Hawaii Account Stated for Construction Work

Description

How to fill out Account Stated For Construction Work?

Are you currently in a location where you require documents for possibly business or personal purposes nearly every day.

There are numerous legal form templates available online, but locating versions you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Hawaii Account Stated for Construction Work, which can be customized to meet state and federal requirements.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

The service provides well-crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Hawaii Account Stated for Construction Work template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

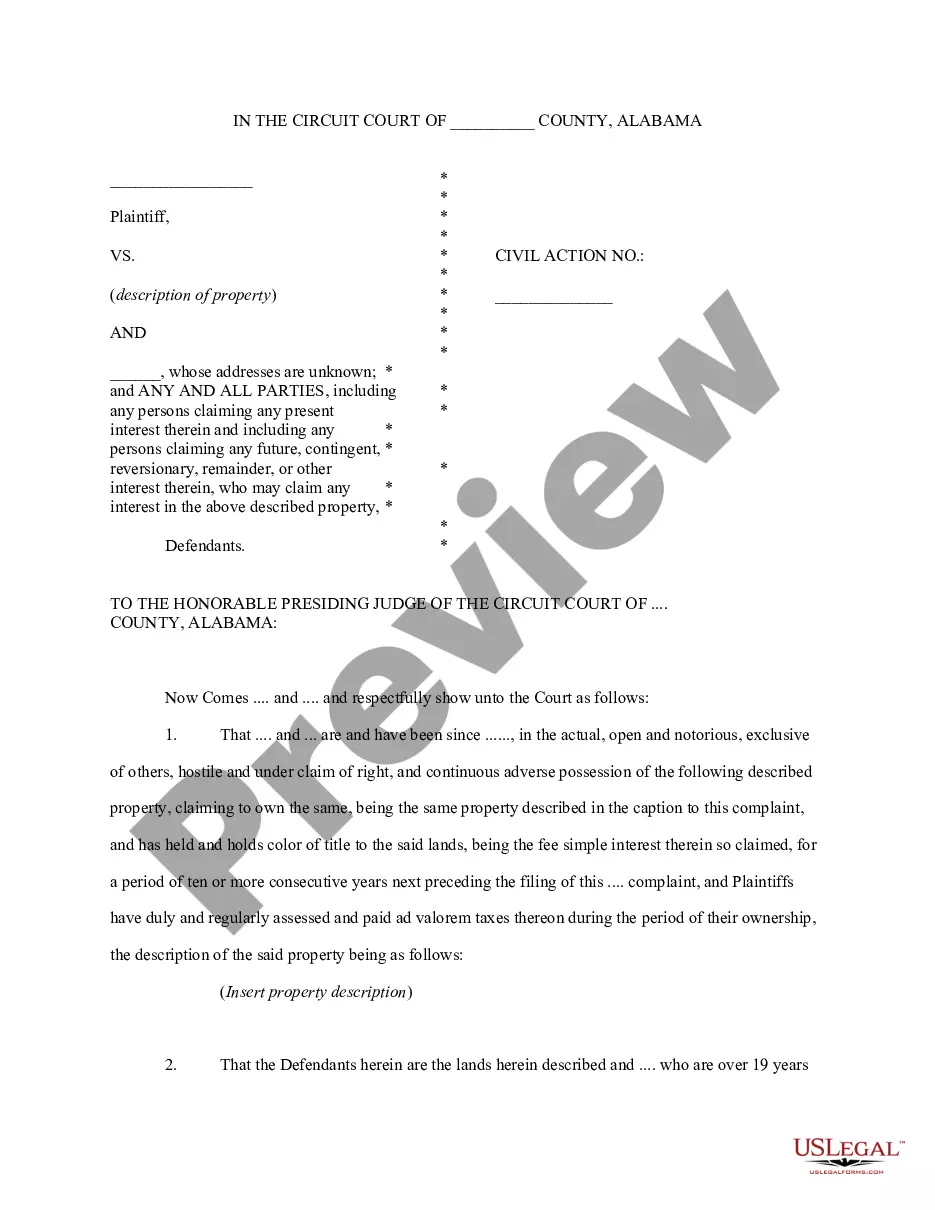

- Utilize the Review button to examine the form.

- Check the details to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs.

- Once you find the correct form, click Get now.

- Select the pricing plan you want, fill out the required information to create your account, and pay for the transaction using your PayPal or credit card.

- Choose a convenient file format and download your version.

- Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Hawaii Account Stated for Construction Work any time, if necessary. Just click the required form to download or print the document template.

Form popularity

FAQ

Construction contractors are subject to income tax, general excise tax (GET) and use tax. A contractor with employees is also subject to withholding and unemployment tax. This Tax Facts answers basic questions about how these taxes apply to construction contractors.

What is Hawaii's sales tax rate? Hawaii does not have a sales tax; instead, we have the GET, which is assessed on all business activities. The tax rate is 0.15% for Insurance Commission, 0.5% for Wholesaling, Manufacturing, Producing, Wholesale Services, and Use Tax on Imports For Resale, and 4% for all others.

Does Hawaii limit the amount of retainage that can be withheld from a contractor? Retainage may not exceed 5% of funds due. Once the project is 50% complete, retainage must be eliminated if progress is satisfactory (if progress is unsatisfactory, retainage may be continued).

Hawaii courts recognize actions to recover damages for injury to real or personal property, or for bodily injury or wrongful death, arising out of a deficiency or negligence, in the planning, design, construction, supervision and administering of construction, and observation of construction.

Contractors performing retail services must collect sales tax based on the tax rate of the jurisdiction where they perform their services. Wholesale sales: Businesses making wholesale sales do not collect retail sales tax on their charges.

The GET is a privilege tax imposed on business activity in the State of Hawaii. The tax is imposed on the gross income received by the person en- gaging in the business activity. The GET applies to nearly every form of business activity.

Overview. Employers need to withhold Hawaii income taxes on employee wages. Employers then pay the withheld taxes to the State of Hawaii, Department of Taxation (DOTAX). Employees reconcile their withholding taxes paid as part of their Individual Income tax return.

The exemption provided in section 444-2.5, Hawaii Revised Statutes, allows you, as the owner or lessee of your property, to act as your own general contractor even though you do not have a license. You must supervise the construction yourself. You must also hire licensed subcontractors.