No particular language is necessary for the return of an account as uncollectible so long as the notice or letter used clearly conveys the necessary information.

Hawaii Collection Agency's Return of Claim as Uncollectible

Description

How to fill out Collection Agency's Return Of Claim As Uncollectible?

Are you currently in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding ones you can rely on isn't easy.

US Legal Forms offers thousands of document templates, such as the Hawaii Collection Agency's Return of Claim as Uncollectible, designed to meet federal and state regulations.

You can find all the document templates you have purchased in the My documents section.

You can acquire an additional copy of Hawaii Collection Agency's Return of Claim as Uncollectible at any time, if necessary. Simply select the desired document to download or print the document template.

- If you are familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Hawaii Collection Agency's Return of Claim as Uncollectible template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

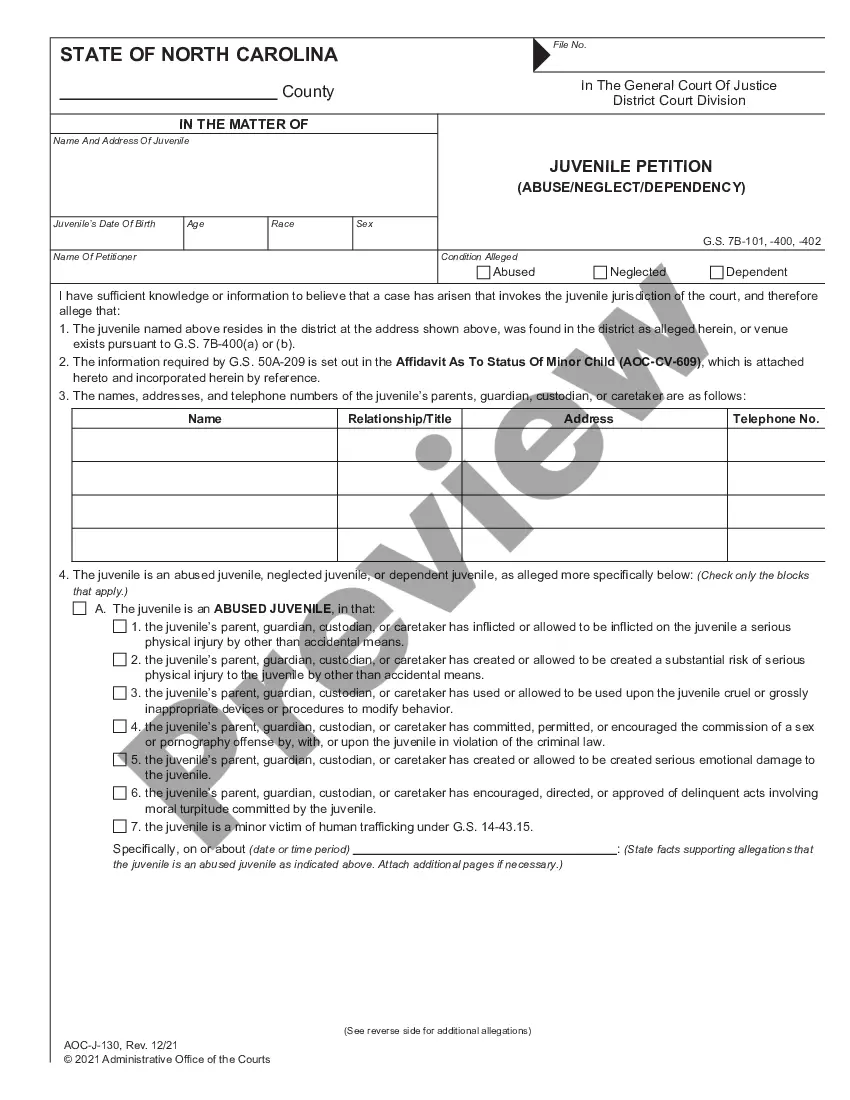

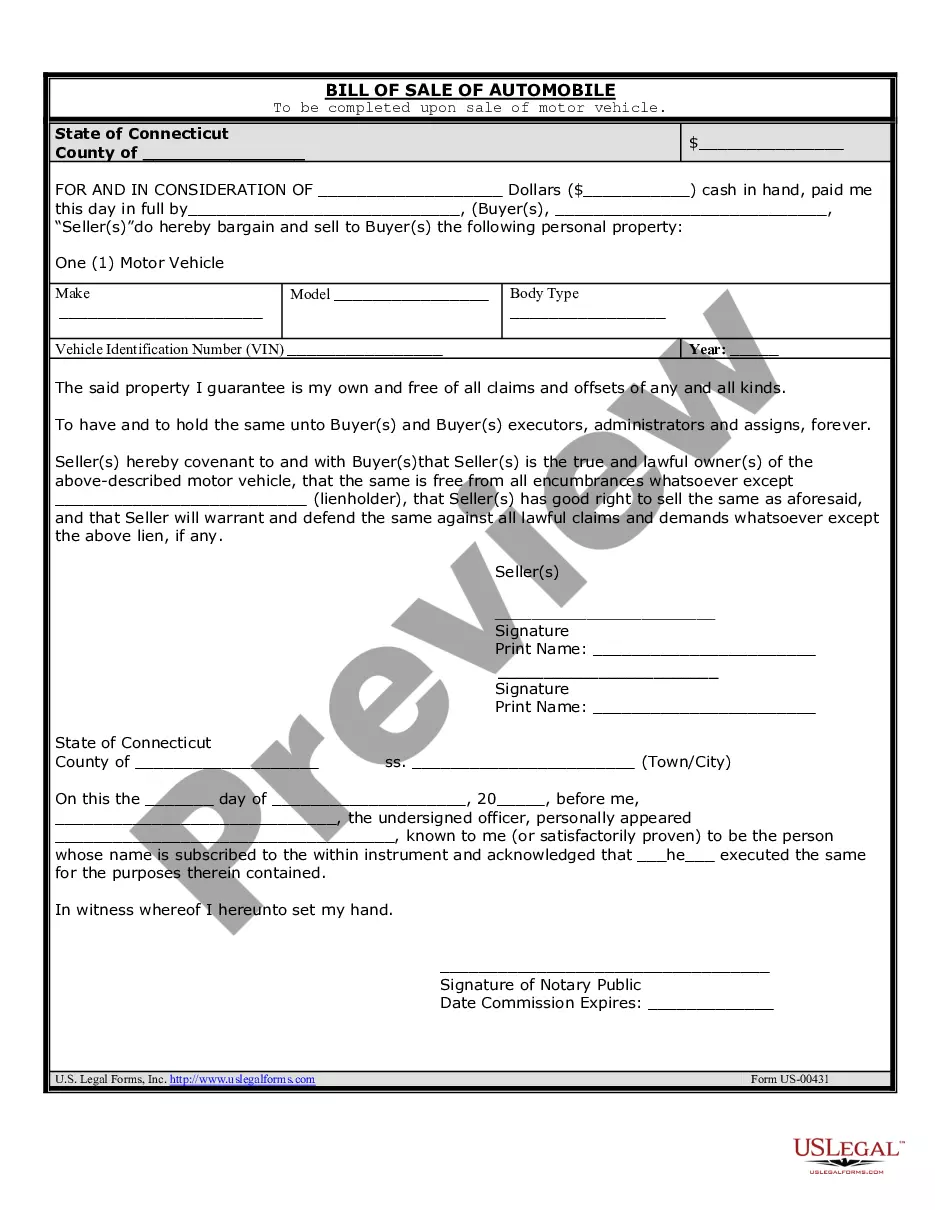

- Find the form you need and make sure it is for your correct city/region.

- Use the Preview button to review the document.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that meets your needs and criteria.

- Once you find the right document, click Buy now.

- Choose the pricing plan you want, fill in the required information to create your account, and complete the order using your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

A goodwill deletion is the only way to remove a legitimate paid collection from a credit report. This strategy involves you writing a letter to your lender. In the letter, you need to explain your circumstances and why you would like the record of the paid collection to be removed from your credit report.

