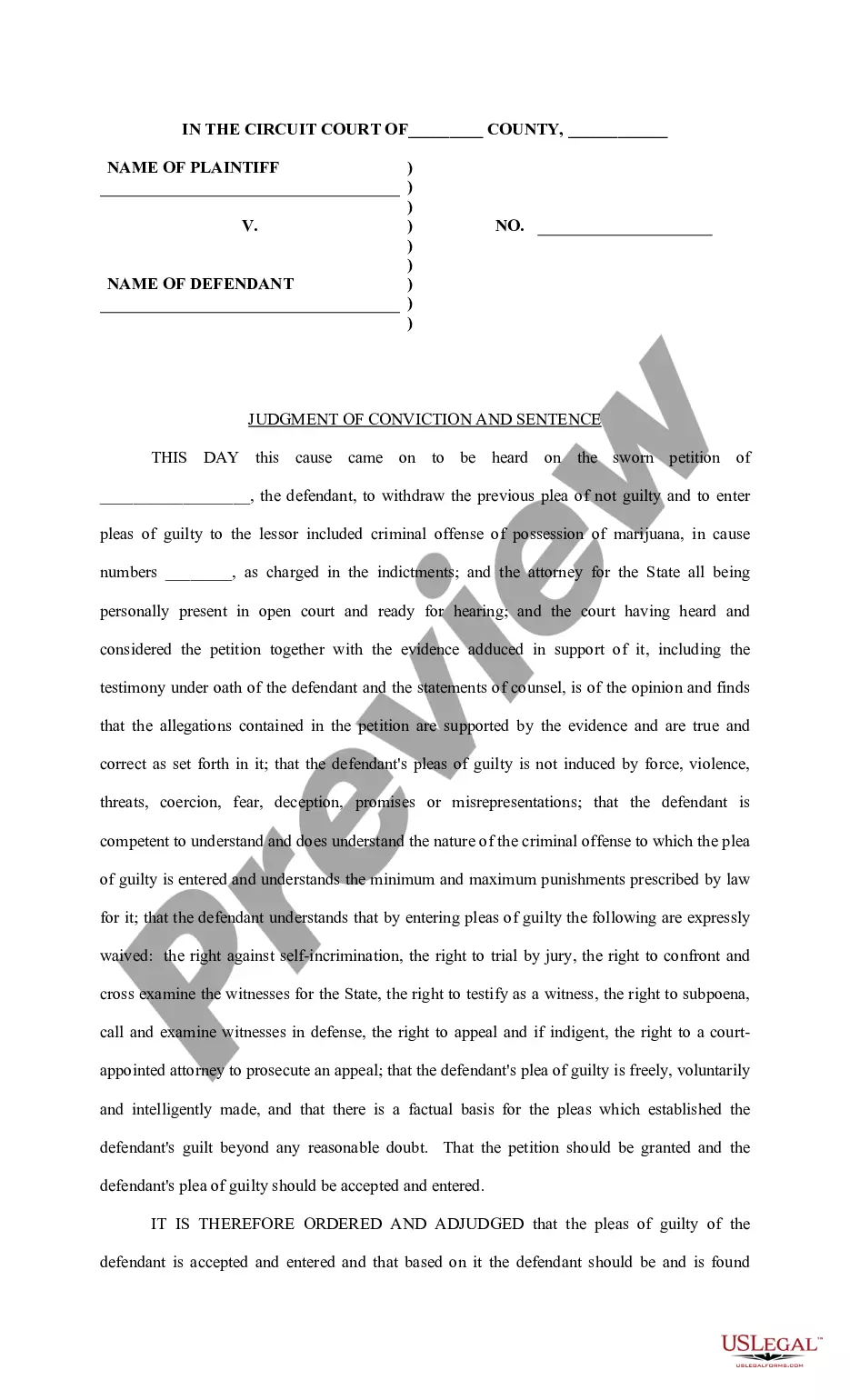

Hawaii Judgment

Description

How to fill out Judgment?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a vast array of legal document samples that you can download or print. By using the website, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms like the Hawaii Judgment in just a few minutes.

If you have a membership, Log In and download the Hawaii Judgment from the US Legal Forms library. The Download button will be visible on every form you view. You have access to all previously saved forms from the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to help you get started: Make sure you have selected the correct form for your city/county. Click the Preview button to review the form's details. Check the form information to ensure you have chosen the right document. If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

Access the Hawaii Judgment with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the purchase.

- Choose the format and download the form to your device.

- Make modifications. Complete, edit, print, and sign the downloaded Hawaii Judgment.

- Each template you added to your account has no expiration date and is yours permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

Form popularity

FAQ

Methods to collect judgments are governed by state and federal laws. The court cannot act as a collection agency; however, the plaintiff, with the help of court forms for collection proceedings, can garnish a defendant's wages and/or bank accounts to collect the judgment.

When and at what rate do judgment debts attract interest? Judgment debts accrue simple interest at a rate of 8% a year until payment, unless rules of court provide otherwise, pursuant to section 17 of the Judgments Act 1838 (JA 1838) and the Judgment Debts (Rate of Interest) Order 1993, SI 1993/564.

Rule 55 - Default (a) Entry. When a party against whom a judgment for affirmative relief is sought has failed to plead or otherwise defend as provided by these rules and that fact is made to appear by affidavit or otherwise, the clerk shall enter the party's default. (b) Judgment.

Under this section, judgment, together with all rights and remedies appurtenant to it, are conclusively presumed paid and discharged after ten years unless timely renewed.

On all final judgments rendered against the State in actions instituted under this chapter, interest shall be computed at the rate of four per cent a year from the date of judgment up to, but not exceeding, thirty days after the date of approval of any appropriation act providing for payment of the judgment.

Calculating interest owed You input the judgment amount, date, and payment history, and the program does all the calculations for you. The calculator has the interest rate set at 10%.

The purpose of usury law is to prevent predatory lending. The legal maximum interest rate allowed on a residential mortgage loan in Hawaii is one percent per month or 12% per year. If a creditor is found guilty of violating the usury law: they cannot collect the excess interest.

The federal statutory corporate tax rate is currently set at 21.0 percent ? reduced from 35.0 percent by the 2017 Tax Cuts and Jobs Act (TCJA).