Hawaii Relocation Agreement between Employer and Employee Regarding Moving Expenses

Description

How to fill out Relocation Agreement Between Employer And Employee Regarding Moving Expenses?

Finding the appropriate legitimate document template can be challenging.

Of course, there are numerous themes available online, but how do you identify the authentic template you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Hawaii Relocation Agreement between Employer and Employee Regarding Moving Expenses, suitable for both business and personal needs.

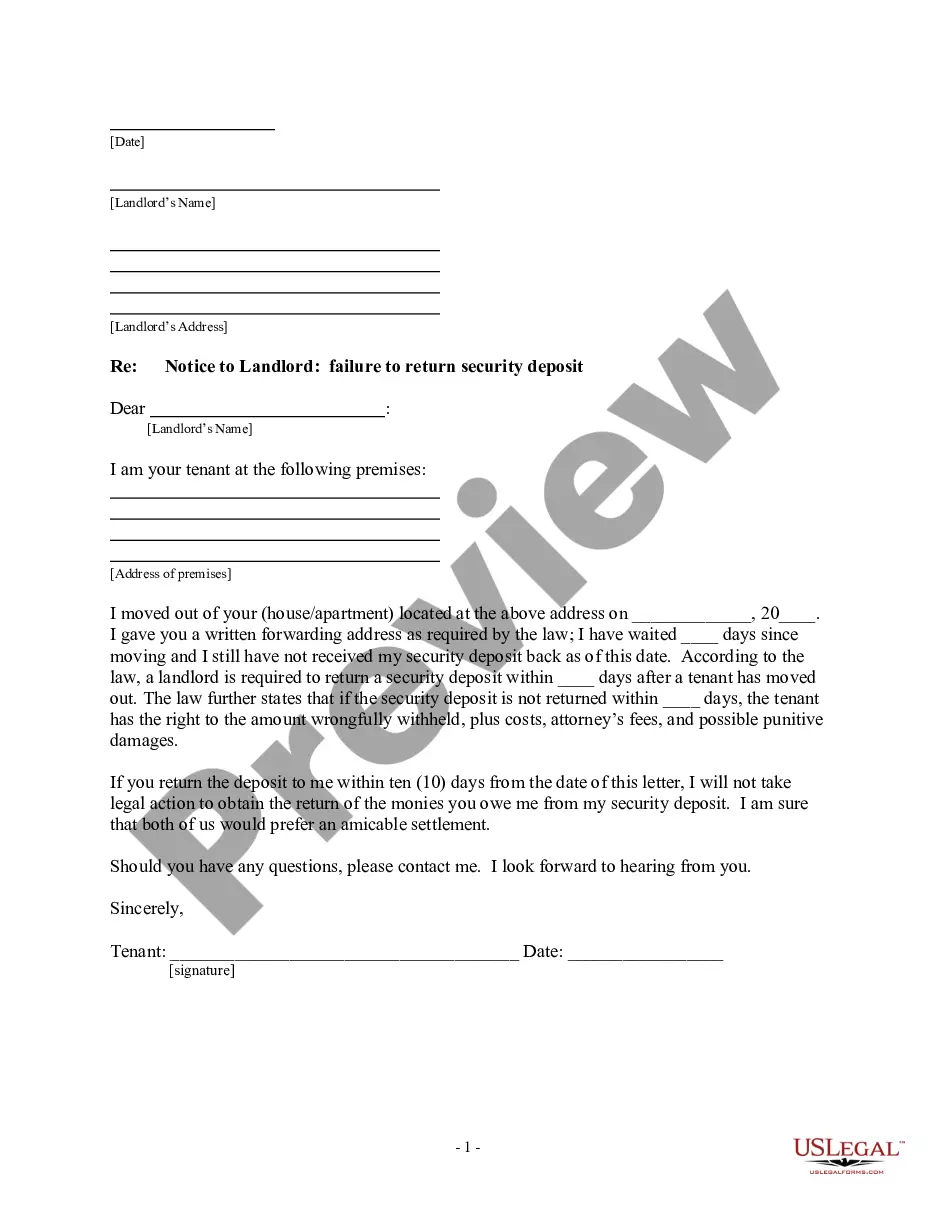

You can preview the document using the Preview button and review the document details to confirm it is suitable for your needs.

