Hawaii Sales Prospect File

Description

How to fill out Sales Prospect File?

If you seek thorough, acquire, or generating authentic document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you need.

Various templates for commercial and personal purposes are organized by categories, states, or keywords.

Step 4. Once you have found the form you desire, click the Purchase now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase. Step 6. Download the format of your legal document and save it to your device. Step 7. Complete, modify, and print or sign the Hawaii Sales Prospect Document.

- Utilize US Legal Forms to obtain the Hawaii Sales Prospect Document with just a few clicks.

- If you are currently a US Legal Forms client, sign in to your account and click on the Download button to retrieve the Hawaii Sales Prospect Document.

- You can also access forms you previously acquired within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

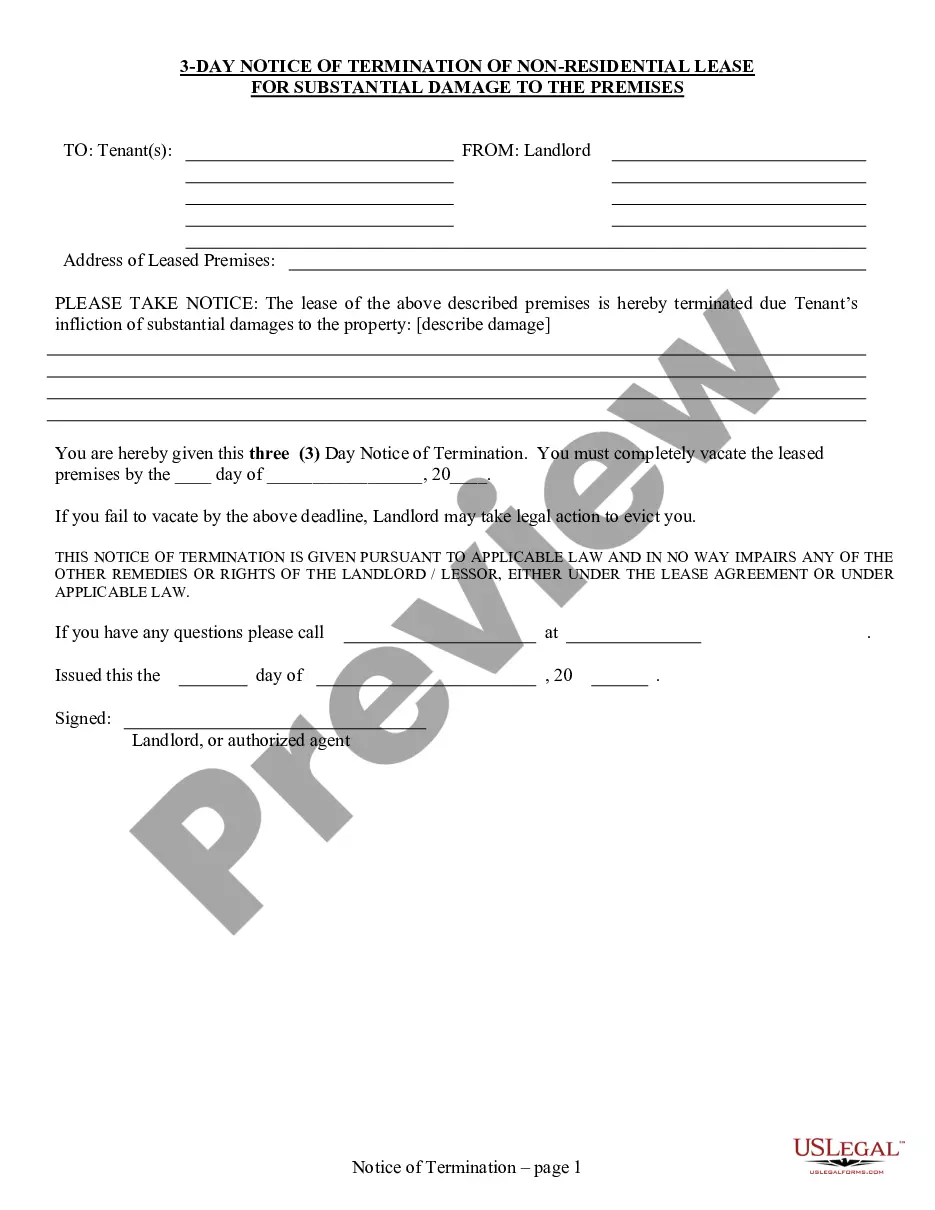

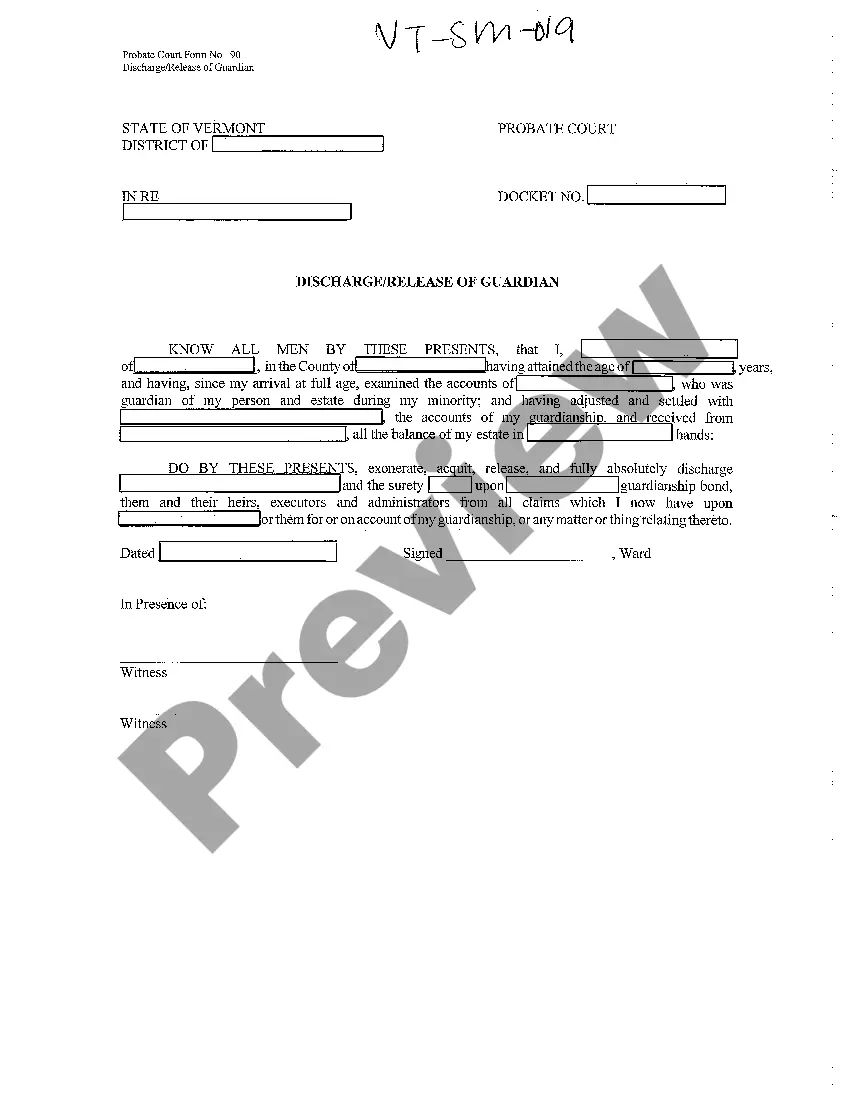

- Step 2. Use the Preview option to review the form's details. Don't forget to read the description.

- Step 3. If you are unsatisfied with the template, utilize the Search area at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

The 1098 F form in Hawaii is used to report certain tax information associated with financial transactions, specifically involving loans and mortgages. This form is important for both individuals and institutions that need to document amounts received in interest. Understanding how this form relates to your finances can be crucial for ensuring accurate tax filings. Utilizing the Hawaii Sales Prospect File can aid in organizing your financial documents for reporting.

In Hawaii, businesses must file General Excise (GE) tax returns on a regular basis, depending on their revenue. Typically, businesses with higher sales need to file monthly, while those with lower sales can file quarterly or annually. The requirement to maintain accurate records directly affects the filing process, which is essential for proper compliance. Using tools like the Hawaii Sales Prospect File can help ensure you track the necessary data efficiently.

The general sales tax rate in Hawaii currently stands at 4%. However, counties can levy additional taxes, making the effective sales tax rate higher in certain areas. Always check the most recent rates on official platforms, as they can change. Resources like the Hawaii Sales Prospect File ensure you have access to up-to-date information.

