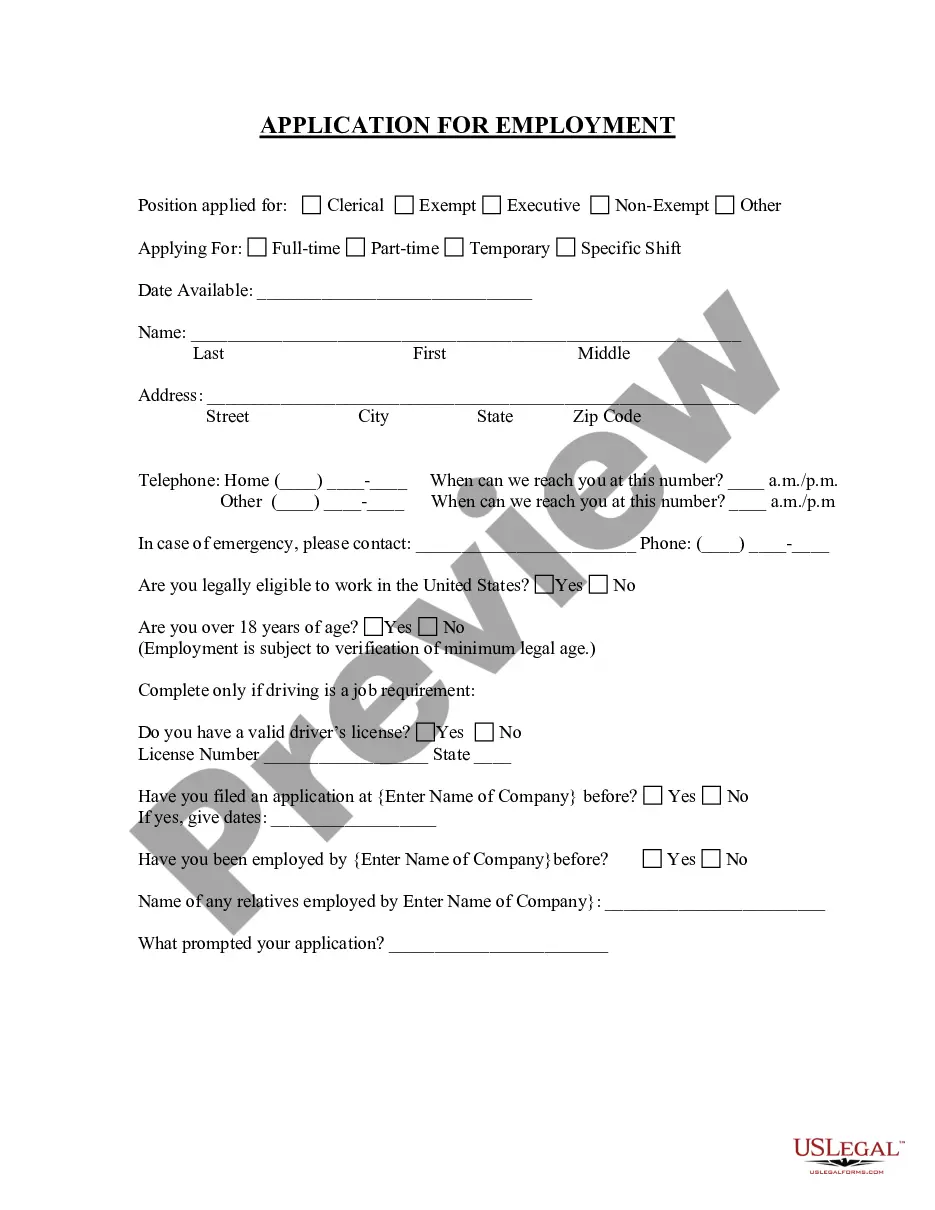

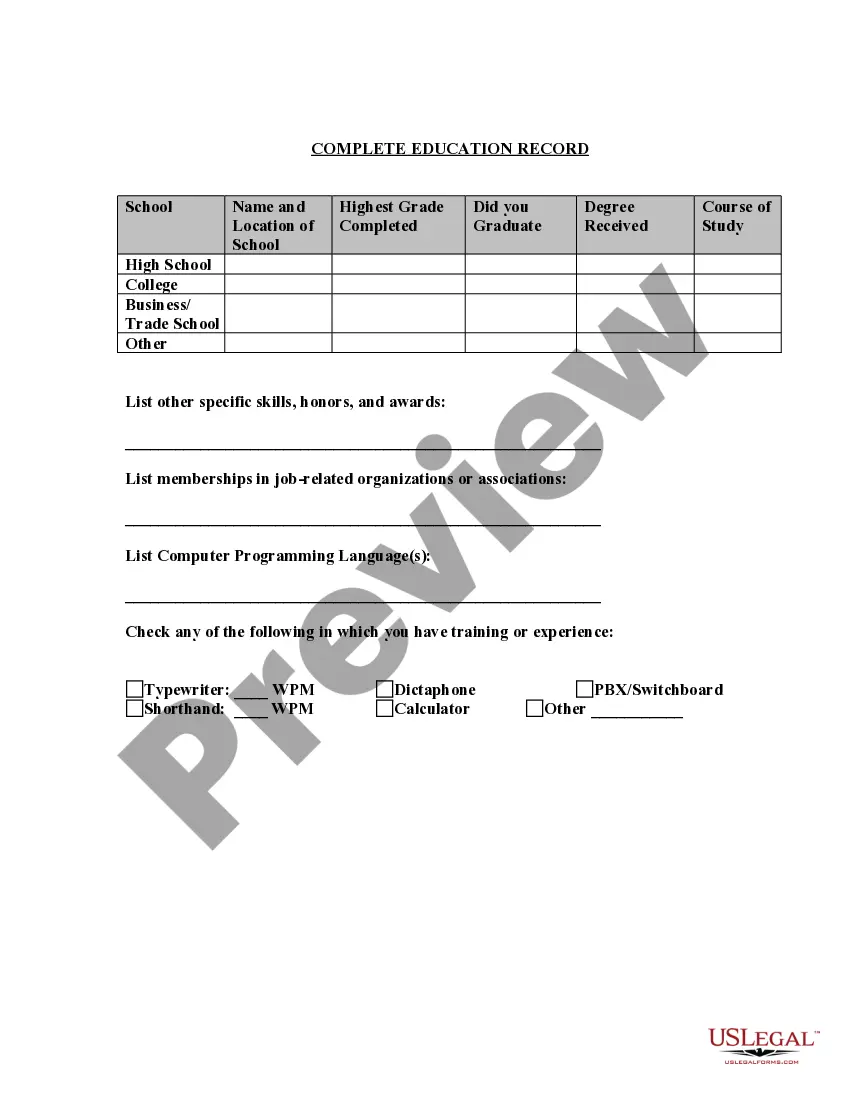

