Guam Clauses Relating to Capital Withdrawals, Interest on Capital

Description

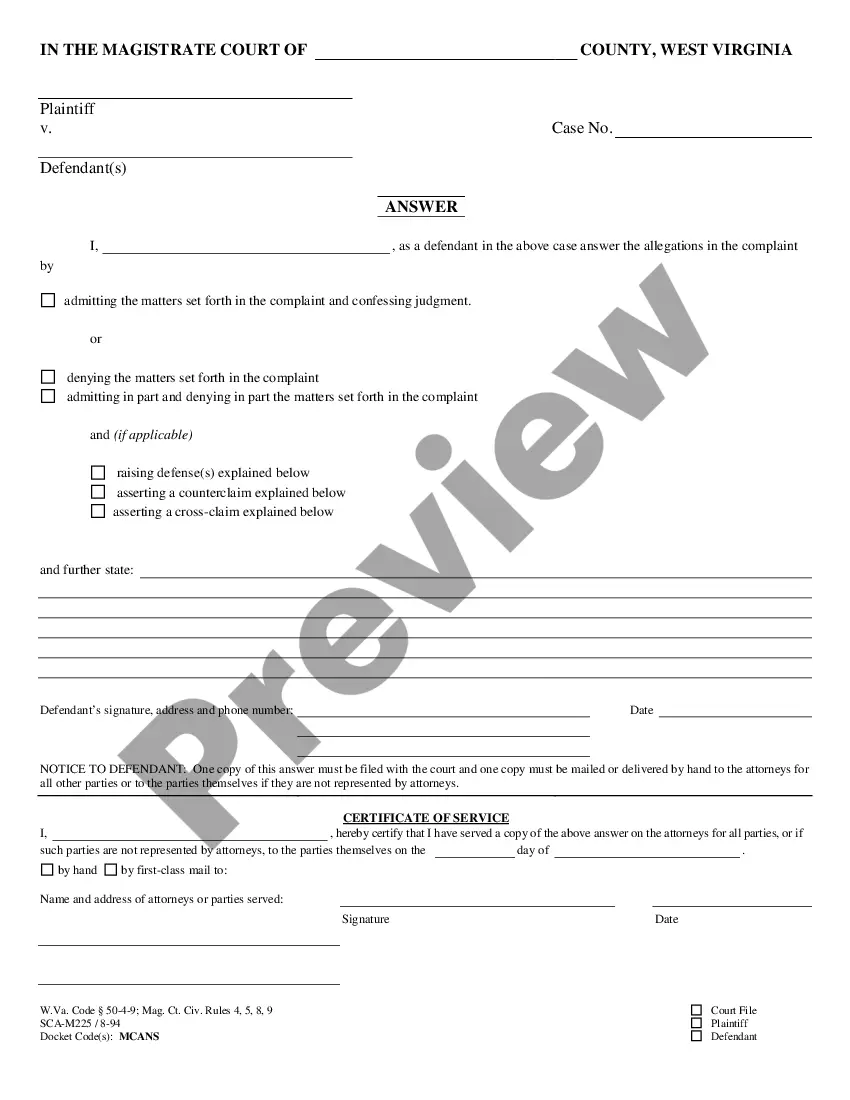

How to fill out Clauses Relating To Capital Withdrawals, Interest On Capital?

US Legal Forms - one of several most significant libraries of legal types in the States - provides a wide range of legal record web templates it is possible to down load or printing. Utilizing the site, you may get thousands of types for company and person functions, categorized by types, states, or keywords and phrases.You can get the most recent variations of types just like the Guam Clauses Relating to Capital Withdrawals, Interest on Capital in seconds.

If you have a registration, log in and down load Guam Clauses Relating to Capital Withdrawals, Interest on Capital from the US Legal Forms library. The Down load option will show up on each develop you perspective. You have access to all in the past saved types from the My Forms tab of your bank account.

If you would like use US Legal Forms initially, allow me to share simple directions to obtain started:

- Make sure you have picked the best develop for the town/area. Select the Review option to check the form`s content material. Read the develop explanation to actually have chosen the proper develop.

- In case the develop does not fit your needs, make use of the Search area at the top of the screen to find the one who does.

- When you are content with the shape, validate your option by clicking the Acquire now option. Then, select the costs prepare you favor and supply your qualifications to register for the bank account.

- Method the deal. Use your bank card or PayPal bank account to complete the deal.

- Select the format and down load the shape on your gadget.

- Make changes. Fill out, modify and printing and signal the saved Guam Clauses Relating to Capital Withdrawals, Interest on Capital.

Each design you added to your bank account does not have an expiry particular date which is your own property for a long time. So, if you would like down load or printing one more duplicate, just go to the My Forms section and then click in the develop you want.

Gain access to the Guam Clauses Relating to Capital Withdrawals, Interest on Capital with US Legal Forms, one of the most extensive library of legal record web templates. Use thousands of expert and condition-specific web templates that fulfill your organization or person demands and needs.

Form popularity

FAQ

To prevent the High-Tax Kickout (HTKO) treatment, do the following: Go to Credits > 1116-Foreign Tax Credit. Select Section 1 - Processing Options. In Line 6 - High tax kickout treatment, select the checkbox.

File Form 1116, Foreign Tax Credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign country or U.S. possession. Corporations file Form 1118, Foreign Tax Credit?Corporations, to claim a foreign tax credit.

File Form 1116, Foreign Tax Credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign country or U.S. possession. Foreign Tax Credit | Internal Revenue Service irs.gov ? individuals ? international-taxpayers irs.gov ? individuals ? international-taxpayers

You'll use a Form 1116 explanation statement to show the foreign exchange conversion you used and the date on which it was determined. OANDA.com is a great source for reliable currency conversion rates.

If you are a shareholder of a mutual fund, or other regulated investment company (RIC), you may be able to claim the credit based on your share of foreign income taxes paid by the fund if it chooses to pass the credit on to its shareholders.