Hawaii Sample Letter for Agreement to Extend Debt Payment

Description

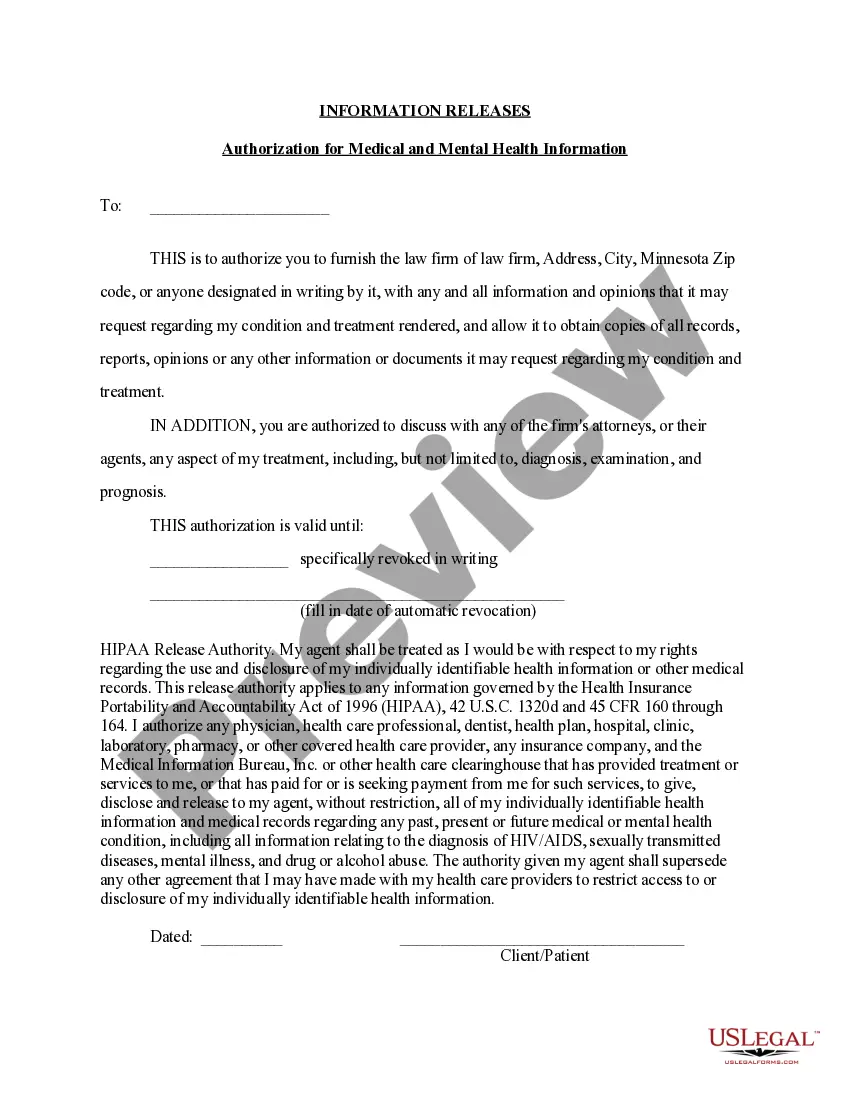

How to fill out Sample Letter For Agreement To Extend Debt Payment?

You can spend multiple hours online searching for the appropriate legal document template that meets the state and federal requirements you seek.

US Legal Forms offers thousands of legal forms that have been reviewed by experts.

You can easily download or print the Hawaii Sample Letter for Agreement to Extend Debt Payment from my resources.

If available, utilize the Preview button to inspect the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, edit, print, or sign the Hawaii Sample Letter for Agreement to Extend Debt Payment.

- Every legal document template you acquire is yours indefinitely.

- To obtain an additional copy of a purchased form, go to the My documents tab and click the appropriate button.

- If you are visiting the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the form description to confirm you have selected the right document.

Form popularity

FAQ

In Hawaii, you typically need to live in the state for at least 183 days within a calendar year to be considered a resident for tax purposes. Factors such as your intent to make Hawaii your permanent home play an essential role in residency determination. If you are managing debts during this transition, a Hawaii Sample Letter for Agreement to Extend Debt Payment can help in communicating your financial situation.

The non-resident tax form for Hawaii is Form N-15, which is specifically designed for non-residents who earn income from Hawaii sources. Completing this form accurately is crucial to ensure compliance with Hawaii tax laws. If there's any need to negotiate payments while dealing with these obligations, consider using a Hawaii Sample Letter for Agreement to Extend Debt Payment.

Hawaii does not grant an automatic extension for filing tax returns; you must actively apply for an extension using the appropriate forms. It’s essential to meet the deadlines to avoid penalties. If you are struggling with debt payments, a Hawaii Sample Letter for Agreement to Extend Debt Payment can effectively communicate your request for assistance during this time.

In Hawaii, individuals who earn a certain amount of income are required to file a tax return. This applies to both residents and non-residents depending on their income sources. If you encounter challenges with your tax obligations, a Hawaii Sample Letter for Agreement to Extend Debt Payment can be a useful tool to negotiate your financial arrangements.

For estimating your taxes in Hawaii, you would typically use Form N-1. This form helps calculate your estimated tax payments based on your income. If you find any discrepancies in your debts while preparing your estimated taxes, consider drafting a Hawaii Sample Letter for Agreement to Extend Debt Payment to ensure all financial matters are addressed.

The corporate extension form for Hawaii is Form N-101A, used by corporations to request an extension of time to file their corporate income tax returns. Filing this form gives businesses additional time, but like personal extensions, it does not cover tax payments. A Hawaii Sample Letter for Agreement to Extend Debt Payment may come in handy for corporations needing to manage debts while waiting to file.

The N11 form in Hawaii is a request for an extension of time to file your income tax return. It allows individuals to extend their tax filing deadline by an additional six months. If you find yourself needing more time, using a Hawaii Sample Letter for Agreement to Extend Debt Payment can help with any unpaid obligations during this period.

Filing a Hawaii extension involves submitting Form N-103 to the Department of Taxation. This form grants you an extension for filing your tax return, but it is important to understand that it does not extend your payment deadline. To ensure a smooth process, you might consider utilizing a Hawaii Sample Letter for Agreement to Extend Debt Payment if you're dealing with debts while managing your taxes.

To write a debt agreement, start by clearly identifying the parties involved and the terms of the agreement, including payment amounts and deadlines. Be sure to include any conditions that apply to the agreement and have both parties sign it. You can refer to the Hawaii Sample Letter for Agreement to Extend Debt Payment as a valuable resource for drafting this important document.

The 777 rule suggests that when dealing with debt collectors, you should respond within seven days after being contacted, attempt to negotiate seven times, and if unsuccessful, consider your options within seven days. This approach can help you stay organized and proactive in managing your debts. Using a structured document like the Hawaii Sample Letter for Agreement to Extend Debt Payment can facilitate these communications effectively.