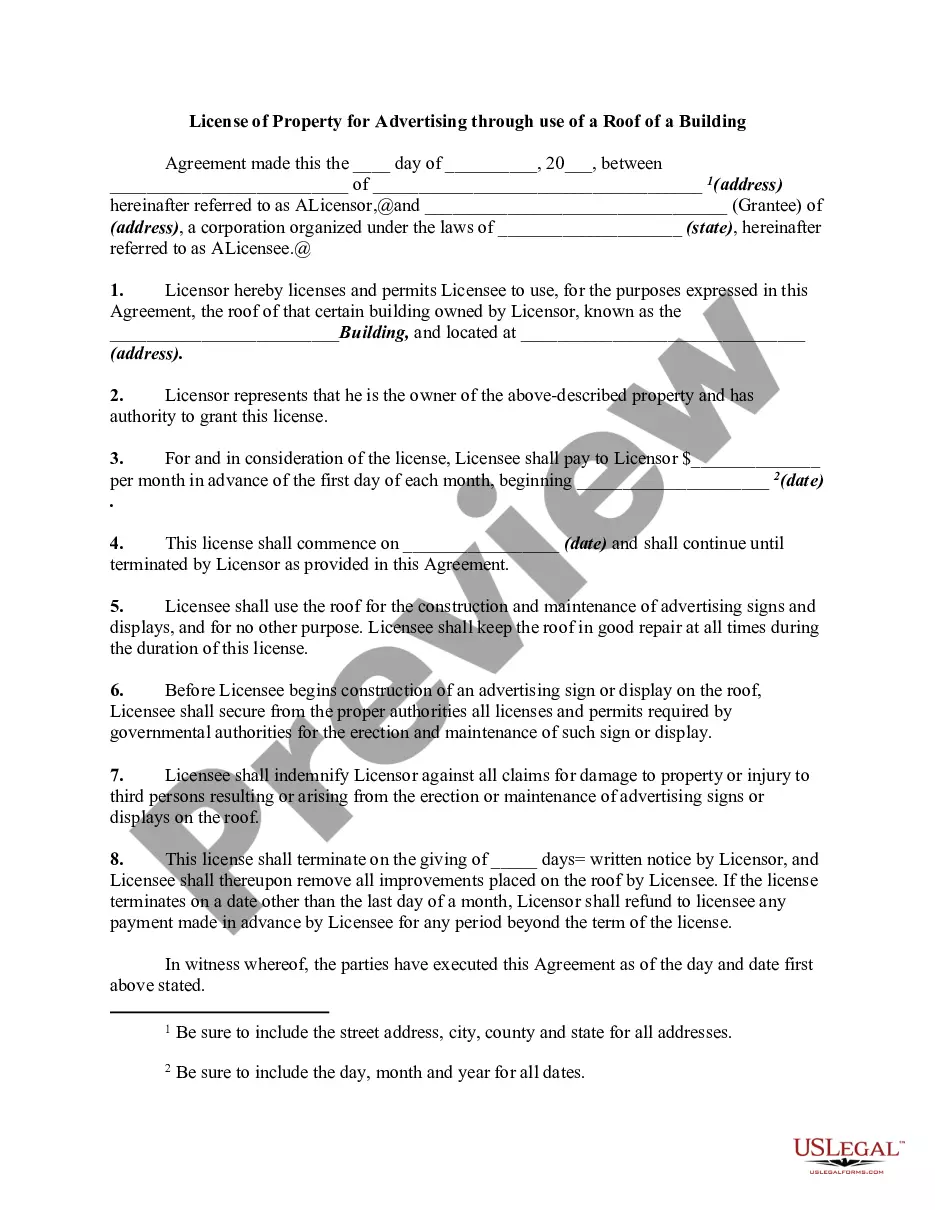

Hawaii Direct Deposit Form for IRS is a government document that allows individuals or businesses in Hawaii to set up a direct deposit with the Internal Revenue Service (IRS). Direct deposit is a convenient and secure way to receive tax refunds or make tax payments electronically, directly into a specified bank account. The Hawaii Direct Deposit Form for IRS is used by taxpayers to provide the necessary information for the direct deposit process. The form requires the taxpayer to provide their Social Security number or Employer Identification Number (EIN), their name and address, and their bank account information. This information includes the bank routing number and the account number where the taxpayer wants the IRS to deposit their funds. The purpose of the Hawaii Direct Deposit Form for IRS is to streamline the tax payment and refund process, eliminating the need for paper checks and reducing the chance of fraud or lost payments. By opting for direct deposit, taxpayers can receive their refunds or make tax payments faster and more conveniently. It is important to note that there are no specific different types of Hawaii Direct Deposit Form for IRS. However, depending on the specific use case, the IRS may have different forms for individuals, businesses, or other entities. For instance, individuals may use Form 8888 to split their refund into multiple accounts, while businesses may use Form 941 for payroll tax deposits. In conclusion, the Hawaii Direct Deposit Form for IRS is a document that facilitates the electronic transfer of funds between the IRS and taxpayers in Hawaii. It offers a secure and convenient method for receiving tax refunds or making tax payments directly into a designated bank account, eliminating the need for paper checks. By using this form, taxpayers can ensure a faster and more efficient process while minimizing the risk of lost or stolen payments.

