Hawaii Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

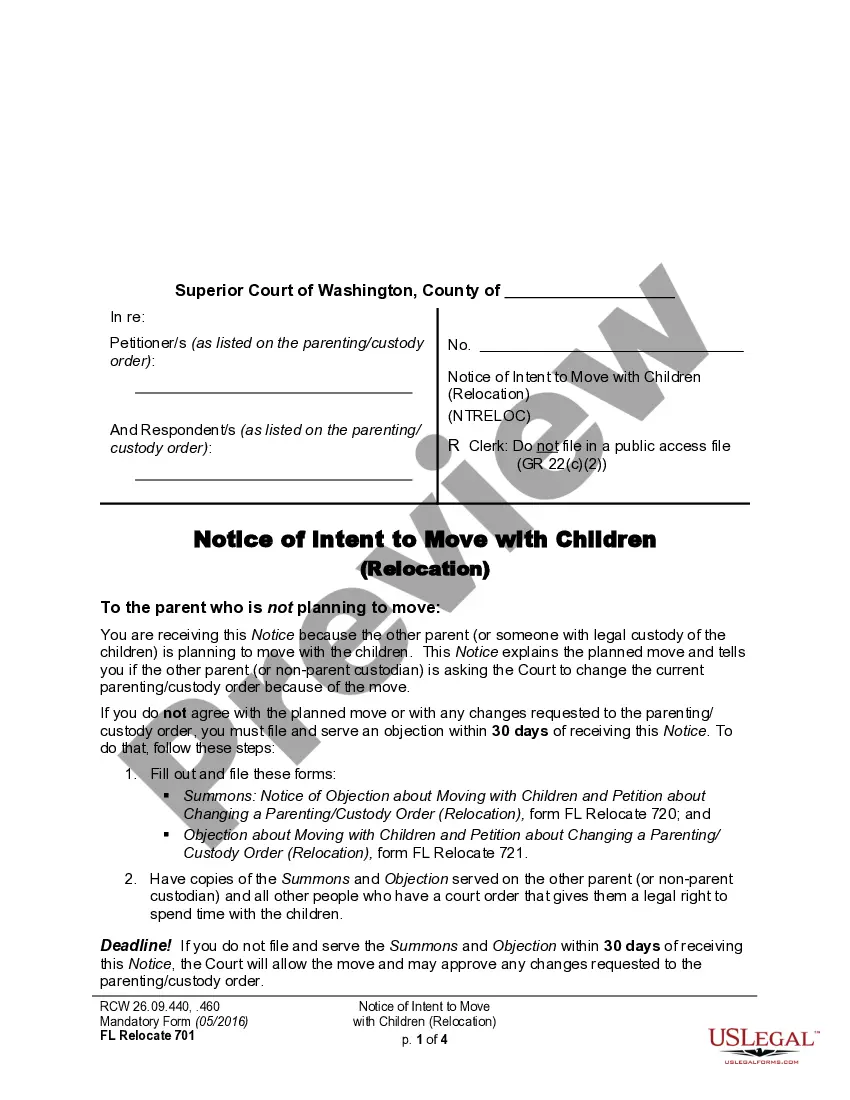

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

Finding the appropriate authentic document template can be a challenge. Clearly, there are numerous formats available online, but how do you locate the authentic form you require.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Hawaii Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, which can be used for business and personal purposes.

All documents are reviewed by professionals and meet federal and state requirements.

If the form does not meet your requirements, utilize the Search field to find the appropriate document. When you are confident that the form is suitable, click the Purchase now button to acquire the form. Select the pricing plan you desire and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, edit, print, and sign the received Hawaii Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. US Legal Forms is the most extensive library of legal forms where you can find various document templates. Take advantage of the service to download professionally crafted documents that comply with state regulations.

- If you are currently registered, Log In to your account and click on the Download button to obtain the Hawaii Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

- Use your account to review the legal documents you may have purchased previously.

- Go to the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct form for your city/county.

- You can browse the form using the Review button and examine the form details to confirm it is right for you.

Form popularity

FAQ

Yes, not reporting a 1099 can lead to serious consequences including fines and the potential for tax audits. The IRS takes reporting seriously, and missing documents can raise a red flag. If you feel unsure about your reporting status, obtaining the Hawaii Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption is advisable. This certification can help confirm your compliance.

According to Hawaii Instructions for Form N-11, every individual doing business in Hawaii during the taxable year must file a return, whether or not the individual derives any taxable income from that business.

Forms G-45, G-49, and GEW-TA-RV-6 can be filed and payments made electronically through the State's Internet portal. For more information, go to tax.hawaii.gov/eservices/. The GET is a tax imposed on the gross income you receive from any business activity you have in Hawaii.

How Is the Conveyance Tax Determined? One dollar and twenty-five cents ($1.25) per $100 of the actual and full consideration for properties with a value of $10,000,000 or greater . The conveyance tax imposed for each transaction shall be not less than one dollar ($1.00).

The amount collected under the HARPTA law is 7.25% of the sales price. What is the actual Hawaii capital gains tax? The Hawaii capital gains tax on real estate is 7.25%.

Other Exceptions to the HARPTA Withholding Requirement:If the seller does not realize a gain or loss with the sale, e.g. 1031 exchange. Or, If the property was used as the seller's principal residence for the year before the sale and the sales price is $300K or less.

Form P-64B, Rev 2019, Exemption from Conveyance Tax.

File a Form N-288B (with Form N-103 included if applicable) in a timely manner prior to closing to avoid HARPTA withholding altogether if you qualify. Or, maybe you qualify for an N-289 exemption? Alternatively, you may need to file a Form N-288C to get your money back2026 if you don't qualify for an exemption.

1 What is HARPTA? Under HARPTA (section 235-68, Hawaii Revised Statutes (HRS)), every buyer is required to withhold and pay to the Department of Taxation (Department) 7.25% of the amount realized on the disposition of Hawaii real property.

The amount collected under the HARPTA law is 7.25% of the sales price. What is the actual Hawaii capital gains tax? The Hawaii capital gains tax on real estate is 7.25%.