Hawaii Employee Evaluation Form for Sole Trader

Description

How to fill out Employee Evaluation Form For Sole Trader?

Are you currently in a situation where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Hawaii Employee Evaluation Form for Sole Trader, which are designed to comply with federal and state regulations.

Once you find the right form, just click Get now.

Choose the pricing plan you prefer, complete the necessary details to set up your payment, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Hawaii Employee Evaluation Form for Sole Trader template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

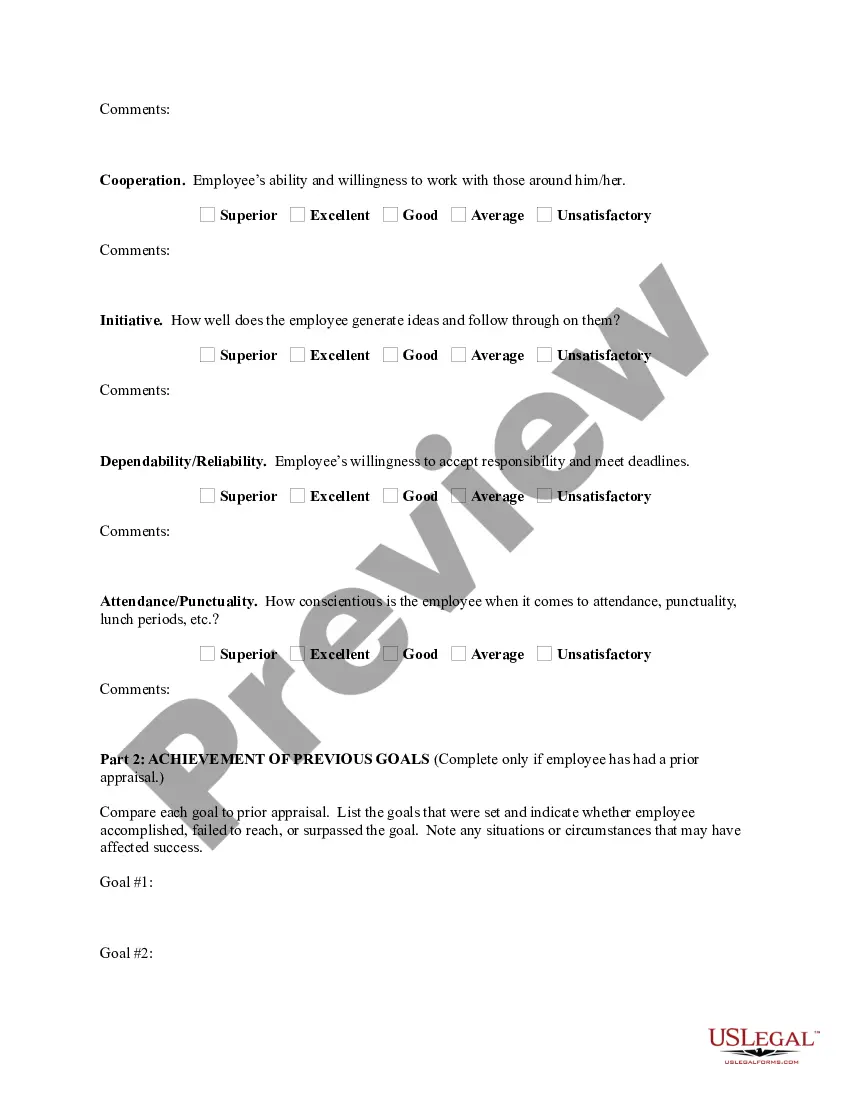

- Use the Review button to examine the form.

- Read the description to ensure you have selected the correct form.

- If the form isn’t what you need, use the Search field to discover the form that suits your needs and requirements.

