Hawaii Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another

Description

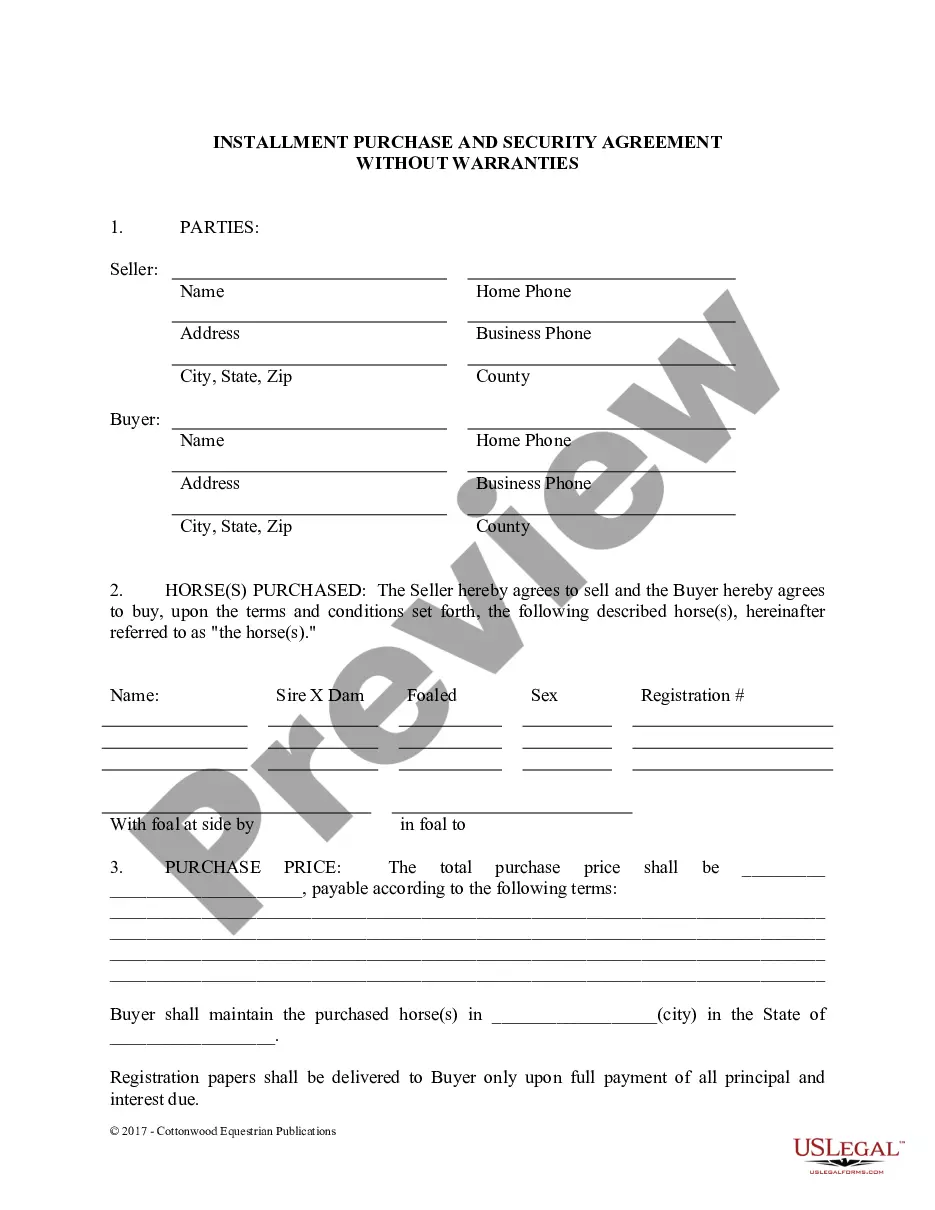

How to fill out Promissory Note And Security Agreement With Regard To The Sale Of An Automobile From One Individual To Another?

US Legal Forms - one of the most substantial compilations of legal documents in the United States - provides an extensive selection of legal template formats you can download or create.

By utilizing the website, you can locate thousands of forms for business and personal uses, categorized by types, states, or keywords.

You can find the latest forms such as the Hawaii Promissory Note and Security Agreement Regarding the Sale of a Vehicle from One Person to Another within moments.

Review the form details to confirm that you have selected the right form.

If the form doesn’t suit your needs, use the Search bar at the top of the screen to find a more suitable one.

- If you possess a monthly subscription, Log In and download the Hawaii Promissory Note and Security Agreement Regarding the Sale of a Vehicle from One Person to Another from the US Legal Forms collection.

- The Download option will be visible on each template you view.

- You have access to all previously saved forms in the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview option to examine the content of the form.

Form popularity

FAQ

To obtain a Hawaii Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, start by visiting a reputable legal forms provider like US Legal Forms. This platform offers customizable templates that you can fill out according to your specific transaction details. Once you have completed the document, it's essential to have both parties review and sign it to ensure all terms are agreed upon. This approach helps protect both the buyer and the seller, creating a clear record of the agreement.

Promissory notes can sometimes be classified as securities, depending on their features and how they are structured. However, in common practice, within the context of a Hawaii Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, they are typically treated as financial instruments rather than traditional securities. If you are unsure about the classification of your promissory note, consulting with a legal expert can provide clarity on this matter.

A promissory note and a security agreement are related but distinct documents. The promissory note is a promise to repay a specific amount over a set period, while the security agreement ensures a lender has a claim over collateral if the borrower defaults. In the context of a Hawaii Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, both documents work together to protect the interests of both the buyer and seller. By understanding these differences, you can better navigate your transactions.

The key difference between a promissory note and a security agreement lies in their purpose. A promissory note is a written promise to repay a specific amount under certain terms. In contrast, a security agreement provides the lender with a legal claim to the assets involved in the event of a default. When selling a vehicle, including a Hawaii Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another combines both elements for secure transactions.

A promissory note may be invalid if it is not properly executed, contains significant errors, or includes conditions that violate the law. Additionally, lack of consideration—such as one party not receiving anything in return—can render it invalid. When drafting a Hawaii Promissory Note and Security Agreement with Regard to the Sale of an Automobile, accuracy and lawful terms are critical.

Yes, a promissory note can also serve as a security agreement if it explicitly details the collateral involved. For instance, in the context of a Hawaii Promissory Note and Security Agreement with Regard to the Sale of an Automobile, the vehicle itself could be used as collateral. This dual function can provide additional peace of mind for the lender.

For a promissory note to be enforceable, it must include specific details such as the names of the parties, the amount borrowed, interest rates, and a clear repayment schedule. Moreover, ensuring compliance with local laws enhances the enforceability of a Hawaii Promissory Note and Security Agreement with Regard to the Sale of an Automobile. Clarity and precision in these details matter greatly.

A promissory note may be deemed unenforceable if it lacks essential elements such as signatures or does not specify payment terms. Furthermore, if it fails to comply with Hawaii's legal standards for a Hawaii Promissory Note and Security Agreement with Regard to the Sale of an Automobile, enforcement becomes problematic. Ensuring accuracy is crucial.

Several factors can void a promissory note, including fraud, coercion, or a clear mistake in the document. Additionally, if the terms are illegal or it does not meet state requirements, it may also be void. In the context of a Hawaii Promissory Note and Security Agreement with Regard to the Sale of an Automobile, clarity is essential to avoid issues.

Yes, you can write your own promissory note. However, it is essential that it meets certain legal requirements to be valid. In the context of a Hawaii Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, ensure it includes all parties' names, the amount owed, and repayment terms.