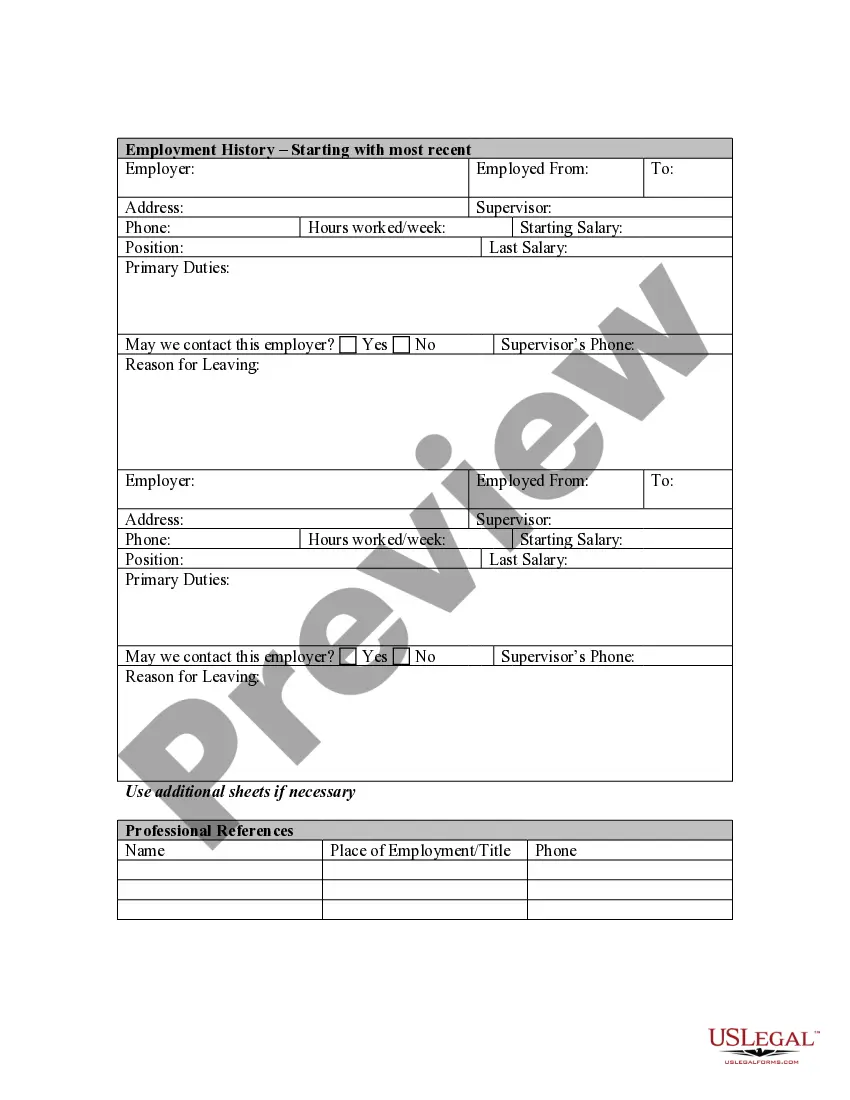

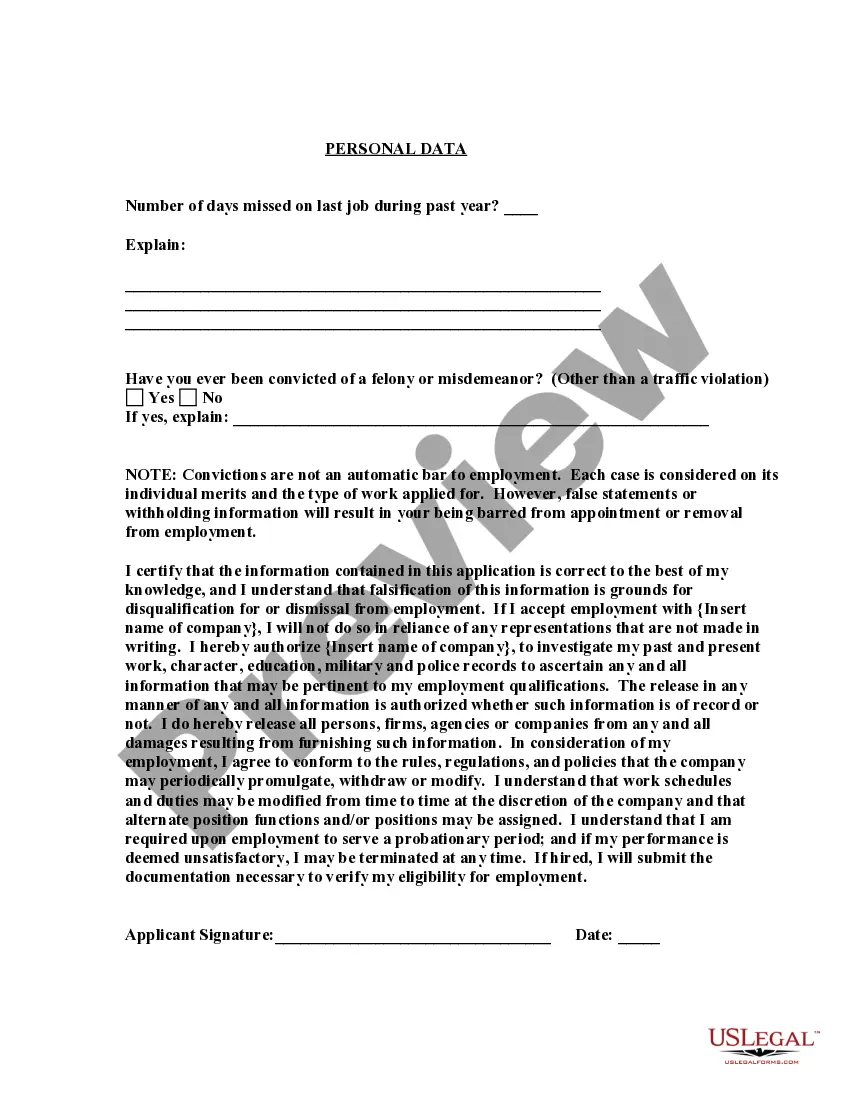