In Hawaii, tangible personal property, services, and certain leases are subject to sales tax. Specific items like prepared food, furniture, and more fall under this category. Keeping up to date with what qualifies as taxable is essential for compliance. The Hawaii Sales Prospect File offers extensive lists and details on taxable goods.

Form N-288A is a tax form used in Hawaii for the withholding of income tax on the state level, primarily for non-resident owners. It details the income and taxes withheld from payments to non-residents. Ensuring you understand this form can simplify your tax processes. For more complete information, refer to the Hawaii Sales Prospect File, which may offer useful tax guidance.

To obtain your 1099-G form in Hawaii, you can check your mailbox if you’ve opted for paper forms, or access it online through the Hawaii Department of Taxation's website. Some businesses may also send you this form directly if you received unemployment benefits or certain types of payments. Keeping accurate records, like those in your Hawaii Sales Prospect File, can simplify this retrieval process.

You should file the G49 form with the Hawaii Department of Taxation, either by mailing it or submitting it electronically through their online portal. Make sure to gather all necessary information beforehand to avoid errors. Utilizing the Hawaii Sales Prospect File can help you track pertinent details for accurate filing.

Hawaii tax forms are available for download from the Hawaii Department of Taxation’s official website, where you can find a variety of forms suited for different tax needs. You can also pick them up at local tax offices if you prefer physical copies. Accessing the correct forms can streamline your tax reporting process, especially when managing a Hawaii Sales Prospect File.

You can file your Hawaii state taxes online through the Hawaii Department of Taxation's e-filing system. Alternatively, you can mail your tax forms to the specified address on the department's website. Ensuring proper filing contributes to maintaining a good standing while managing your assets, such as the ones listed in your Hawaii Sales Prospect File.

You can obtain a copy of your Hawaii General Excise tax license online via the Hawaii Department of Taxation's website. If you need a physical copy, you can also request one directly by contacting their offices. Having access to your license is vital for ensuring you make informed business decisions while utilizing the Hawaii Sales Prospect File.