Hawaii Grantor Trust Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA and Bank One, National Assoc.

Description

How to fill out Grantor Trust Agreement Between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA And Bank One, National Assoc.?

US Legal Forms - among the largest libraries of legitimate kinds in the States - gives a variety of legitimate file web templates you may obtain or printing. While using website, you can get a huge number of kinds for business and specific uses, categorized by groups, claims, or keywords and phrases.You will find the most up-to-date variations of kinds such as the Hawaii Grantor Trust Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA and Bank One, National Assoc. within minutes.

If you have a registration, log in and obtain Hawaii Grantor Trust Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA and Bank One, National Assoc. from the US Legal Forms local library. The Down load key will show up on every single form you look at. You gain access to all formerly delivered electronically kinds from the My Forms tab of your own profile.

If you want to use US Legal Forms for the first time, allow me to share straightforward directions to help you get started:

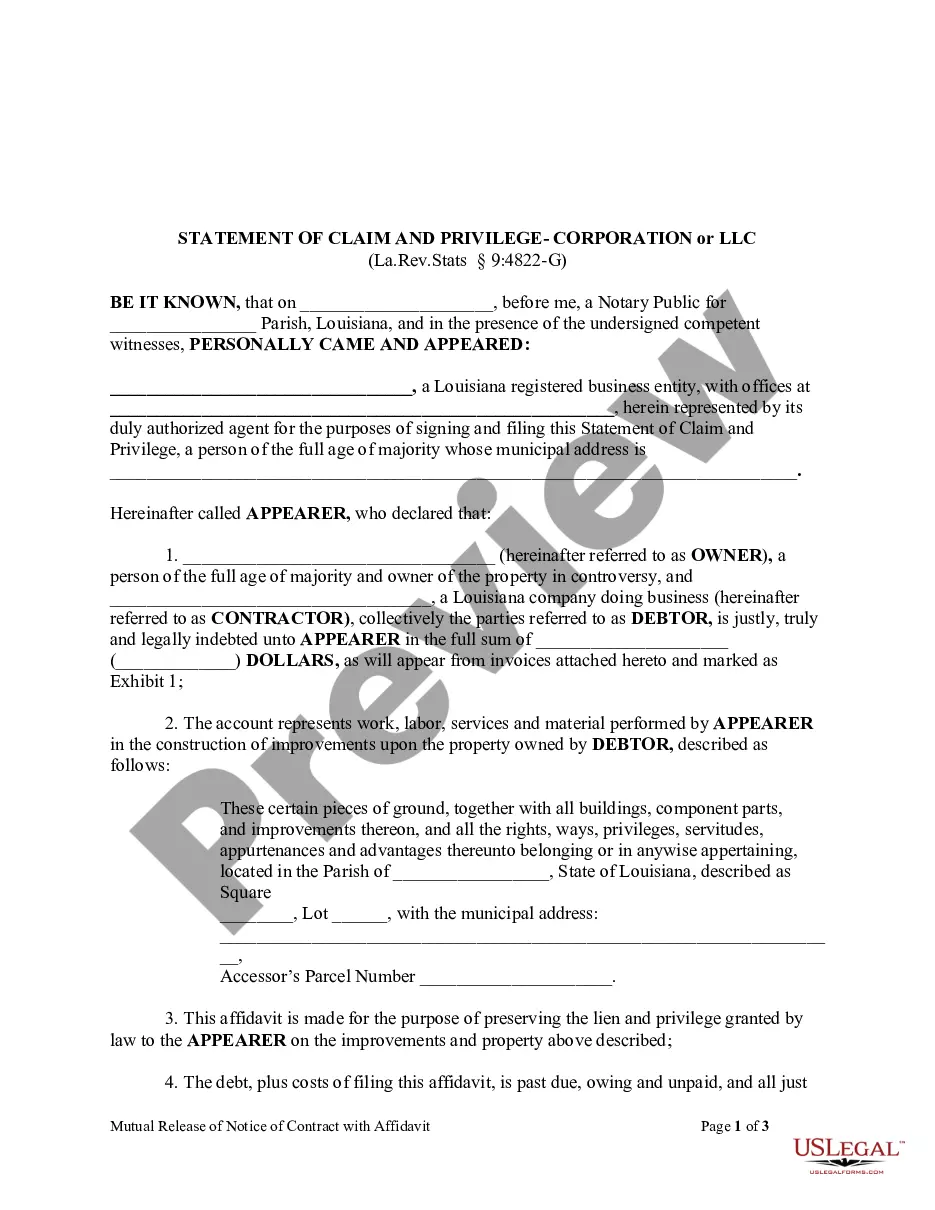

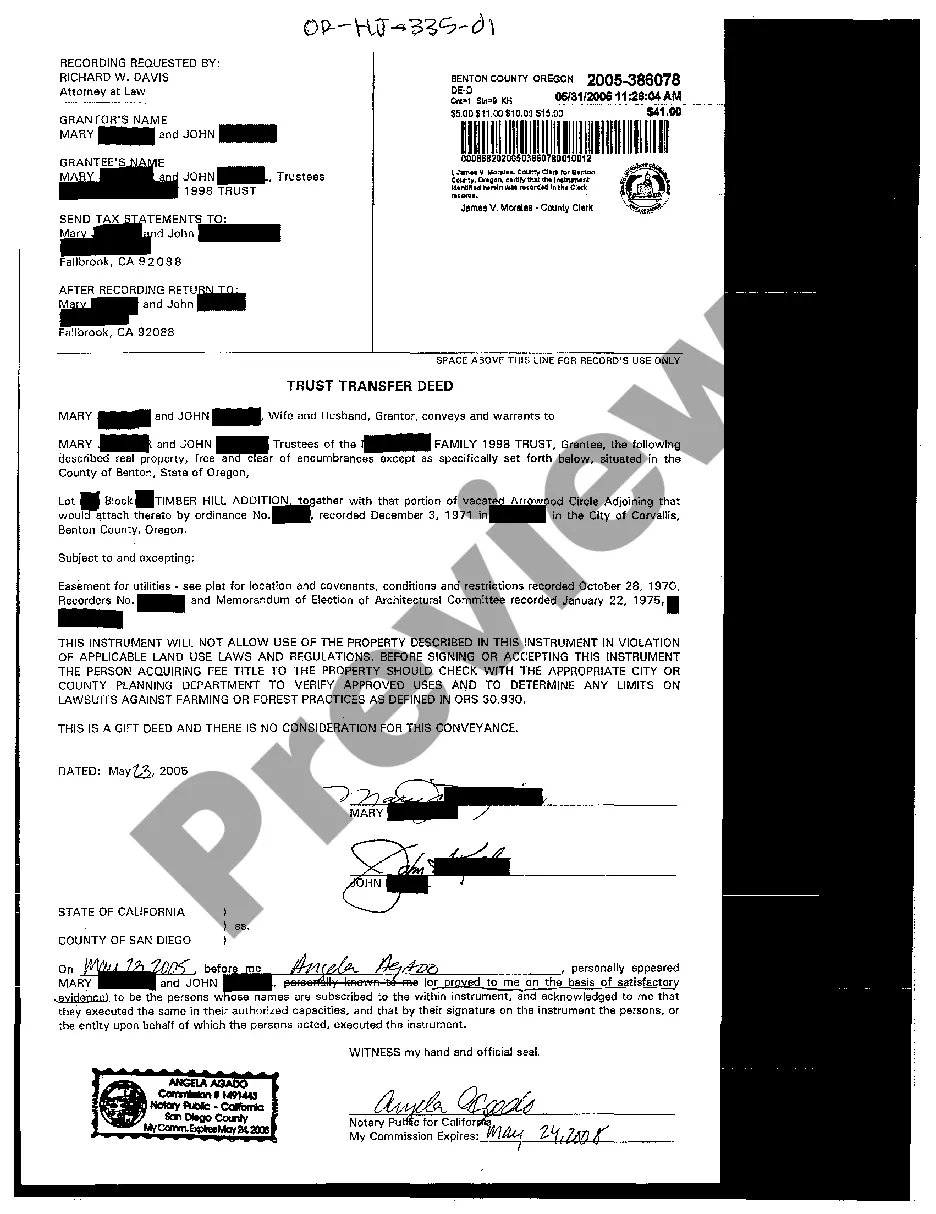

- Make sure you have selected the proper form for your area/area. Click the Preview key to check the form`s content. Read the form information to actually have chosen the proper form.

- In case the form does not suit your requirements, use the Research discipline on top of the screen to get the one who does.

- In case you are pleased with the shape, confirm your decision by simply clicking the Acquire now key. Then, choose the pricing program you like and give your qualifications to sign up for the profile.

- Process the deal. Use your Visa or Mastercard or PayPal profile to finish the deal.

- Pick the structure and obtain the shape on the gadget.

- Make alterations. Fill up, change and printing and signal the delivered electronically Hawaii Grantor Trust Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA and Bank One, National Assoc..

Each format you included in your account lacks an expiry date which is the one you have eternally. So, in order to obtain or printing an additional version, just proceed to the My Forms area and then click on the form you need.

Gain access to the Hawaii Grantor Trust Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank FA and Bank One, National Assoc. with US Legal Forms, the most comprehensive local library of legitimate file web templates. Use a huge number of expert and state-specific web templates that fulfill your business or specific needs and requirements.