Hawaii Letter of Notice to Borrower of Assignment of Mortgage

Description

How to fill out Letter Of Notice To Borrower Of Assignment Of Mortgage?

If you wish to total, download, or produce authorized file templates, use US Legal Forms, the most important collection of authorized kinds, which can be found on the Internet. Take advantage of the site`s simple and convenient search to get the papers you need. Various templates for organization and personal functions are sorted by categories and claims, or key phrases. Use US Legal Forms to get the Hawaii Letter of Notice to Borrower of Assignment of Mortgage with a handful of click throughs.

When you are already a US Legal Forms consumer, log in to your accounts and click on the Obtain switch to get the Hawaii Letter of Notice to Borrower of Assignment of Mortgage. Also you can gain access to kinds you formerly saved in the My Forms tab of your own accounts.

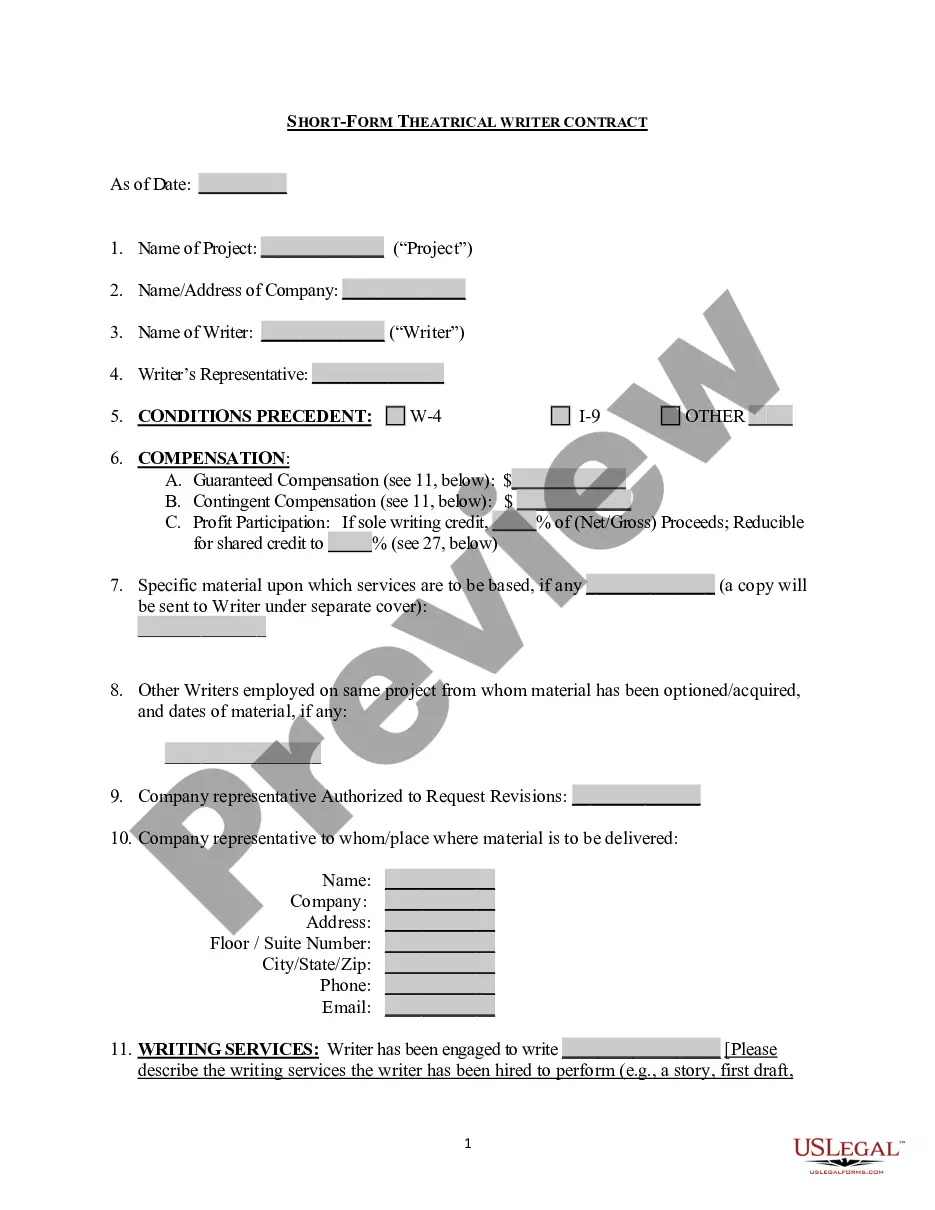

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape to the correct area/nation.

- Step 2. Utilize the Preview option to examine the form`s articles. Never neglect to read the description.

- Step 3. When you are unsatisfied together with the type, take advantage of the Research industry at the top of the monitor to discover other versions of the authorized type web template.

- Step 4. After you have found the shape you need, go through the Buy now switch. Opt for the costs prepare you prefer and add your accreditations to sign up on an accounts.

- Step 5. Method the purchase. You can utilize your Мisa or Ьastercard or PayPal accounts to perform the purchase.

- Step 6. Pick the formatting of the authorized type and download it on your own gadget.

- Step 7. Complete, revise and produce or indication the Hawaii Letter of Notice to Borrower of Assignment of Mortgage.

Every single authorized file web template you acquire is the one you have permanently. You might have acces to every single type you saved within your acccount. Click on the My Forms section and select a type to produce or download again.

Contend and download, and produce the Hawaii Letter of Notice to Borrower of Assignment of Mortgage with US Legal Forms. There are thousands of expert and state-distinct kinds you can utilize to your organization or personal requires.

Form popularity

FAQ

How to write a letter of explanation The date you're writing the letter. The lender's name, mailing address, and phone number. Your full legal name and loan application number. Your explanation, with references to any supporting documents you're including. Your mailing address and phone number.

A corporate assignment is an assignment of the mortgage from one corporation to another. A mers assignment involves the Mortgage Electronic Registration System (MERS). Mortgages often designate MERS as a nominee (agent for) the lender.

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

Loan assumption, however, allows a buyer to take over the current owner's mortgage while the loan's terms ? including the repayment period and interest rate ? remain the same. Ultimately, it can help people get into a home at a lower interest rate even as the housing market around them becomes more expensive.

Again, the loan transaction consists of two main documents: the mortgage (or deed of trust) and a promissory note. The mortgage or deed of trust is the document that pledges the property as security for the debt and permits a lender to foreclosure if you fail to make the monthly payments.

An assignment by way of security is a type of mortgage. It involves an assignment (ie transfer) of rights by the assignor to the assignee subject to an obligation to reassign those rights back to the assignor upon the discharge of the obligations which have been secured.

AOM(Assignment of Mortgages) Management We ensure that the AOM of a loan portfolio has been verified before you make the decision to onboard them.

AOM(Assignment of Mortgages) Management We enable you keep track of all the previous lenders who have serviced a loan before you purchase and move it aboard your portfolio.