Hawaii Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

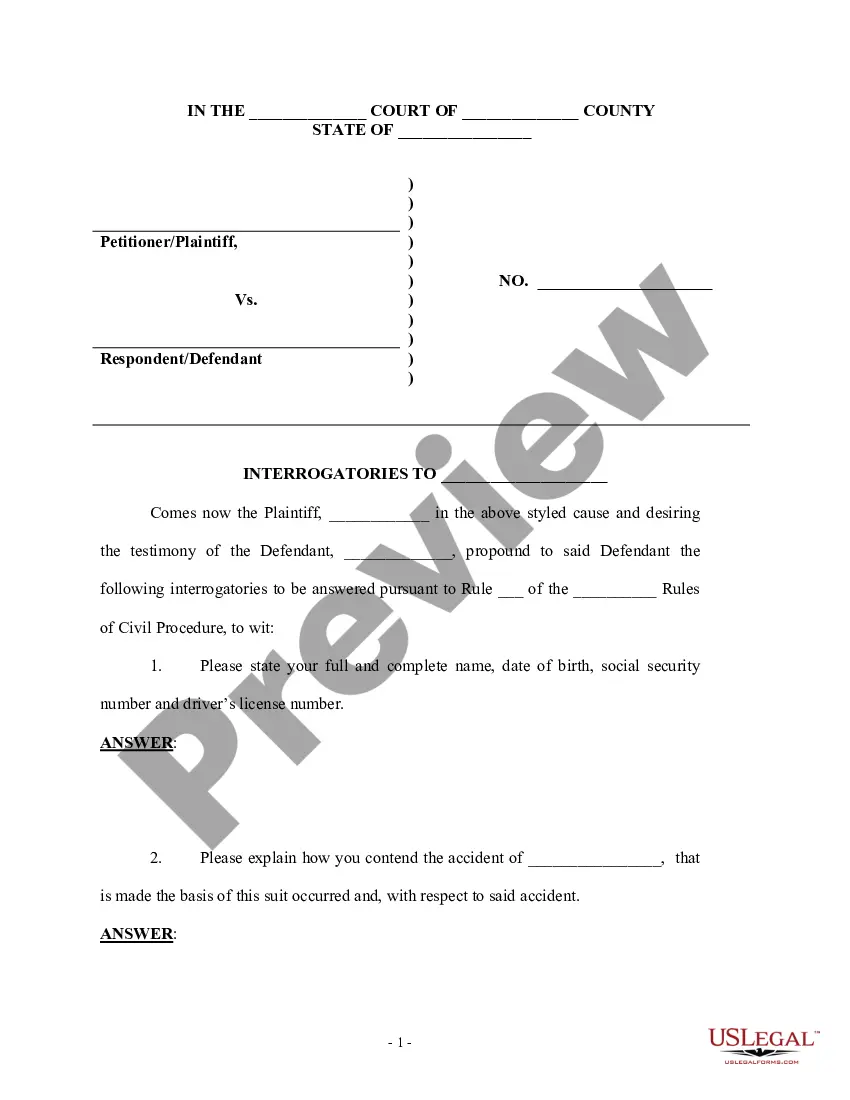

How to fill out Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

Are you currently inside a placement the place you require files for sometimes company or personal purposes virtually every day time? There are a lot of legitimate document web templates available on the Internet, but getting kinds you can trust isn`t easy. US Legal Forms provides a huge number of kind web templates, just like the Hawaii Challenge to Credit Report of Experian, TransUnion, and/or Equifax, that happen to be composed to fulfill federal and state needs.

When you are presently knowledgeable about US Legal Forms web site and also have your account, basically log in. Afterward, it is possible to obtain the Hawaii Challenge to Credit Report of Experian, TransUnion, and/or Equifax design.

Unless you offer an accounts and would like to begin using US Legal Forms, adopt these measures:

- Get the kind you require and ensure it is for the right city/area.

- Use the Review option to analyze the shape.

- Browse the outline to actually have selected the correct kind.

- When the kind isn`t what you`re seeking, use the Lookup field to obtain the kind that meets your requirements and needs.

- Once you get the right kind, click on Purchase now.

- Opt for the prices strategy you want, submit the necessary information and facts to produce your money, and buy an order using your PayPal or bank card.

- Decide on a convenient data file file format and obtain your duplicate.

Find all of the document web templates you have bought in the My Forms food selection. You may get a more duplicate of Hawaii Challenge to Credit Report of Experian, TransUnion, and/or Equifax any time, if necessary. Just click on the required kind to obtain or printing the document design.

Use US Legal Forms, probably the most extensive collection of legitimate types, to conserve time and stay away from mistakes. The support provides skillfully created legitimate document web templates that you can use for a selection of purposes. Produce your account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

To freeze your credit, you have to contact each of the three credit bureaus individually. Placing a credit freeze is free for you and your children, as is lifting it when applying for new credit.

The Bottom Line You are entitled by law to freeze your credit reports anytime, for free. To do so, you must request a security freeze at each of the national credit bureaus individually. Freezing your credit limits criminals' ability to open loans and credit card accounts in your name.

If you want to freeze your credit, you need to do it at each of the three major credit bureaus: Equifax (1-800-349-9960) TransUnion (1-888-909-8872) Experian (1-888-397-3742) .

Dispute mistakes with the credit bureaus. You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureau's dispute form (if they have one), copies of documents that support your dispute, and keep records of everything you send.

A freeze can give you a false sense of security ? you may still be susceptible to credit fraud or other fraud involving your Social Security number.

Freezing your credit is free, and you'll need to do it with all three credit bureaus to lock down each of your credit reports. And again, the freeze will stay in place until you lift it.

The law was passed in 1970 and amended twice. It is primarily aimed at the three major credit reporting agencies ? Experian, Equifax and TransUnion ? because of the widespread use of the information those bureaus collect and sell.

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus ? Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.