Hawaii Restricted Endowment to Educational, Religious, or Charitable Institution

Description

How to fill out Restricted Endowment To Educational, Religious, Or Charitable Institution?

Are you in a situation where you will require documents for occasional business or particular functions almost every day.

There is an assortment of legal document templates accessible on the web, but discovering ones you can trust is not straightforward.

US Legal Forms offers thousands of form templates, such as the Hawaii Restricted Endowment to Educational, Religious, or Charitable Institution, that are designed to comply with federal and state regulations.

Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid errors.

The service provides professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and begin making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Hawaii Restricted Endowment to Educational, Religious, or Charitable Institution template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and confirm that it is for the correct region/area.

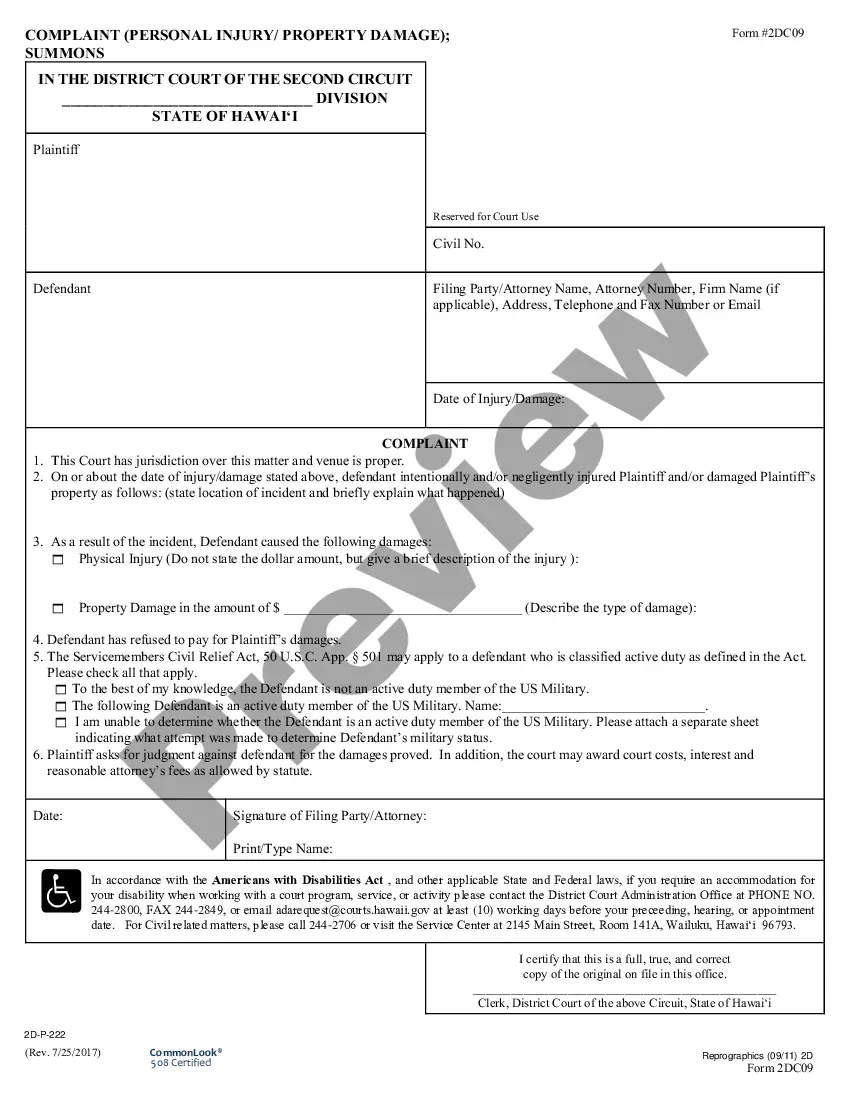

- Utilize the Review button to examine the document.

- Check the description to ensure you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to locate the document that fits your requirements.