Form popularity

FAQ

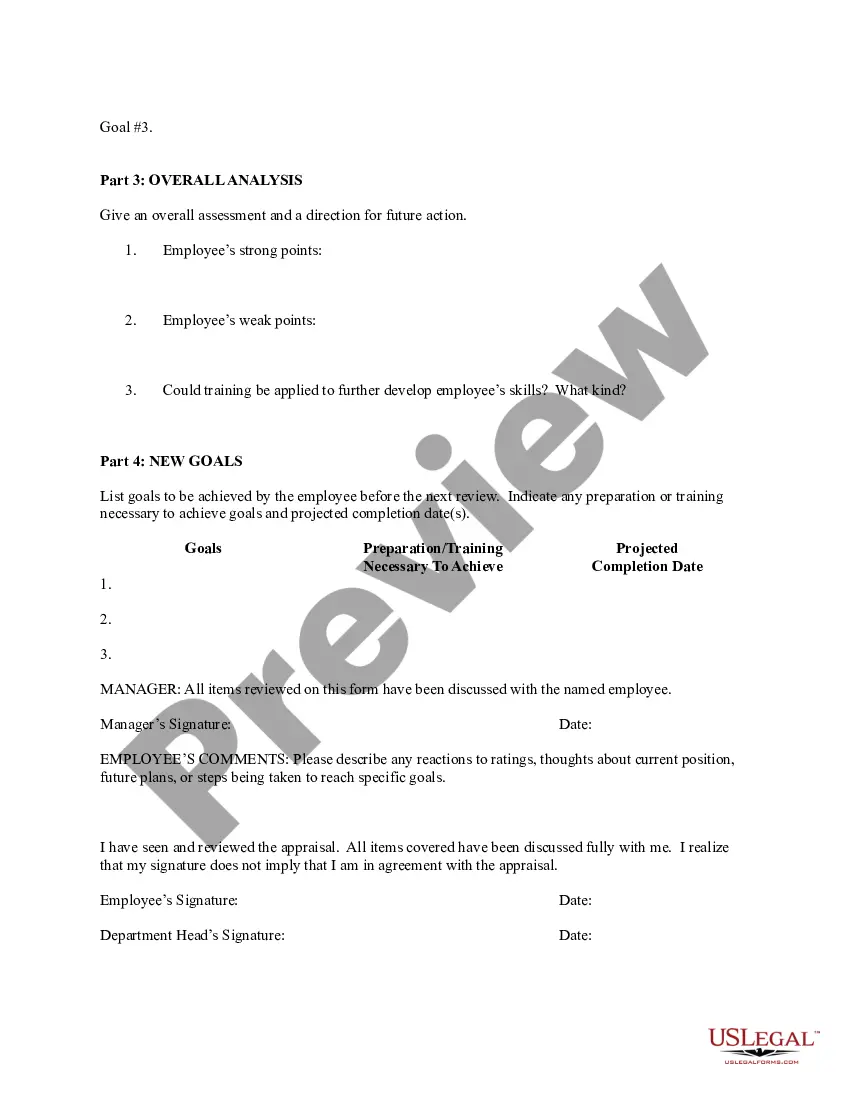

An employee self-appraisal form allows employees to evaluate their own job performance and reflect on their achievements and challenges. This form encourages open communication and self-awareness, which are crucial for growth. When used alongside a Hawaii Employee Evaluation Form for Sole Trader, it can foster a collaborative environment focused on continuous improvement and clear goals.

The Hawaii Unemployment Insurance (UI) Division offers unemployed workers the choice to have UI benefits direct deposited into their checking or savings accounts. You can have your UI benefits electronically deposited into your account as long as your financial institution participates in the direct deposit program.

They could determine the size and delivery of your paycheck, for example.5 forms to complete when starting a new job. You might be wondering why you need to be prepared for your new-hire paperwork.I-9 documents.W-4 form.Direct deposit form.Benefits enrollment.Company-specific paperwork.

Are unemployment benefits taxable? Yes. You may elect to withhold 10% for federal taxes and 5% for Hawaii state taxes from your regular UI benefits.

A. Form UC-B6, Employer's Quarterly Wage, Contribution and Employment and Training Assessment Report is mailed to the last known mailing address on file for all active employers, fifteen days prior to the end of EACH calendar quarter.

Applicants must fill out the CL-1 Form. Applications for this certificate can be downloaded at: . Completed applications may be faxed to the Wage Standards Division.

Hawaii legislation lowers SUI tax rates for 2021 and 2022; COVID-19 benefits continue not to be charged to employer accounts.

Use Hawaii Unemployment Insurance (HUI) Express to file quarterly UC-B6 reports and pay contributions. Create an account to use HUI Express and then download the free QWRS program to create electronic files to send online. QWRS calculates the total and taxable wages and contributions due.

Performance Appraisal Systems (PAS) Forms Used for evaluating employees on an annual basis who passed their probation period. HRD 526 (Rev 7/17) Employee Performance Appraisal pdf Form Fillable Used for evaluating employees on initial probation, new probation, or on notice to improve performance.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.