Unpaid credit card debt will drop off an individual's credit report after 7 years, meaning late payments associated with the unpaid debt will no longer affect the person's credit score.

Ask the Creditor to Take the Debt Back Unfortunately, that's rare. It's more likely that the creditor will only take the debt back if you negotiate with the collection agency, establish a repayment plan, and make two or three payments under the plan.

There are 3 ways to remove collections without paying: 1) Write and mail a Goodwill letter asking for forgiveness, 2) study the FCRA and FDCPA and craft dispute letters to challenge the collection, and 3) Have a collections removal expert delete it for you.

The debt will likely fall off of your credit report after seven years. In some states, the statute of limitations could last longer, so make a note of the start date as soon as you can.

In most states, the debt itself does not expire or disappear until you pay it. Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that.

Highlights: Most negative information generally stays on credit reports for 7 years. Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type. Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years.

Accounts uncollectible are receivables, loans, or other debts that have virtually no chance of being paid. An account may become uncollectible for many reasons, including the debtor's bankruptcy, an inability to find the debtor, fraud on the part of the debtor, or lack of proper documentation to prove that debt exists.

Typically, the only way to remove a collection account from your credit reports is by disputing it. But if the collection is legitimate, even if it's paid, it'll likely only be removed once the credit bureaus are required to do so by law.