Hawaii Personnel Change Notice

Description

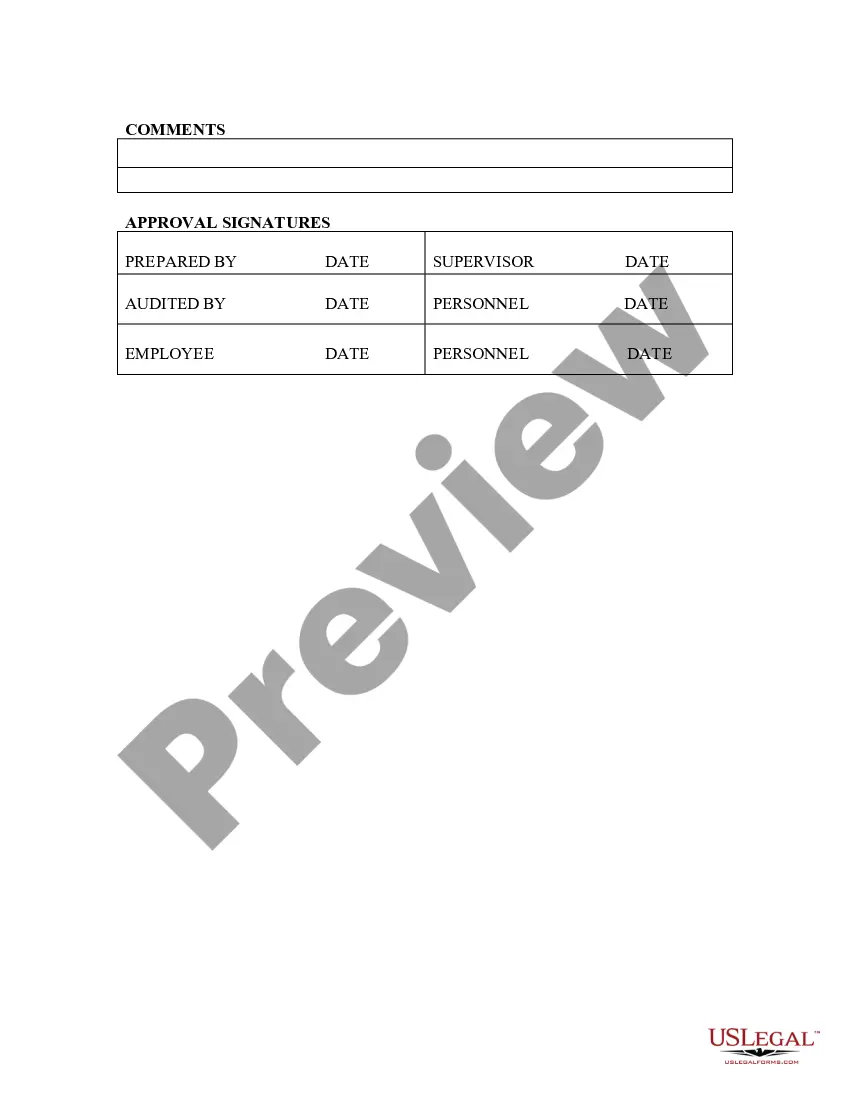

How to fill out Personnel Change Notice?

You might spend time online searching for the legal document format that meets the state and federal requirements you need.

US Legal Forms offers a wide array of legal templates that have been reviewed by experts.

You can download or print the Hawaii Personnel Change Notice from their services.

If you wish to find another version of your form, use the Search field to locate the format that suits your needs and requirements.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the Hawaii Personnel Change Notice.

- Every legal document format you acquire is yours permanently.

- To obtain an additional copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document format for the state/city of your choice.

- Check the form details to confirm you have chosen the proper form.

- If available, use the Review button to examine the document format as well.

Form popularity

FAQ

A personal change notice is a document similar to a personnel change notice but focuses on individual details. It typically involves updates about personal information such as address, name, or marital status changes. Utilizing a Hawaii Personnel Change Notice can streamline the process of informing your employer about these changes.

Personnel changes refer to adjustments made within an organization's employee structure. This can include promotions, transfers, or the addition of new employees. Understanding the concept is vital, as a Hawaii Personnel Change Notice will often be required to formally document these changes within a company.

To change your mailing address in Hawaii, you can submit a form to the relevant government agency, such as the Department of Motor Vehicles or your employer. The Hawaii Personnel Change Notice can be used for notifying your employer about your address change. It's essential to keep your address up to date to receive important communications.

Yes, if you're making changes that affect your employment or personal records, you will need to fill out the appropriate Hawaii form. This is often done through the Hawaii Personnel Change Notice. Completing this form ensures that all relevant parties have up-to-date information and helps maintain accurate records at your workplace.

To change your last name after marriage in Hawaii, you need to update your identification and documents. Typically, you can do this on your marriage certificate. The Hawaii Personnel Change Notice may also be required to inform your employer and relevant authorities about the change if it affects your employment records.

At-will employment is an employer-employee agreement in which a worker can be fired or dismissed for any reason, without warning, and without explanation.

Under Section 388-3(b), HRS, when an employee quits or resigns, the employer shall pay the employee's wages in full no later than the next regular pay day, except that if the employee gives at least one pay period's notice of intention to quit, the employer shall pay all wages earned at the time of quitting.

As noted in #5 above, California requires that your employer pay all of your final wages no later than 72 hours after quit, or at the time you quit if you gave 72 hour advance notice of quitting.

You are entitled to be paid your wages for the hours you worked up to the date you quit your job. In general, it is unlawful to withhold pay (for example holiday pay) from workers who do not work their full notice unless a clear written term in the employment contract allows the employer to make deductions from pay.

Generally, Hawaii is an at will State. This means an employer does not need to give you a reason to let you go, lay you off, or fire you unless: You have a contract with the employer that requires you be notified of the reason.