Hawaii Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

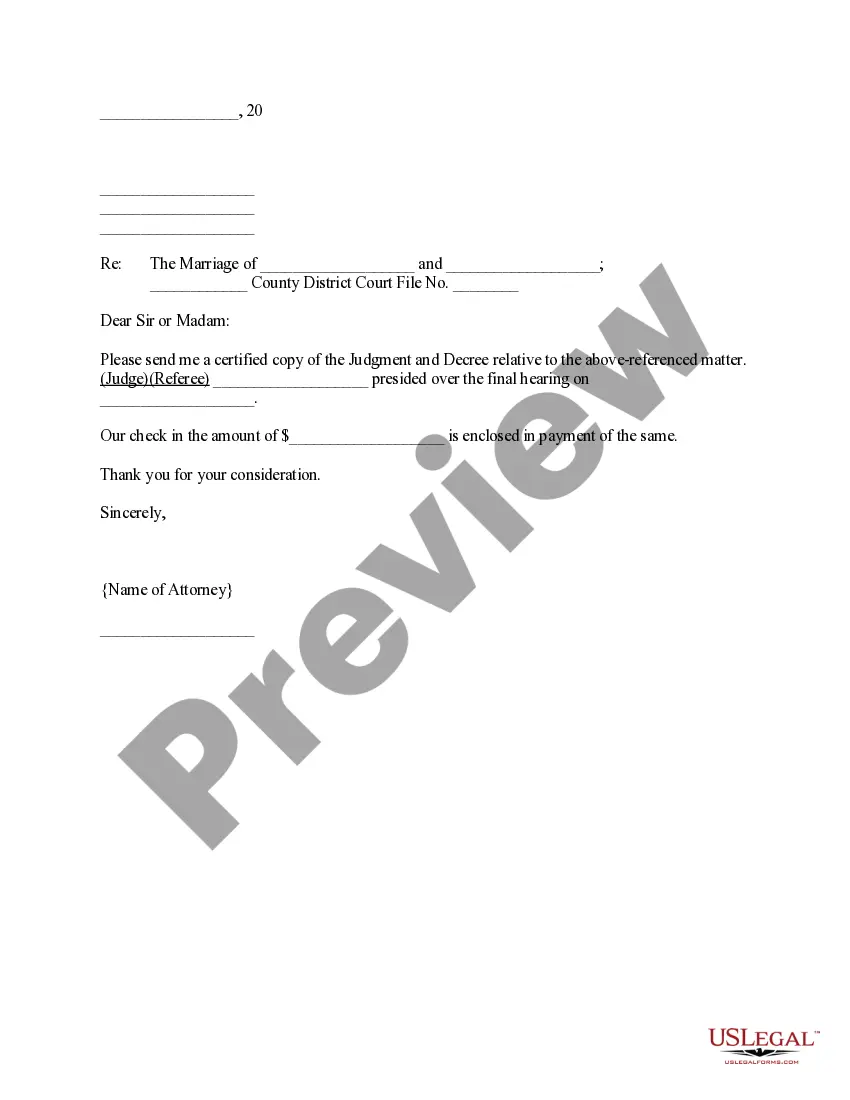

How to fill out Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

If you want to aggregate, retrieve, or produce sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms, available online. Employ the site’s straightforward and user-friendly search to locate the documents you need. A range of templates for commercial and individual purposes are categorized by types and jurisdictions, or keywords.

Utilize US Legal Forms to acquire the Hawaii Acknowledgment by Charitable or Educational Institution of Receipt of Gift in just a few clicks. If you are already a US Legal Forms customer, Log In to your account and then click the Obtain button to find the Hawaii Acknowledgment by Charitable or Educational Institution of Receipt of Gift. You may also access forms you previously downloaded from the My documents tab in your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Preview option to review the form’s details. Do not forget to read the description. Step 3. If you are not content with the form, make use of the Search field at the top of the screen to find alternative forms in the legal document template. Step 4. Once you have located the form you need, click on the Get now button. Select the pricing plan you prefer and enter your information to register for an account. Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase. Step 6. Choose the format of the legal document and download it to your device. Step 7. Complete, modify and print or sign the Hawaii Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

- Every legal document template you obtain is yours indefinitely.

