Hawaii Clauses Relating to Capital Withdrawals, Interest on Capital

Description

How to fill out Clauses Relating To Capital Withdrawals, Interest On Capital?

If you have to total, obtain, or printing legitimate document templates, use US Legal Forms, the greatest collection of legitimate types, that can be found on-line. Make use of the site`s basic and convenient look for to discover the paperwork you will need. Numerous templates for company and individual functions are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to discover the Hawaii Clauses Relating to Capital Withdrawals, Interest on Capital with a few clicks.

In case you are presently a US Legal Forms customer, log in to your bank account and click on the Obtain switch to find the Hawaii Clauses Relating to Capital Withdrawals, Interest on Capital. You can even accessibility types you formerly downloaded inside the My Forms tab of your bank account.

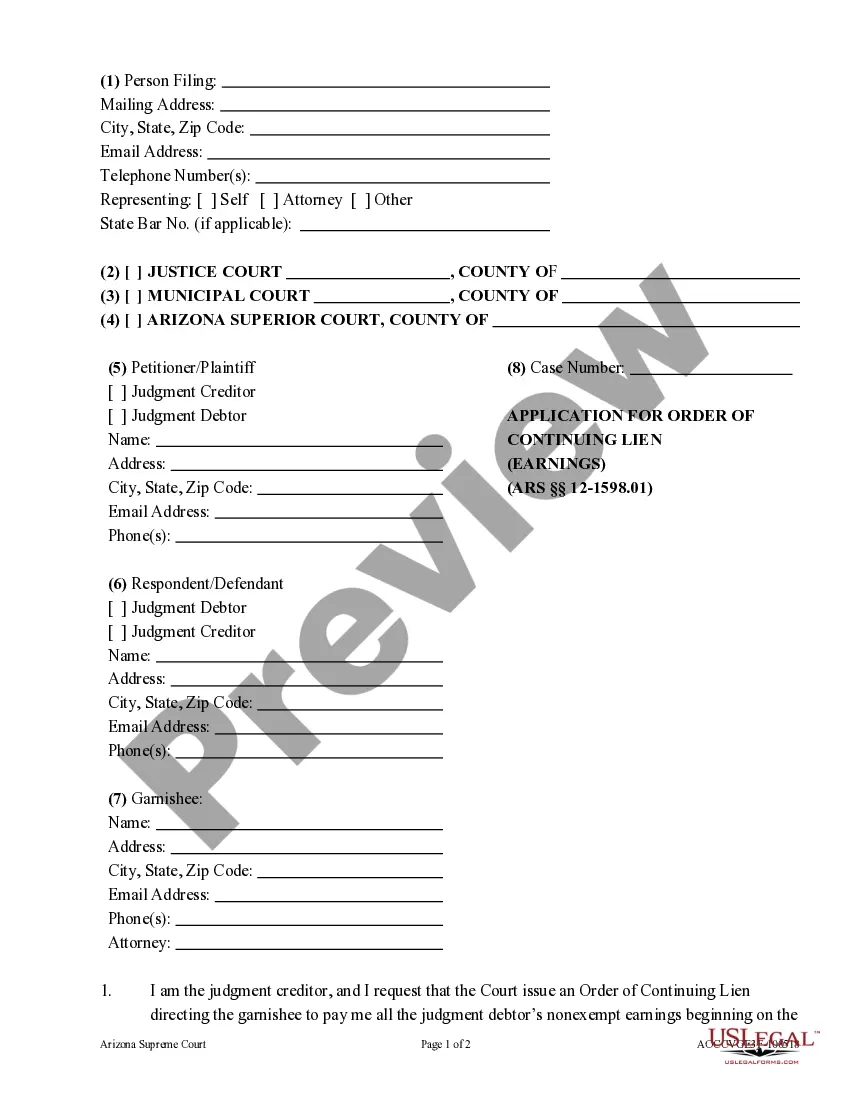

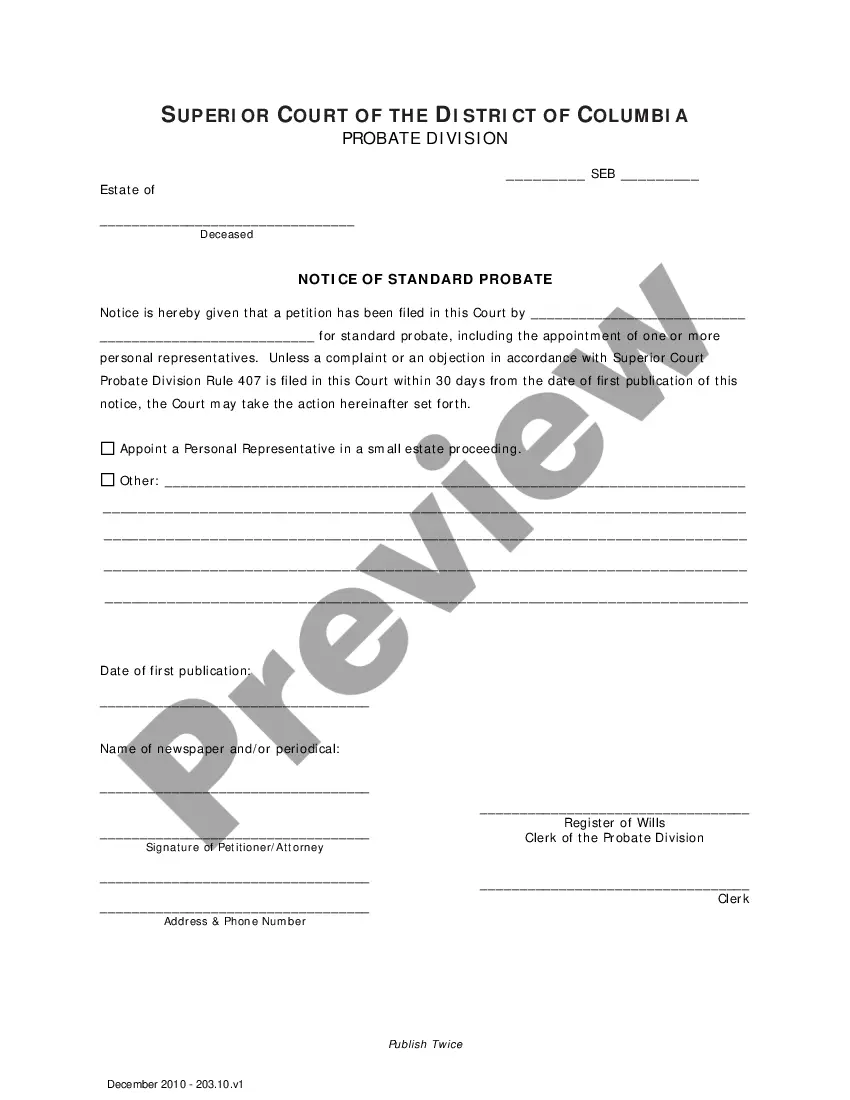

If you work with US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the form for that right metropolis/land.

- Step 2. Utilize the Review method to look over the form`s content. Do not forget about to read the outline.

- Step 3. In case you are unhappy with the kind, use the Lookup industry towards the top of the screen to locate other versions of the legitimate kind format.

- Step 4. After you have found the form you will need, click on the Purchase now switch. Pick the pricing strategy you choose and include your qualifications to sign up on an bank account.

- Step 5. Procedure the transaction. You may use your credit card or PayPal bank account to accomplish the transaction.

- Step 6. Select the format of the legitimate kind and obtain it on the device.

- Step 7. Total, change and printing or signal the Hawaii Clauses Relating to Capital Withdrawals, Interest on Capital.

