Hawaii Direct Deposit Form for Stimulus Check

Description

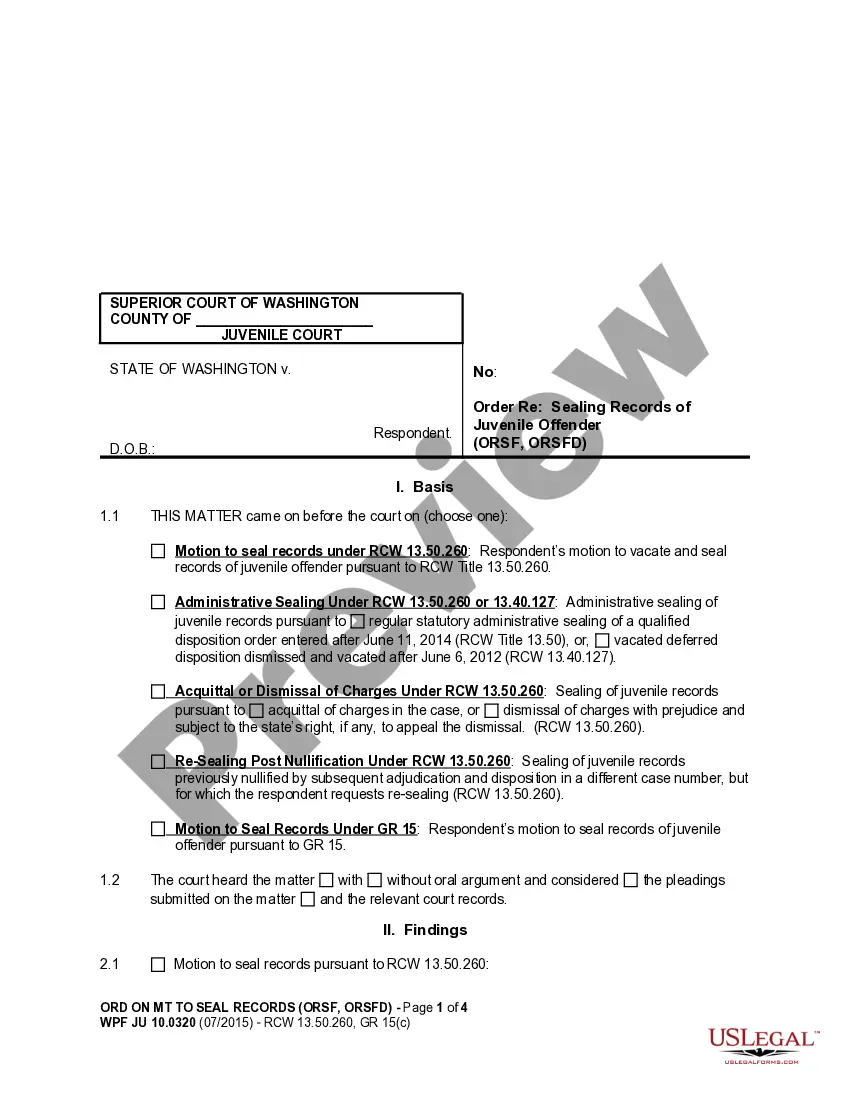

How to fill out Direct Deposit Form For Stimulus Check?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest forms such as the Hawaii Direct Deposit Form for Stimulus Check in just a few minutes.

If you have a membership, Log In and download the Hawaii Direct Deposit Form for Stimulus Check from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your profile.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Edit. Fill out, modify, and print and sign the saved Hawaii Direct Deposit Form for Stimulus Check. Every template you add to your account has no expiration date and belongs to you forever. So, if you need to download or print another copy, just go to the My documents section and click on the form you need. Access the Hawaii Direct Deposit Form for Stimulus Check with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure that you have selected the correct form for your area/state.

- Click on the Review button to examine the form's content.

- Check the form description to confirm that you have selected the right form.

- If the form doesn't meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the payment plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Hawaii does accept federal extensions, allowing residents some extra time to file their taxes. It’s important to check the deadlines and requirements as they can differ from federal guidelines. When applying for an extension, also consider the implications for submitting the Hawaii Direct Deposit Form for Stimulus Check to receive your funds without delay.

Yes, Hawaii accepts federal extensions for individual taxpayers, but there are specific conditions to meet. To ensure compliance, it is advisable to review the guidelines on the Hawaii Department of Taxation website. In the context of receiving your stimulus check, remember to complete the Hawaii Direct Deposit Form for Stimulus Check accordingly.

Hawaii does accept Form 7004 for tax extensions, but it's vital to check specific details about submission. This form allows you to request an automatic extension for your federal return. However, for the Hawaii Direct Deposit Form for Stimulus Check, it's crucial to follow Hawaii's unique filing requirements.

To claim your $1,400 stimulus check, you must ensure you're eligible and then fill out the appropriate forms. Depending on your tax situation, you may need to complete the Hawaii Direct Deposit Form for Stimulus Check to ensure speedy payment delivery. Make sure to submit all necessary documentation on time to avoid delays.

Yes, Hawaii provides e-file options for various tax forms, making filing easier for residents. Utilizing electronic filing simplifies the submission process, especially for those needing to submit the Hawaii Direct Deposit Form for Stimulus Check. By e-filing, you can expect quicker processing times for your stimulus payments.

Several states do not accept federal extensions, which impacts taxpayers filing their returns. It's essential to verify with your state's guidelines to ensure compliance. Hawaii offers its own tax extensions, so always check if they align with federal forms, particularly the Hawaii Direct Deposit Form for Stimulus Check.

Yes, Hawaii follows federal law but also has its own regulations. When it comes to tax laws and stimulus checks, the state aligns many of its policies with federal provisions. Therefore, you can expect the Hawaii Direct Deposit Form for Stimulus Check to comply with both state and federal requirements.

On your direct deposit form, specifically the Hawaii Direct Deposit Form for Stimulus Check, include your full name, address, and the last four digits of your Social Security Number. You’ll also need to specify your bank name, account type, account number, and routing number. These details are crucial, as they ensure that your stimulus check is properly deposited into your designated bank account. Ensure that your signature and date are included to validate the information.

When completing an authorization form, start with your personal details, which include your full name and contact information. For the Hawaii Direct Deposit Form for Stimulus Check, you must also provide banking information, such as your account number and the bank’s routing number. Make sure to double-check all the information you provide is correct, as this will help facilitate a smooth deposit process. Lastly, remember to sign and date the form at the bottom.

Filling out the authorization for direct deposit using the Hawaii Direct Deposit Form for Stimulus Check is straightforward. Begin by filling in your contact information at the top of the form. After that, enter the specifics of your bank account, including the account type, account number, and routing number. Don’t forget to sign the form to authorize the transaction; this will ensure that your funds are deposited directly into your account.