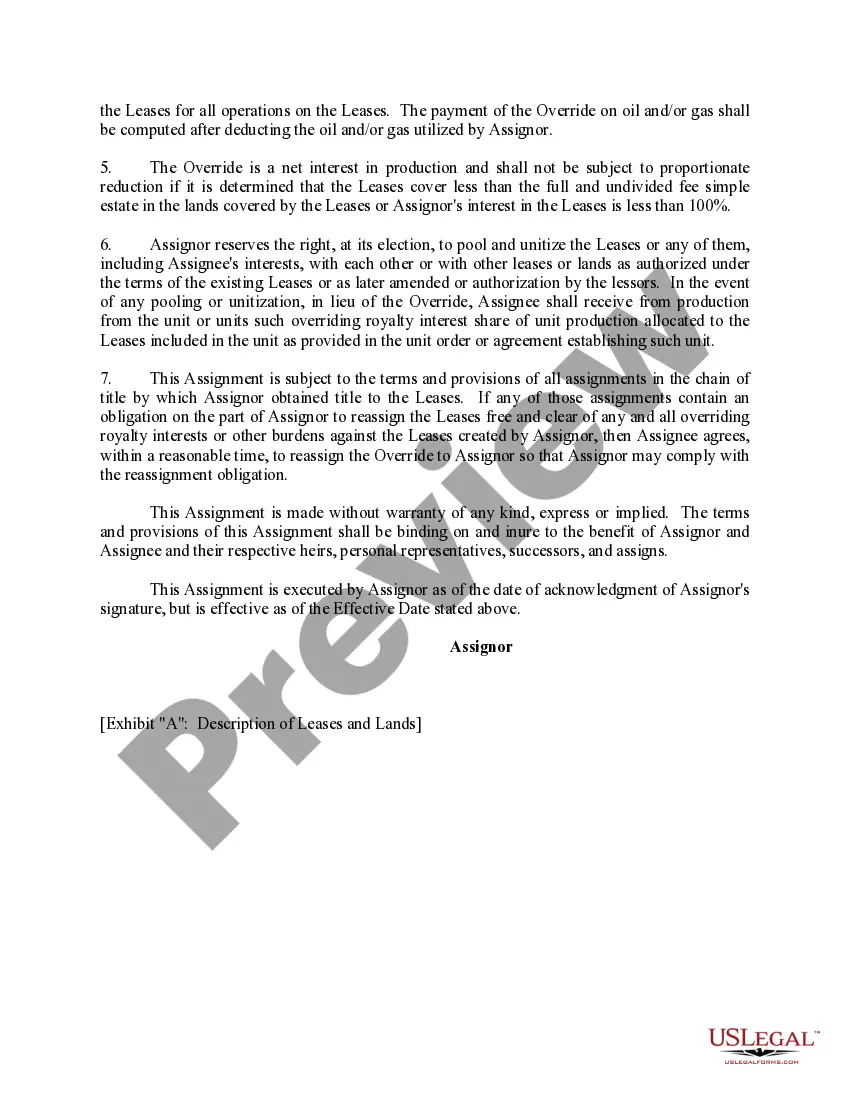

Hawaii Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

How to fill out Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

Have you been in a situation in which you will need files for sometimes company or person purposes virtually every working day? There are tons of lawful file layouts available online, but finding ones you can rely isn`t easy. US Legal Forms delivers a huge number of form layouts, much like the Hawaii Assignment of Overriding Royalty Interest (No Proportionate Reduction), which are published in order to meet federal and state specifications.

In case you are previously knowledgeable about US Legal Forms web site and get an account, basically log in. After that, it is possible to acquire the Hawaii Assignment of Overriding Royalty Interest (No Proportionate Reduction) design.

If you do not offer an account and would like to begin using US Legal Forms, abide by these steps:

- Obtain the form you require and make sure it is for your correct town/state.

- Use the Preview button to review the shape.

- Browse the outline to ensure that you have chosen the correct form.

- In the event the form isn`t what you are trying to find, utilize the Search area to find the form that meets your requirements and specifications.

- If you find the correct form, click Purchase now.

- Pick the pricing plan you want, fill out the specified details to generate your money, and buy the transaction making use of your PayPal or charge card.

- Pick a handy file structure and acquire your copy.

Locate each of the file layouts you possess purchased in the My Forms menu. You can aquire a extra copy of Hawaii Assignment of Overriding Royalty Interest (No Proportionate Reduction) whenever, if required. Just select the required form to acquire or print the file design.

Use US Legal Forms, one of the most extensive collection of lawful types, to save lots of time and stay away from mistakes. The service delivers professionally produced lawful file layouts that can be used for a range of purposes. Create an account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

Finally, overriding royalty. An overriding royalty is ?carved out of? the working interest. If ABC Oil Company acquires an oil and gas lease covering Blackacre that reserves a 25% royalty, ABC has a 75% net revenue interest.

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

The lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.

Several factors determine the value of an overriding royalty interest in a working lease. They include: Location ? A mineral interest in high producing shale basins will be more valuable. Producing Wells ? Producing wells are valued higher than non-producing wells.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.