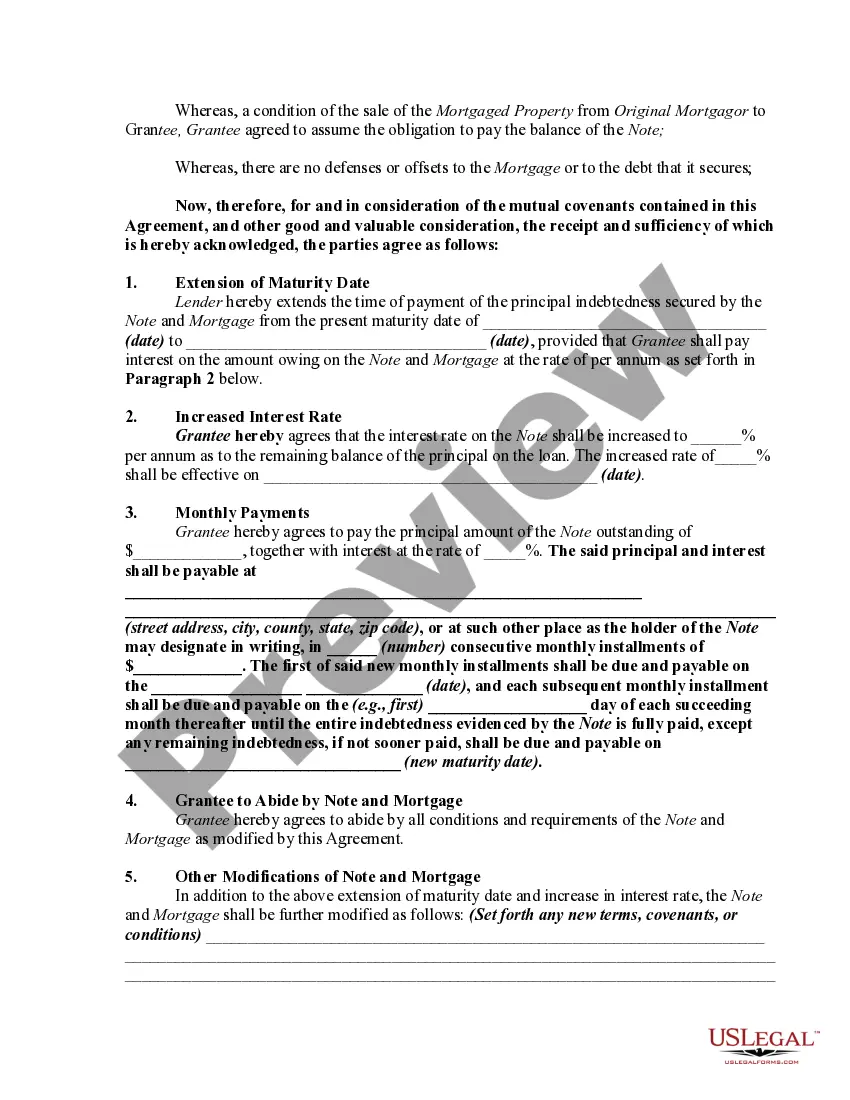

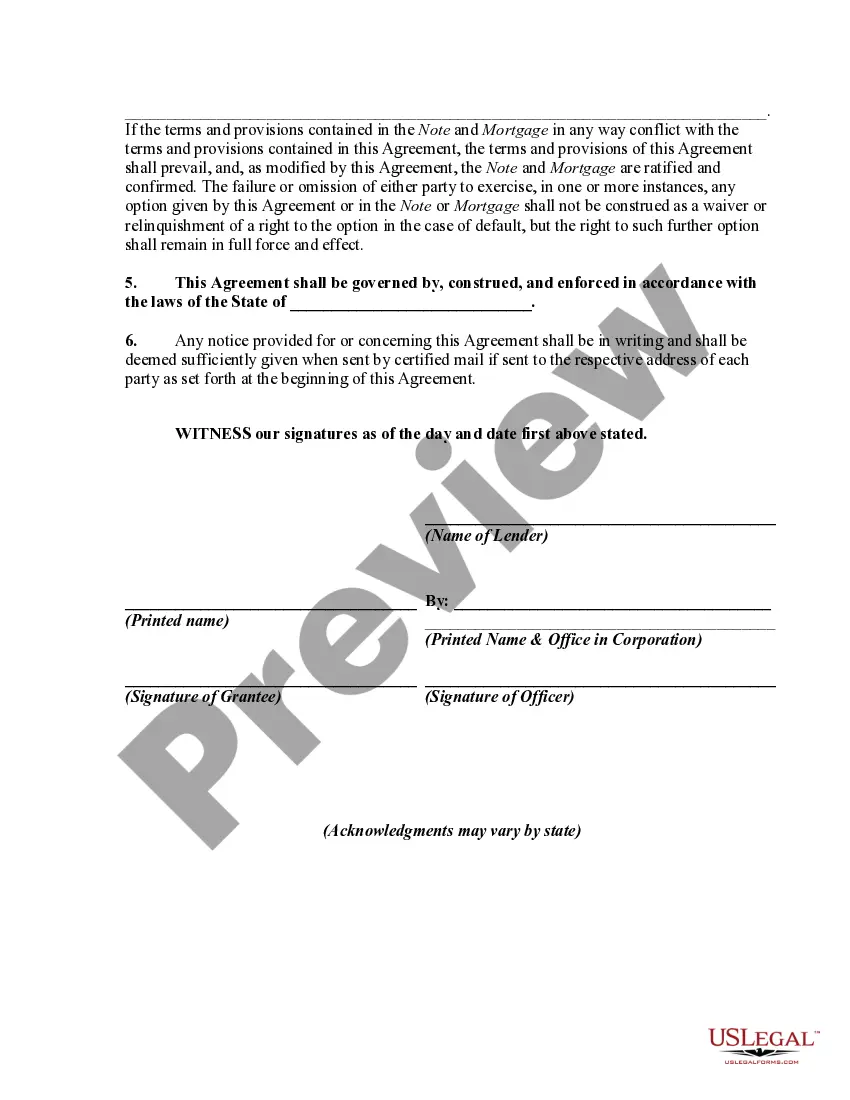

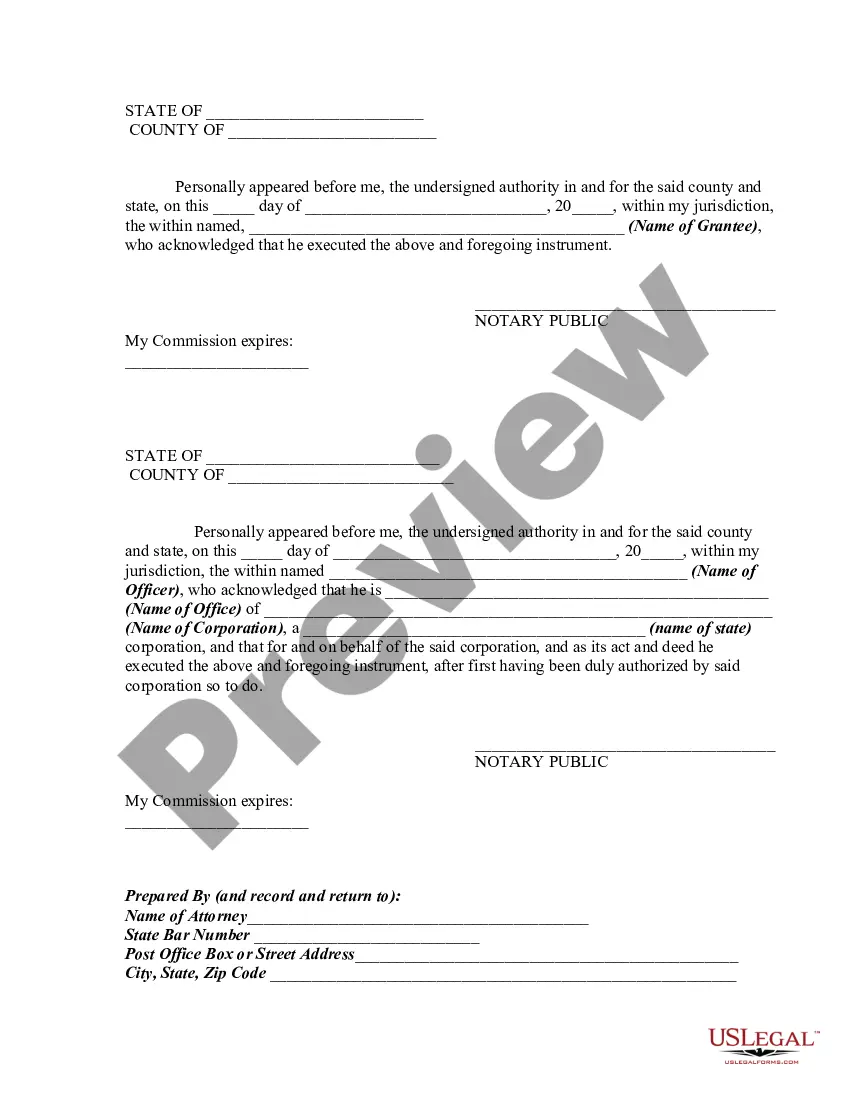

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Hawaii Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest

Description

How to fill out Mortgage Extension Agreement With Assumption Of Debt By New Owner Of Real Property Covered By The Mortgage And Increase Of Interest?

Discovering the right authorized record format can be a battle. Of course, there are plenty of web templates available online, but how would you discover the authorized form you will need? Utilize the US Legal Forms web site. The services gives thousands of web templates, including the Hawaii Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest, which you can use for company and personal requires. Each of the types are inspected by specialists and satisfy state and federal needs.

When you are presently authorized, log in to the profile and click the Download key to have the Hawaii Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest. Use your profile to check throughout the authorized types you might have bought formerly. Check out the My Forms tab of the profile and get another duplicate of the record you will need.

When you are a whole new user of US Legal Forms, allow me to share basic recommendations so that you can stick to:

- Initial, make certain you have selected the proper form for the city/area. You can look over the form utilizing the Review key and read the form information to ensure this is basically the best for you.

- When the form will not satisfy your expectations, use the Seach area to discover the proper form.

- Once you are sure that the form is acceptable, go through the Acquire now key to have the form.

- Opt for the pricing plan you want and type in the required details. Build your profile and buy an order with your PayPal profile or credit card.

- Select the submit structure and acquire the authorized record format to the system.

- Comprehensive, edit and produce and sign the obtained Hawaii Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest.

US Legal Forms is definitely the largest collection of authorized types that you can find different record web templates. Utilize the company to acquire professionally-produced documents that stick to express needs.

