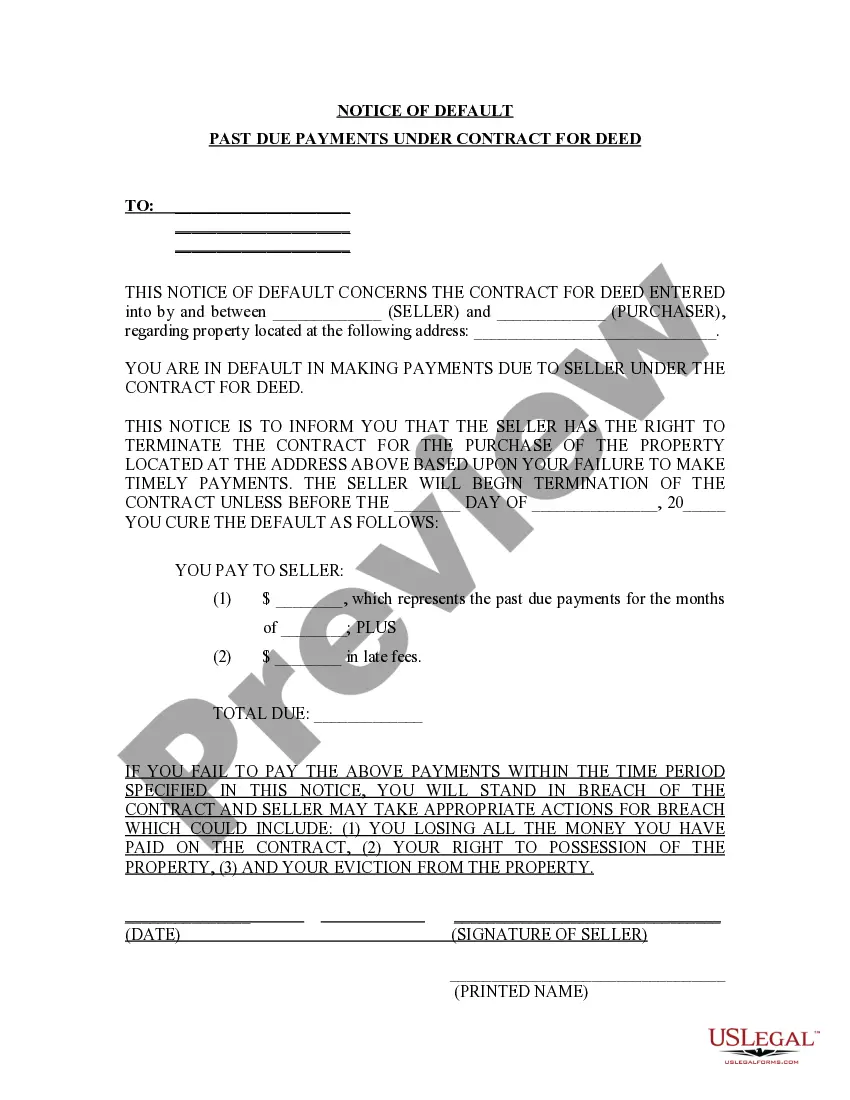

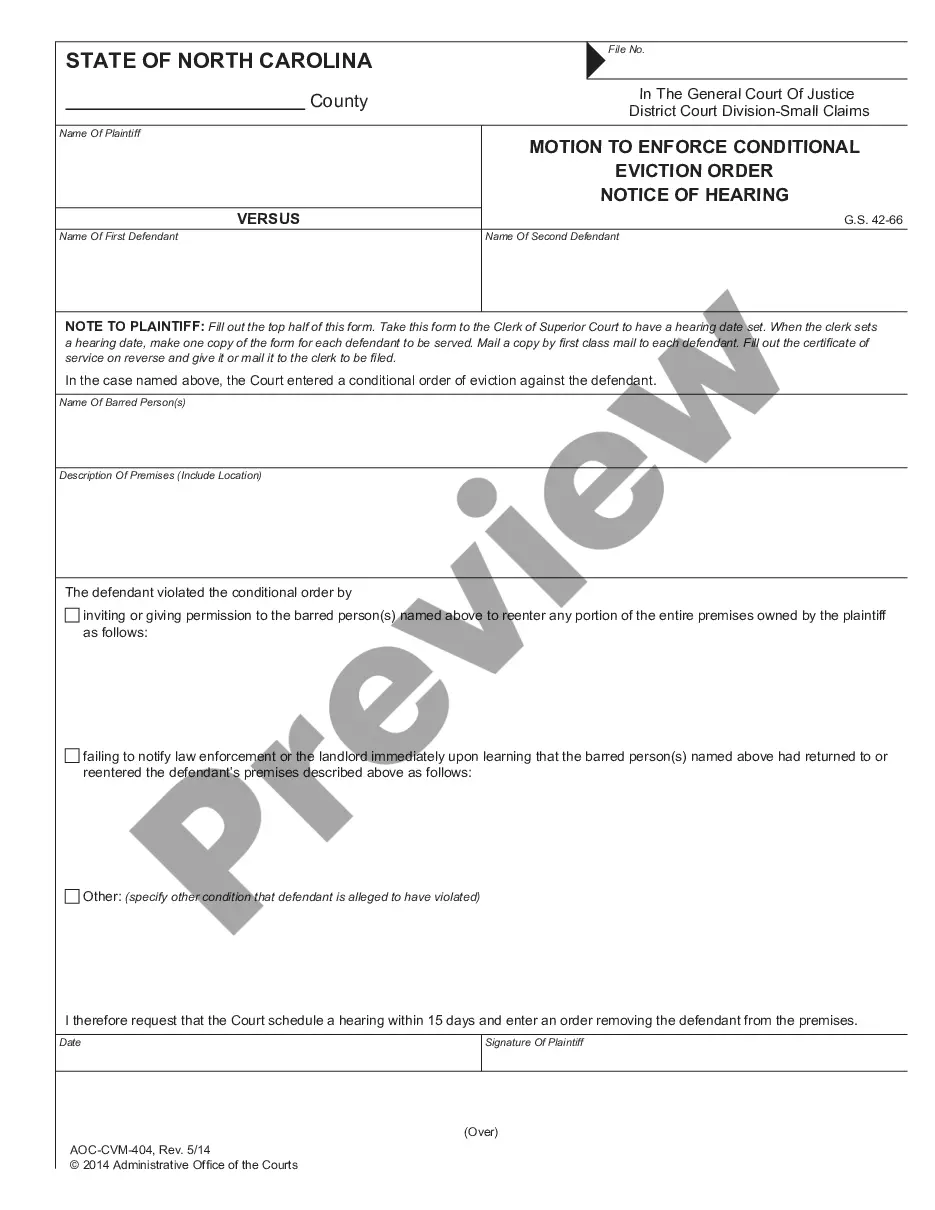

This NOTICE OF HARRASSMENT & VALIDATION OF DEBT is to be used when creditors call you repeatedly and mail you letters too. This form includes a cease and desist and a validation of debt, 2 letters in one.

Hawaii Notice of Harassment and Validation of Debt

Description

How to fill out Notice Of Harassment And Validation Of Debt?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print. By utilizing the website, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents such as the Hawaii Notice of Harassment and Validation of Debt in moments.

If you already possess a monthly subscription, Log In and obtain the Hawaii Notice of Harassment and Validation of Debt from the US Legal Forms collection. The Acquire button will appear on each document you view. You can access all previously saved documents within the My documents section of your account.

If you are using US Legal Forms for the first time, here are straightforward instructions to help you get started: Ensure you have selected the correct document for your city/state. Click the Preview button to review the document’s content. Check the document summary to ensure you have selected the correct one. If the document does not meet your needs, utilize the Search field at the top of the screen to find one that does. If you are satisfied with the document, confirm your selection by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your details to register for an account. Process the payment. Use a Visa or Mastercard or PayPal account to finalize the transaction. Select the format and download the document to your device. Make edits. Fill out, modify, print, and sign the saved Hawaii Notice of Harassment and Validation of Debt. Every template you added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the document you need.

