An agreement should indemnify the indemnitee against any lawful claim by any other party on account of the lost instrument, and against all costs and expenses by reason of the claim. The agreement should be sufficient in amount to cover the instrument and reasonable expenses connected with a claim against the agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Hawaii Indemnity Against Loss Resulting from Lost or Mislaid Deed

Description

How to fill out Indemnity Against Loss Resulting From Lost Or Mislaid Deed?

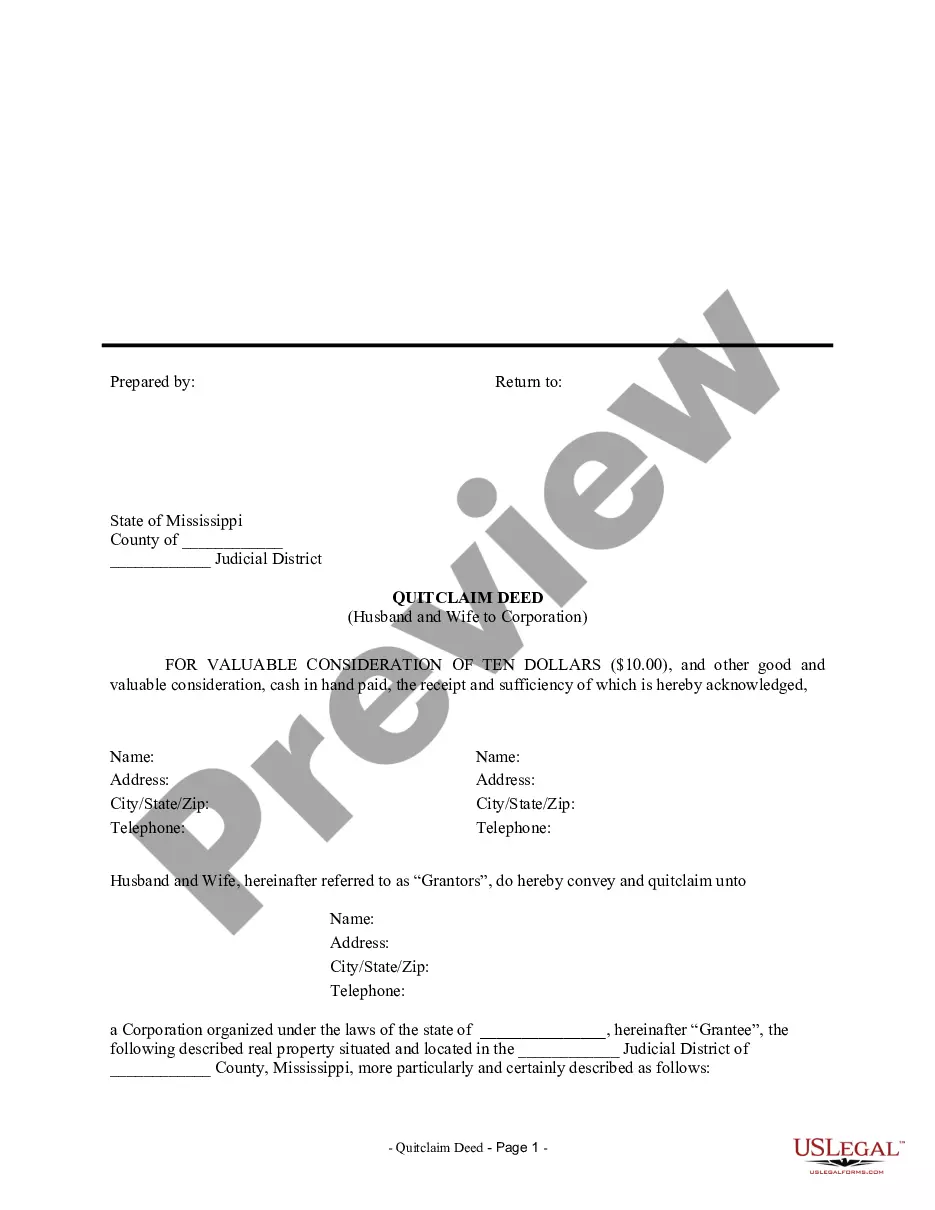

Discovering the right lawful document design could be a battle. Needless to say, there are a variety of web templates available on the net, but how can you discover the lawful develop you require? Take advantage of the US Legal Forms web site. The assistance offers thousands of web templates, like the Hawaii Indemnity Against Loss Resulting from Lost or Mislaid Deed, which can be used for business and private demands. All of the varieties are checked out by experts and meet federal and state specifications.

If you are already signed up, log in in your account and click the Down load switch to have the Hawaii Indemnity Against Loss Resulting from Lost or Mislaid Deed. Use your account to look throughout the lawful varieties you have acquired formerly. Visit the My Forms tab of your account and acquire another copy of your document you require.

If you are a whole new consumer of US Legal Forms, listed below are simple directions for you to adhere to:

- First, ensure you have selected the appropriate develop for your city/state. You may look over the form using the Preview switch and look at the form outline to make certain this is basically the right one for you.

- In case the develop does not meet your expectations, make use of the Seach discipline to obtain the proper develop.

- Once you are sure that the form is acceptable, click on the Get now switch to have the develop.

- Pick the rates strategy you need and enter in the essential information. Make your account and buy an order with your PayPal account or Visa or Mastercard.

- Pick the document format and obtain the lawful document design in your product.

- Comprehensive, change and produce and sign the acquired Hawaii Indemnity Against Loss Resulting from Lost or Mislaid Deed.

US Legal Forms is the most significant local library of lawful varieties that you can discover numerous document web templates. Take advantage of the service to obtain skillfully-created documents that adhere to express specifications.