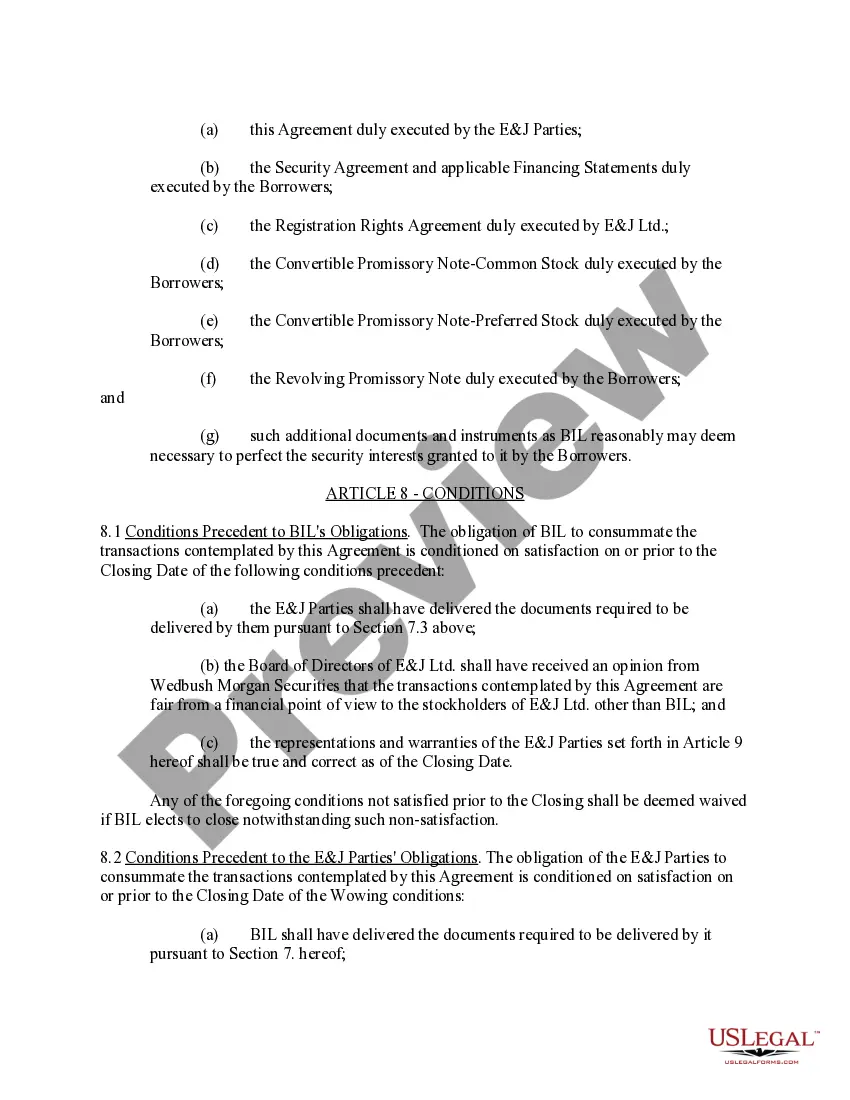

Hawaii Debt Conversion Agreement with exhibit A only

Description

How to fill out Debt Conversion Agreement With Exhibit A Only?

You can spend time on-line looking for the legitimate file web template which fits the state and federal requirements you want. US Legal Forms provides a huge number of legitimate forms which can be evaluated by professionals. It is simple to obtain or printing the Hawaii Debt Conversion Agreement with exhibit A only from the service.

If you already possess a US Legal Forms profile, you are able to log in and then click the Obtain key. Afterward, you are able to comprehensive, edit, printing, or indicator the Hawaii Debt Conversion Agreement with exhibit A only. Every single legitimate file web template you acquire is the one you have forever. To obtain an additional copy for any purchased type, check out the My Forms tab and then click the related key.

If you are using the US Legal Forms internet site for the first time, keep to the simple guidelines under:

- Very first, make sure that you have selected the best file web template to the region/area that you pick. Look at the type description to ensure you have selected the correct type. If accessible, utilize the Preview key to search throughout the file web template at the same time.

- If you would like get an additional edition of the type, utilize the Research area to find the web template that meets your needs and requirements.

- After you have identified the web template you need, click Purchase now to proceed.

- Pick the prices program you need, enter your references, and register for your account on US Legal Forms.

- Total the financial transaction. You should use your charge card or PayPal profile to fund the legitimate type.

- Pick the file format of the file and obtain it in your product.

- Make alterations in your file if needed. You can comprehensive, edit and indicator and printing Hawaii Debt Conversion Agreement with exhibit A only.

Obtain and printing a huge number of file templates while using US Legal Forms site, which provides the biggest selection of legitimate forms. Use professional and express-particular templates to take on your company or specific requires.

Form popularity

FAQ

Paying too high a price ? The lender may ask for an equity interest that represents a much higher financial price than the outstanding loan balance. Loss of equity ? By giving away part of the company's equity, the owners lose part of their interest and control in the business.

With convertible debt, a business borrows money from a lender or investor where both parties enter the agreement with the intent (from the outset) to repay all (or part) of the loan by converting it into a certain number of its preferred or common shares at some point in the future.

A debt for equity swap involves a creditor converting debt owed to it by a company into equity in that company. The effect of the swap is the issue of the equity to the creditor in satisfaction of the debt, such that the debt is discharged, released or extinguished.

In a debt-for-adaptation swap, countries who borrowed money from other nations or multilateral development banks (e.g., the IMF and World Bank) could have that debt forgiven, if the money that was to be spent on repayment was instead diverted to climate adaptation and resilience projects.

Debt-to-equity swaps are common transactions that enable a borrower to transform loans into shares of stock or equity. Mostly, a financial institution such as an insurer or a bank will hold the new shares after the original debt is transformed into equity shares.

There are a number of risks and rewards associated with debt conversion. One of the biggest risks is that the company may not be able to make the required interest payments on the new equity. If this happens, the company may be forced to issue more equity or take on additional debt in order to make the payments.

In order for a loan to be converted into equity, the company must have passed a special resolution at the time of accepting the loan, which specifies that the loan may be converted into equity in the future.

Reasons for Swaps The company may want to keep the debt/equity ratio in a target range so they can get good terms on credit/debt if they need it, or will be able to raise cash through a share offering if needed. If the ratio is too lopsided, it may limit what they can do in the future to raise cash.