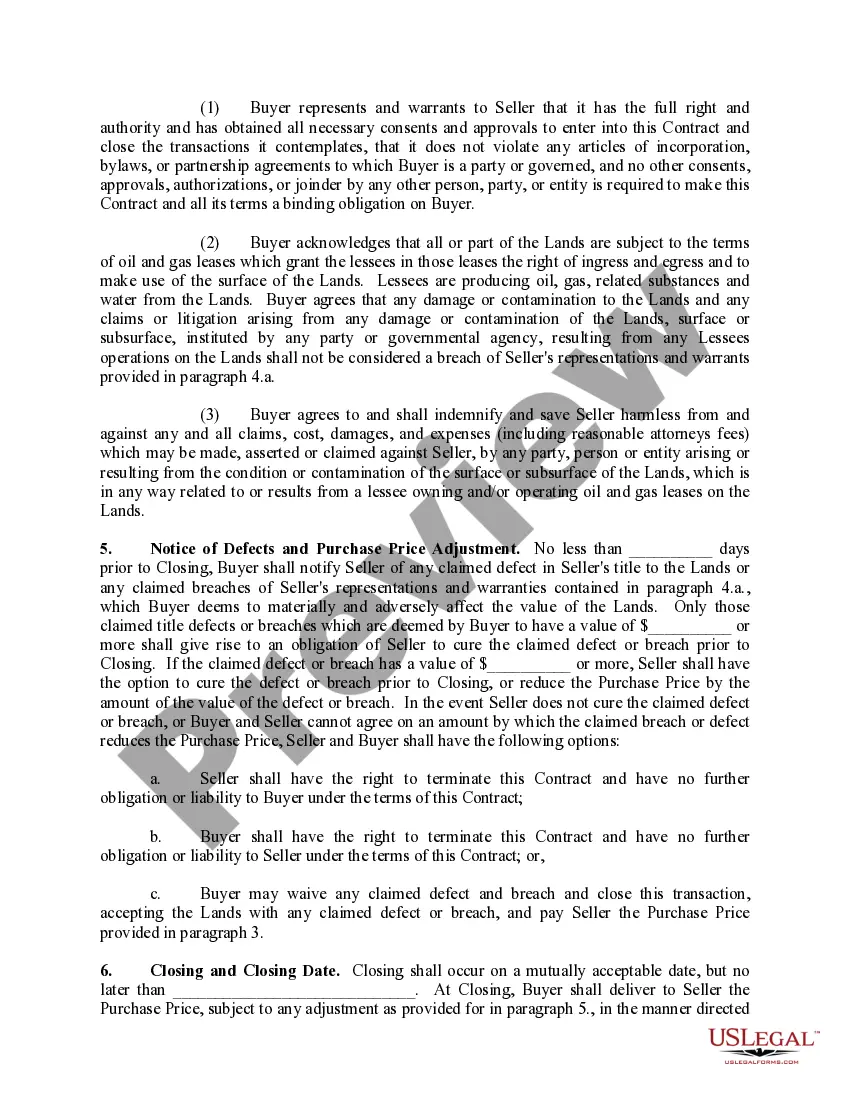

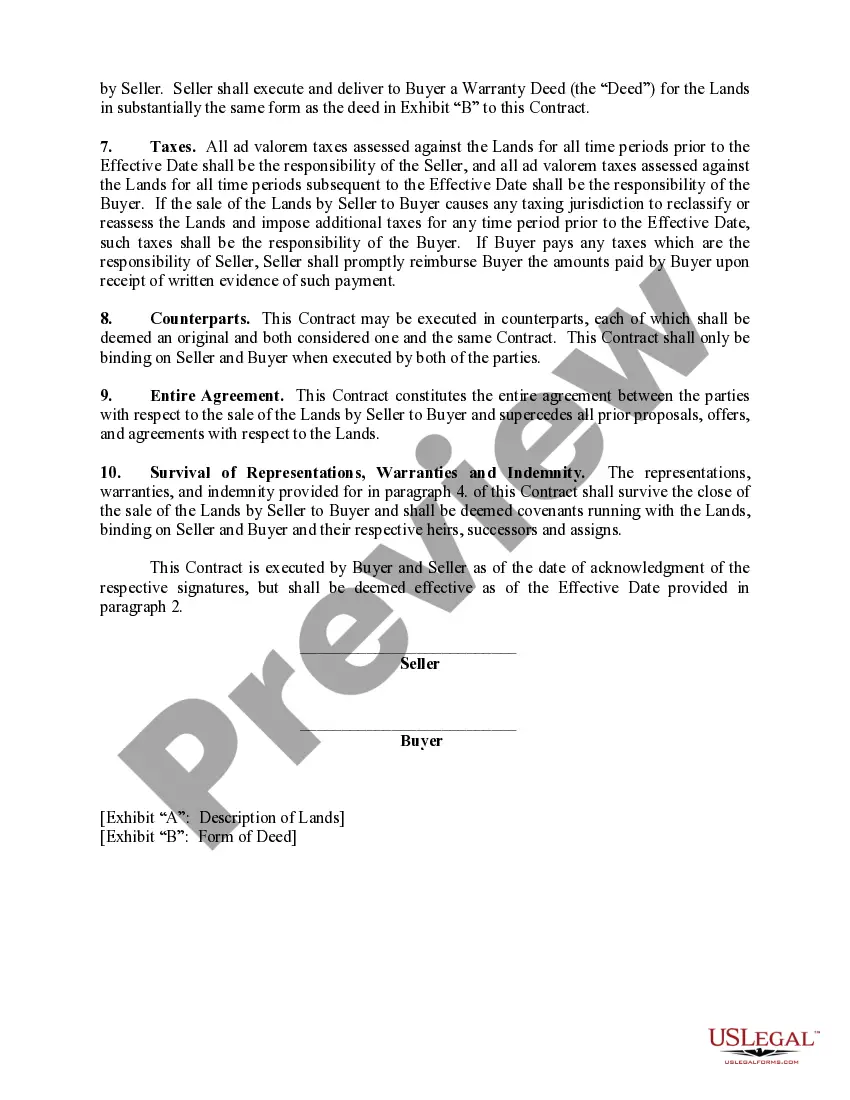

This is a form of Contract For the Sale of Land.

Guam Contract For Sale of Land

Description

How to fill out Contract For Sale Of Land?

It is feasible to spend time online trying to locate the authentic document template that meets the state and federal requirements you require.

US Legal Forms offers a vast selection of legitimate forms that are reviewed by professionals.

You can download or print the Guam Contract For Sale of Land from our platform.

If available, utilize the Preview button to browse the document template as well.

- If you possess a US Legal Forms account, you can sign in and then click the Obtain button.

- Subsequently, you can fill out, modify, print, or sign the Guam Contract For Sale of Land.

- Each legitimate document template you purchase is yours indefinitely.

- To acquire another copy of any purchased form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your location/region of choice.

- Review the form details to confirm you have chosen the right form.

Form popularity

FAQ

Yes, a Guam Contract For Sale of Land is essential for legal protection for both the buyer and seller. This contract outlines the agreed-upon terms and conditions, minimizing the risk of disputes later. Additionally, it serves as a formal record of the transaction, which can be important for tax and legal purposes. Utilizing services like US Legal Forms can help you create a comprehensive contract tailored to your needs.

No, Guam does not file federal taxes as a territory. Instead, it has its tax laws that residents must follow. When dealing with a Guam Contract For Sale of Land, understanding these local tax laws is crucial to ensure proper compliance and avoid any potential issues.