- You have access to every form you downloaded within your account.

- Click the My documents section and select a form to print or download again.

- Be proactive and download, and print the Hawaii Acknowledgment by Charitable or Educational Institution of Receipt of Gift with US Legal Forms.

- There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

Form popularity

FAQ

A gift acknowledgment letter is a formal communication from a charitable organization confirming the receipt of a donation. This letter typically outlines the donor's name, the donation amount, and the purpose of the gift, if applicable. It's important that this letter serves as a Hawaii Acknowledgment by Charitable or Educational Institution of Receipt of Gift, which can be crucial for tax deductions. Using platforms like USLegalForms can streamline the process of generating these letters to ensure compliance and clarity.

To show proof of a charitable donation, you can present a written acknowledgment from the organization that received your gift. This acknowledgment must include specific details like the organization's name, the date of the donation, and the amount contributed. Utilizing resources like USLegalForms can help you create a proper Hawaii Acknowledgment by Charitable or Educational Institution of Receipt of Gift, which serves as an official document to validate your generosity.

A written acknowledgment for a charitable contribution typically includes the name of the charitable organization, the donor's name, the date of the contribution, and the amount donated. For instance, if you donate to a nonprofit in Hawaii, the acknowledgment should clearly state that it is a Hawaii Acknowledgment by Charitable or Educational Institution of Receipt of Gift. This document serves as proof for tax purposes and ensures that donors can substantiate their contributions when filing taxes.

A gift acknowledgment is a formal recognition of a donation received by a charitable or educational institution. It typically includes details such as the donor's name, the amount of the gift, and the purpose of the donation. Crafting a thoughtful Hawaii Acknowledgment by Charitable or Educational Institution of Receipt of Gift is crucial for transparency and record-keeping. You can easily create these acknowledgments using services like UsLegalForms, ensuring they meet legal standards and convey gratitude.

Traditional gift giving in Hawaii often involves the exchange of leis, which symbolize love and respect. Gifts may also include food, crafts, or items made from local resources, reflecting the culture and community spirit of the islands. Understanding these customs can enhance your charitable practices, especially when issuing a Hawaii Acknowledgment by Charitable or Educational Institution of Receipt of Gift. This acknowledgment can strengthen your relationship with donors and honor their contributions.

To acknowledge a gift from a donor-advised fund, you should provide a written statement to the donor that includes the amount of the gift and the date it was received. This is essential for the donor’s tax records. Utilize the Hawaii Acknowledgment by Charitable or Educational Institution of Receipt of Gift, as it ensures compliance with state and federal regulations. You can streamline this process through platforms like UsLegalForms, which offer templates for proper acknowledgment.

The gift tax limit in Hawaii aligns with federal guidelines, allowing individuals to gift a certain amount annually without incurring taxes. As part of the Hawaii Acknowledgment by Charitable or Educational Institution of Receipt of Gift, it is important for donors to keep track of their contributions. Currently, the annual exclusion amount is set at $15,000 per recipient. Staying informed about these limits can help individuals make the most of their charitable contributions while minimizing tax implications.

Hawaii's gift law primarily governs how gifts are defined and what conditions apply to their acceptance. Under the Hawaii Acknowledgment by Charitable or Educational Institution of Receipt of Gift, institutions must provide documentation to donors for tax purposes. This documentation illustrates that the gift was indeed received and specifies its value. Understanding these legal requirements is crucial for both donors and institutions to maintain transparency and compliance.

A gift may be accepted when it is offered voluntarily and without expectation of return. In the context of Hawaii Acknowledgment by Charitable or Educational Institution of Receipt of Gift, it is essential for the institution to confirm the donor's intent. This acknowledgment not only solidifies the acceptance of the gift but also establishes the relationship between the donor and the institution. Therefore, clear communication is vital to ensure compliance with applicable laws.