Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Hawaii Demand for Accounting from a Fiduciary

Description

How to fill out Demand For Accounting From A Fiduciary?

You might spend numerous hours online trying to locate the legal document template that complies with the state and federal requirements you desire.

US Legal Forms offers an extensive collection of legal templates that can be reviewed by experts.

You can easily download or print the Hawaii Demand for Accounting from a Fiduciary from their service.

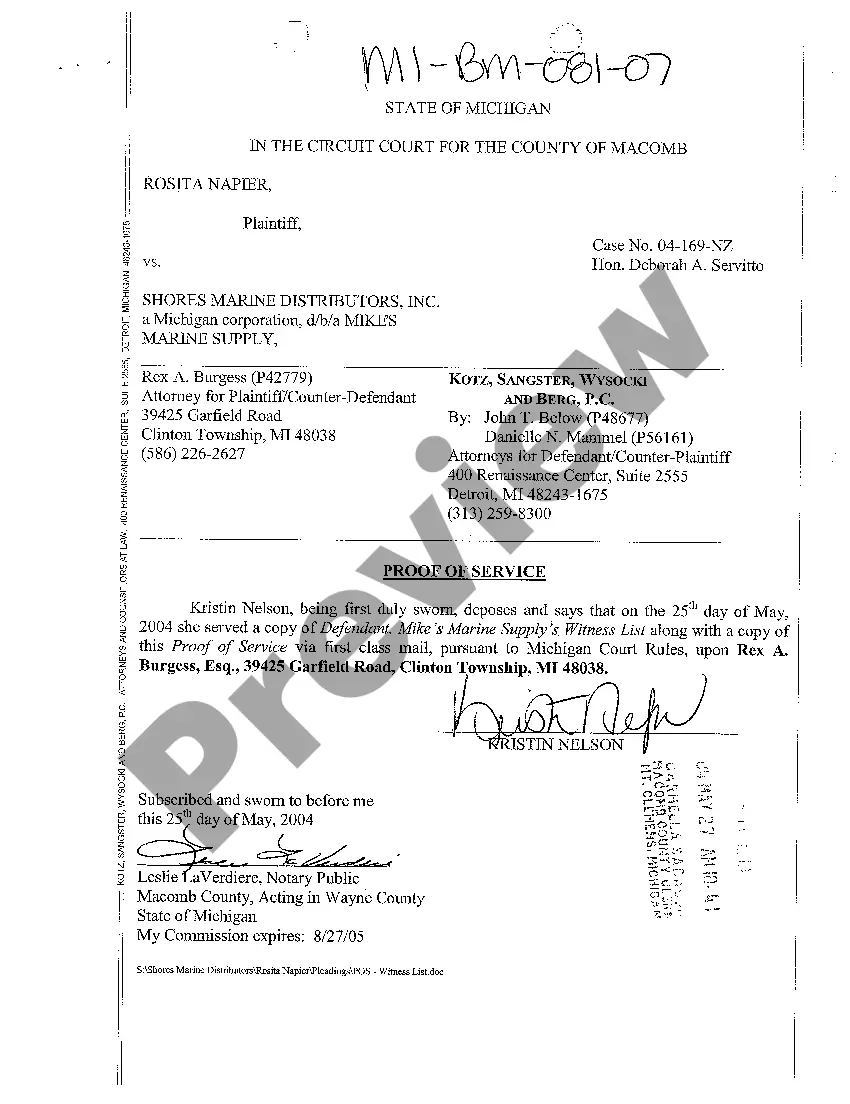

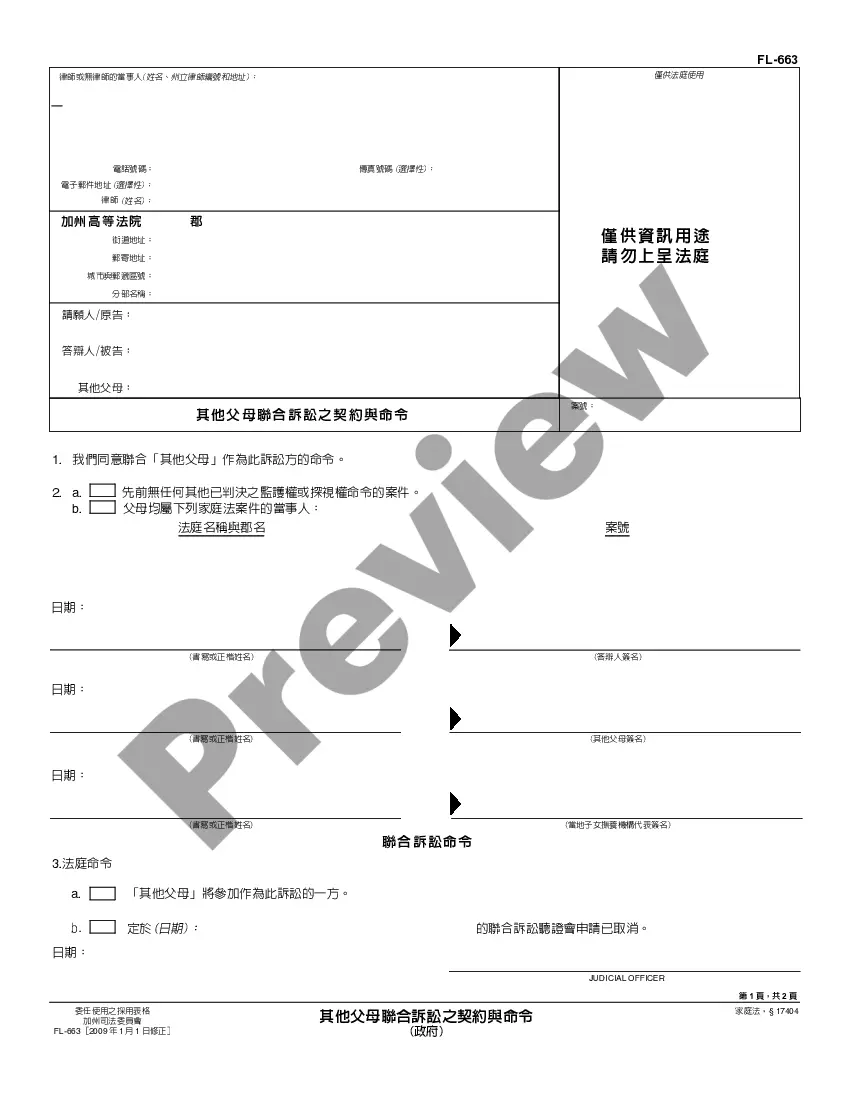

First, ensure that you have selected the correct document template for the county/town of your choice. Review the form description to verify that you have selected the appropriate form. If available, utilize the Preview option to examine the document template as well.

- If you possess a US Legal Forms account, you can sign in and click on the Download button.

- Next, you can fill out, edit, print, or sign the Hawaii Demand for Accounting from a Fiduciary.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click on the corresponding option.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

Form popularity

FAQ

Generally, any beneficiary or interested party can demand an accounting from a fiduciary. This includes individuals with a vested interest in the trust or estate's management. It's important for beneficiaries to understand their rights to ensure that fiduciaries adhere to their responsibilities. The Hawaii demand for accounting from a fiduciary allows individuals to seek transparency and protect their interests.

Rule 126 deals with the requirements for notices and deadlines in probate filings in Hawaii. This rule helps ensure that all interested parties receive timely information regarding estate management or trust distributions. It plays a crucial role in maintaining transparency and communication. Familiarity with the rules under the Hawaii demand for accounting from a fiduciary is essential for beneficiaries seeking accountability.

Rule 42 in Hawaii probate addresses the rules surrounding the accounting and distribution of trust assets. Specifically, it outlines how overseers of estates should manage financial records and report to beneficiaries. Understanding this rule can significantly impact your rights as a beneficiary, especially when navigating the complexities of trust management. The Hawaii demand for accounting from a fiduciary is governed by such regulations.

Requesting an accounting involves submitting a formal request to the fiduciary overseeing the trust. Be specific in your request and include a deadline for the fiduciary to respond. If there's no response or the information provided is inadequate, you may need to take further action, possibly seeking legal assistance. It is critical, under the Hawaii demand for accounting from a fiduciary, to ensure all parties remain accountable.