The primary tax form for Guam is the Guam Individual Income Tax Return, known as Form 1040. This form is similar to the federal 1040 but includes specific adjustments for Guam residents. If you enter into a Guam Contract For Sale of Land, using the correct tax form will help you report any income correctly.

Guam does not file a federal U.S. tax return like the fifty states do. Instead, Guam has its tax system, which aligns closely with federal tax laws. If you are involved in a Guam Contract For Sale of Land, it’s essential to familiarize yourself with local tax regulations to ensure compliance.

Yes, living in Guam is considered living in the United States, although there are some differences in legal and tax obligations. When engaging in a Guam Contract For Sale of Land, it’s important to understand these distinctions. This knowledge can help you navigate property ownership and related responsibilities effectively.

Failing to file Guam taxes can lead to penalties, interest, and potential legal actions. It is crucial to adhere to tax regulations to avoid complications, especially if you are involved in a Guam Contract For Sale of Land. The consequences can affect both your finances and your ability to conduct business in Guam.

Yes, Guam imposes a capital gains tax on the sale of property, including land. This tax applies to profits made from selling real estate, which means it's essential to account for this when considering your Guam Contract For Sale of Land. Consulting a tax professional can help you understand how this tax may affect your overall investment.

Yes, U.S. citizens can buy land in Guam. The Guam Contract For Sale of Land simplifies this process, ensuring that all legal requirements are met. It's important to understand local regulations and any restrictions that may apply. By using the right legal documents, you can navigate the buying process smoothly.