Hawaii Revocable Living Trust for House

Description

How to fill out Revocable Living Trust For House?

If you require to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, which is accessible online.

Make use of the site's straightforward and user-friendly search to locate the documents you need.

Numerous templates for business and personal purposes are categorized by groups and states, or keywords.

Every legal document template you obtain is your property forever. You have access to every form you saved in your account.

Click on the My documents section and choose a form to print or download again.

- Use US Legal Forms to acquire the Hawaii Revocable Living Trust for House in just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and press the Download button to locate the Hawaii Revocable Living Trust for House.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/region.

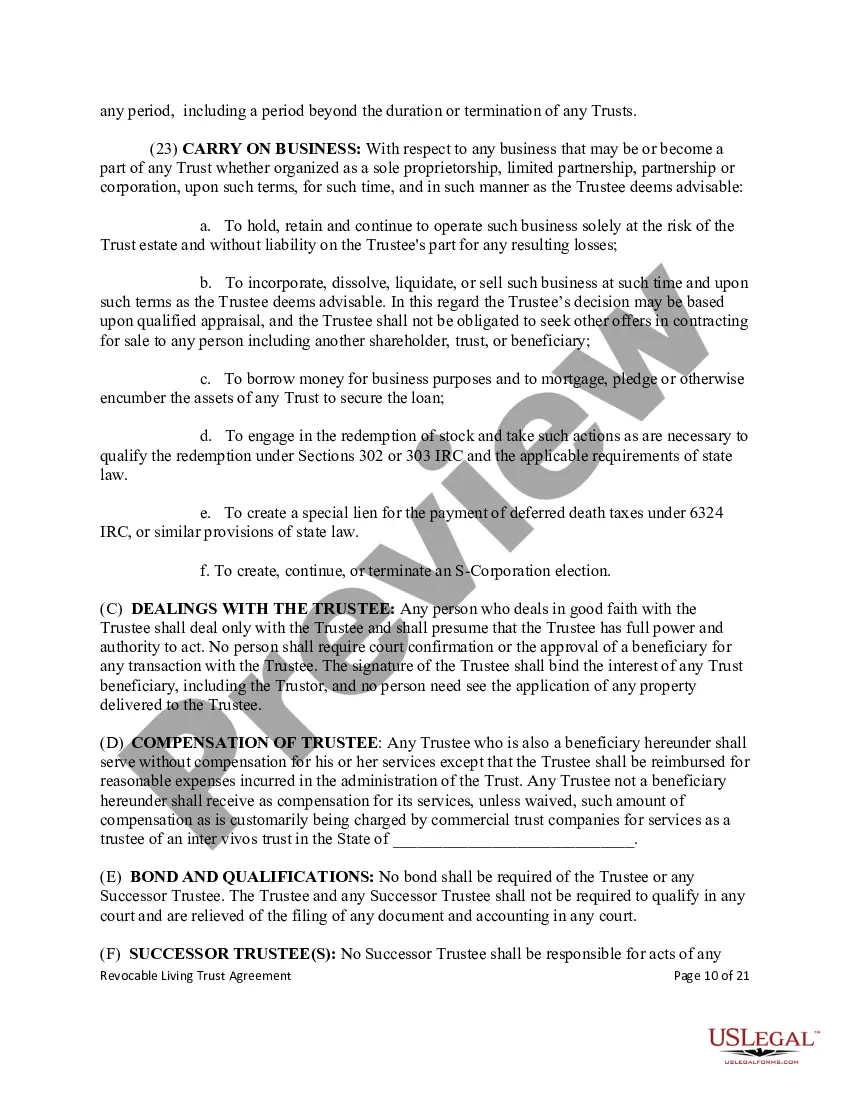

- Step 2. Use the Review feature to examine the form's content. Remember to read the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other templates in the legal form category.

- Step 4. After finding the form you need, select the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your system.

- Step 7. Fill out, edit, and print or sign the Hawaii Revocable Living Trust for House.

Form popularity

FAQ

To place your house in a trust in Hawaii, start by creating a Hawaii Revocable Living Trust for House document, which outlines your wishes. Next, transfer the title of your property to the trust, a process that often involves filling out a new deed and filing it with your local county's recorder's office. It can be beneficial to work with legal professionals or platforms like uslegalforms to ensure the process goes smoothly and complies with state laws.

It's often beneficial for your parents to consider putting their assets in a trust, such as a Hawaii Revocable Living Trust for House. This can ensure that their wishes are honored while avoiding the lengthy probate process. A trust can also offer tax benefits and protect assets from unintentional loss. Discussing their specific needs with a legal advisor can clarify their options.

While trust funds can provide significant advantages, they can also pose dangers if not managed properly. Mismanagement may lead to disputes among beneficiaries, especially if the terms are not clear. Additionally, trusts can be vulnerable to fraud if proper safeguards are not established. Using a reliable platform like uslegalforms can help you avoid these pitfalls.

Yes, a Hawaii Revocable Living Trust for House allows your beneficiaries to avoid the probate process. By transferring your house and other assets into the trust, they can bypass court proceedings after your passing. This often leads to a quicker distribution of your estate and can help maintain your family's privacy during what can be a difficult time.

In Hawaii, a trust can last for a maximum of 90 years. This duration applies to various types of trusts, including the Hawaii Revocable Living Trust for House. After this period, the trust must be dissolved or its terms must be reassessed. This timeframe allows you to effectively manage your assets and provide for future generations.

A living will and a living trust serve different purposes in Hawaii. A living will outlines your wishes regarding medical treatment in case you become incapacitated, while a living trust, such as a Hawaii Revocable Living Trust for House, pertains to the management and distribution of your financial assets after your death. Understanding these distinctions can help you make informed decisions for your estate planning.

In Hawaii, a trust does not need to be notarized to be valid, but notarization can help in certain situations. Having your Hawaii Revocable Living Trust for House notarized may simplify the process when you need to present the trust document to banks or other institutions. While not required, it enhances the document's credibility and can reduce disputes among beneficiaries.

To establish a Hawaii Revocable Living Trust for House, begin by drafting the trust document, which outlines the terms and appoints a trustee. You will need to transfer your property, including your house, into the trust by changing the title. Following that, it's essential to identify beneficiaries who will receive the assets upon your passing, ensuring a secure plan for your family's future.

In Hawaii, a trust does not need to be recorded with a court or government agency. However, it is advisable to keep the trust document in a safe place. You may want to inform your beneficiaries or trusted individuals about its location. This ensures that everyone knows where to find the Hawaii Revocable Living Trust for House when needed.

The major disadvantages of revocable living trusts include potential complexity in transferring assets, and the possibility of higher administration fees. Even though a Hawaii Revocable Living Trust for House allows for easy changes, if not properly managed, it can lead to costly mistakes. Furthermore, this type of trust does not shield assets from lawsuits or creditors, which is a critical consideration. Understanding these factors before establishing a trust can prevent future complications.