Hawaii Sale of Goods, General

Description

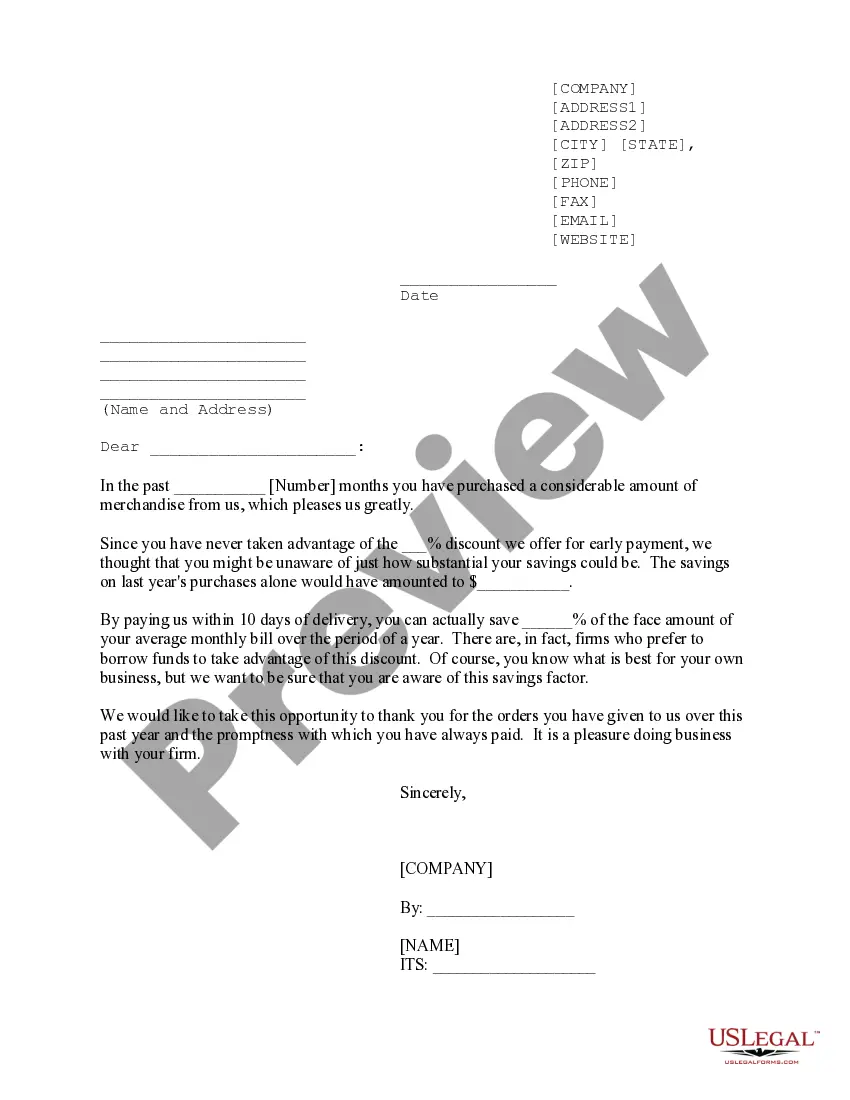

How to fill out Sale Of Goods, General?

US Legal Forms, one of the largest repositories of legal documents in the United States, offers a wide range of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms like the Hawaii Sale of Goods, General within minutes.

If you have an account, Log In to download the Hawaii Sale of Goods, General from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms from the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your system. Edit. Complete, modify, print, and sign the saved Hawaii Sale of Goods, General. Each form you add to your account has no expiration date and belongs to you permanently. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Get access to the Hawaii Sale of Goods, General with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the appropriate form for your city/state.

- Click the Review button to examine the contents of the form.

- Check the form details to ensure you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Buy Now button.

- Then, select the pricing plan you prefer and provide your information to create an account.

Form popularity

FAQ

If you need a copy of your General Excise (GE) license in Hawaii, contact the Department of Taxation either online or by phone. You may need to provide your license number and some personal identification. A copy of your GE license is necessary for any business dealings related to Hawaii Sale of Goods, General, helping you stay organized and compliant in your sales operations.

To acquire a General Excise Identification (GEID) number in Hawaii, you must apply through the Department of Taxation. This process usually involves completing an application form, which requests essential information about your business. A GEID number is crucial for all transactions tied to Hawaii Sale of Goods, General, as it helps maintain accurate sales records and tax obligations.

To obtain a General Excise (GE) license in Hawaii, you need to apply through the Department of Taxation. Complete the application form, provide necessary documentation about your business, and submit the application online or at a local office. Once approved, your GE license will enable you to effectively engage in transactions related to Hawaii Sale of Goods, General, ensuring compliance with state regulations.

You can request a copy of your Hawaii General Excise (GE) license through the Hawaii Department of Taxation. Ensure that you have your license number handy, along with identification documents. This process is straightforward, allowing you to have an official record of your business activities in line with Hawaii Sale of Goods, General. Having your license will help streamline your sales transactions.

The G-45 form is designed for regular reporting of general excise tax on a periodic basis, usually filed quarterly. In contrast, the G-49 is a final return, filed after business activities cease or if a business is closing down. Both forms are essential for compliance in the context of the Hawaii Sale of Goods, General, but they serve different purposes. It’s important for businesses to understand when to file each form.

The G-45 tax form in Hawaii is used for the periodic reporting of general excise tax, typically submitted quarterly. This form allows businesses to report the sales activities and taxes collected during a specific period. Understanding the use of the G-45 is important for businesses involved in the Hawaii Sale of Goods, General, as it contributes to proper tax reporting. Filing this form on time can prevent complications with tax agencies.

A GE tax license in Hawaii is necessary for any business that engages in selling goods or services. This license allows businesses to collect and report general excise tax to the state. Obtaining a GE tax license ensures compliance with Hawaii Sale of Goods, General regulations, and helps avoid potential penalties. It's a crucial step for any legitimate business operation in the state.

In Hawaii, the general excise (GE) tax rate is generally 4% on most sales of goods and services. However, certain counties may impose an additional surcharge, raising the total rate to as high as 4.5%. Understanding these tax rates is vital for any business involved in the Hawaii Sale of Goods, General. It helps companies calculate their tax obligations accurately.

The Hawaii tax G-49 form is a final return for businesses that have been engaged in selling goods or services in Hawaii. This form is essential for reporting general excise tax collected from sales during the tax year. By filing the G-49, businesses ensure compliance with state regulations regarding the Hawaii Sale of Goods, General. It's crucial for maintaining good standing with tax authorities.

The General Excise (GE) tax in Hawaii functions differently from traditional sales tax found in other states. The GE tax applies to all business activities, including the sale of goods, general services, and rental of properties. Unlike sales tax, which is only charged to customers, the GE tax is assessed on the business's gross income. Understanding these differences is crucial for any business engaged in Hawaii Sale of Goods, General, and using US Legal Forms can help clarify the regulations.