Form popularity

FAQ

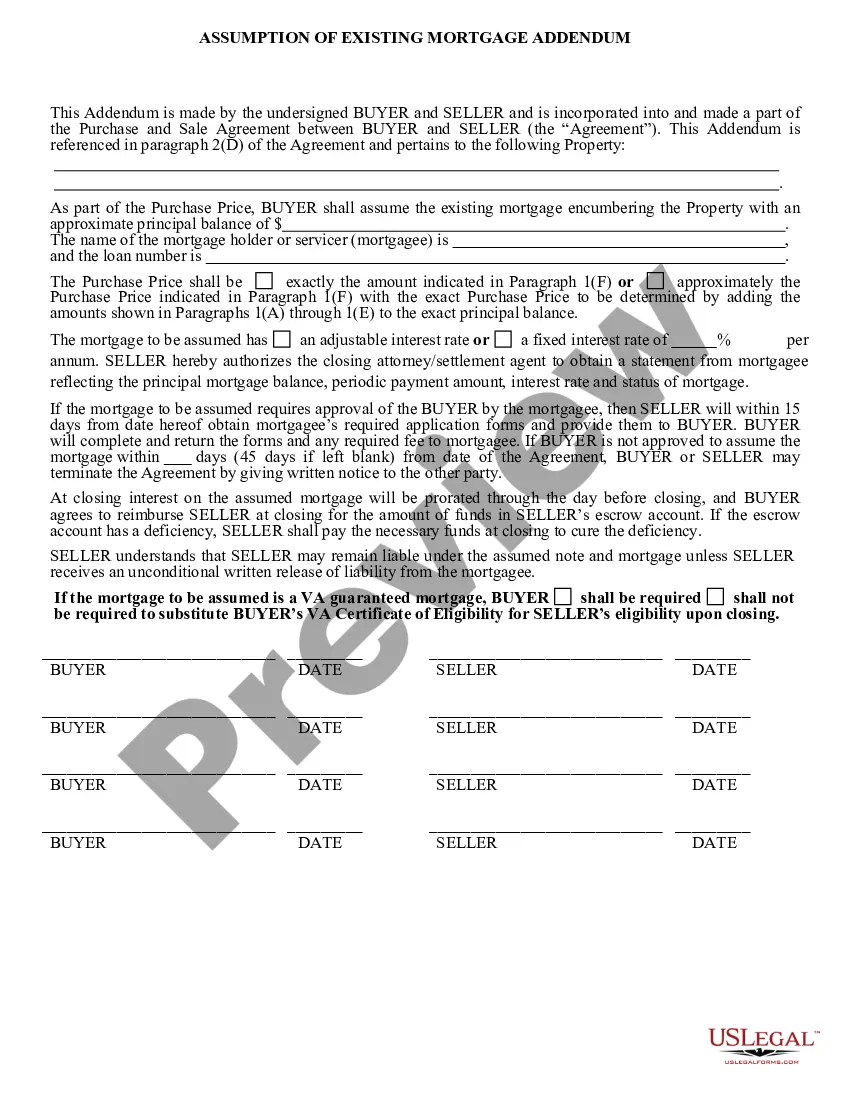

An assumable mortgage is an arrangement in which an outstanding mortgage and its terms can be transferred from the current owner to a buyer. When interest rates rise, an assumable mortgage is attractive to a buyer who takes on an existing loan with a lower rate.

An arrangement where the purchaser, or grantee, obtains title to real property and assumes the seller's liability for payment of an existing note secured by a mortgage that encumbers the real property at the time title is transferred.

An assumed mortgage goes through a similar underwriting process, in which all of your financial documents are reviewed and vetted as a regular mortgage. Often their standards are higher for an assumed mortgage, which means the process can take a little longer.

7. Pay your closing costs and put down cash to cover the seller's equity. Closing costs on assumed government-backed loans are cheaper than the 2% to 6% you'd normally pay to close a loan. Each type of government loan has its own cap on how much you can pay in fees at closing, which keeps costs low.

An important thing to know about VA loans is that they are assumable. This means that a borrower can take over the terms of an existing VA loan, even if they are not eligible to take out a VA loan for themselves. With that, the home buyer will have the same mortgage payment the home seller had.

Calculation. The mortgage assumption value can be calculated as the net present value of the sum of the future monthly payment savings due to the assumable loan rate being lower than the prevailing new loan interest rate.

When you assume a mortgage, the current borrower signs the balance of their loan over to you, and you become responsible for the remaining payments. That means the mortgage will have the same terms the previous homeowner had, including the same interest rate and monthly payments.

In some situations, a buyer may be able to assume the seller's existing mortgage. The buyer takes over the seller's mortgage payments, and the seller receives the value of their equity in the home.