This form is a Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Hawaii Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage

Description

How to fill out Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage?

Are you presently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but locating ones you can rely on isn’t simple.

US Legal Forms offers thousands of form templates, such as the Hawaii Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, designed to comply with state and federal regulations.

Once you locate the right form, click on Buy now.

Choose the payment plan you desire, provide the necessary information to create your account, and pay for your order with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Hawaii Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct area/state.

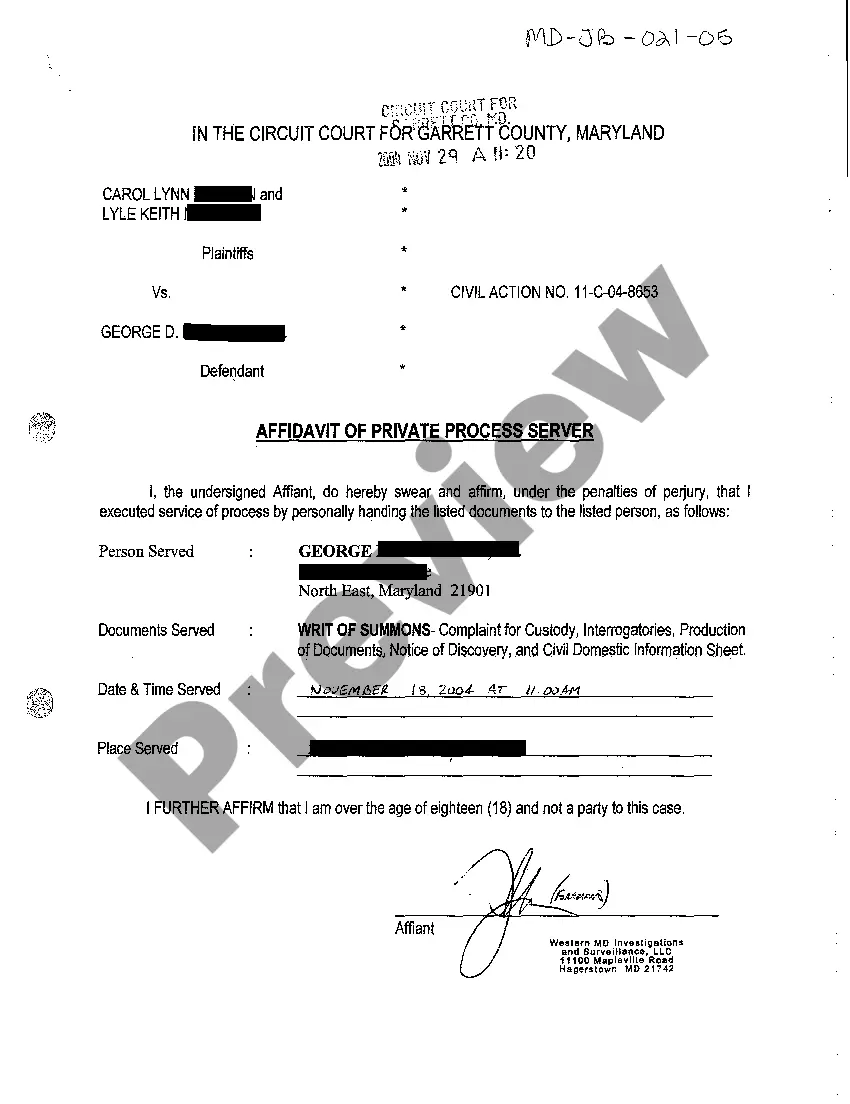

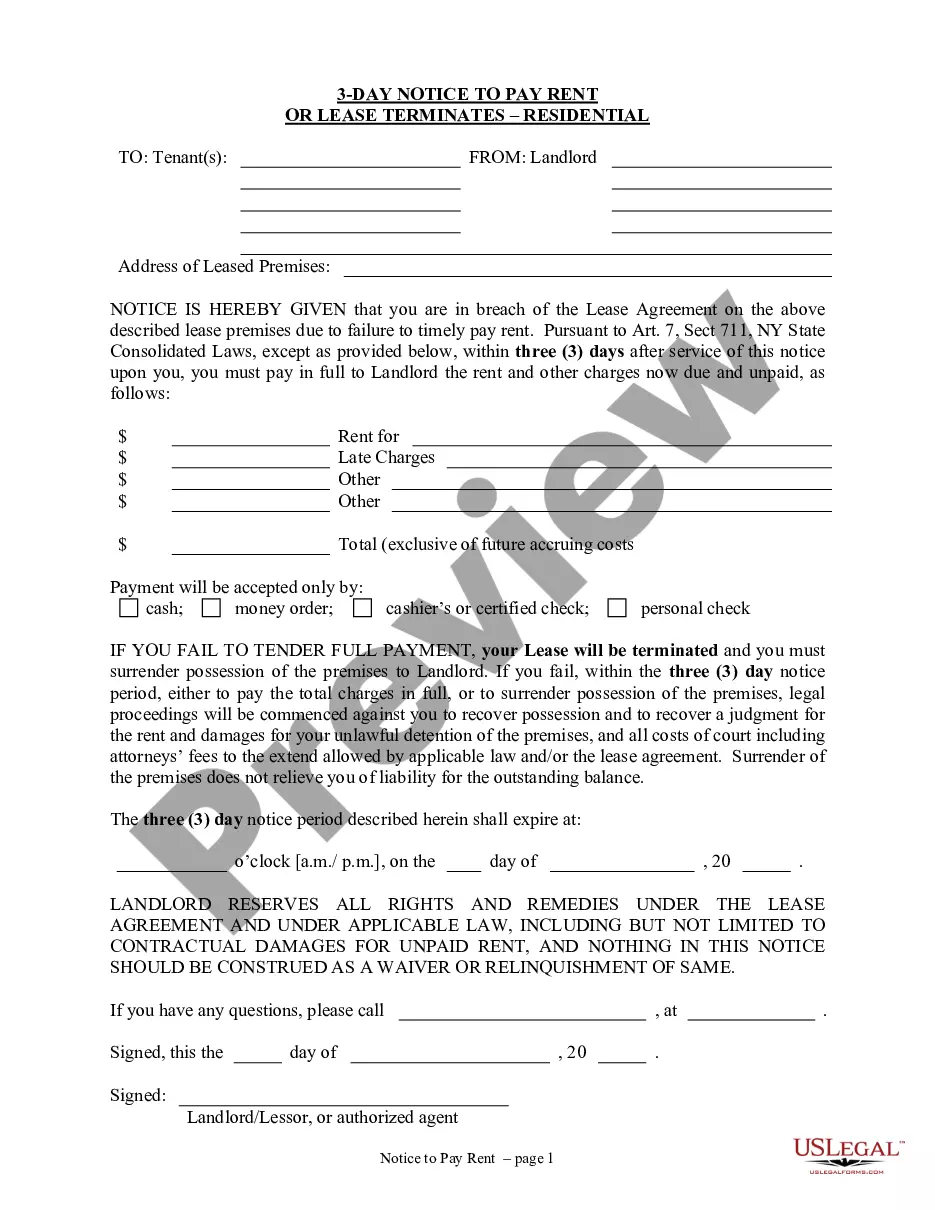

- Use the Review button to examine the form.

- Read the description to ensure you have selected the right form.

- If the form isn’t what you are looking for, use the Lookup field to find the form that suits your needs and requirements.

Form popularity

FAQ

To file a complaint against a company in Hawaii, you should start by gathering all relevant documents, including your policy details and correspondence with the company. Next, you can visit the official Hawaii Department of Commerce and Consumer Affairs website to find the appropriate complaint form. Additionally, if your complaint involves a credit life policy, you may want to consider filing a Hawaii Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage for a clearer resolution. Lastly, you can use the US Legal Forms platform to access legal documents and templates that can guide you through this process.

In Hawaii, property damage limits can vary based on the type of insurance policy and coverage you select. Typically, basic liability insurance provides minimum coverage limits, but it's crucial to review your policy carefully. If you're uncertain about your coverage limits or need to clarify any disputes, you can file a Hawaii Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage to help determine your entitlements.

If an insurance agent makes a misrepresentation, it can impact your policy and potential claims. You have the right to dispute any misleading information and may consider filing a complaint with the Hawaii Insurance Division. Additionally, in cases where coverage is unclear, a Hawaii Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage can help clarify your situation and enforce your rights.

