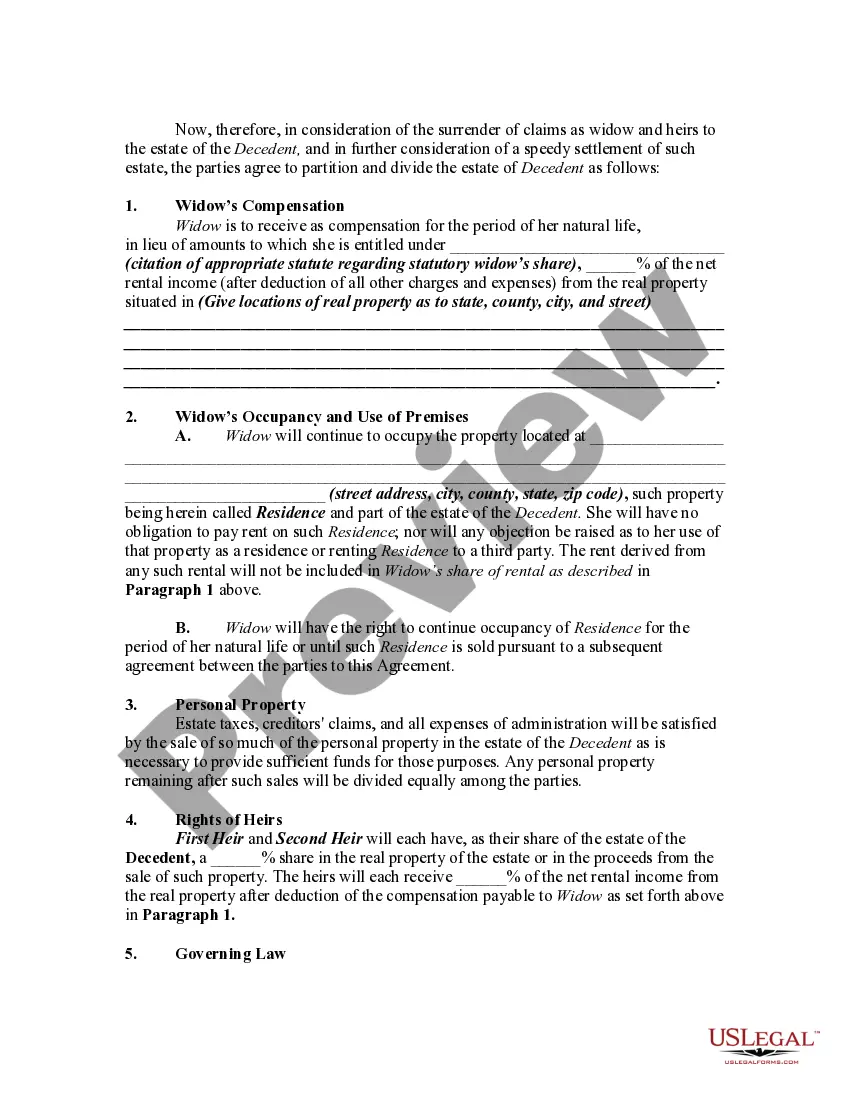

If you want to total, acquire, or print legal record layouts, use US Legal Forms, the most important assortment of legal kinds, which can be found on-line. Use the site`s easy and hassle-free research to discover the files you require. Different layouts for company and individual reasons are categorized by groups and claims, or keywords. Use US Legal Forms to discover the Hawaii Agreement Between Widow and Heirs as to Division of Estate with a number of click throughs.

If you are currently a US Legal Forms client, log in in your accounts and click the Down load option to find the Hawaii Agreement Between Widow and Heirs as to Division of Estate. You can also entry kinds you previously saved in the My Forms tab of the accounts.

If you work with US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for your right city/nation.

- Step 2. Utilize the Review option to check out the form`s content material. Don`t forget to see the explanation.

- Step 3. If you are not satisfied together with the kind, use the Look for field towards the top of the monitor to find other types in the legal kind template.

- Step 4. Upon having found the form you require, go through the Acquire now option. Choose the prices prepare you like and add your references to register for the accounts.

- Step 5. Method the financial transaction. You should use your charge card or PayPal accounts to complete the financial transaction.

- Step 6. Choose the format in the legal kind and acquire it on the gadget.

- Step 7. Comprehensive, edit and print or signal the Hawaii Agreement Between Widow and Heirs as to Division of Estate.

Every legal record template you get is yours permanently. You possess acces to each kind you saved inside your acccount. Click the My Forms area and select a kind to print or acquire yet again.

Compete and acquire, and print the Hawaii Agreement Between Widow and Heirs as to Division of Estate with US Legal Forms. There are many skilled and status-specific kinds you can use for your company or individual needs.