Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Hawaii General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping

Description

How to fill out General Consultant Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping?

If you wish to obtain, download, or print legal document templates, utilize US Legal Forms, the most extensive array of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search feature to find the documentation you require.

Various templates for business and personal purposes are grouped by categories and states, or keywords.

Step 4. Once you have identified the form you need, click the Purchase now button. Select the pricing plan you prefer and provide your details to create an account.

Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to acquire the Hawaii General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping within just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to access the Hawaii General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping.

- You can also access forms you previously downloaded in the My documents tab in your account.

- If you are using US Legal Forms for the first time, adhere to the steps outlined below.

- Step 1. Confirm you have selected the form for the correct city/state.

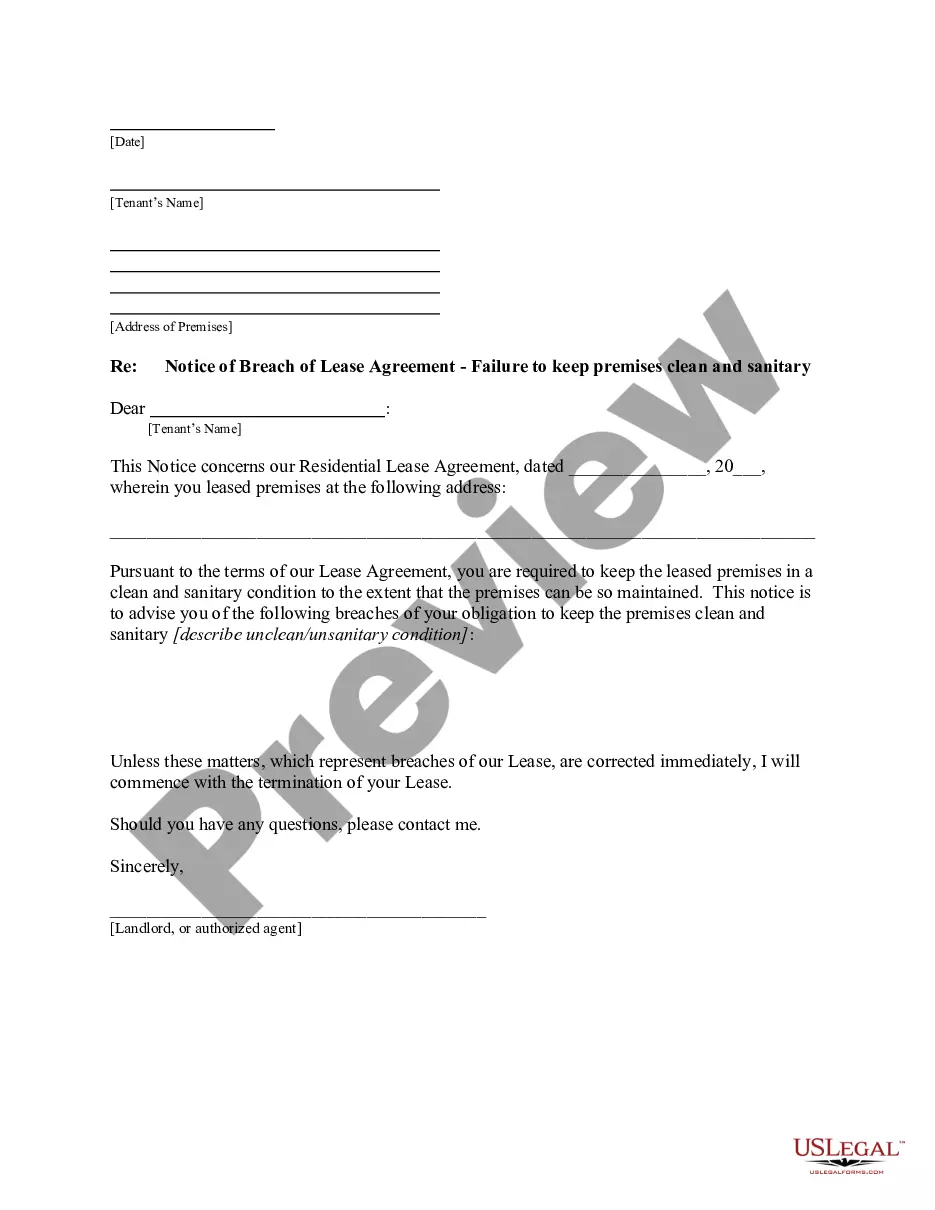

- Step 2. Use the Preview option to review the form’s contents. Don’t forget to read the summary.

- Step 3. If you are not content with the form, utilize the Search bar at the top of the page to locate alternative versions of the legal form.

Form popularity

FAQ

The agreement between a client and a CPA is designed to formalize the terms of service, including the nature of the work, fees, and the duration of the engagement. This document minimizes misunderstandings and sets a professional tone for the relationship. The Hawaii General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping is an excellent tool for establishing a clear framework and commitment.

The agreement between a client and a service provider is a contract that defines the services offered, payment terms, and any specific obligations. This contract is crucial in setting clear expectations for both parties. The Hawaii General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can serve as a reliable template for ensuring everything is well-documented.

A CPA agreement is a formal document that outlines the mutual responsibilities and expectations of a CPA and their client. This agreement ensures clarity on the services provided, fees, and deadlines. Using the Hawaii General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can help clarify each party's commitment and facilitate a productive partnership.

An agreement between a Certified Public Accountant (CPA) and her client is generally referred to as a client engagement letter. This letter lays out the terms of service and expectations from both sides. Implementing a Hawaii General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can serve as a comprehensive framework for this important relationship.

A contract for the provision of accounting services outlines the expectations and responsibilities between you and your client. This document typically details the scope of work, fees, and the timeline for services. Utilizing the Hawaii General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can help both parties remain aligned on commitments and deliverables.

By including consulting and advisory services in your accounting practice, you enhance your value to clients. You can provide tailored advice on strategic financial decisions and compliance, strengthening your clients' trust in your expertise. Additionally, the Hawaii General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can establish clear guidelines, ensuring you meet client needs effectively.

Client privilege refers to the legal protection that ensures communications between a client and their accountant are confidential. This privilege encourages open and honest discussions about sensitive financial matters. With a Hawaii General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, clients can be assured that their conversations with accountants remain private and are treated with the utmost care.

Accountants provide a variety of services, including tax preparation, financial planning, and auditing. They help clients make informed financial decisions and ensure regulatory compliance. Under a Hawaii General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, accountants support clients in navigating complex tax issues and maintaining proper record keeping.

The fiduciary duty of an accountant is to act in the best interests of their client. This includes maintaining confidentiality, providing honest and transparent advice, and adhering to ethical standards. By signing a Hawaii General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, clients can expect their accountants to uphold these duties faithfully.

In Hawaii, Certified Public Accountants (CPAs) must complete Continuing Professional Education (CPE) to maintain their licenses. This involves obtaining a minimum number of hours in various subjects, including accounting and tax topics. Adhering to these CPE requirements enhances the quality of service provided under a Hawaii General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, ensuring you receive knowledgeable and competent advice.