Insurance companies in Hawaii are regulated by the Hawaii Department of Commerce and Consumer Affairs. This department ensures that insurers comply with state laws and protect consumers. If you face issues with your insurance coverage, you might find it helpful to file a Hawaii Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage to seek resolution.

To complain about insurance in Hawaii, first gather all relevant documents related to your policy and the issue at hand. You can then file a complaint with the Hawaii Insurance Division or contact the insurance company directly. If necessary, you may want to consider filing a Hawaii Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage to clarify your rights and obligations under your policy.

Rule 68 in Hawaii relates to offers of judgment, allowing a party to propose a settlement before trial. If the opposing party does not accept the offer and fails to achieve a better outcome in court, they may be responsible for certain costs. This rule can significantly impact cases involving a Hawaii Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Understanding Rule 68 can help you strategize effectively when considering settlement options.

Rule 58 of the Hawaii Rules of Civil Procedure outlines the requirements for the entry of judgment. It specifies how judgments should be documented and communicated to involved parties. When dealing with a Hawaii Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, familiarity with Rule 58 can help you manage your case more effectively. This rule ensures that all parties are aware of the court's decision and the next steps.

A Rule 58 notice in Hawaii is a formal communication that informs parties of the entry of judgment. This notice is crucial as it triggers the timeline for appeals and other post-judgment actions. If you are navigating a Hawaii Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, understanding the implications of a Rule 58 notice is essential. It ensures you remain aware of your legal standing and options following a court decision.

An insurance company may request a declaratory judgment when there is uncertainty regarding coverage or policy interpretation. This often occurs in disputes over claims, such as those involving a Hawaii Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. By seeking a court's ruling, the insurer aims to clarify its obligations under the policy. This process helps both the insurer and the insured understand their rights and responsibilities.

Rule 60 in Hawaii pertains to the relief from judgment or order. This rule allows a party to seek a court's permission to set aside a judgment under specific circumstances, such as mistake or newly discovered evidence. If you find yourself needing to file a Hawaii Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, knowing Rule 60 can be beneficial. It provides a path to challenge previous decisions that may affect your case.