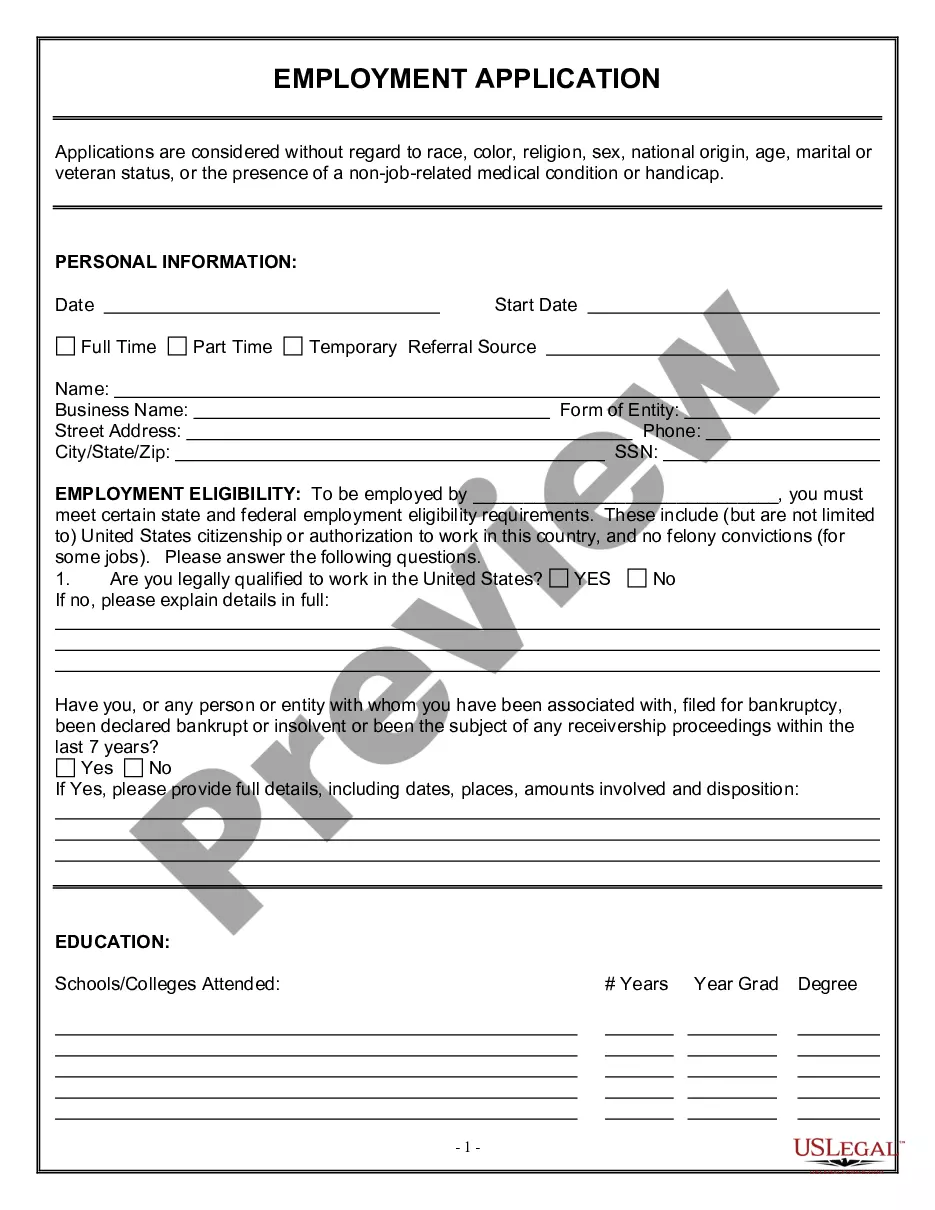

Hawaii Application for Work or Employment - Clerical, Exempt, Executive, or Nonexempt Position