Every single legitimate document format you purchase is the one you have forever. You may have acces to each kind you downloaded within your acccount. Click the My Forms section and decide on a kind to printing or obtain once more.

Be competitive and obtain, and printing the Hawaii Clauses Relating to Capital Withdrawals, Interest on Capital with US Legal Forms. There are many skilled and condition-specific types you can utilize for your company or individual requires.

Form popularity

FAQ

A Corporation Income Tax Return, Form N-30, shall be filed by every corporation, includ- ing regulated investment companies and real es- tate investment trusts, domestic or foreign, other than one qualifying as an S Corporation, having gross income from property owned, trade or busi- ness carried on, or any other ...

Capital gains tax rate ? 2021 thresholds RatesSingleMarried Filing Separately0%Up to $40,400Up to $40,40015%$40,401 to $445,850$40,401 to $250,80020%Above $445,850Above $250,800

A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account, converting the property from an investment property to a primary residence, utilizing tax harvesting, and using Section 1031 of the IRS code for deferring taxes.

Form N-35 is used to report the income, de- ductions, gains, losses, etc., of an S corporation doing business in Hawaii.

Then there are 2-3 states that do not tax federal pension income, but do tax your TSP distributions: Hawaii and Alabama.

Hawaii taxes capital gains at a lower rate than ordinary income. The highest rate reaches 7.25%.

Hawaii taxes capital gains at a lower rate than ordinary income. The highest rate reaches 7.25%. Taxes capital gains as income and the rate reaches 8.53%.

Long-Term Capital Gains Tax Rates for 2023 RateSingleMarried Filing Jointly0%$0 ? $44,625$0 ? $89,25015%$44,626 ? $492,300$89,251 ? $553,85020%$492,300+$553,850+