Hawaii Affidavit That There Are No Creditors

Description

How to fill out Affidavit That There Are No Creditors?

Are you facing a circumstance where you need documentation for potential business or personal reasons nearly every day.

There are numerous legal document templates accessible online, but finding ones you can trust isn't easy.

US Legal Forms offers thousands of form templates, such as the Hawaii Affidavit That There Are No Creditors, which are designed to meet federal and state standards.

Once you have the correct form, click on Buy now.

Select the pricing plan you want, fill in the required information to set up your account, and complete the purchase using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Hawaii Affidavit That There Are No Creditors template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct area/state.

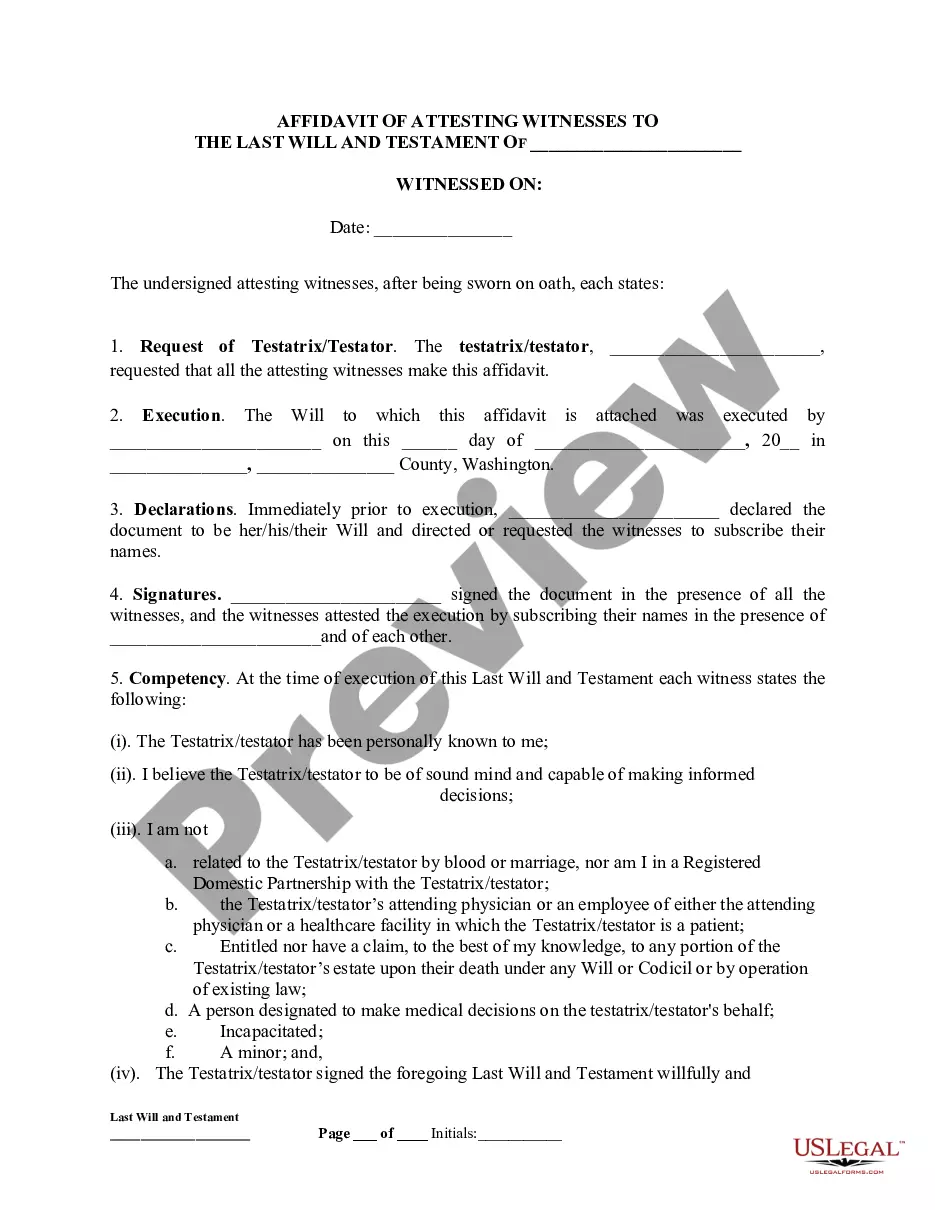

- Utilize the Review option to examine the document.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you're seeking, use the Search field to find the form that matches your needs and requirements.

Form popularity

FAQ

A quitclaim deed in Hawaii allows a property owner to transfer their interest in a property to another person without making any warranties about the title. This means that the recipient receives whatever interest the grantor has, if any, and must rely on their own research regarding any liens or claims. If you're involved in a property transaction, consider using a Hawaii Affidavit That There Are No Creditors to provide additional protection and assurance during the process. This document helps establish that there are no existing claims against the property, giving peace of mind.

You do not necessarily need a lawyer to file a small estate affidavit, but consulting one can provide clarity. If your case is straightforward and you follow the appropriate guidelines, you can complete the filing yourself. However, assistance may be beneficial for a Hawaii Affidavit That There Are No Creditors, ensuring everything is filled out correctly.

To fill out a lack of probate affidavit, you must confirm that the deceased’s estate does not require probate based on state laws. Gather evidence of the absence of debts and specify the relationship with the deceased, supporting your claim. Utilizing a Hawaii Affidavit That There Are No Creditors may assist in this process by simplifying documentation requirements.

To fill out an affidavit form, begin by stating your name, address, and the purpose of the affidavit clearly. Provide any necessary details relevant to your claim, being specific and truthful to maintain credibility. Always conclude by signing the affidavit in front of a notary public, which may be vital when you need a Hawaii Affidavit That There Are No Creditors.

Filling out an affidavit of inheritance involves outlining the relationship between the heirs and the deceased. Collect required documents, including the death certificate and proof of your relationship to the decedent. This affidavit serves to assert inheritance rights while simplifying the ownership transfer process, especially when filing a Hawaii Affidavit That There Are No Creditors.

To fill out a small estate affidavit, gather information about the deceased, including their assets and liabilities. Use the official form specific to your state, ensuring to include details such as the date of death and the names of the heirs. After you've filled out the affidavit, have it signed and notarized, which may be necessary to validate a Hawaii Affidavit That There Are No Creditors.

A statement of no probate is a document that certifies there is no need for formal probate proceedings for a deceased person's estate. This is often used when the estate consists only of personal property or has minimal value. Filing a Hawaii Affidavit That There Are No Creditors can help streamline the process and avoid unnecessary legal expenses.

To fill out an affidavit of claim, start by gathering necessary documents, such as the original claim and supporting evidence. Clearly state your claim on the form, detailing information about the property or assets involved. Finally, ensure that you sign the document in front of a notary public. Remember, a Hawaii Affidavit That There Are No Creditors is often essential in these claims.

To get a letter of testamentary in Hawaii, you must submit an application to the local probate court. This involves providing the original will, proof of death, and any necessary identification. If you need assistance throughout the process, platforms like US Legal Forms offer resources and forms that can make obtaining this letter smoother and more straightforward.

A letter of testamentary remains valid until the estate is fully resolved, which can vary in duration based on the complexity of the estate. Typically, this letter remains in effect until the court closes the probate case. Therefore, it is crucial to manage the estate effectively during this period to ensure compliance with all legal obligations.