Description

How to fill out Application For Work Or Employment - Clerical, Exempt, Executive, Or Nonexempt Position?

It is feasible to spend hours online trying to locate the valid documents template that meets the state and federal requirements you need.

US Legal Forms provides thousands of valid forms that are reviewed by experts.

It is straightforward to acquire or generate the Hawaii Application for Work or Employment - Clerical, Exempt, Executive, or Nonexempt Position from the service.

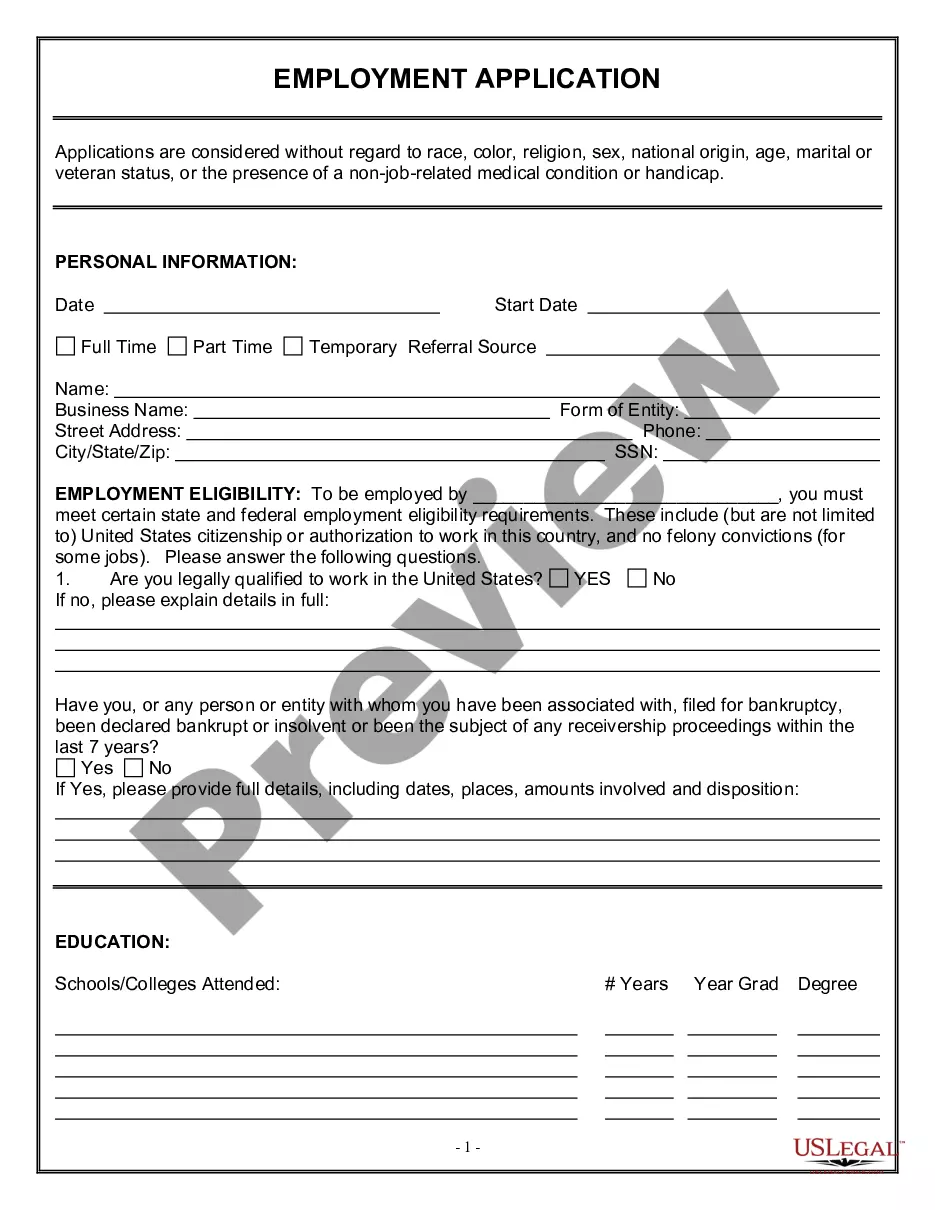

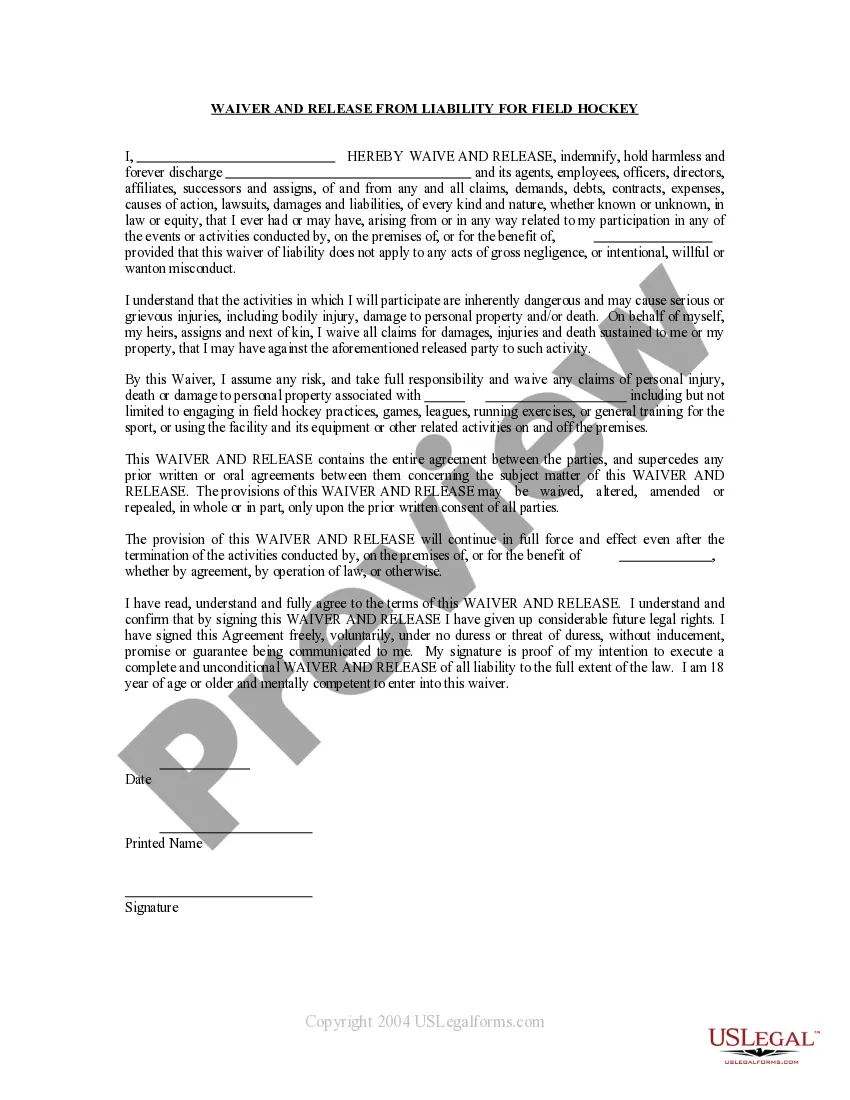

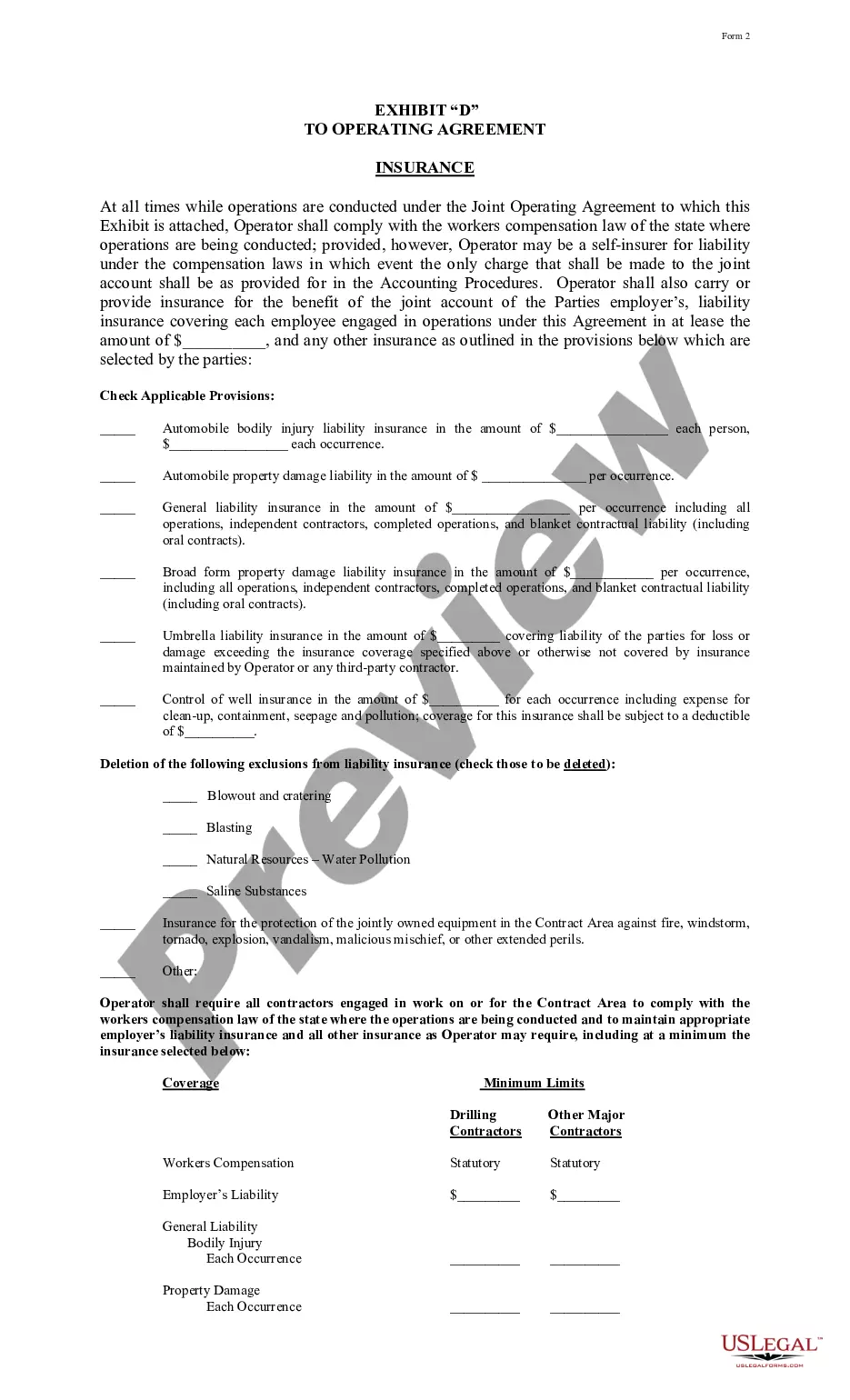

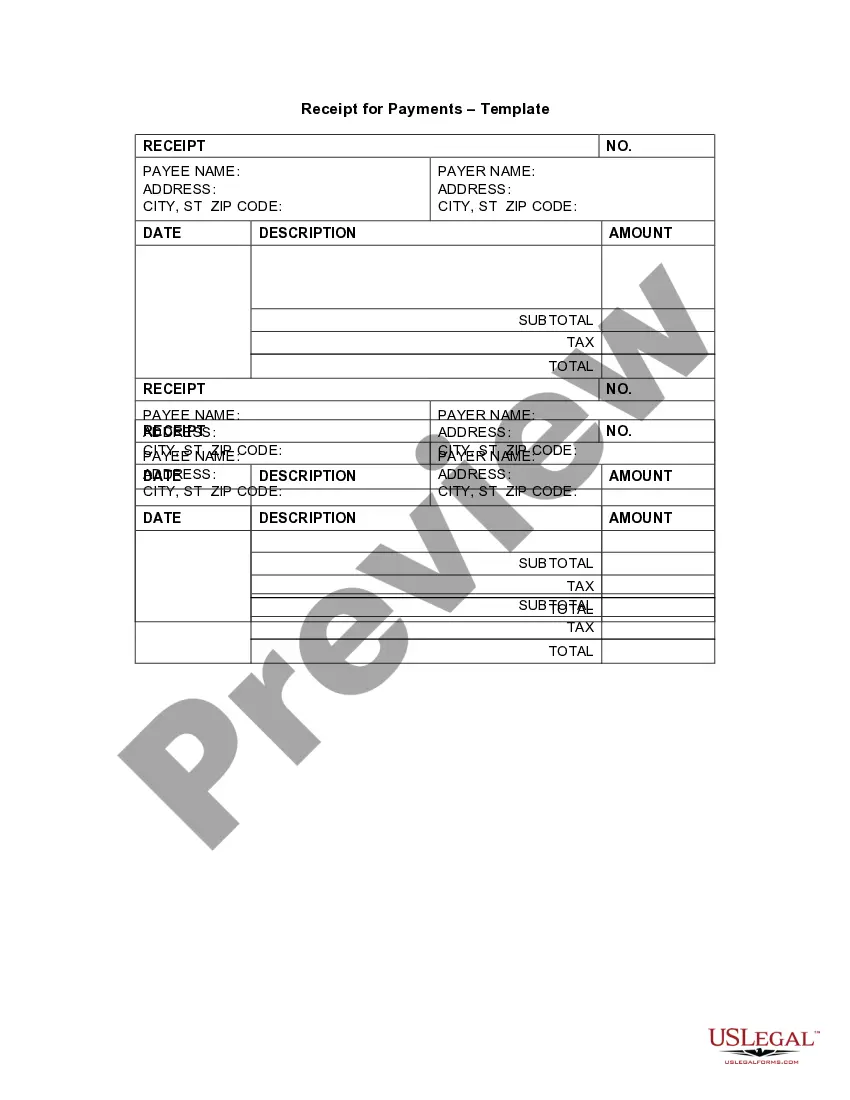