- All templates are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Hawaii Relocation Agreement between Employer and Employee Regarding Moving Expenses.

- Use your account to browse through the legitimate templates you have previously purchased.

- Go to the My documents section of your account to retrieve another copy of the document you require.

- If you are a first-time user of US Legal Forms, here are simple guidelines you can follow.

- Firstly, ensure you have selected the correct template for your city/state.

Form popularity

FAQ

In most cases, relocation expenses are taxable to the employee unless specified otherwise. It's important to review the terms of your Hawaii Relocation Agreement between Employer and Employee Regarding Moving Expenses to identify which expenses, if any, may be non-taxable. Consulting a tax expert can clarify your situation and help minimize tax impacts.

To claim moving expenses, you will need to report them on your federal tax return, using IRS Form 3903 if applicable. Make certain you have all necessary records, including a Hawaii Relocation Agreement between Employer and Employee Regarding Moving Expenses. This documentation will help you substantiate your claims and ensure a smooth filing process.

Yes, most relocation expenses are considered taxable for employees under current IRS regulations, with some exceptions. If you are covered by a Hawaii Relocation Agreement between Employer and Employee Regarding Moving Expenses, it is crucial to review the terms of your agreement for any tax implications. It's beneficial to work with a tax professional to navigate these complexities.

Generally, expense reimbursements for moving costs may be subject to tax unless they fall under qualified moving expenses. In the context of a Hawaii Relocation Agreement between Employer and Employee Regarding Moving Expenses, the details of reimbursement may influence your tax liability. Always consult a tax advisor to understand how these reimbursements will affect your tax situation.

The IRS has specific regulations regarding moving expenses that are governed by the Tax Cuts and Jobs Act. Currently, most employees cannot deduct moving expenses, but active-duty members of the Armed Forces can claim certain moving costs under specific circumstances. If you are part of a Hawaii Relocation Agreement between Employer and Employee Regarding Moving Expenses, check with your employer for guidance on applicable regulations.

To account for relocation expenses on your taxes, you should gather all relevant receipts and documentation. If you're following a Hawaii Relocation Agreement between Employer and Employee Regarding Moving Expenses, you can list these expenses when filing your taxes. Be sure to separate personal and business-related moving costs for accurate reporting.

Yes, Hawaii permits moving expense deductions, but the specifics can vary based on your circumstances. Under a Hawaii Relocation Agreement between Employer and Employee Regarding Moving Expenses, employees may be able to deduct qualifying expenses. However, it's important to consult a tax professional to determine your eligibility and ensure compliance with state tax regulations.

The average relocation incentive can fluctuate widely, but many companies offer incentives ranging from $5,000 to $15,000. These figures are often found in standard Hawaii Relocation Agreements between Employer and Employee Regarding Moving Expenses. Companies may consider factors such as distance, job level, and market standards when determining the amount. Engaging in open communication with your employer can help clarify the offered incentive.

Qualified moving expenses generally include transportation fees, packing costs, and storage fees associated with your relocation. Under a Hawaii Relocation Agreement between Employer and Employee Regarding Moving Expenses, employers can cover these costs to ease the burden on employees. However, expenses related to temporary living arrangements, meals, or house-hunting trips do not typically qualify. Always consult your agreement to understand what costs are eligible.

To report relocation expenses, you must first develop a detailed record of your moving costs incurred during your transition. This documentation is essential for the Hawaii Relocation Agreement between Employer and Employee Regarding Moving Expenses, as it outlines eligibility for reimbursement. Additionally, ensure that you complete the necessary tax forms, such as IRS Form 3903, to deduct these costs properly. Keeping careful records can help you avoid complications during tax season.