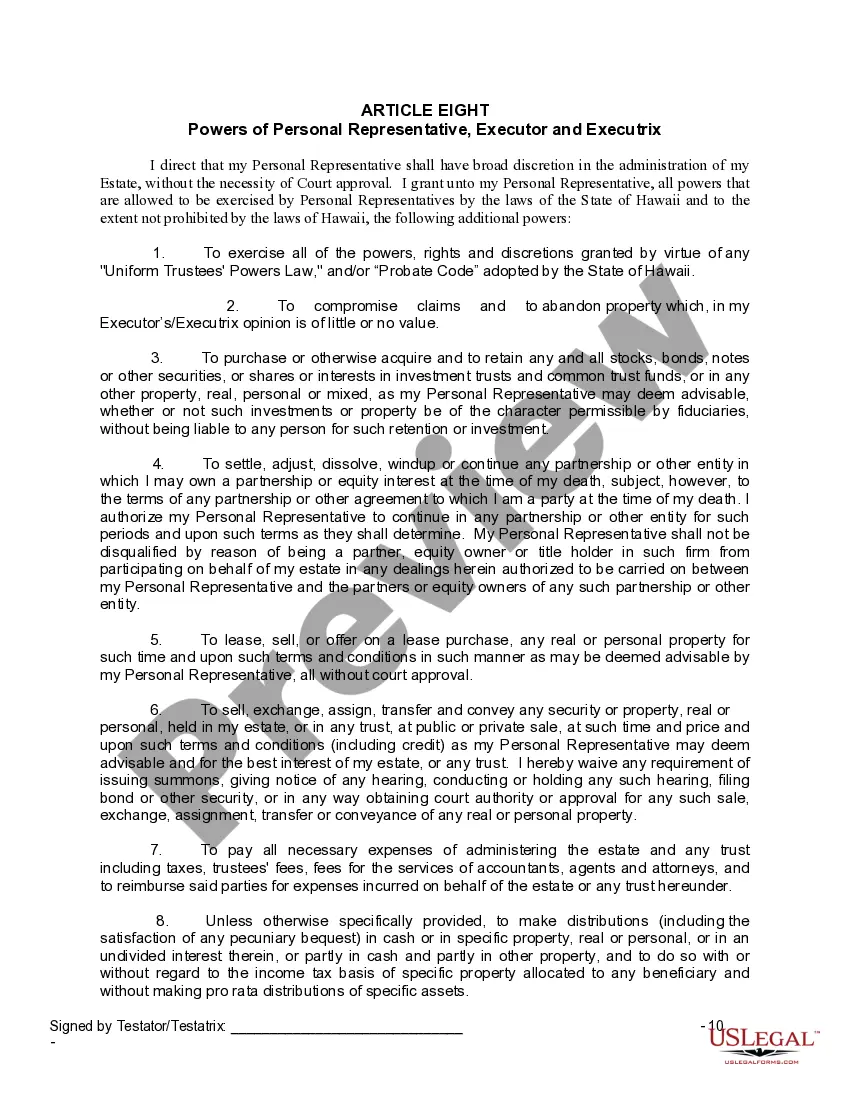

In a Hawaii Last Will and Testament for a Widow or Widower with Adult Children, the executor is typically the surviving spouse. This individual holds the responsibility of managing the estate, ensuring that the deceased's wishes are honored, and distributing assets according to the will. The surviving spouse can also appoint another trusted person as the executor if they prefer. It's essential to choose someone who can handle these duties effectively.

No, you do not have to register a will for it to be valid in Hawaii. A will becomes effective upon your death if it meets the legal requirements. However, registering your Hawaii Last Will and Testament for a Widow or Widower with Adult Children can provide clarity and ensure that your wishes are easily accessible during probate proceedings.

For a will to be valid in Hawaii, it must be in writing, signed by the testator, and witnessed by two people. Additionally, the testator must be at least 18 years old and of sound mind. Understanding these requirements is essential when creating your Hawaii Last Will and Testament for a Widow or Widower with Adult Children, to protect your estate effectively.

Yes, a widow can change a will, but it must be done through a proper legal process. This can involve drafting a new will or creating a codicil, which is an amendment to the existing will. Always ensure that changes follow the legal requirements for a Hawaii Last Will and Testament for a Widow or Widower with Adult Children to remain valid.

To write a will in Hawaii, start by clearly stating your assets and beneficiaries. Follow this by ensuring you meet the legal requirements, which include being of sound mind, signing the document, and having it witnessed appropriately. Using USLegalForms can streamline the process of drafting a Hawaii Last Will and Testament for a Widow or Widower with Adult Children, making it easier to follow.

The three basic requirements of a valid will in Hawaii are: it must be in writing, it must be signed by you, and it must be witnessed by two competent individuals. Meeting these requirements helps to ensure that your Hawaii Last Will and Testament for a Widow or Widower with Adult Children reflects your true intentions. Failing to comply with these can lead to disputes or invalidation of your will.

Yes, you can write your own Hawaii Last Will and Testament for a Widow or Widower with Adult Children, and it can be notarized. However, it is important to ensure that all legal requirements are met for the will to be valid. Consider using a reliable platform like USLegalForms to help guide you in creating a comprehensive document.

In Hawaii, a last will and testament does not override a marriage. Should you marry after creating a will, your new spouse may have rights to your estate unless specifically excluded. Updating your Hawaii Last Will and Testament for a Widow or Widower with Adult Children after marriage is advisable to reflect your current wishes.

To ensure your Hawaii Last Will and Testament for a Widow or Widower with Adult Children is legal, it must be in writing, signed by you, the testator, and witnessed by two people. These witnesses should not be beneficiaries of the will to avoid conflicts of interest. Properly following these requirements will give your will the legal backing it needs.

You can write your own will in Hawaii, which is a common practice among many individuals. Crafting a Hawaii Last Will and Testament for a Widow or Widower with Adult Children allows you to specify how you want your assets distributed. While writing your own will is possible, utilizing resources like US Legal Forms can provide you with expert guidance and ensure your will meets all legal standards.