If available, utilize the Preview button to examine the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click on the Download button.

- Subsequently, you can fill out, modify, produce, or sign the Hawaii Application for Work or Employment - Clerical, Exempt, Executive, or Nonexempt Position.

- Every valid document template you obtain is yours permanently.

- To obtain an additional copy of a purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the area/region of your preference.

- Review the form description to confirm you have selected the right document.

Form popularity

FAQ

What does non-exempt mean? If employees are non-exempt, it means they are entitled to minimum wage and overtime pay when they work more than 40 hours per week.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

Exempt employees must be paid on a salary basis, as discussed above. Nonexempt employees may be paid on a salary basis for a fixed number of hours or under the fluctuating workweek method. Salaried nonexempt employees must still receive overtime in accordance with federal and state laws.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

What Is an Exempt Employee? The term exempt employee refers to a category of employees set out in the Fair Labor Standards Act (FLSA). Exempt employees do not receive overtime pay, nor do they qualify for minimum wage. When an employee is exempt, it primarily means that they are exempt from receiving overtime pay.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

Key Takeaways. An exempt employee is an employee who does not receive overtime pay or qualify for minimum wage. Exempt employees are paid a salary rather than by the hour, and their work is executive or professional in nature.

Exempt or Nonexempt.Employees whose jobs are governed by the FLSA are either "exempt" or "nonexempt." Nonexempt employees are entitled to overtime pay. Exempt employees are not.

Exempt employees refer to workers in the United States who are not entitled to overtime pay. This simply implies that employers of exempt employees are not bound by law to pay them for any extra hours of work. The federal standard for work hours in the United States is 40 hours per workweek.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.