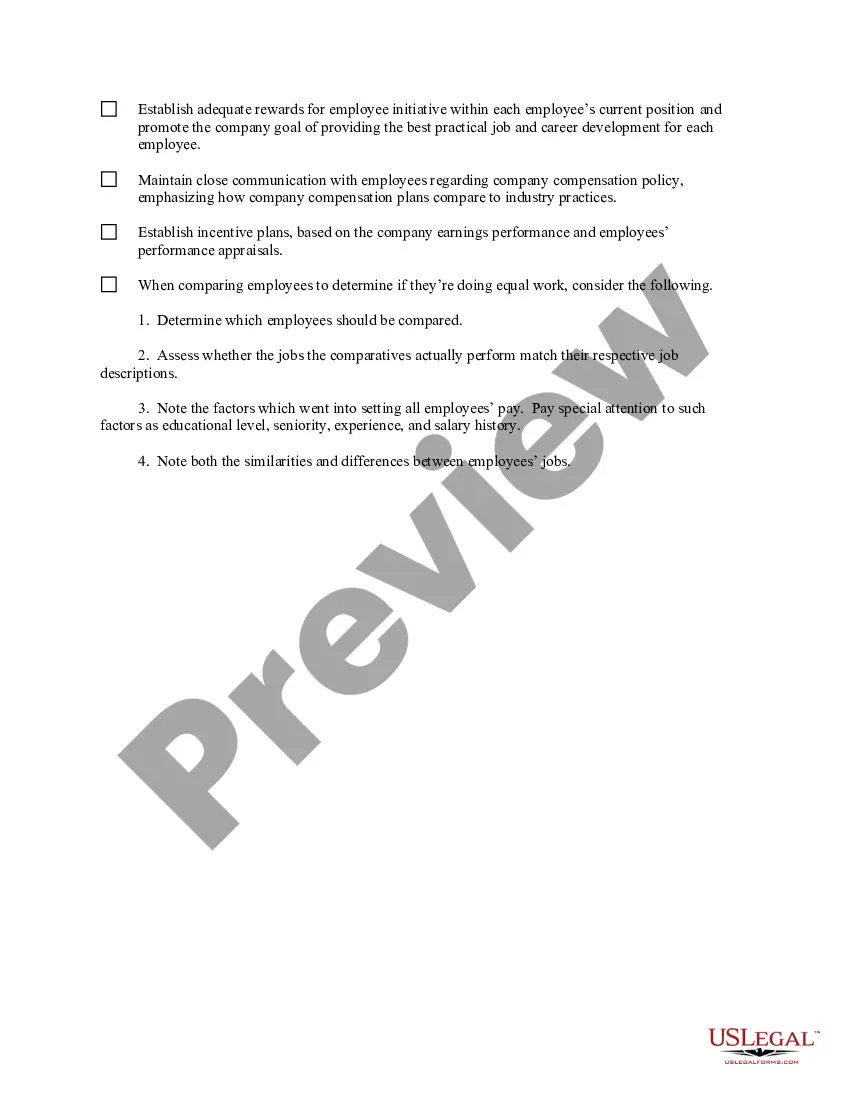

Hawaii Equal Pay Checklist

Description

How to fill out Equal Pay Checklist?

Are you presently in the situation that you need documentation for sometimes business or particular activities virtually every day.

There are many authentic document templates accessible online, but locating ones you can trust isn’t straightforward.

US Legal Forms offers thousands of form templates, such as the Hawaii Equal Pay Checklist, which are designed to comply with federal and state regulations.

Choose the pricing plan you want, complete the required information to create your account, and pay for the order using your PayPal or credit card.

Select a convenient file format and download your copy.

- If you are already acquainted with the US Legal Forms site and have your account, just Log In.

- After that, you can download the Hawaii Equal Pay Checklist template.

- If you don’t have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and make sure it is for the correct city/area.

- Utilize the Review option to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your requirements.

- Once you find the correct form, click on Get now.

Form popularity

FAQ

In Hawaii, the minimum salary for exempt employees is generally set at $1,200 per week, which translates to $62,400 per year. This policy ensures that workers receive fair compensation for their contributions. By following the Hawaii Equal Pay Checklist, employers can easily verify compliance with these salary standards. Understanding these requirements is crucial for both employers and employees in maintaining workplace equity.

The requirements for equal pay state that employees must receive the same compensation for performing jobs that are similar in skill, effort, and responsibility. However, employers can justify pay differences based on factors such as seniority or merit. Establishing a Hawaii Equal Pay Checklist can help both employees and employers ensure compliance with these requirements.

To prove discrimination under the Equal Pay Act, you require various forms of evidence including pay records, performance evaluations, and any communications related to compensation. Documentation is crucial as it provides a basis for your claims. Make sure your Hawaii Equal Pay Checklist includes these elements to build a strong case.

Proving equal pay discrimination involves demonstrating that two employees, performing similar work in comparable conditions, are receiving different wages. You need to present clear evidence, such as pay stubs and job descriptions, to support your claim. Your Hawaii Equal Pay Checklist can serve as a roadmap to ensure that you gather all necessary documentation effectively.

The burden of proof in an Equal Pay Act claim initially lies with the employee, requiring them to show evidence of unequal pay for equal work. Once this is established, the employer must justify any pay differences under acceptable exceptions. It is essential to be thorough in your approach, and a well-prepared Hawaii Equal Pay Checklist can greatly assist you.

To support an equal pay claim, you need relevant documentation that showcases your job responsibilities, pay records, and any pay disparity issues. Gathering this evidence can strengthen your case and is vital in adhering to your Hawaii Equal Pay Checklist. Consult with professionals or platforms like uslegalforms to create a comprehensive dossier.

The Equal Pay Act in Hawaii aims to eliminate wage disparities based on gender. It mandates that employees in similar roles must receive equal pay for equal work, allowing for only specific exceptions. Understanding this law is essential when creating your Hawaii Equal Pay Checklist to ensure compliance and promote fairness in the workplace.

Setting up payroll in Hawaii involves several important steps to ensure compliance with state regulations. First, you will need to register your business with the Hawaii Department of Taxation to obtain a Tax Identification Number. Next, make sure to create a Hawaii Equal Pay Checklist to help ensure you are meeting all local pay equity laws. Finally, consider using a payroll service like USLegalForms that provides comprehensive solutions, making the payroll process smoother and ensuring you stay compliant.

Hawaii Senate Bill 1057 aims to address pay disparities among workers in the state. This legislation requires employers to demonstrate equal pay for equal work, and it promotes transparency in wage discussions. Understanding this bill is essential for employees and employers alike, making the Hawaii Equal Pay Checklist an excellent resource for navigating compliance and ensuring fair practices.