Hawaii Direct Deposit Form for IRS

Description

How to fill out Direct Deposit Form For IRS?

Are you in a situation where you frequently need to have documents for both corporate or personal purposes? There are numerous authentic file templates available online, but finding ones you can rely on isn't simple.

US Legal Forms provides thousands of form templates, including the Hawaii Direct Deposit Form for IRS, which is designed to meet federal and state regulations.

If you're already familiar with the US Legal Forms website and possess an account, simply Log In. Then, you can download the Hawaii Direct Deposit Form for IRS template.

Find all the form templates you have purchased in the My documents section. You can download another copy of the Hawaii Direct Deposit Form for IRS at any time, if needed. Just select the required form to download or print the document template.

Utilize US Legal Forms, one of the most comprehensive collections of authentic forms, to save time and avoid errors. The service offers professionally created legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- Obtain the form you need and verify it is for the right city/region.

- Utilize the Review button to inspect the form.

- Check the description to confirm that you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that suits your needs and requirements.

- Once you find the correct form, simply click Acquire now.

- Choose the pricing plan you prefer, complete the necessary details to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Form 3911 cannot typically be faxed to the IRS as they require a physical copy for processing. Therefore, it is crucial to mail the form to the appropriate address. If you are using the Hawaii Direct Deposit Form for IRS, be sure to follow all submission guidelines carefully. For easier navigation through the form submission process, consider using services like uslegalforms that can assist with your needs.

You should mail form 3911 to the specific address mentioned in the instructions that come with the form. For those using the Hawaii Direct Deposit Form for IRS, ensure you double-check the mailing address to avoid delays. Accurate information is key to ensuring your form reaches the right department. If you need more support, platforms like uslegalforms can provide guidance on where to send your form.

Typically, the IRS takes around four to six weeks to process form 3911, depending on their workload and the accuracy of the information provided. If you have submitted the Hawaii Direct Deposit Form for IRS, you might experience a smoother processing time. Keep an eye on your mail for any communications from the IRS regarding your submission.

You can submit form 3911 by mailing it directly to the IRS at the address indicated in the form's instructions. Ensure you include all required information to avoid delays. If you're looking for easy submission options, the Hawaii Direct Deposit Form for IRS streamlines this process. For added convenience, consider using reliable services like uslegalforms to help manage your submissions.

To mail form CT 3911, you should send it to the address specified in the instructions provided with the form. If you are submitting the Hawaii Direct Deposit Form for IRS, ensure all personal information is complete and accurate. This can help expedite the process. Always check for the latest mailing details directly from the IRS or relevant authority.

You should mail your Hawaii state tax return to the address listed in the tax instructions for your specific form. This proves crucial for ensuring that your return is processed without delays. Always verify the address before mailing to ensure your Hawaii Direct Deposit Form for IRS and overall return are handled properly.

To fill out an authorization for direct deposit, start by entering your account details, including the bank routing number and your account number. Select whether the account is a checking or savings account and include your personal information, such as your name and address. Completing these sections accurately is vital for your Hawaii Direct Deposit Form for IRS to work properly.

When addressing an envelope to the IRS, use the address provided on the tax return instructions for your filing type. Include the full name and address of the applicable IRS office as indicated. Make sure your return address is included in the corner, which guarantees that your envelope reaches the right department quickly and efficiently.

Filling out an authorization form involves providing your personal information, such as your name and address, along with the details of the account where you want your funds deposited. For the IRS, specifically complete the areas regarding your bank routing number and account number. This ensures that your tax refund goes directly to the correct account as indicated in your Hawaii Direct Deposit Form for IRS.

To give the IRS your direct deposit information, complete the direct deposit section on your tax return. Ensure you include your bank's routing number, your account number, and specify if it's a savings or checking account. Submitting this information with your tax return allows the IRS to process your Hawaii Direct Deposit Form for IRS seamlessly.