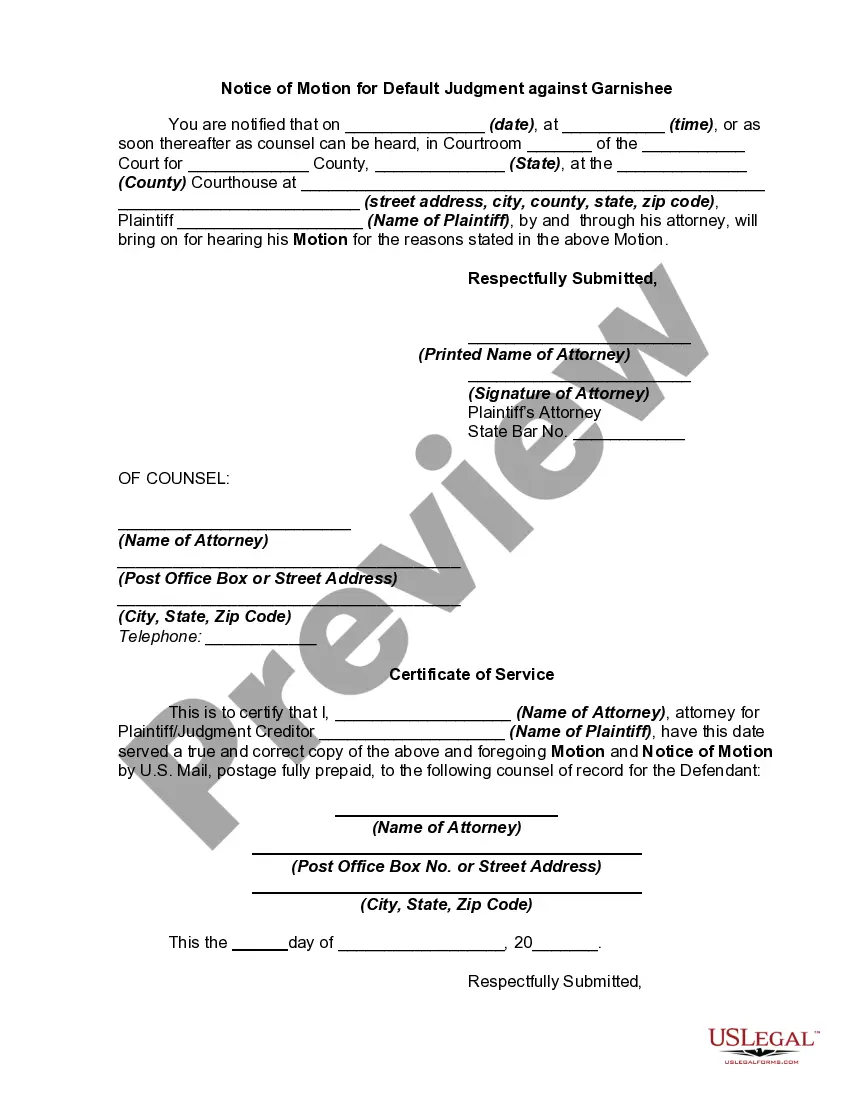

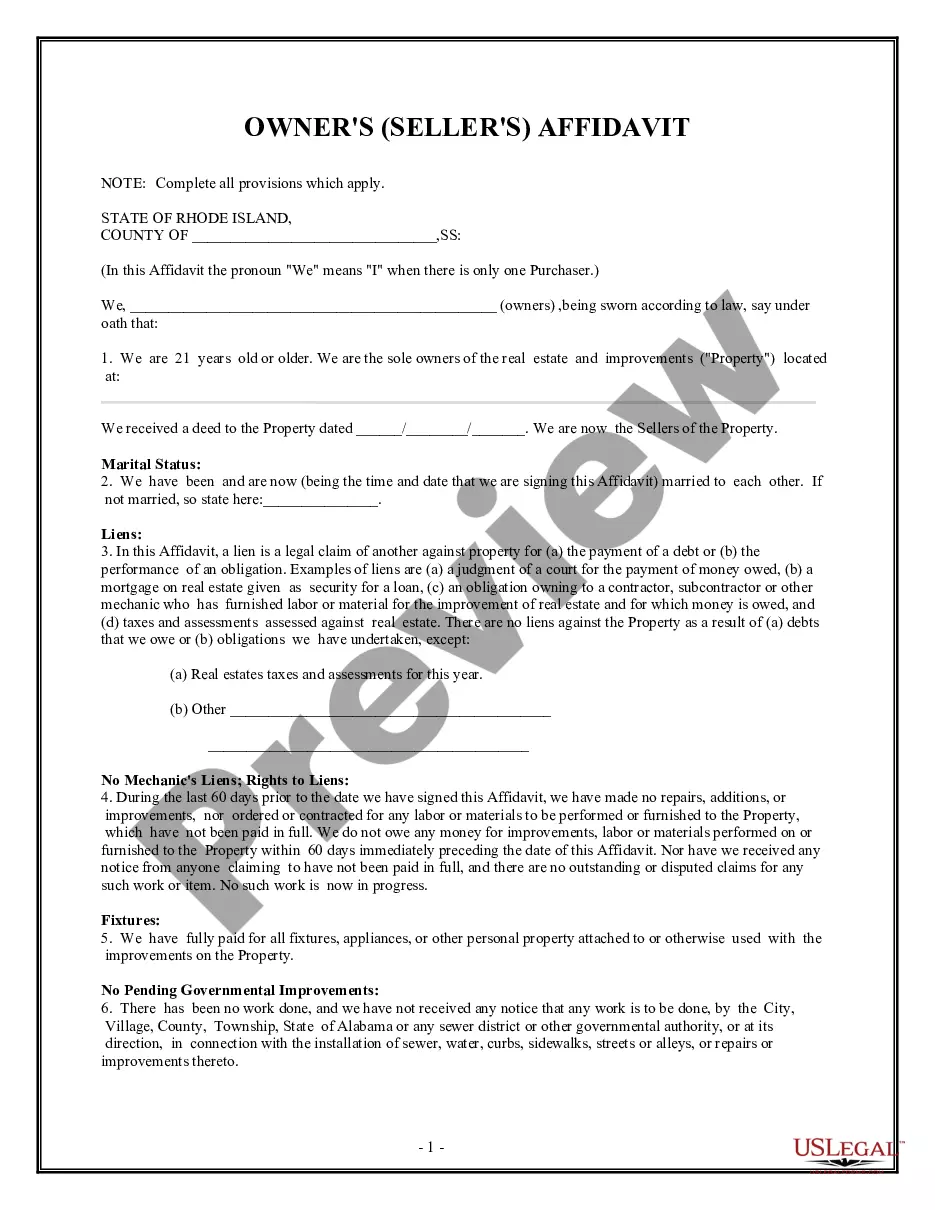

Are you within a situation that you will need documents for either organization or person uses nearly every day time? There are a variety of legitimate papers web templates available on the net, but getting ones you can depend on is not effortless. US Legal Forms gives 1000s of form web templates, just like the Hawaii Motion for Default Judgment against Garnishee, that are composed to satisfy state and federal specifications.

If you are currently knowledgeable about US Legal Forms site and also have an account, merely log in. Next, it is possible to download the Hawaii Motion for Default Judgment against Garnishee format.

If you do not offer an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Discover the form you require and ensure it is to the correct town/region.

- Make use of the Review button to examine the shape.

- Browse the explanation to actually have selected the right form.

- When the form is not what you are seeking, take advantage of the Lookup field to discover the form that meets your requirements and specifications.

- When you get the correct form, simply click Buy now.

- Choose the rates program you need, fill in the necessary info to generate your money, and pay for an order utilizing your PayPal or credit card.

- Choose a hassle-free document formatting and download your version.

Locate all of the papers web templates you might have bought in the My Forms menus. You can get a more version of Hawaii Motion for Default Judgment against Garnishee whenever, if possible. Just click the essential form to download or printing the papers format.

Use US Legal Forms, probably the most comprehensive assortment of legitimate forms, to save lots of efforts and stay away from mistakes. The assistance gives expertly manufactured legitimate papers web templates which you can use for an array of uses. Make an account on US Legal Forms and commence creating your daily life a little easier.