- Once you find the right form, click on Purchase now.

- Choose the payment plan you prefer, complete the necessary details to create your account, and complete the transaction using your PayPal, Visa, or Mastercard.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Hawaii Restricted Endowment to Educational, Religious, or Charitable Institution whenever you need it. Just click on the required form to download or print the document template.

Form popularity

FAQ

In Hawaii, various types of income are not taxed, particularly those related to nonprofits or charitable contributions. Donations made to a Hawaii Restricted Endowment to Educational, Religious, or Charitable Institution often do not result in tax liability for the donor. Understanding tax exemptions can help maximize the benefits for your organization, and utilizing tools from USLegalForms can simplify the process.

Yes, nonprofits can be tax exempt in Hawaii if they meet certain requirements. Organizations established for educational, religious, or charitable purposes may apply for exemption under IRS rules. This means that a Hawaii Restricted Endowment to Educational, Religious, or Charitable Institution can enjoy financial benefits that promote their mission. For specific guidance, consider using the resources available on the USLegalForms platform.

Nonprofits in Hawaii report varying income levels, influenced by their size and mission. On average, they can earn anywhere from thousands to millions of dollars annually, depending on donations, grants, and fundraising efforts. A Hawaii Restricted Endowment to Educational, Religious, or Charitable Institution can significantly impact financial stability, offering essential resources for nonprofit sustainability. Understanding these earnings can help new organizations plan their budgets effectively.

As of recent estimates, there are over 1.5 million nonprofits in the United States. These organizations serve various purposes, including educational, religious, and charitable missions. Many of these nonprofits benefit from programs such as the Hawaii Restricted Endowment to Educational, Religious, or Charitable Institution, which provides crucial funding to help sustain their operations. This vibrant sector continues to grow, reflecting the diverse needs of communities nationwide.

Setting up a nonprofit in Hawaii involves several steps. First, you need to choose a name and ensure it complies with state laws. Next, draft your nonprofit's articles of incorporation, and file them with the State of Hawaii. Additionally, a Hawaii Restricted Endowment to Educational, Religious, or Charitable Institution may help secure funds for your mission. Don’t forget to apply for federal tax-exempt status to enhance your organization's financial capabilities.

Yes, nonprofits operating as 501(c)(3) organizations in Hawaii can qualify for federal tax-exempt status. This means that contributions to these organizations may be tax-deductible for donors. Establishing a Hawaii Restricted Endowment to Educational, Religious, or Charitable Institution allows you to take advantage of these benefits. Our platform provides guidance on applying for tax-exempt status, ensuring you align with state and federal regulations.

Hawaii is home to a vibrant nonprofit sector, with several hundred registered organizations. These nonprofits operate across various areas, including education, religion, and charitable services. If you're looking to establish a Hawaii Restricted Endowment to Educational, Religious, or Charitable Institution, understanding the landscape of existing nonprofits can be vital. Our platform offers resources to help you navigate the nonprofit formation process effectively.

In Hawaii, a nonprofit organization must have at least three board members to comply with state regulations. This board structure supports effective governance and oversight of the organization. If your group is forming as a Hawaii Restricted Endowment to Educational, Religious, or Charitable Institution, ensuring you meet this requirement will be essential for your nonprofit’s success.

Yes, the University of Hawaii holds tax-exempt status as it is a public educational institution. This status allows it to avoid certain taxes, enhancing its capacity to serve students and the community. For similar organizations considering tax-exempt status under the Hawaii Restricted Endowment to Educational, Religious, or Charitable Institution guidelines, there are beneficial resources available through platforms like USLegalForms.

Hawaii is not entirely a tax-exempt state, but it offers various tax exemptions for certain entities. Organizations classified as Hawaii Restricted Endowment to Educational, Religious, or Charitable Institutions may qualify for these exemptions. It’s important for potential applicants to be aware of these provisions and seek guidance to effectively navigate the application process.