Hawaii Sample Letter for Withheld Delivery

Description

How to fill out Sample Letter For Withheld Delivery?

Are you in the situation where you regularly need documents for business or distinct reasons almost every workday.

There are numerous legitimate document templates available online, but locating ones you can rely on is challenging.

US Legal Forms provides thousands of template documents, including the Hawaii Sample Letter for Withheld Delivery, which can be customized to adhere to federal and state regulations.

Once you obtain the appropriate document, click Buy now.

Select your preferred pricing plan, enter the necessary information to process your payment, and buy the order using your PayPal or Visa/Mastercard.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Next, you can download the Hawaii Sample Letter for Withheld Delivery template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and verify that it is for the correct city/region.

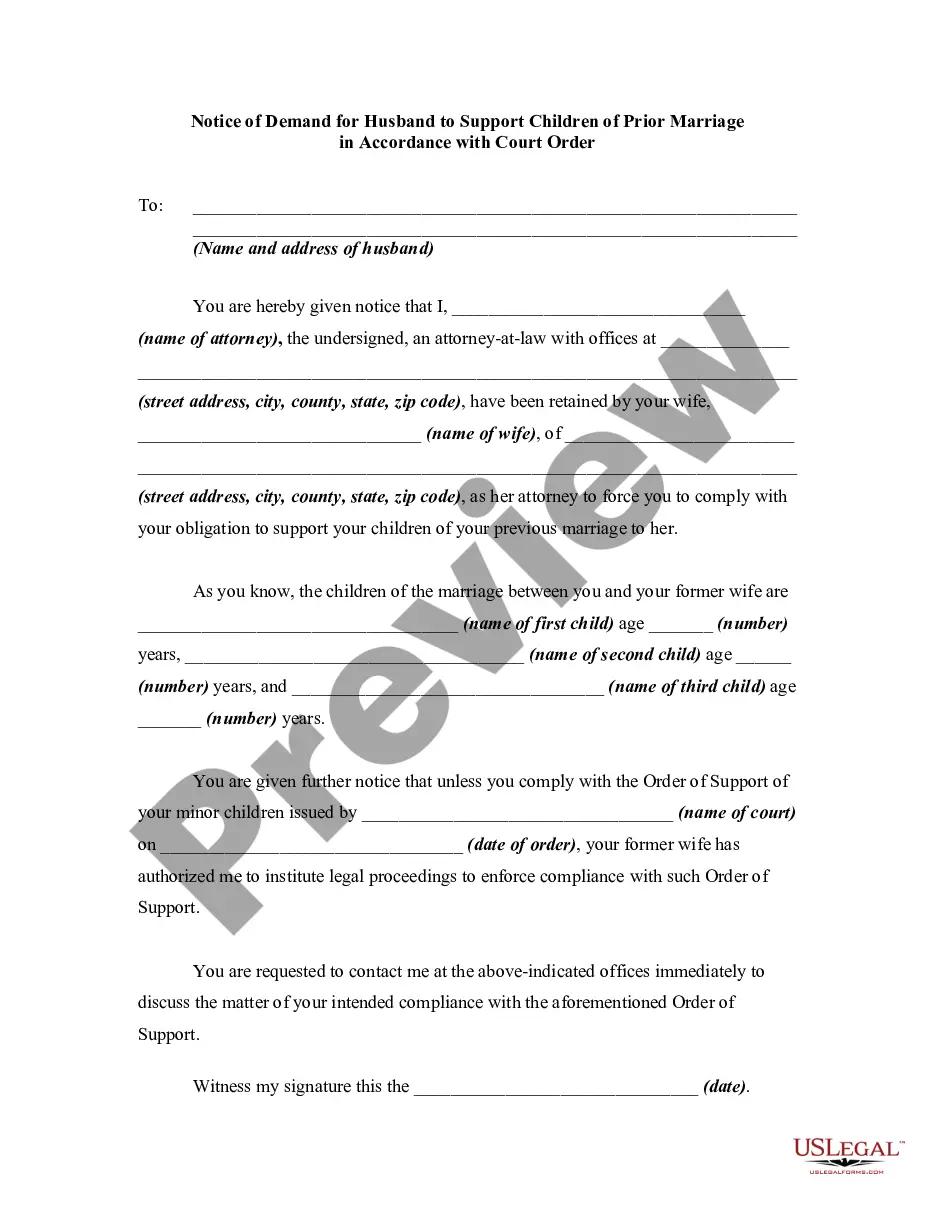

- Use the Preview button to review the form.

- Check the description to ensure you’ve selected the right document.

- If the document is not what you are looking for, utilize the Lookup area to find the document that meets your needs.

Form popularity

FAQ

When deciding on your withholding allowance, consider your overall tax situation, including dependents and any tax credits you may qualify for. The more allowances you claim, the less tax will be withheld from your paycheck. If you're unsure, the Hawaii Sample Letter for Withheld Delivery can offer valuable insights to help you make an informed decision.

To properly fill out the hw 4 form, start by entering your name, Social Security number, and other required personal data. Next, indicate the exemption you are applying for and select how much tax you wish to withhold. For a better understanding of the criteria and best practices, refer to resources like the Hawaii Sample Letter for Withheld Delivery.

To file the G45 form in Hawaii, you need to report your general excise or use tax and detail any associated income for the reporting period. Make sure to follow the instructions provided on the form to prevent errors. Helpful templates such as the Hawaii Sample Letter for Withheld Delivery can provide you with additional context on this process.

Yes, Hawaii does have state withholding for income tax purposes. Employers are required to deduct state tax from employees' paychecks based on the information provided in their W4 forms. For more details about state withholding procedures, check out guides like the Hawaii Sample Letter for Withheld Delivery to ensure you're fully informed.

To fill out your W4 correctly, begin by providing your personal information and then decide on your withholding settings based on your financial situation. It's important to consider any changes in your life, such as marriage or home purchases, as these can affect your allowances. Resources like the Hawaii Sample Letter for Withheld Delivery can help clarify your choices.

The G49 form is used to reconcile your Hawaii withholding tax for the preceding year. It helps the state assess the total amount withheld and any adjustments that may be necessary. If you're uncertain about completing this form, consider using resources such as the Hawaii Sample Letter for Withheld Delivery for comprehensive explanations.

Filling out the hw 4 form involves entering your personal details, the type of exemption you are claiming, and your desired withholding amounts. Take your time to review the instructions provided with the form to avoid common mistakes. For clarity on withholding amounts, a detailed guide like the Hawaii Sample Letter for Withheld Delivery can be beneficial.

To fill out a 4 form in Hawaii, you need to start by entering your personal information, including your name and address. Ensure you provide accurate income details for proper calculations. If needed, you can refer to the Hawaii Sample Letter for Withheld Delivery to guide your understanding of requirements.

Delays in receiving your Hawaii state tax refund can stem from various reasons, including incomplete tax filings or higher processing volumes. The state usually advises patience, but you can check your refund status online. In your communication about refund delays, a Hawaii Sample Letter for Withheld Delivery can serve as a formal way to inquire further about the status of your refund.

To obtain a copy of your Hawaii General Excise (GE) tax license, you can visit the Department of Taxation's website or contact them directly. You may need to provide specific information to verify your identity. If you encounter issues or delays, utilizing a Hawaii Sample Letter for Withheld Delivery could help in requesting any needed documents or clarifications from the department.