Take advantage of the extensive resources available through US Legal Forms to simplify your legal documentation process.

With a variety of templates at your fingertips, you can ensure compliance and professionalism in your legal matters.

- Access the Hawaii Notice of Harassment and Validation of Debt with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Don't forget to review your selections thoroughly before finalizing.

- You have the option to save any document for future use.

- All transactions are secure and confidential.

- Enjoy hassle-free access to all your legal document needs.

Form popularity

FAQ

A debt validation letter is typically sent when a debt collector is trying to collect a debt from you. This letter serves to inform you of the debt and your rights regarding it. Understanding the specifics of the Hawaii Notice of Harassment and Validation of Debt can help you respond effectively. If you have questions or concerns about the letter, consider utilizing services like US Legal Forms for guidance.

If you do not receive a debt validation letter, you may have grounds to dispute the debt. Creditors must send a validation notice, and failure to do so can violate your rights. It is crucial to keep records of any communications and consider seeking help through resources like US Legal Forms to ensure proper handling of the Hawaii Notice of Harassment and Validation of Debt.

You may receive a debt validation notice because a creditor is required to provide proof of the debt when they attempt to collect. This notice gives you the opportunity to confirm the legitimacy of the debt. Understanding your rights under the Hawaii Notice of Harassment and Validation of Debt can empower you to challenge any inaccuracies. Always ensure you verify the information presented in such notices.

Generally, you cannot go to jail simply for owing debt. Debt itself is a civil matter, not a criminal one. However, circumstances like failing to appear in court for a debt-related issue can lead to legal consequences. It's essential to understand your rights regarding the Hawaii Notice of Harassment and Validation of Debt to avoid any misunderstandings.

When you receive a debt validation letter, it's important to respond promptly. First, review the letter carefully to understand the debt details. You can request additional information if the letter does not clarify the debt or the creditor. Using a service like US Legal Forms can help you draft a proper response, ensuring you address the Hawaii Notice of Harassment and Validation of Debt appropriately.

To dispute the validity of a debt, start by gathering all relevant information, including any communications from the debt collector. Write a formal dispute letter clearly stating your reasons for questioning the debt's validity. Sending this letter to the collector will initiate a review process, and the Hawaii Notice of Harassment and Validation of Debt can provide additional guidance on your rights during this dispute. This proactive approach can lead to a resolution in your favor.

To file a debt validation claim, you should first send a written request to the debt collector asking for proof of the debt. Be sure to include your contact information and any relevant details about the debt. The collector must respond with the necessary documentation, and you can reference the Hawaii Notice of Harassment and Validation of Debt to ensure they comply. This process can safeguard you against erroneous claims.

You can report harassment from debt collectors to several organizations, including the Federal Trade Commission and the Consumer Financial Protection Bureau. Additionally, state agencies, such as the Hawaii Division of Financial Institutions, also handle complaints regarding debt collection practices. Utilizing the Hawaii Notice of Harassment and Validation of Debt can guide you through the reporting process and help ensure your rights are upheld.

To file harassment against a debt collector in Hawaii, first document each instance of harassment you experience. This includes noting dates, times, and the nature of the interactions. You can then file a complaint with the Consumer Financial Protection Bureau or your state's attorney general's office. Additionally, the Hawaii Notice of Harassment and Validation of Debt provides a framework for addressing these issues legally.

Yes, debt validation is often a smart step when facing potential harassment from debt collectors. It allows you to confirm whether the debt is legitimate and provides you with the ability to dispute inaccuracies. Moreover, understanding your rights under the Hawaii Notice of Harassment and Validation of Debt can help protect you from unfair practices. This process can empower you to take control of your financial situation.