Hawaii Notice of Claim of Mineral Interest for Dormant Mineral Interest

Description

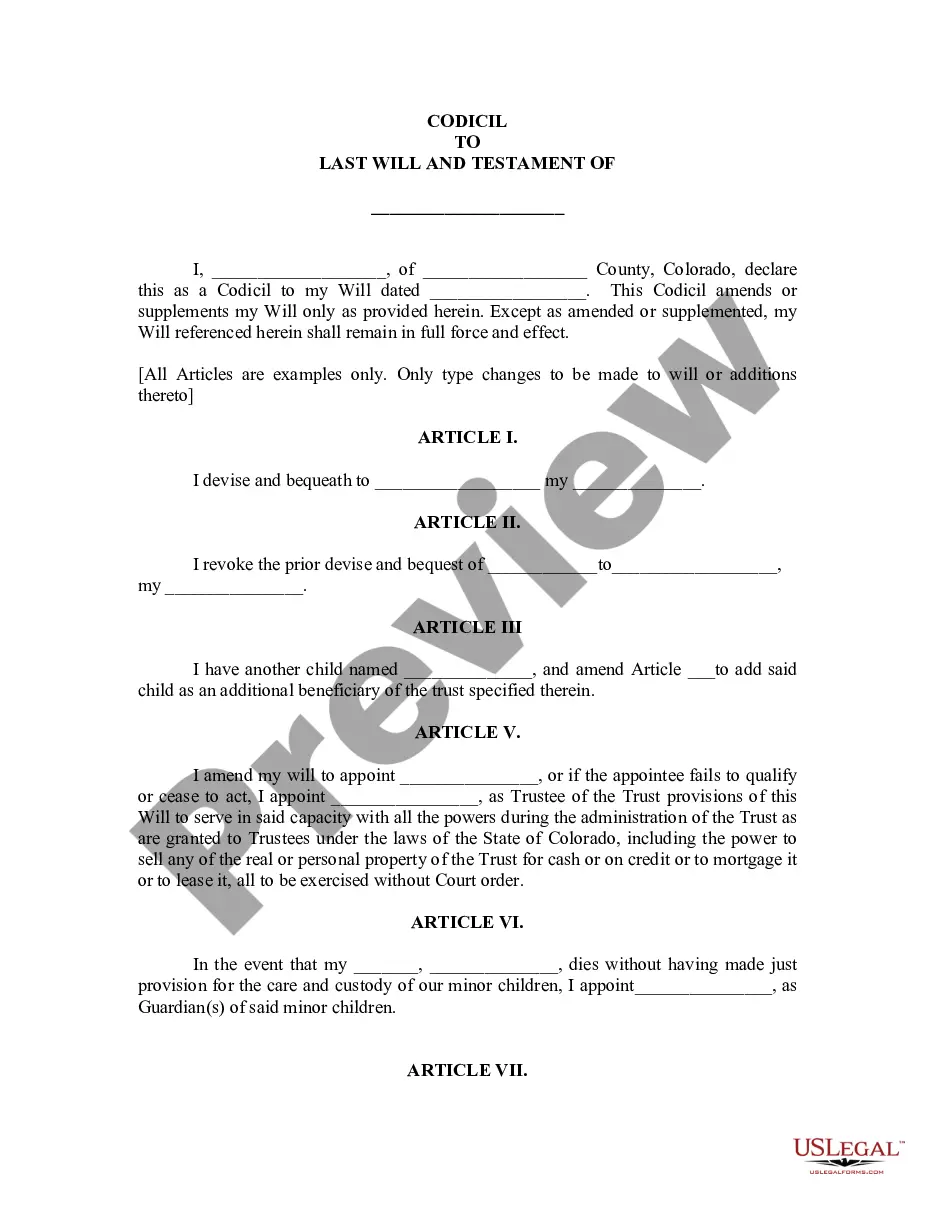

How to fill out Notice Of Claim Of Mineral Interest For Dormant Mineral Interest?

Are you in the place where you need to have papers for possibly enterprise or individual functions nearly every day? There are a lot of authorized file templates available on the Internet, but discovering versions you can rely isn`t easy. US Legal Forms provides thousands of kind templates, much like the Hawaii Notice of Claim of Mineral Interest for Dormant Mineral Interest, that are created to fulfill federal and state requirements.

If you are already informed about US Legal Forms website and also have a merchant account, basically log in. Next, you may down load the Hawaii Notice of Claim of Mineral Interest for Dormant Mineral Interest design.

Unless you have an profile and wish to start using US Legal Forms, follow these steps:

- Get the kind you require and make sure it is for that right metropolis/state.

- Make use of the Review option to review the form.

- Look at the description to ensure that you have chosen the appropriate kind.

- In case the kind isn`t what you`re seeking, take advantage of the Lookup discipline to get the kind that suits you and requirements.

- If you obtain the right kind, simply click Get now.

- Pick the rates prepare you would like, complete the specified details to make your money, and purchase an order with your PayPal or bank card.

- Choose a handy file formatting and down load your duplicate.

Get every one of the file templates you have purchased in the My Forms food list. You can obtain a more duplicate of Hawaii Notice of Claim of Mineral Interest for Dormant Mineral Interest whenever, if needed. Just click the needed kind to down load or printing the file design.

Use US Legal Forms, probably the most substantial assortment of authorized varieties, to conserve time and steer clear of faults. The service provides skillfully manufactured authorized file templates that you can use for a selection of functions. Produce a merchant account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

A mineral interest is an economic interest in subsurface minerals. This interest gives the owner the right to mine the minerals situated beneath the surface of a property. For the purposes of this definition, minerals are assumed to include hydrocarbons.

However, since mineral rights are a severed portion of the land rights themselves (they're separated from the land's "surface rights" and sold separately by deed, just like the land itself), they are usually considered real property.

The term severed mineral rights refers to a state of title to a given parcel of land in which the mineral estate is owned by a party other than the party that is the owner of the surface estate ? in other words, the mineral estate has been severed from the surface estate.

Mineral ownership, or mineral rights, are understood to be the property rights to exploit an area for the minerals, gas, or oil it harbors. The four types of mineral ownership are: Mineral Interest ? interest generated after the production of oil and gas after the sale of a deed or a lease.

Where the mineral rights on a proposed project site have been severed, the developer is the owner or tenant of the surface estate, but a third party party holds the mineral estate.

In the oil & gas context, a fee simple interest, sometimes called the mineral fee or fee simple mineral estate, is complete ownership of the mineral estate. The fee owner of the mineral estate has the rights to: Receive bonus. Receive delay rentals. Develop the minerals.

Mining assets include mineral rights which are considered tangible assets under ASC 930-805.

The ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate.

Severance by mineral deed occurs when someone who owns both the surface and mineral rights chooses to sell all or a portion of the mineral rights to another party. Another scenario is when the owner of both the surface and mineral rights sells the land to one party and the minerals to a different party.