Compelling an accounting from a reluctant trustee can be challenging, but it is possible. You can start by formally requesting the accounting in writing, clearly outlining your concerns. If the trustee continues to resist, you may need to seek legal counsel to explore options such as filing a petition in court. Utilizing resources like USLegalForms can help guide you through this process, ensuring your rights under the Hawaii demand for accounting from a fiduciary are upheld.

Yes, as a beneficiary, you have the right to demand an accounting from the fiduciary. This right ensures that you receive accurate information about the trust's financial activities and management. If the fiduciary fails to comply with your request, you may consider legal options. The Hawaii demand for accounting from a fiduciary provides important protections for beneficiaries.

To request trust accounting, you should first communicate directly with the fiduciary managing the trust. A written request is often most effective, clearly stating your rights as a beneficiary. If the fiduciary does not respond or provides insufficient information, you may need to enforce your rights through legal actions. The Hawaii demand for accounting from a fiduciary emphasizes the importance of transparency and accountability.

Yes, there is a significant demand for accounting in cases involving fiduciaries in Hawaii. Beneficiaries often seek clear and transparent financial reports regarding the management of trust assets. When fiduciaries fail to provide adequate accounting, it could lead to disputes and legal actions. Consequently, understanding the Hawaii demand for accounting from a fiduciary becomes essential for all parties involved.

To calculate accounting income for a trust, start by identifying all income generated during the tax year, which includes interest and dividends. Then, subtract any expenses directly related to producing that income. Understanding how to efficiently manage this calculation is vital for fulfilling your Hawaii Demand for Accounting from a Fiduciary, and resources like UsLegalForms can assist in clarifying these steps.

To fill out a 1041 estate tax return, gather all necessary financial information about the estate, including income generated and deductions. Follow the IRS guidelines closely, ensuring you accurately report income, calculate deductions, and determine distributions. If you encounter challenges meeting your Hawaii Demand for Accounting from a Fiduciary, UsLegalForms offers templates and resources that simplify the process.